Preparing and Filing Taxes is Difficult — for someone like a business owner or an accountant, no one would find it hard to disagree with this phrase especially when it comes to setting up, where you’ll need to start from scratch.

There are many factors to be considered, and requirements to be accomplished before you could even start filing your returns and aside from relying on spreadsheets, you might often need the assistance of an accounting software at your side to help ease that burden.

But what if you don’t have an accounting software? Would you already consider yourself in the so called “end game” in filing taxes, and you’re left with no choice but to re-enter those information from an excel file to your tax preparation software?

Don’t fret, for we have the solution for you: JuanTax has a standalone version which lets you create and import transactions straight into the accounting software with ease! In this article, we’re sharing 3 simple and easy steps on how you can start using JuanTax Standalone version, and get rid of all those troubles of data entry.

3 Easy Steps in Using JuanTax Standalone

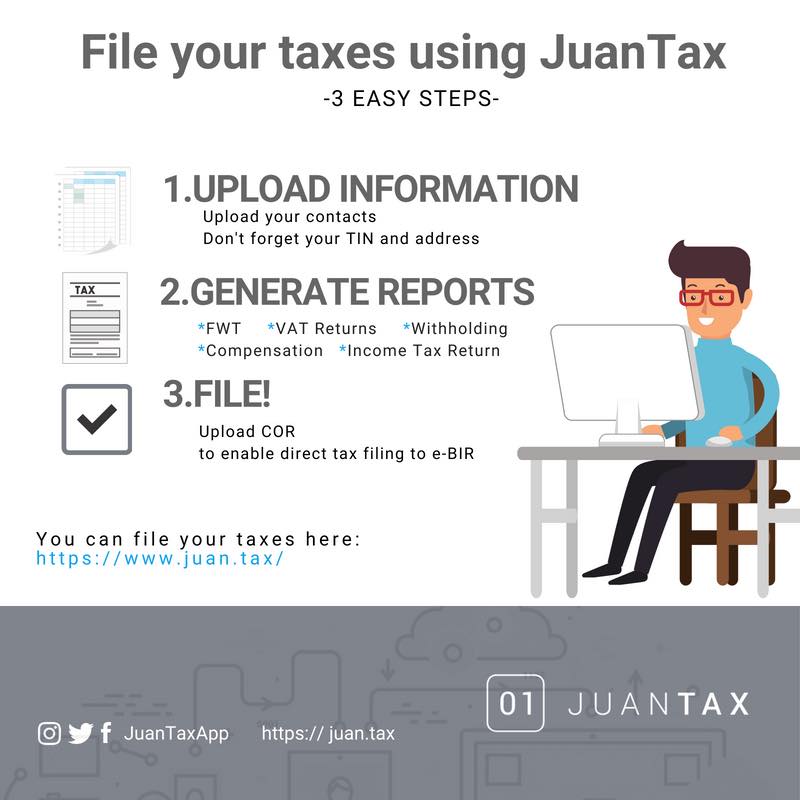

This infographic illustrates the 3 easy steps in using JuanTax Standalone version:

1. Upload Information

Once you’ve created an account in JuanTax, the first thing that you need to do is to set up the information needed on your account by uploading information such as Contacts as well as their Address and TIN. You can do this by importing those information through a CSV Excel spreadsheet.

2. Generate Reports

The next step is to create a report of the tax return that you wanted to file. Once you’ve added a report, and selected the Month and Year of the return, it’s now time for you to add those transactions to your report!

As we said earlier, aside from creating transactions directly in JuanTax, you also have the option of importing bulk transactions in CSV spreadsheets directly within the tax software.

If you already created a spreadsheet containing your transactions, then you can simply upload it in JuanTax, map the columns and that’s it! Also, you can choose from our wide selection of tax forms that you can use for filing local taxes such as VAT, Percentage Tax, Income Tax Returns and Withholding Tax Returns.

3. File!

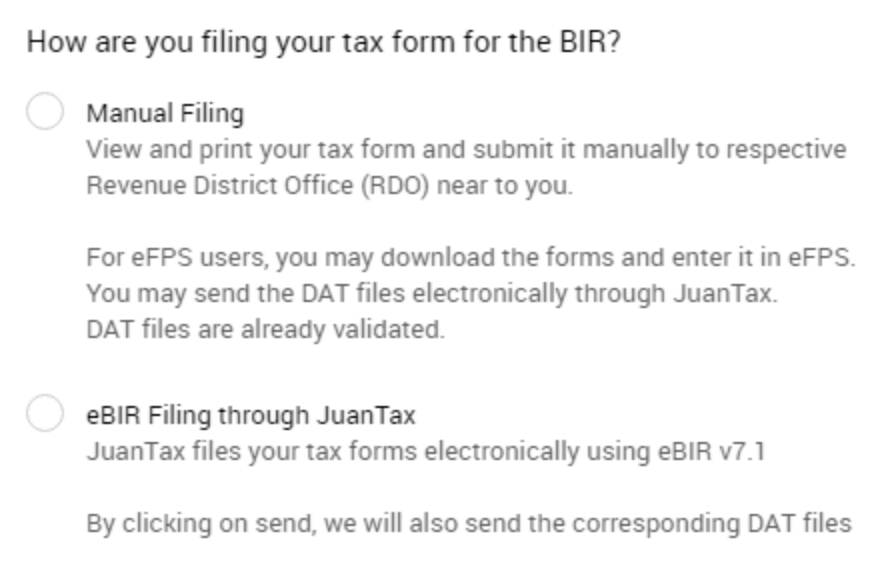

Last but not the least, you need to file the return after generating the reports. There are two options available (1) Manual Filing and (2) eBIR Filing.

In order for you to enable eBIR filing in JuanTax, make sure to upload a scanned image of your Certificate of Registration (BIR Form 2303).

Want to know more on how JuanTax could help change the way you file your taxes? Visit our website at https://juan.tax/ and Sign Up today!