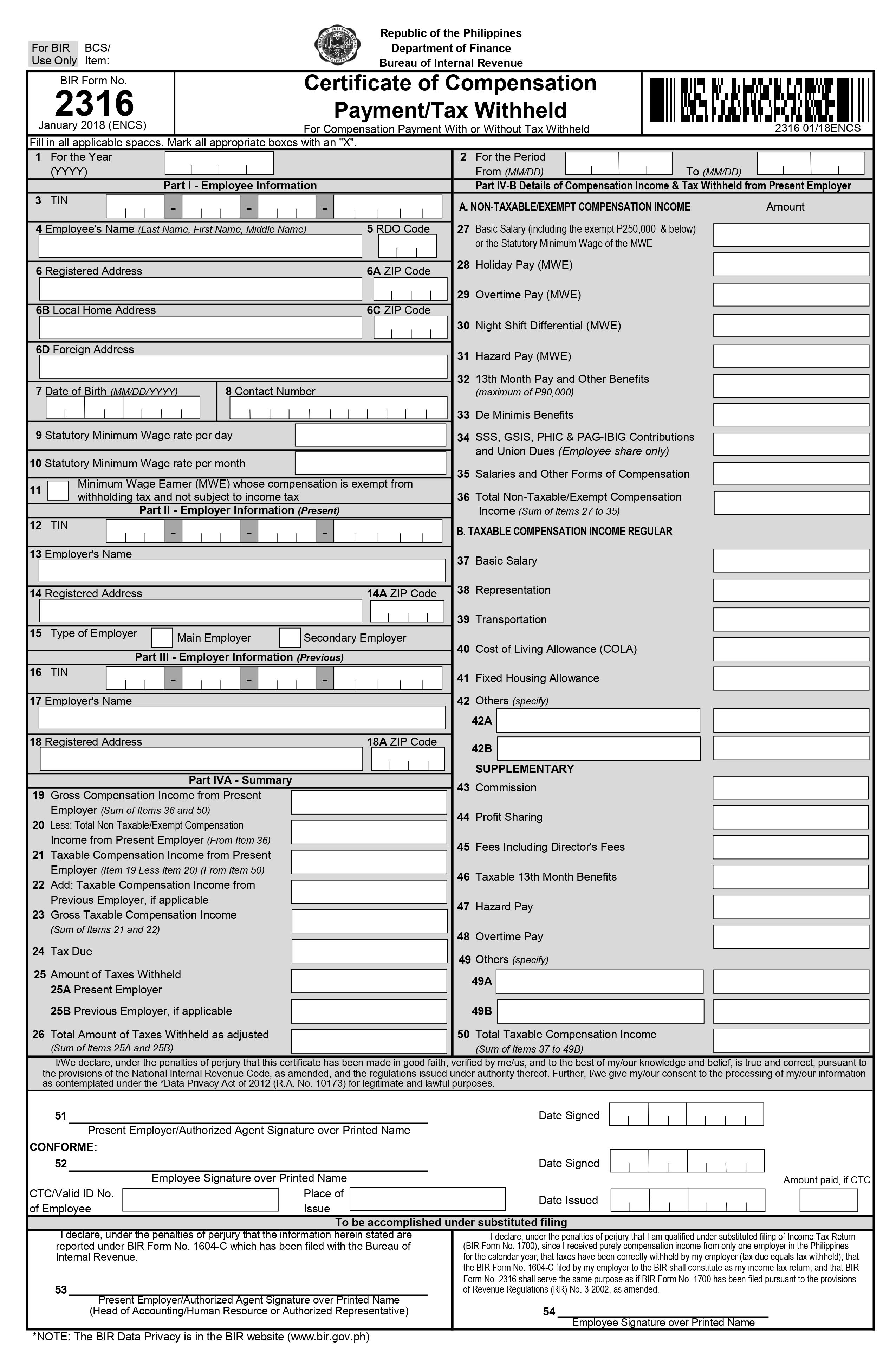

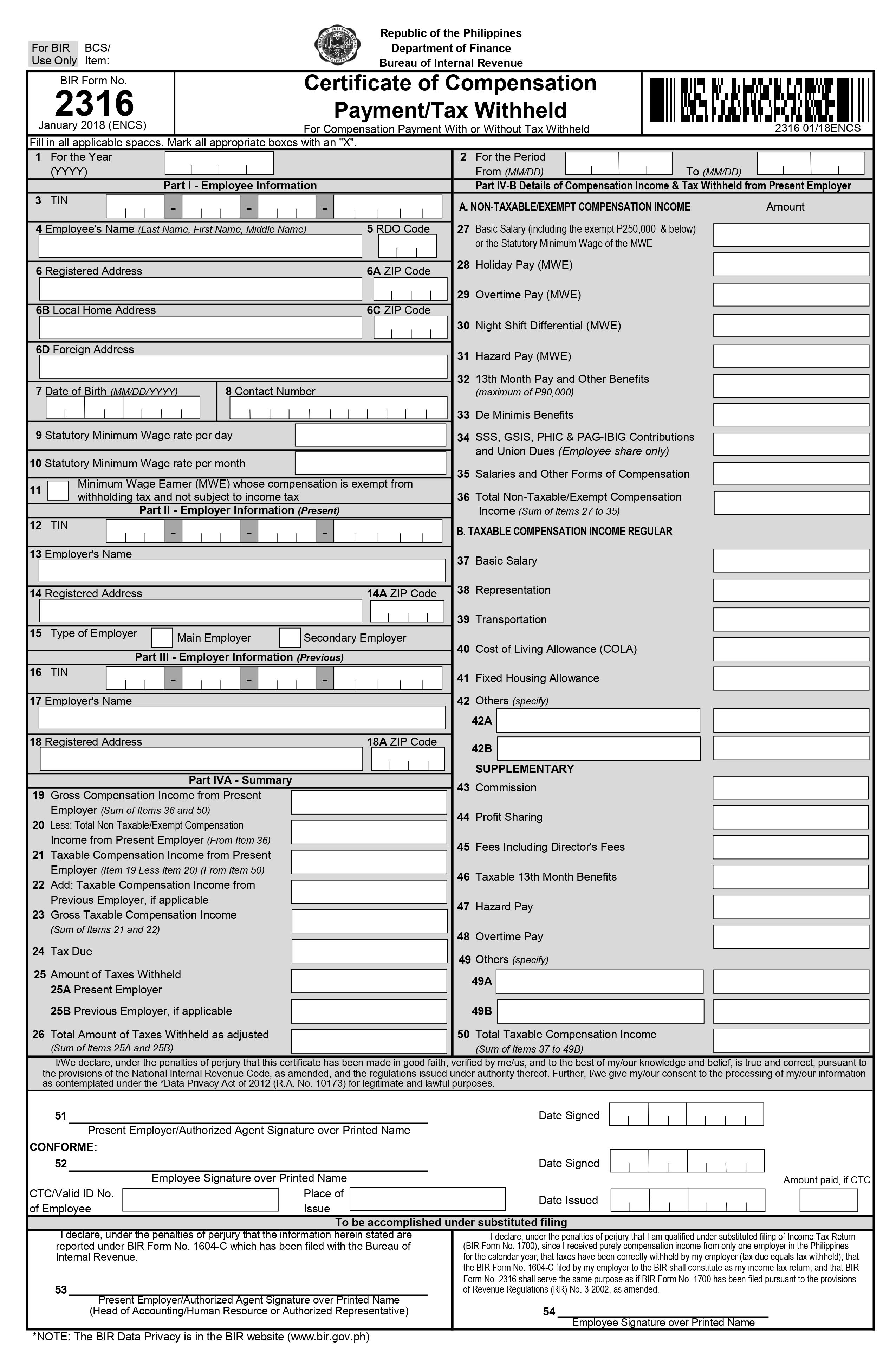

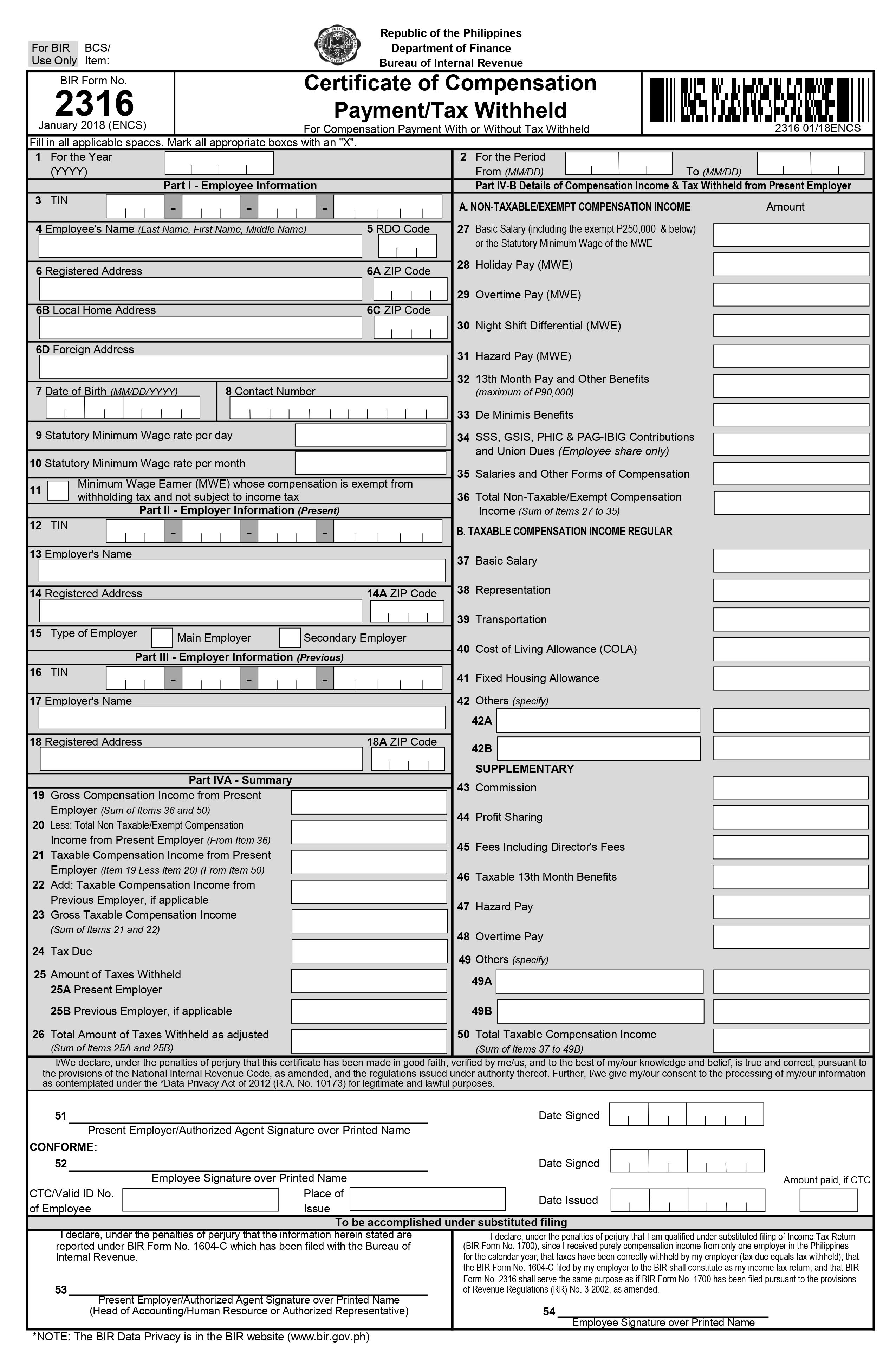

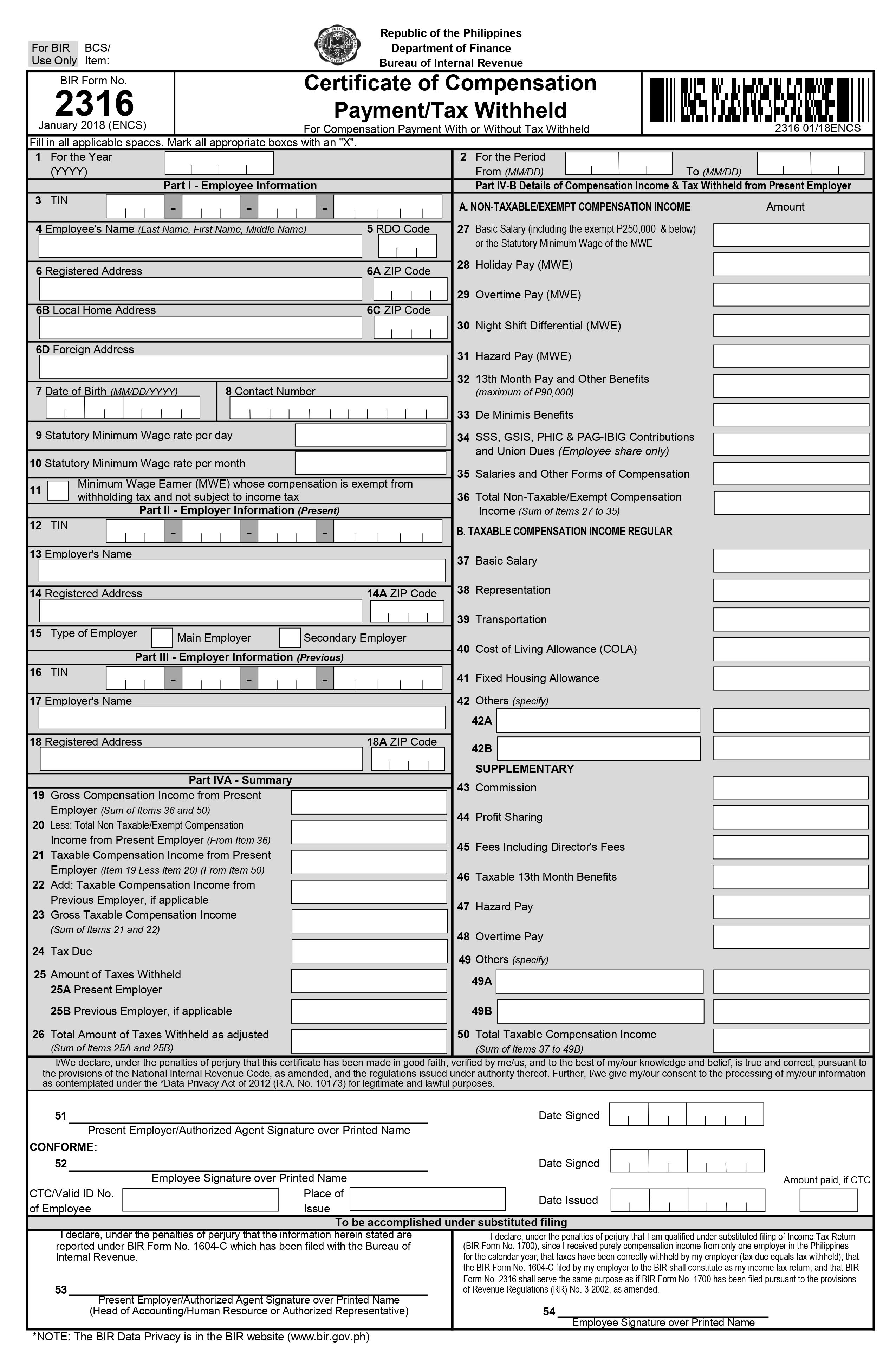

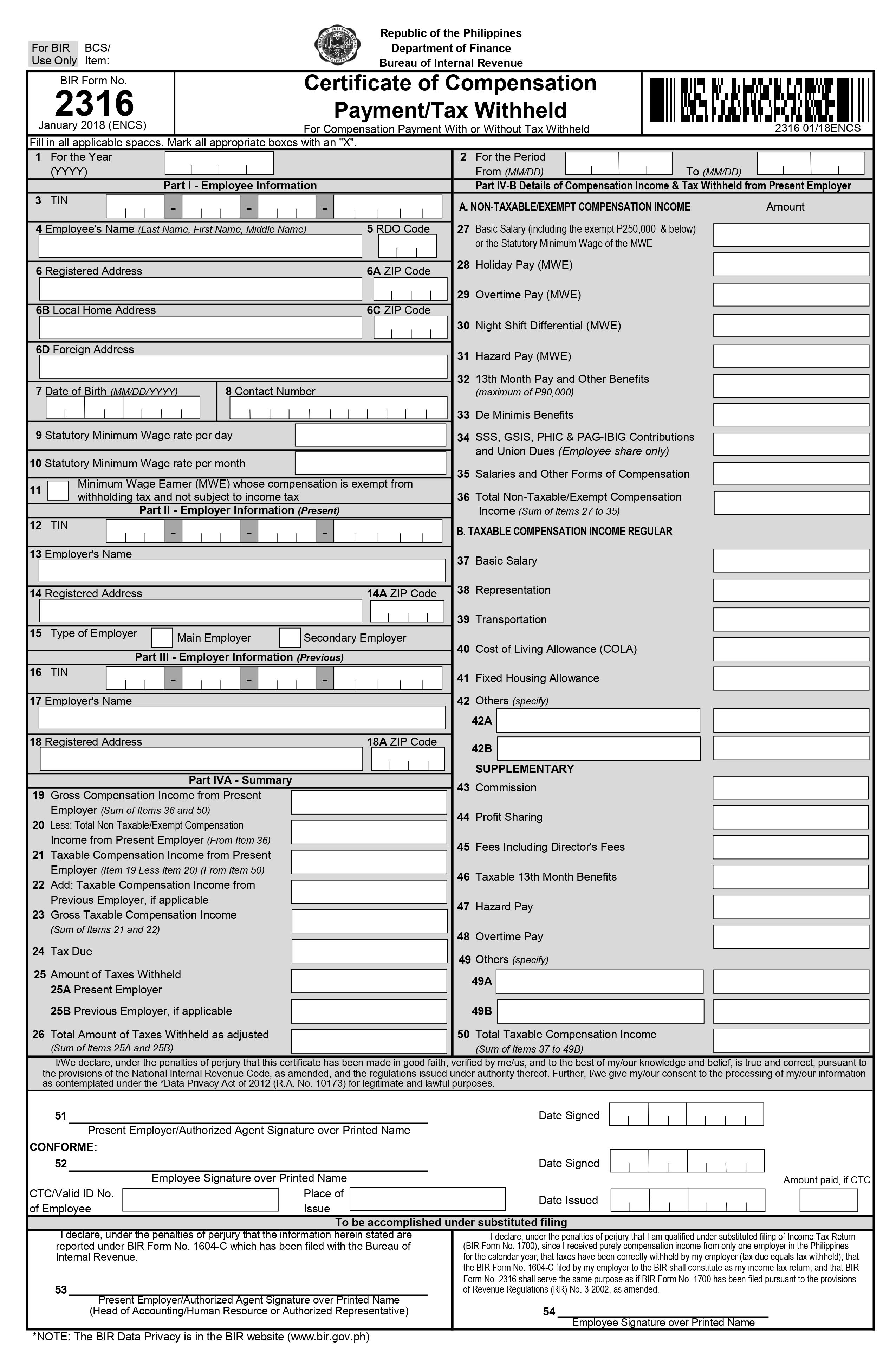

BIR form 2316, or also known as Certificate of Compensation Payment or Income Tax Withheld is a yearly certificate that needs to be issued by the payor to employees who are subject to a declaration of final tax.

FORM 2316

Who needs to file?

Form 2316 shall be filed by the employer acting out as the payor for employees within a business. The employer should indicate the total amount that was paid to employees, as well as the taxes withheld during the course of the calendar year.

When to file?

These forms needs to be accomplished with employees on or before January 31, after the year that the payment was made. For employment termination purposes, Form 2316 needs to be issued the same day when last wage pay is settled.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

What is this form?

BIR form 2316, or also known as Certificate of Compensation Payment or Income Tax Withheld is a yearly certificate that needs to be issued by the payor to employees who are subject to a declaration of final tax.

Related Articles:

Who needs to file?

Form 2316 shall be filed by the employer acting out as the payor for employees within a business. The employer should indicate the total amount that was paid to employees, as well as the taxes withheld during the course of the calendar year.

When to file?

These forms needs to be accomplished with employees on or before January 31, after the year that the payment was made. For employment termination purposes, Form 2316 needs to be issued the same day when last wage pay is settled.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

Available in: