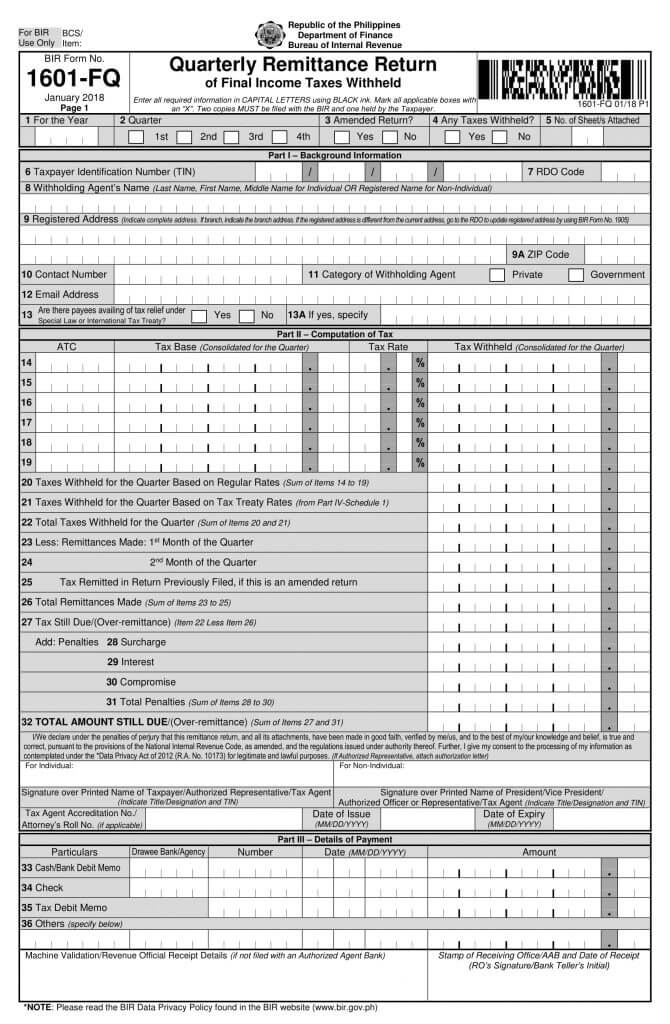

BIR form 1601-FQ, or the Quarterly Remittance Return of Final Income Taxes Withheld is a tax form which is used to remit all other forms of final withholding taxes.

Much like form 1601EQ, 1601-FQ forms can be used in remitting taxes withheld for the 3rd month of the quarter, in accordance with the provisions listed within the TRAIN law.