Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sale.

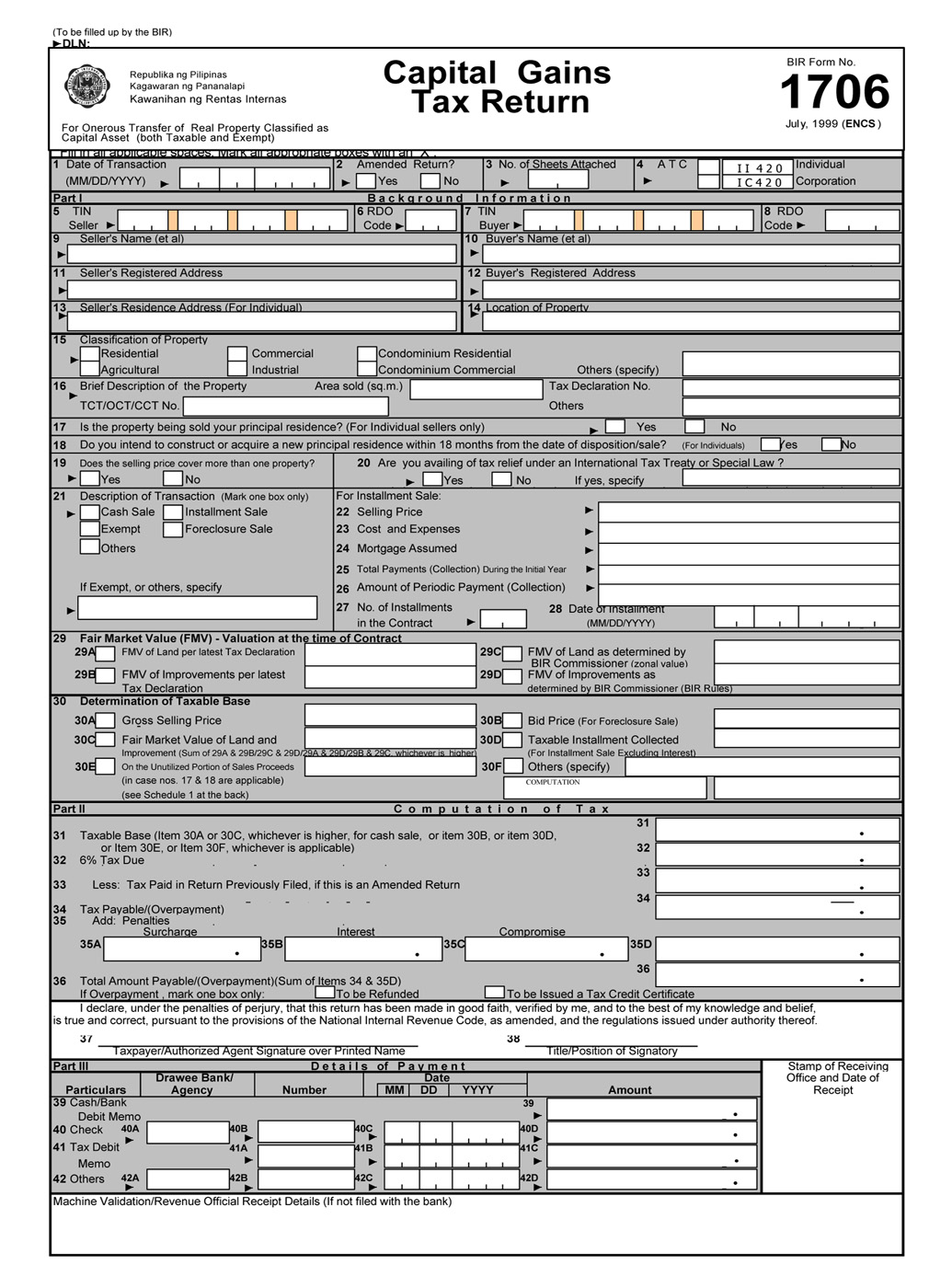

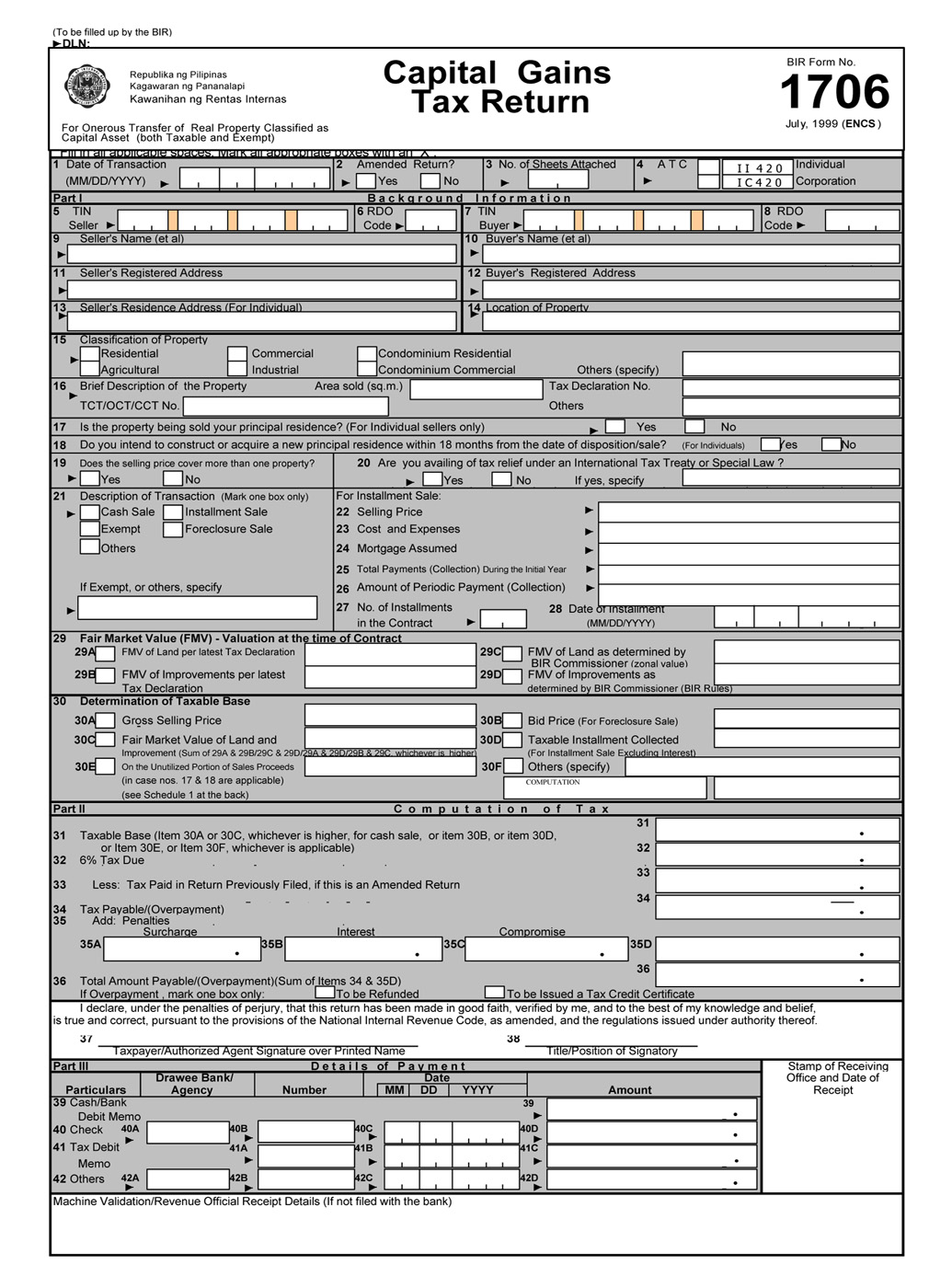

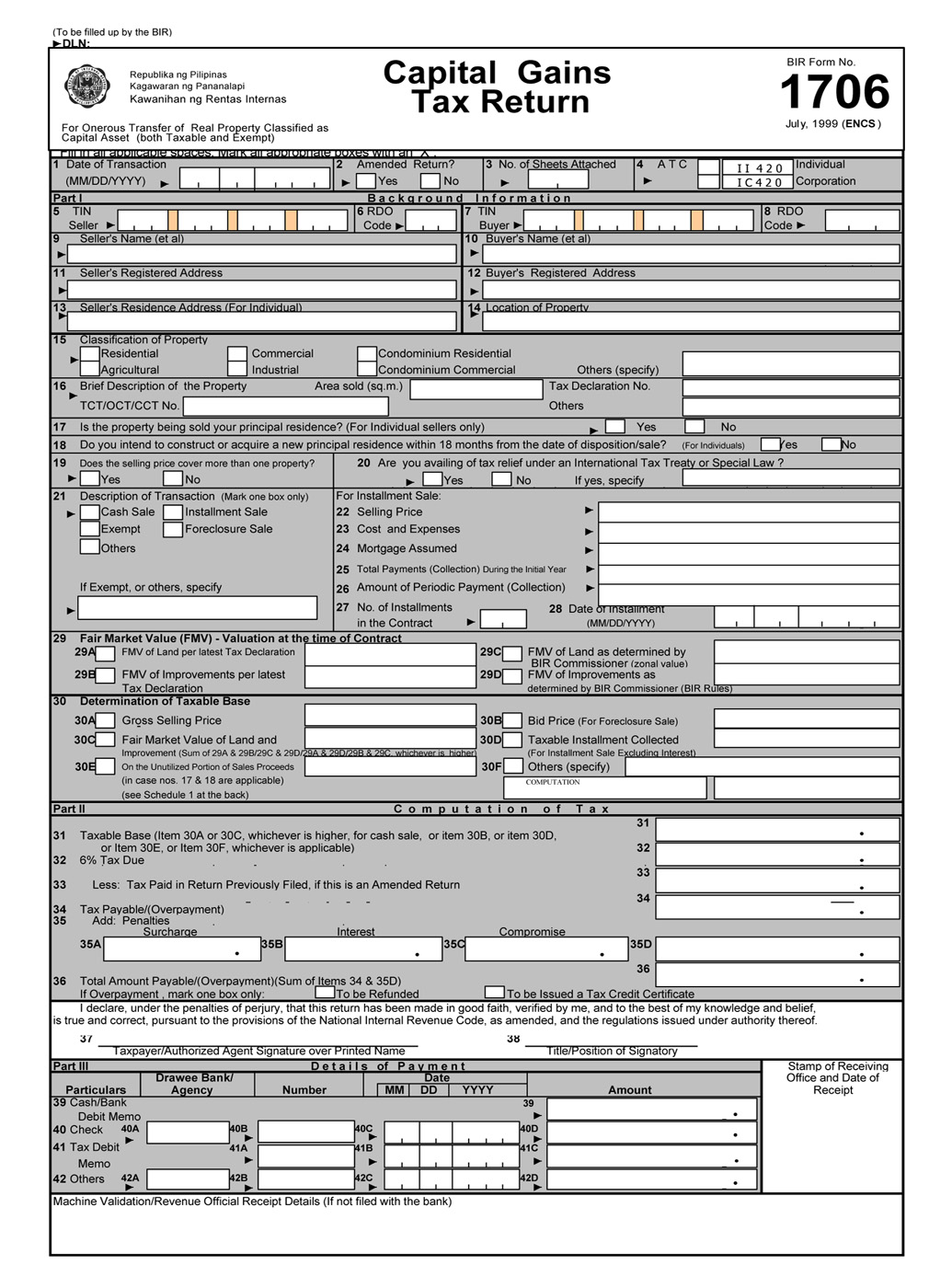

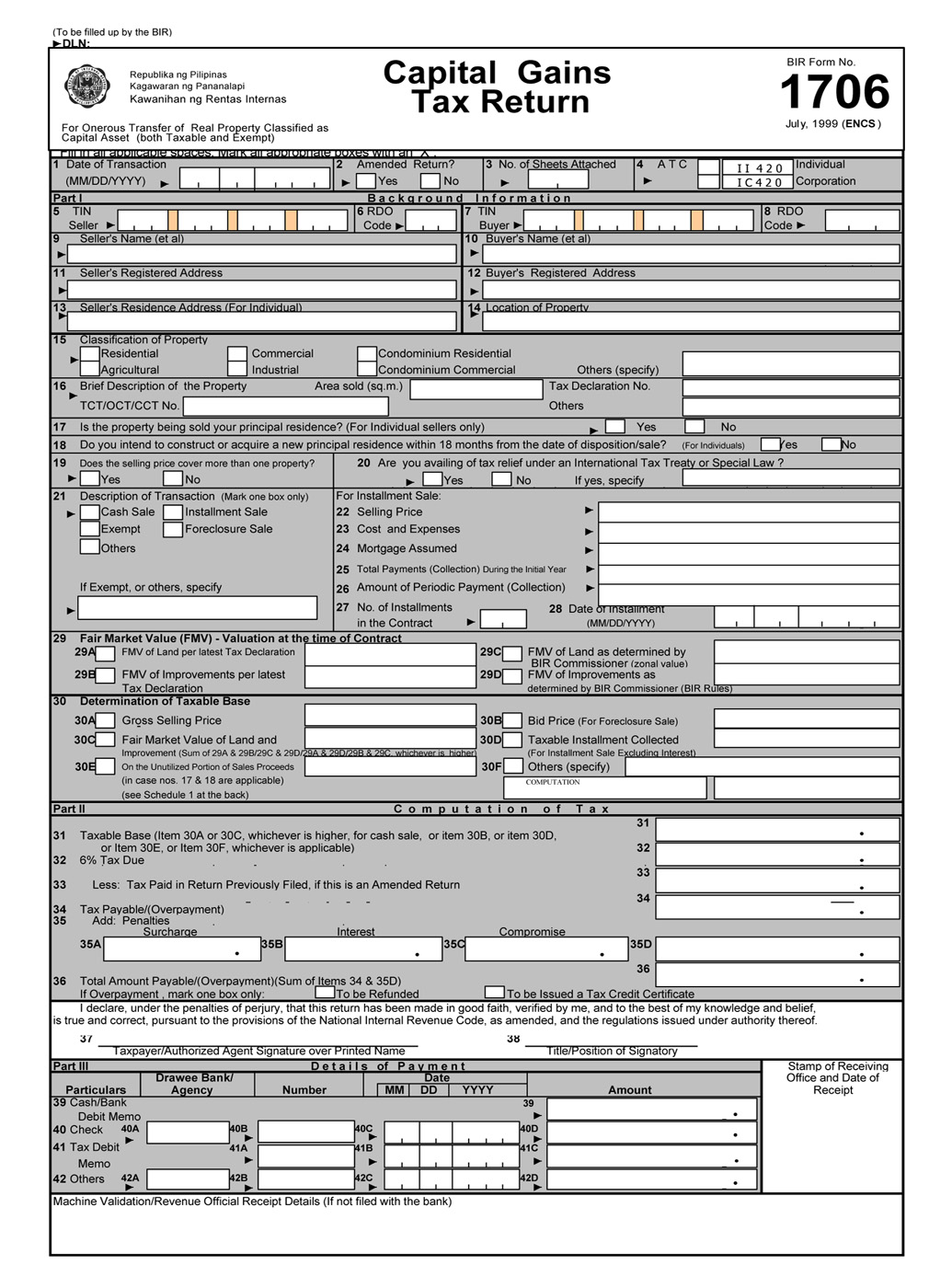

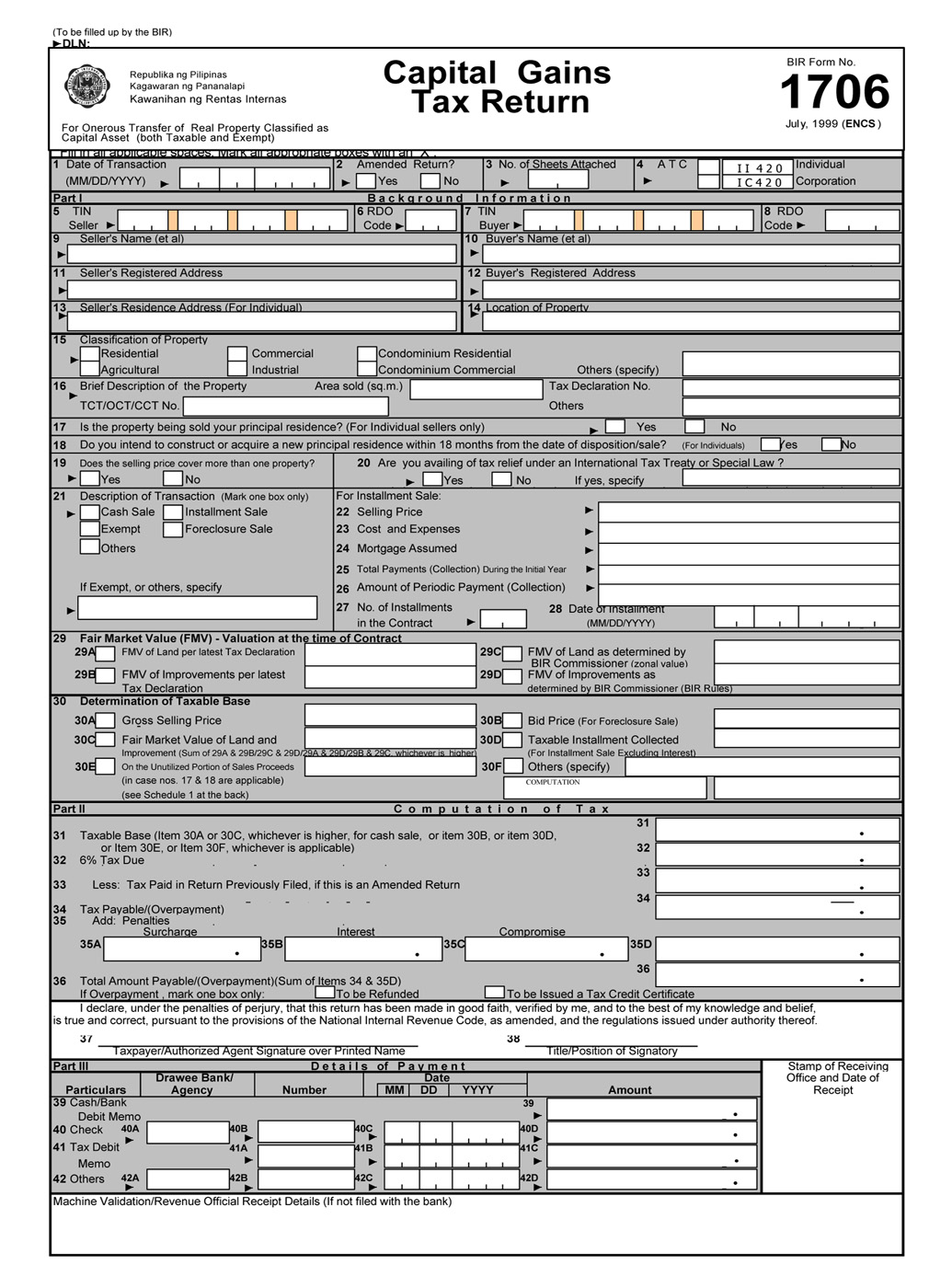

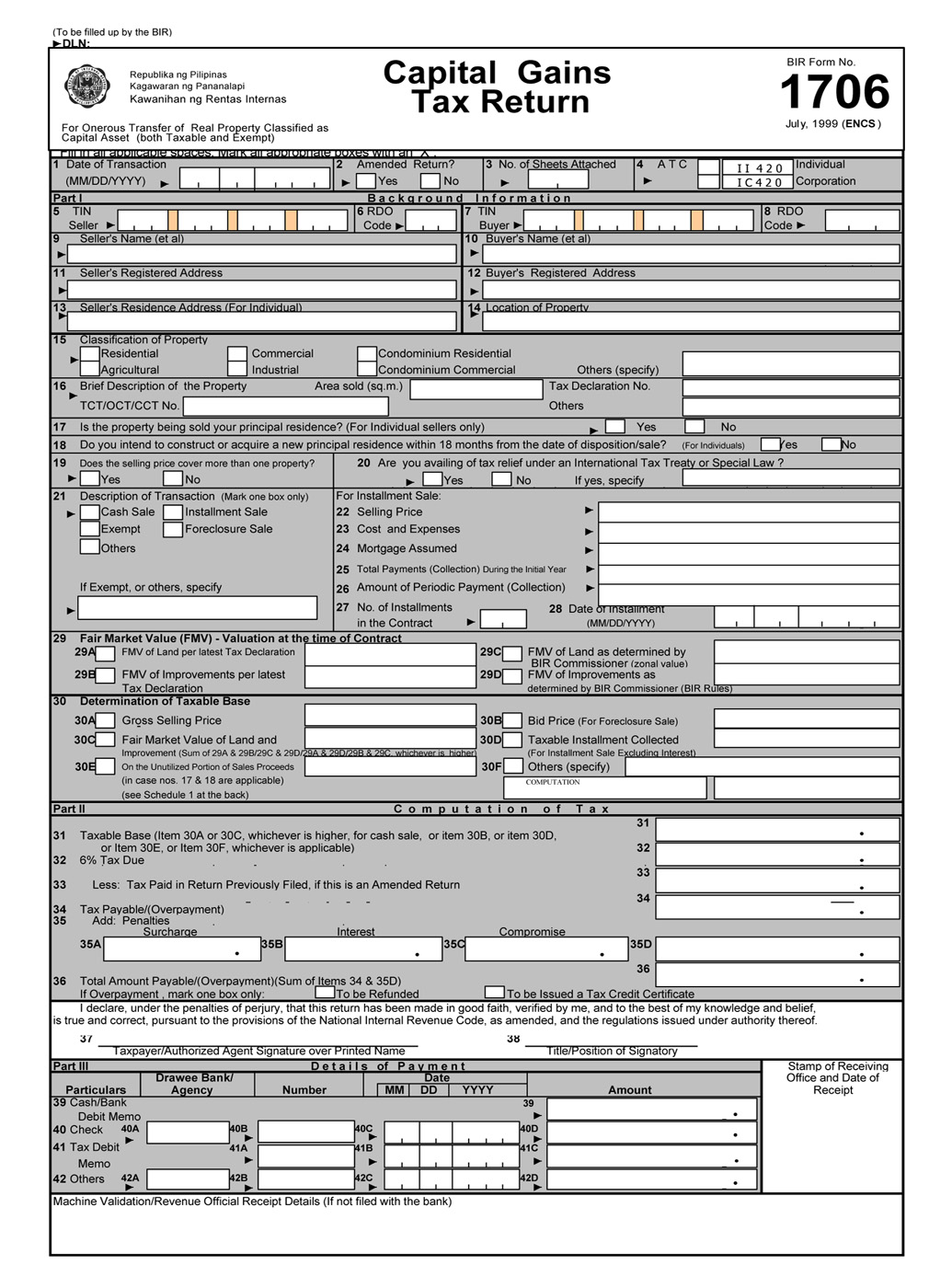

FORM 1706

Who needs to file?

The Capital Gains Tax Return (BIR Form No. 1706) shall be filed in triplicate copies by the Seller/Transferor who is natural or juridical whether resident or non-resident, including Estates and Trusts, who sell, exchange, or dispose of a real property located in the Philippines classified as a capital asset as defined under Sec. 39 (A) (1) of RA No. 8424. The term “sale” includes pacto de retro sale and other forms of conditional sales. The transaction may be taxable or exempt.

Taxpayers who are filing BIR Form No. 1706 are excluded in the mandatory coverage from using the eBIRForms (Section 2 of RR No. 9-2016).

When to file?

The Capital Gains Tax Return (BIR Form No. 1706) shall be filed and paid within thirty (30) days following the sale, exchange, or disposition of real property, with any Authorized Agent Bank (AAB) or Revenue Collection Officer (RCO) of the Revenue District Office (RDO) having jurisdiction over the place where the property being transferred is located.

Please take note that your tax forms will be sent electronically to the BIR by 9 PM. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

What is this form?

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other forms of conditional sale.

Related Articles:

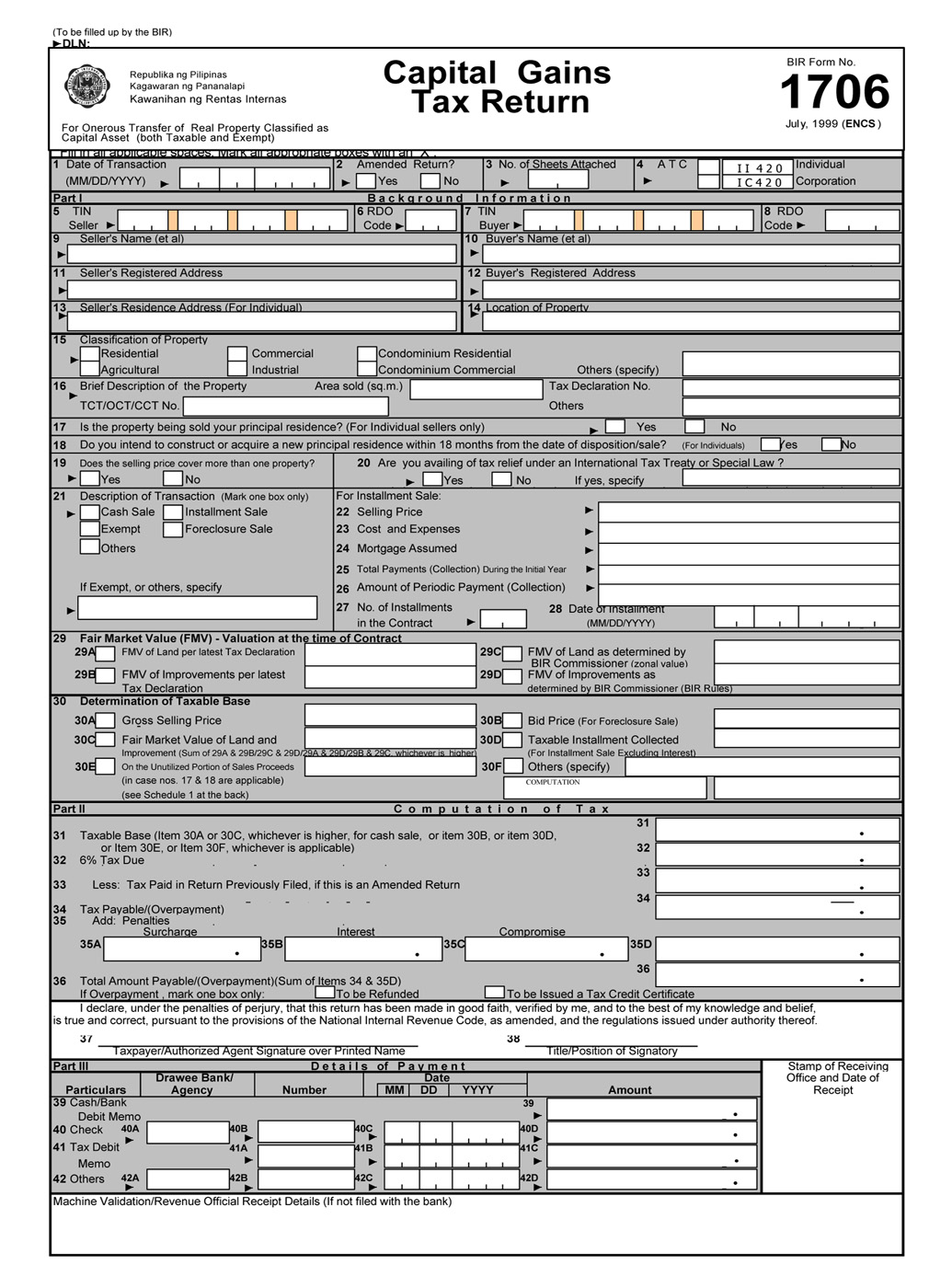

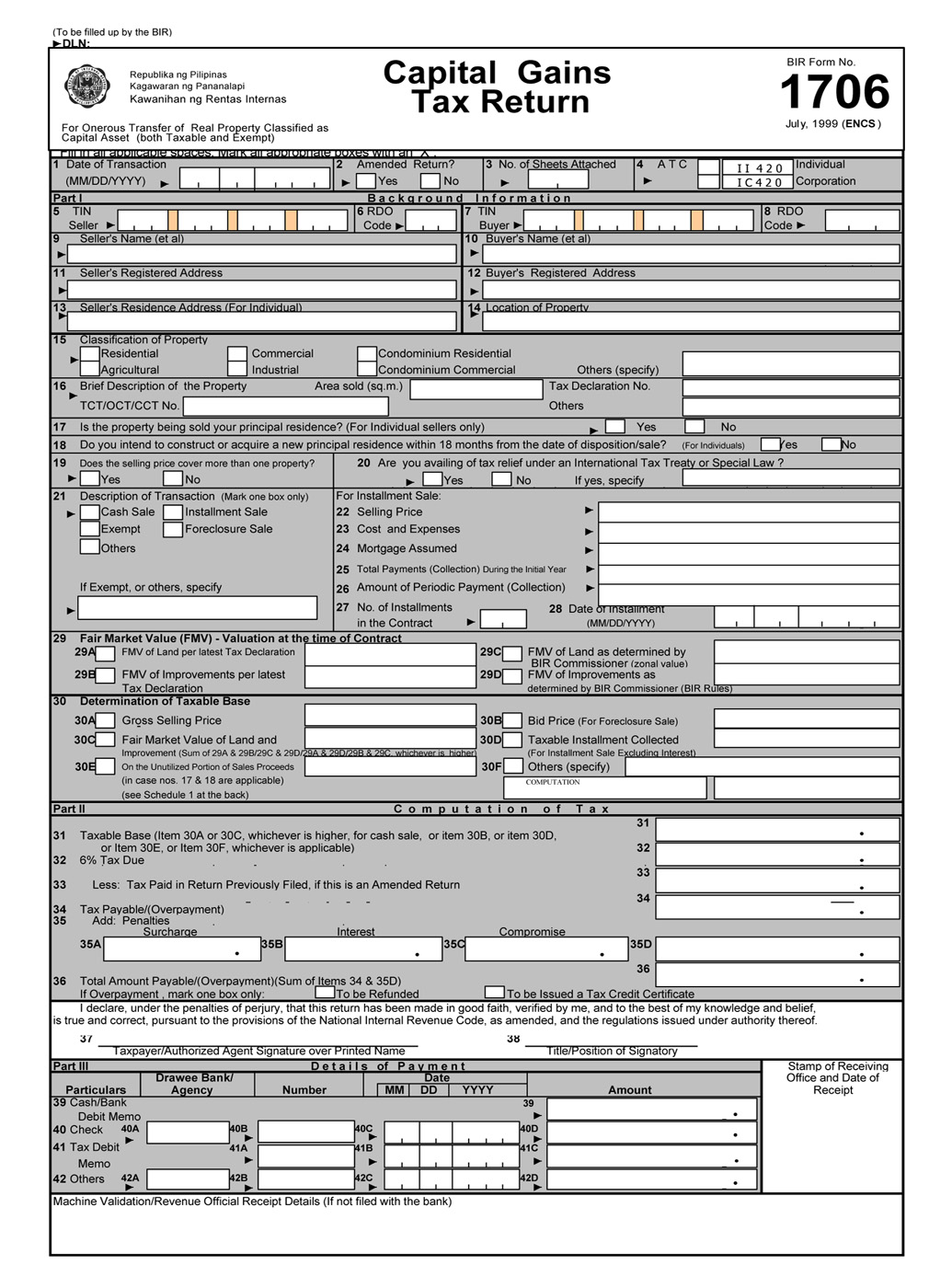

Who needs to file?

The Capital Gains Tax Return (BIR Form No. 1706) shall be filed in triplicate copies by the Seller/Transferor who is natural or juridical whether resident or non-resident, including Estates and Trusts, who sell, exchange, or dispose of a real property located in the Philippines classified as a capital asset as defined under Sec. 39 (A) (1) of RA No. 8424. The term “sale” includes pacto de retro sale and other forms of conditional sales. The transaction may be taxable or exempt.

Taxpayers who are filing BIR Form No. 1706 are excluded in the mandatory coverage from using the eBIRForms (Section 2 of RR No. 9-2016).

When to file?

The Capital Gains Tax Return (BIR Form No. 1706) shall be filed and paid within thirty (30) days following the sale, exchange, or disposition of real property, with any Authorized Agent Bank (AAB) or Revenue Collection Officer (RCO) of the Revenue District Office (RDO) having jurisdiction over the place where the property being transferred is located.

Please take note that your tax forms will be sent electronically to the BIR by 9 PM. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: