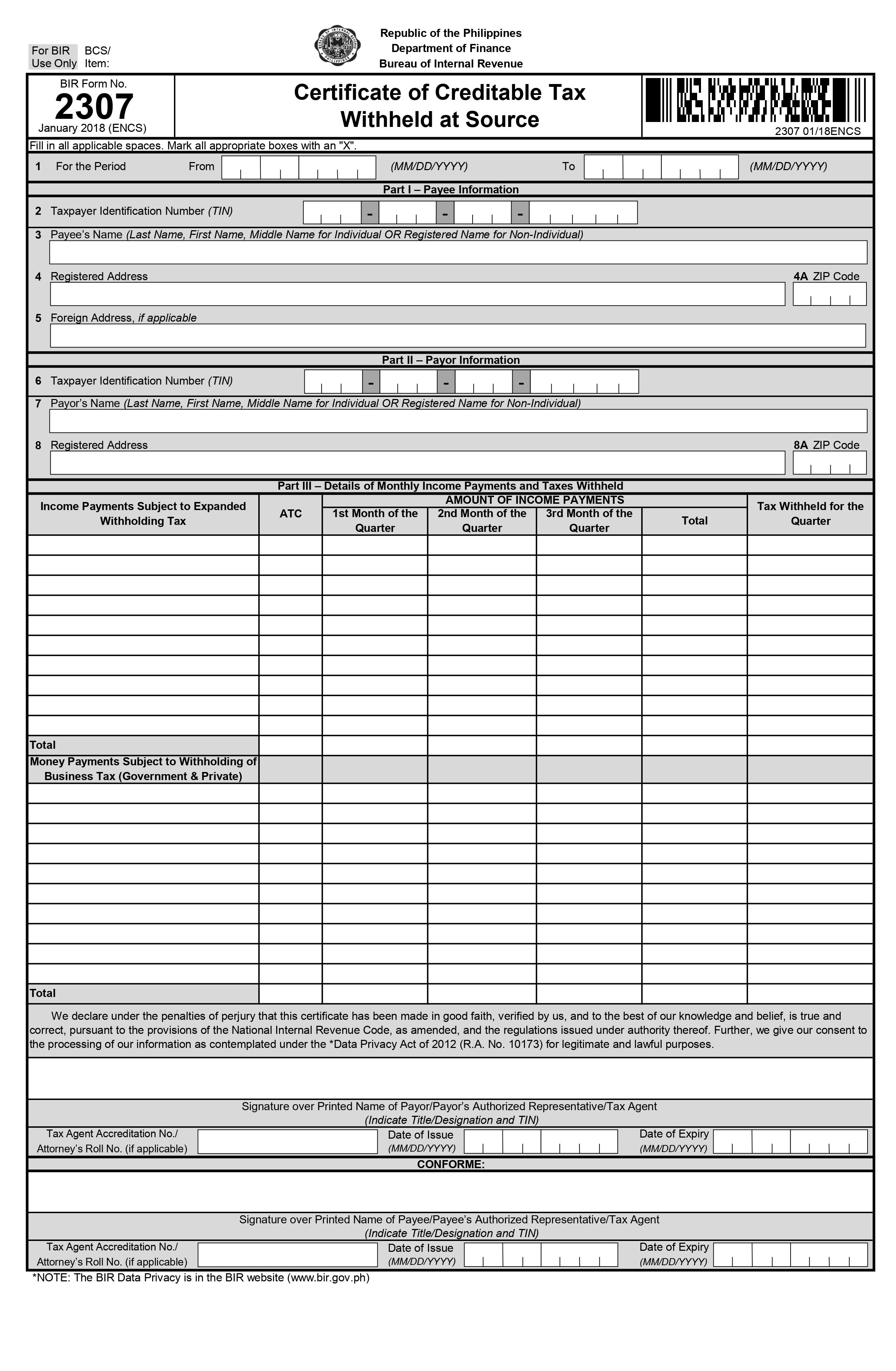

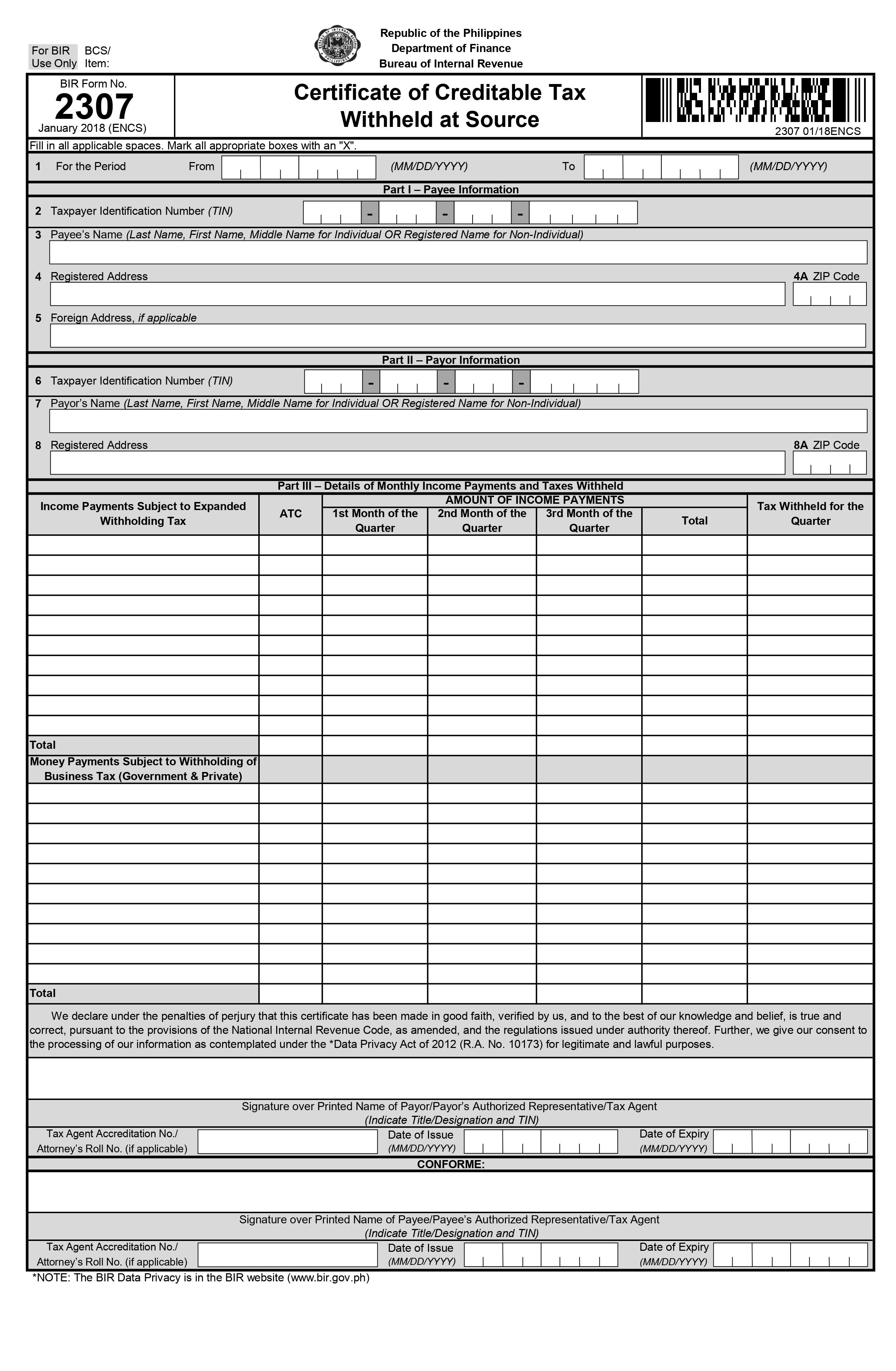

SAWT or also known as Summary Alphalist of Withholding Tax at Source serves as a consolidated Alphalist of withholding agents from whom income was received and are subjected to withholding agents in the process.

SAWT

Who needs to file?

This needs to be submitted by the payee-recipient as an attachment to a filed return based on the specific period and contains a summary of data such as gross sales/receipts and tax credits from all 2307 certificates as issued by the payor. Also, individuals claiming a refund or applying creditable tax withheld at source against the tax due with not more than 10 withholding agents-payor of income payment per return.

When to file?

SAWTs need to be submitted along with forms 1700, 1701Q, 1701, 1702Q, 1702, 2550M, 2550Q, 2551M, and 2553.

a. For VAT

Monthly – Within twenty (20) days following the end of each month

Quarterly – Within twenty (25) days following the end of each quarter

b. For Withholding – Within ten (10) days following the end of each month

c. For Percentage – Within ten (10) days following the end of each month.

Please take note that your tax forms will be sent electronically to the BIR by 9 PM. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

What is this file?

SAWT or also known as Summary Alphalist of Withholding Tax at Source serves as a consolidated Alphalist of withholding agents from whom income was received and are subjected to withholding agents in the process.

Related Articles:

Who needs to file?

This needs to be submitted by the payee-recipient as an attachment to a filed return based on the specific period and contains a summary of data such as gross sales/receipts and tax credits from all 2307 certificates as issued by the payor. Also, individuals claiming a refund or applying creditable tax withheld at source against the tax due with not more than 10 withholding agents-payor of income payment per return.

When to file?

SAWTs need to be submitted along with forms 1700, 1701Q, 1701, 1702Q, 1702, 2550M, 2550Q, 2551M, and 2553.

a. For VAT

Monthly – Within twenty (20) days following the end of each month

Quarterly – Within twenty (25) days following the end of each quarter

b. For Withholding – Within ten (10) days following the end of each month

c. For Percentage – Within ten (10) days following the end of each month.

Please take note that your tax forms will be sent electronically to the BIR by 9 PM. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.