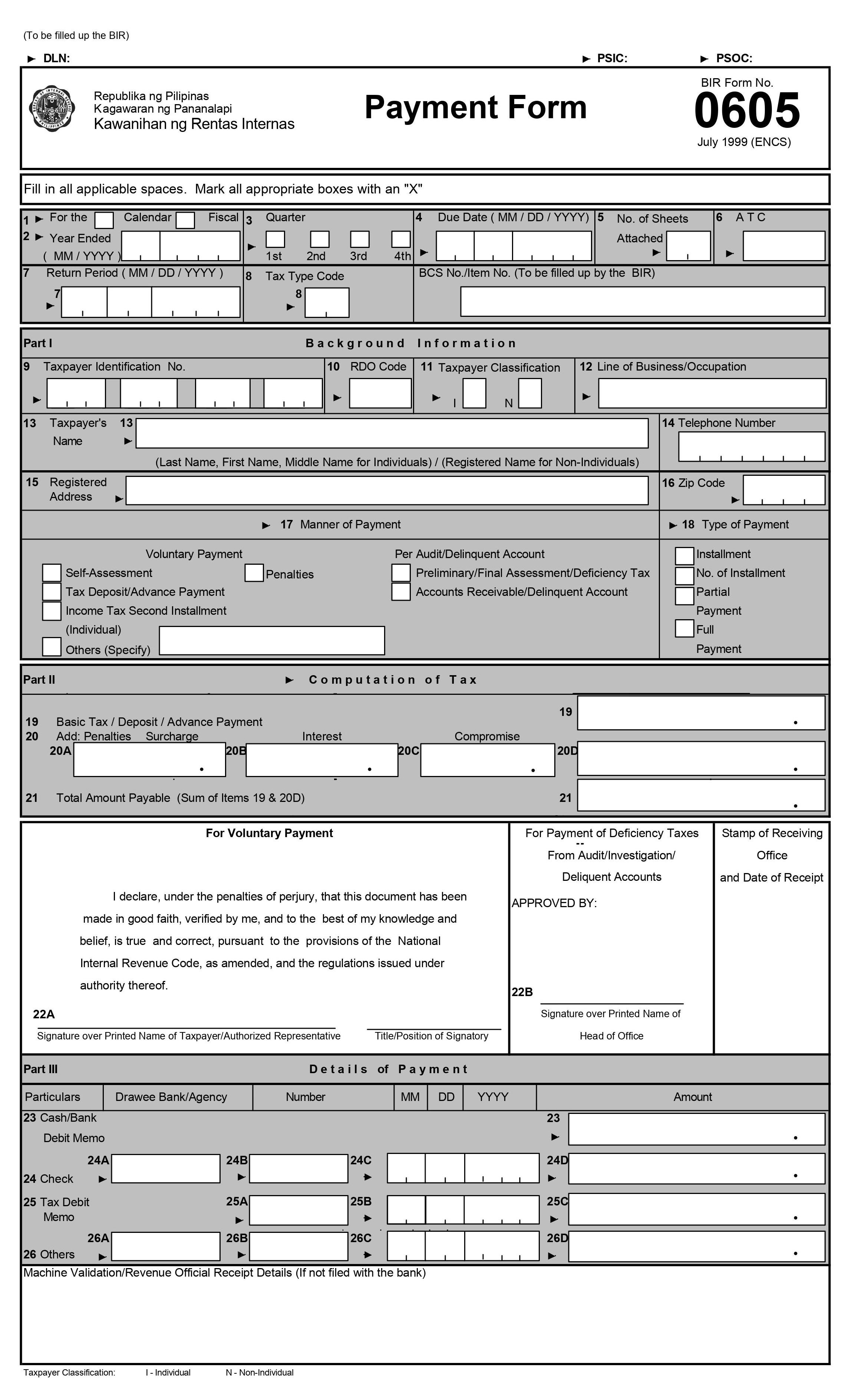

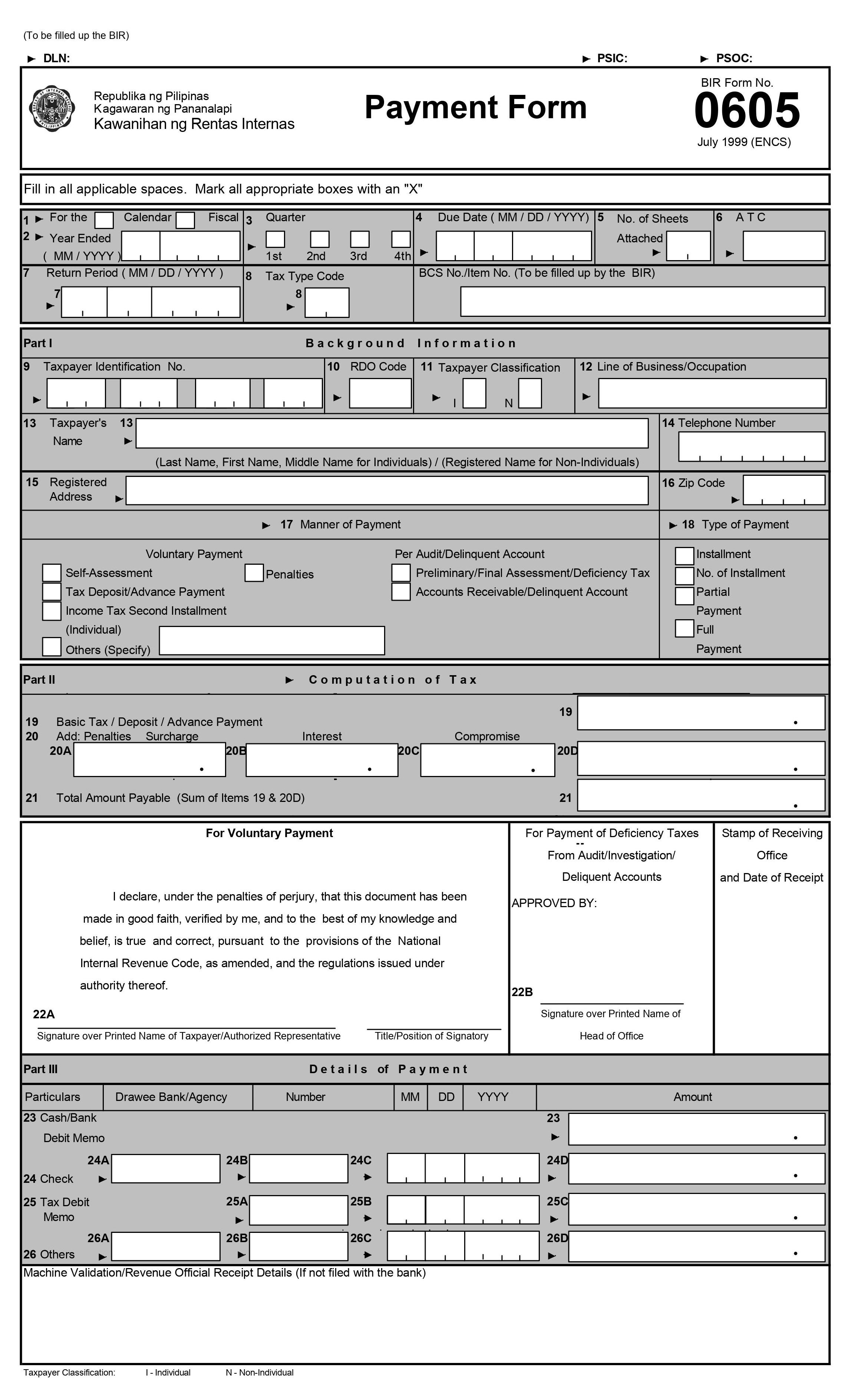

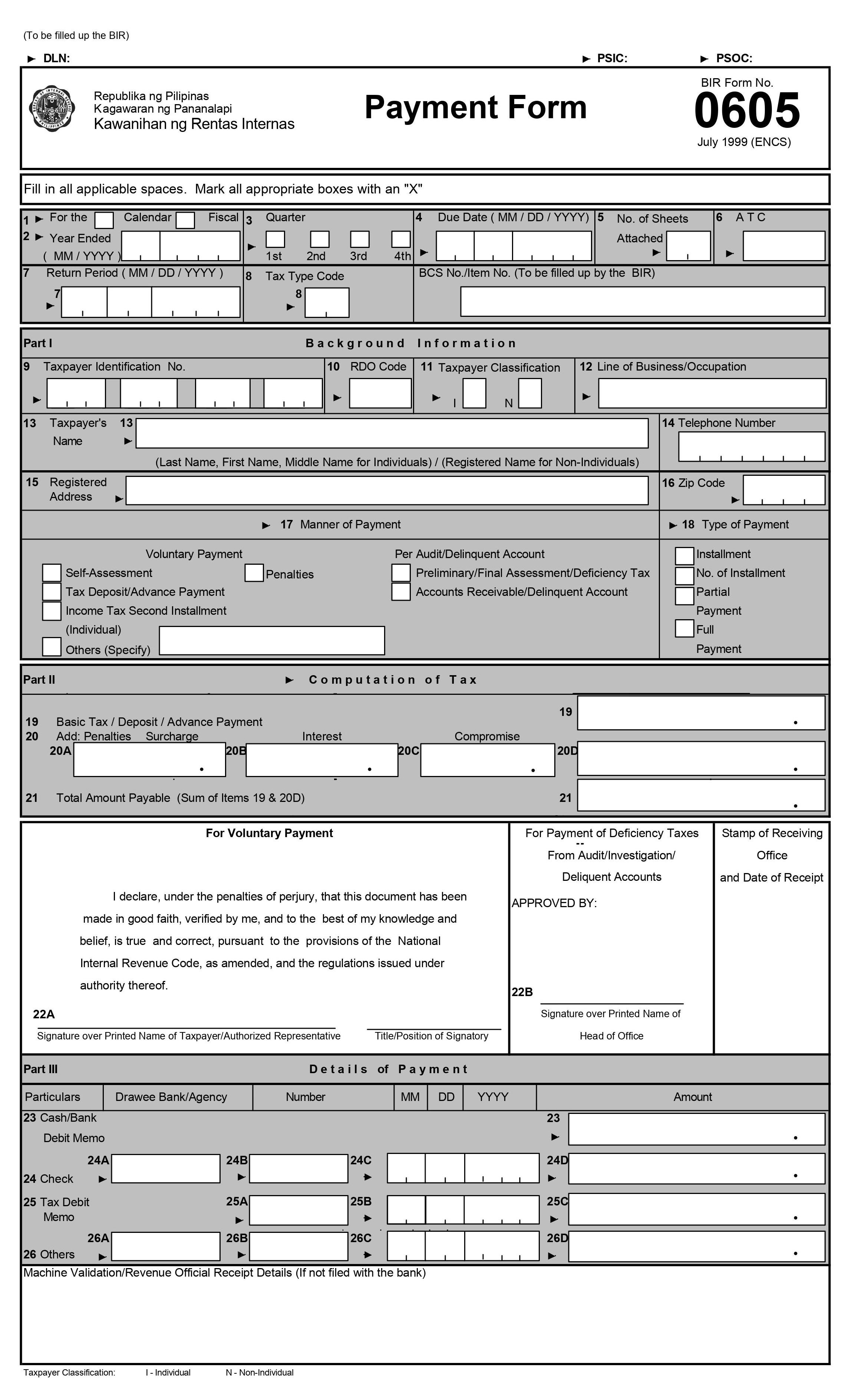

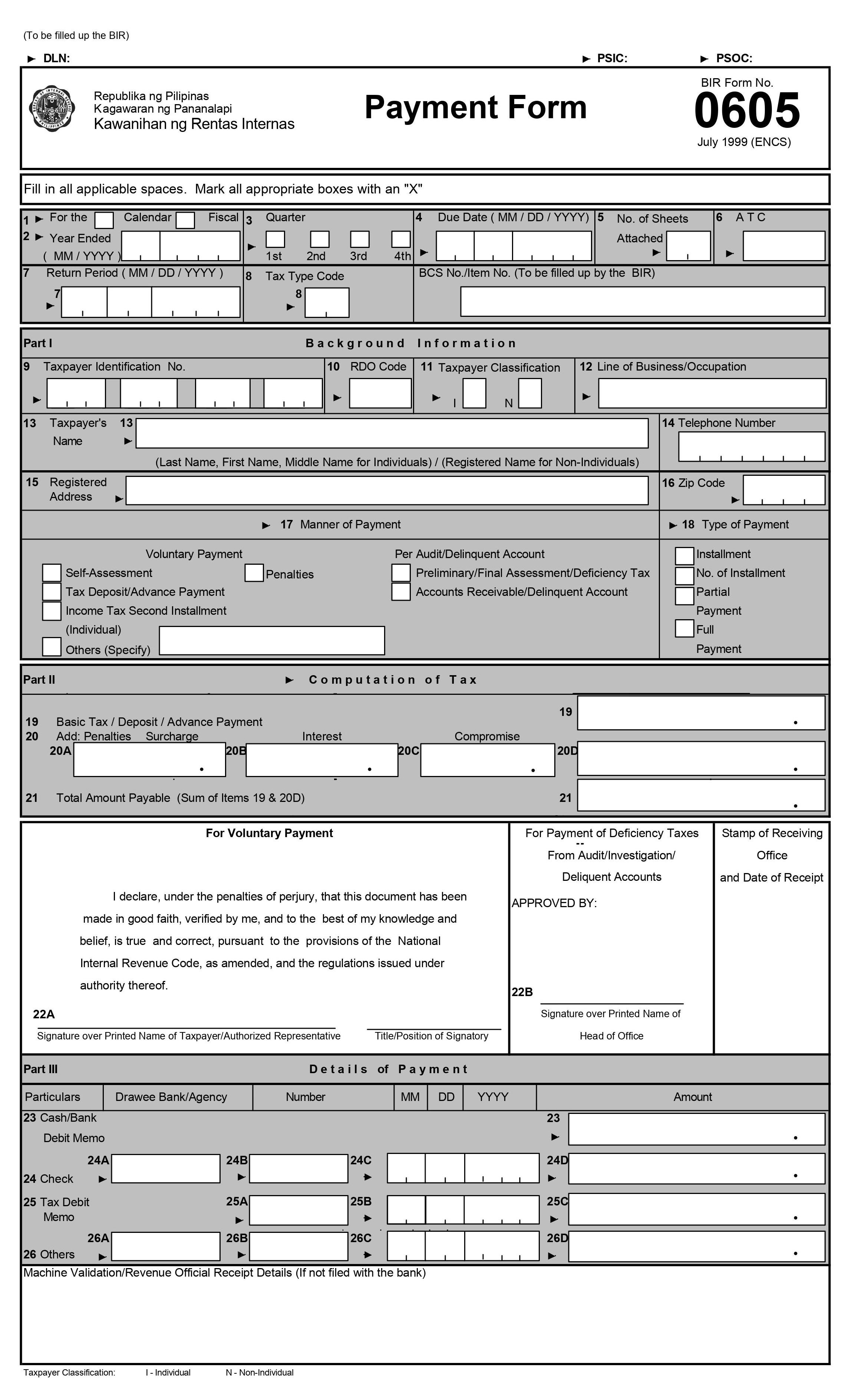

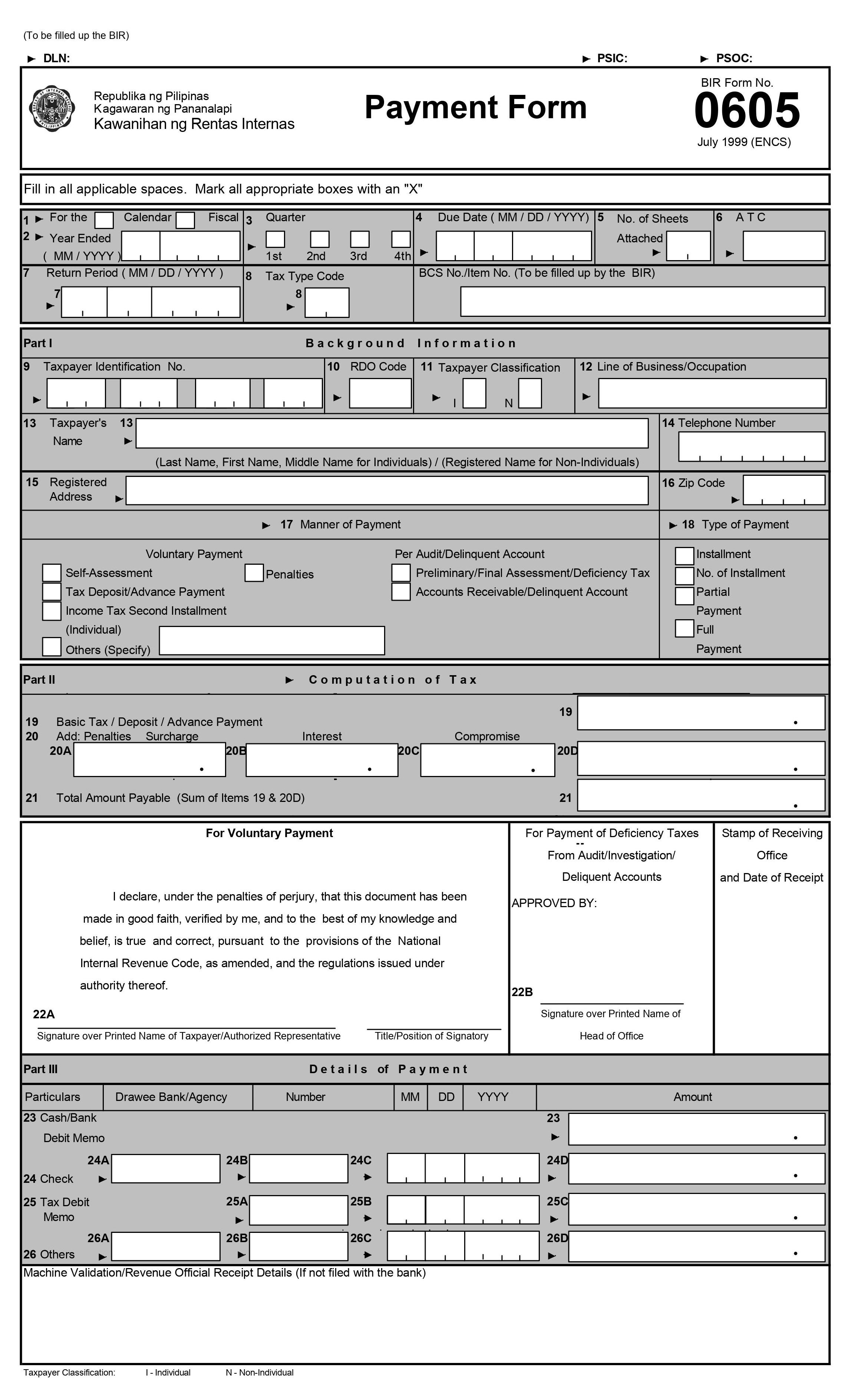

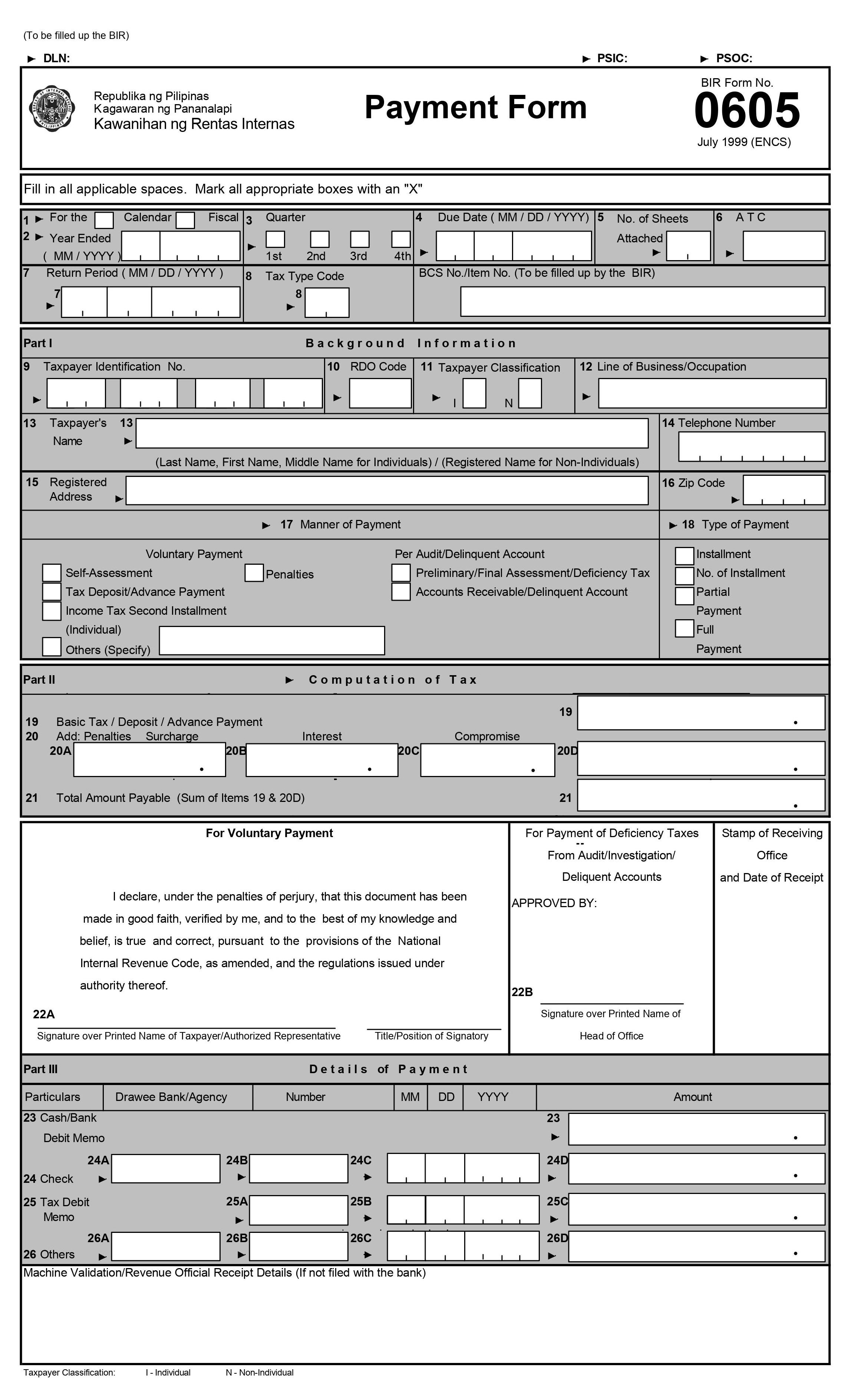

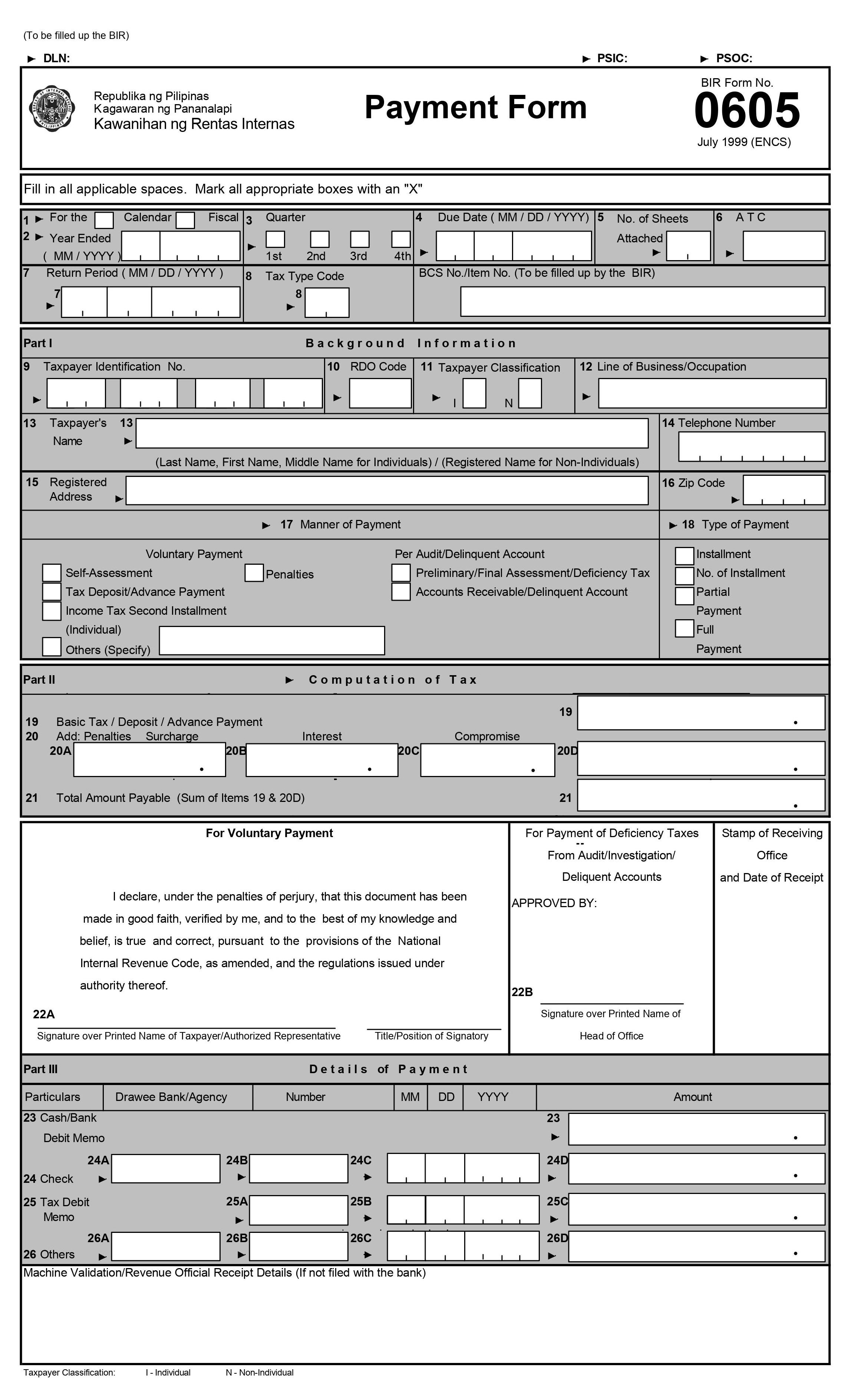

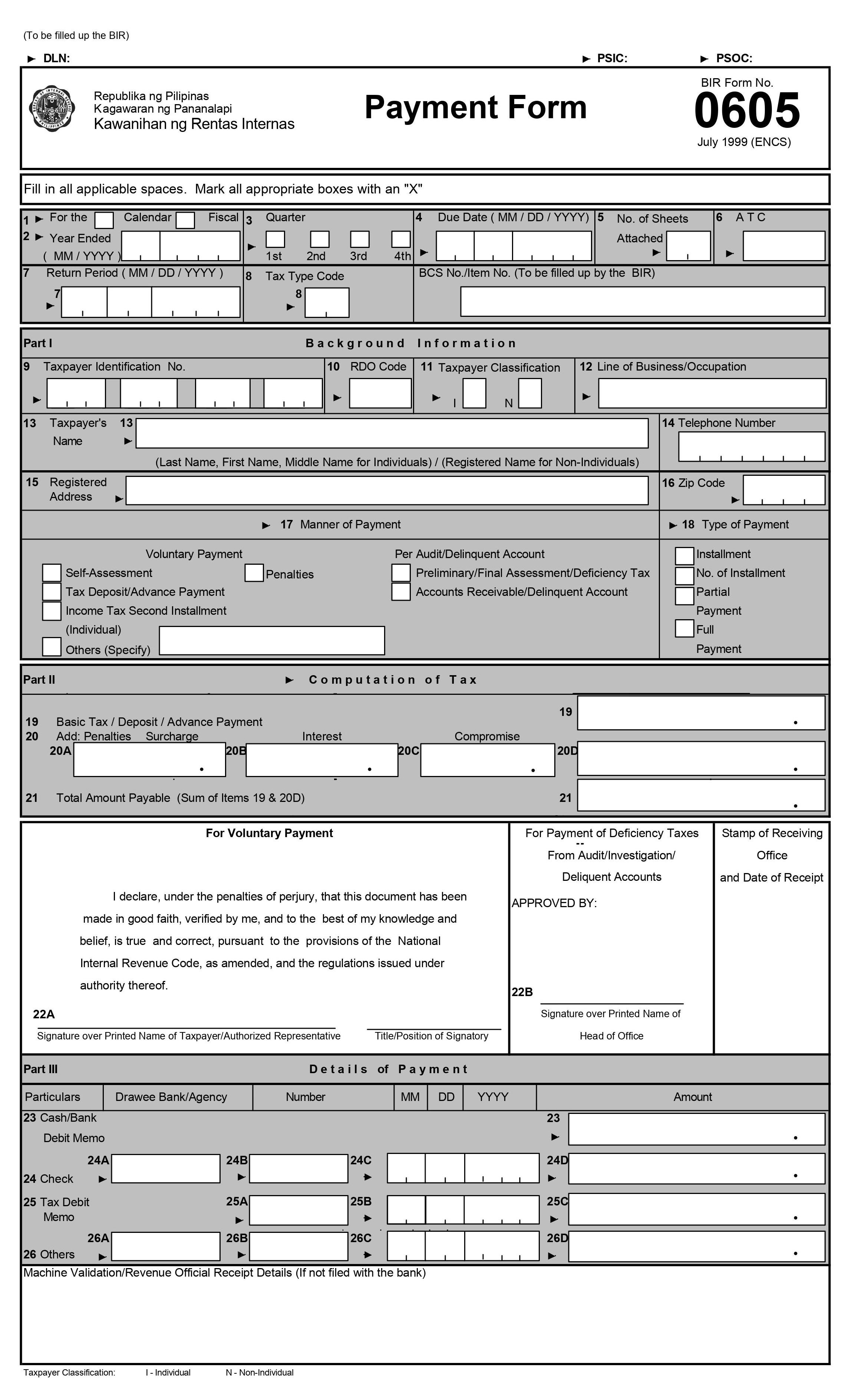

BIR Payment Form 0605 needs to be accomplished once the taxpayer settles his/her payments for taxes and fees which does not require the use of tax return as second installment payment for things such as deficiency tax, income tax, delinquency tax, penalties, advance payments, other forms of installment payments etc.

FORM 0605

Who needs to file?

Every taxpayer (whether individual or business) needs to use this form in order for them to be able to pay tax fees which does not require the use of a tax return.

When to file?

This form needs to be accomplished every time that the taxpayer faces due on tax penalties, or when the filer needs to make an advance payment. This can be used once the taxpayer receives a collection letter from the BIR, or when a business taxpayer would settle annual registration fees either for a new business or renewal which should be on or before January 31st of every year.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

How to file?

Just like any other tax form, you can e-file and e-pay your forms in JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

What is this form?

BIR Payment Form 0605 needs to be accomplished once the taxpayer settles his/her payments for taxes and fees which does not require the use of tax return as second installment payment for things such as deficiency tax, income tax, delinquency tax, penalties, advance payments, other forms of installment payments etc.

Related Articles:

Who needs to file?

Every taxpayer (whether individual or business) needs to use this form in order for them to be able to pay tax fees which does not require the use of a tax return.

When to file?

This form needs to be accomplished every time that the taxpayer faces due on tax penalties, or when the filer needs to make an advance payment. This can be used once the taxpayer receives a collection letter from the BIR, or when a business taxpayer would settle annual registration fees either for a new business or renewal which should be on or before January 31st of every year.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

How to file?

Just like any other tax form, you can e-file and e-pay your forms in JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

Available in: