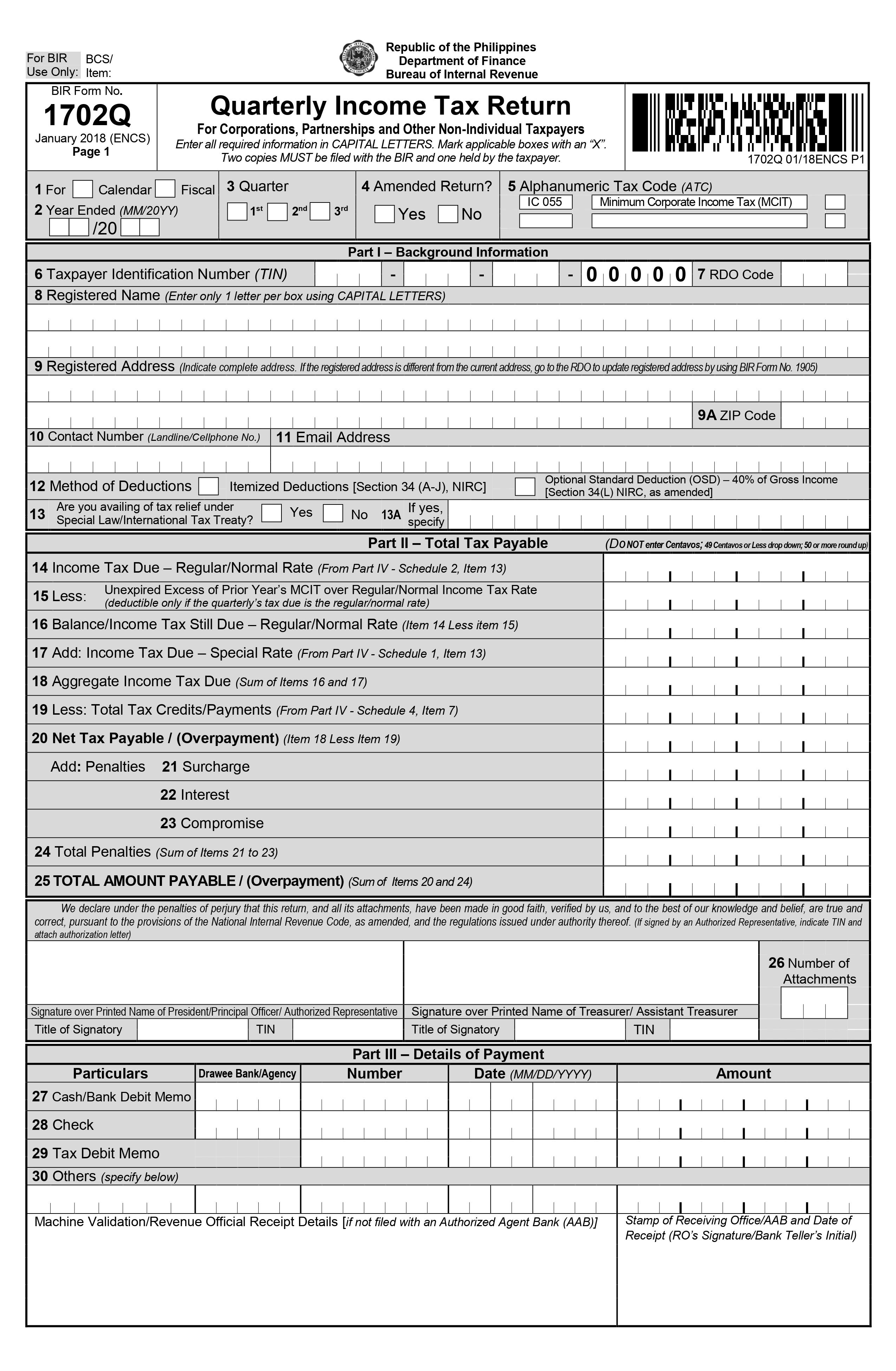

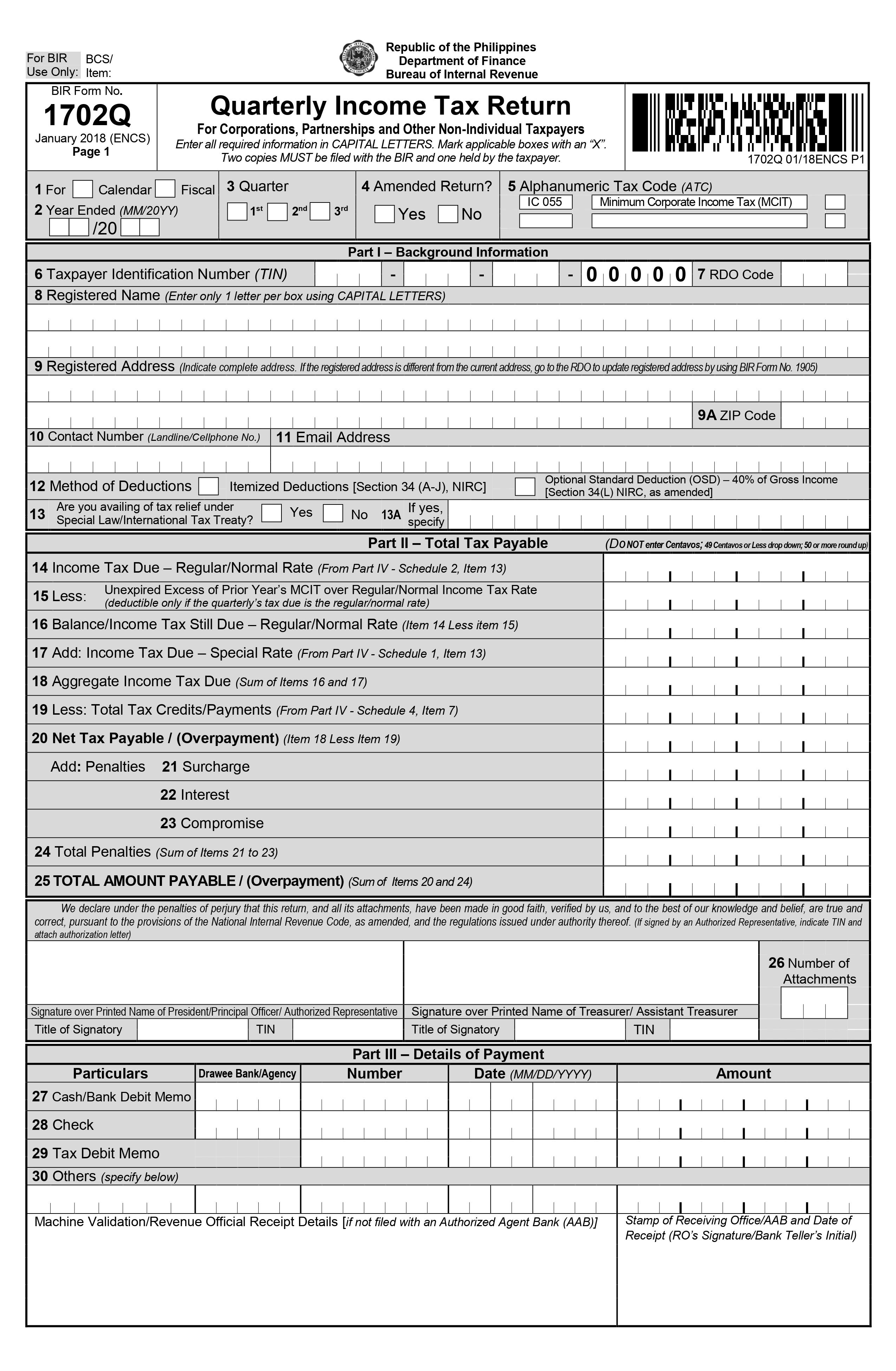

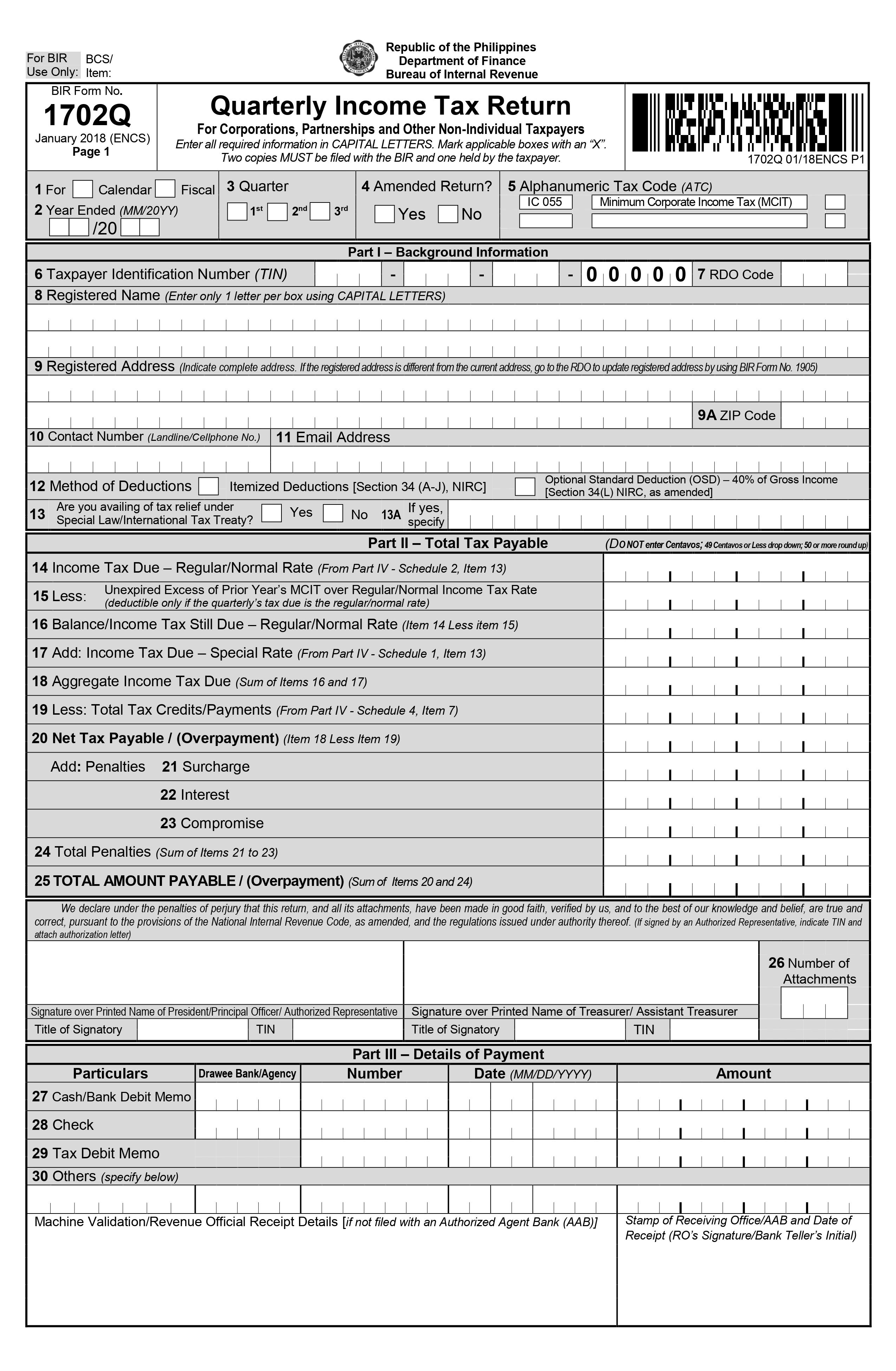

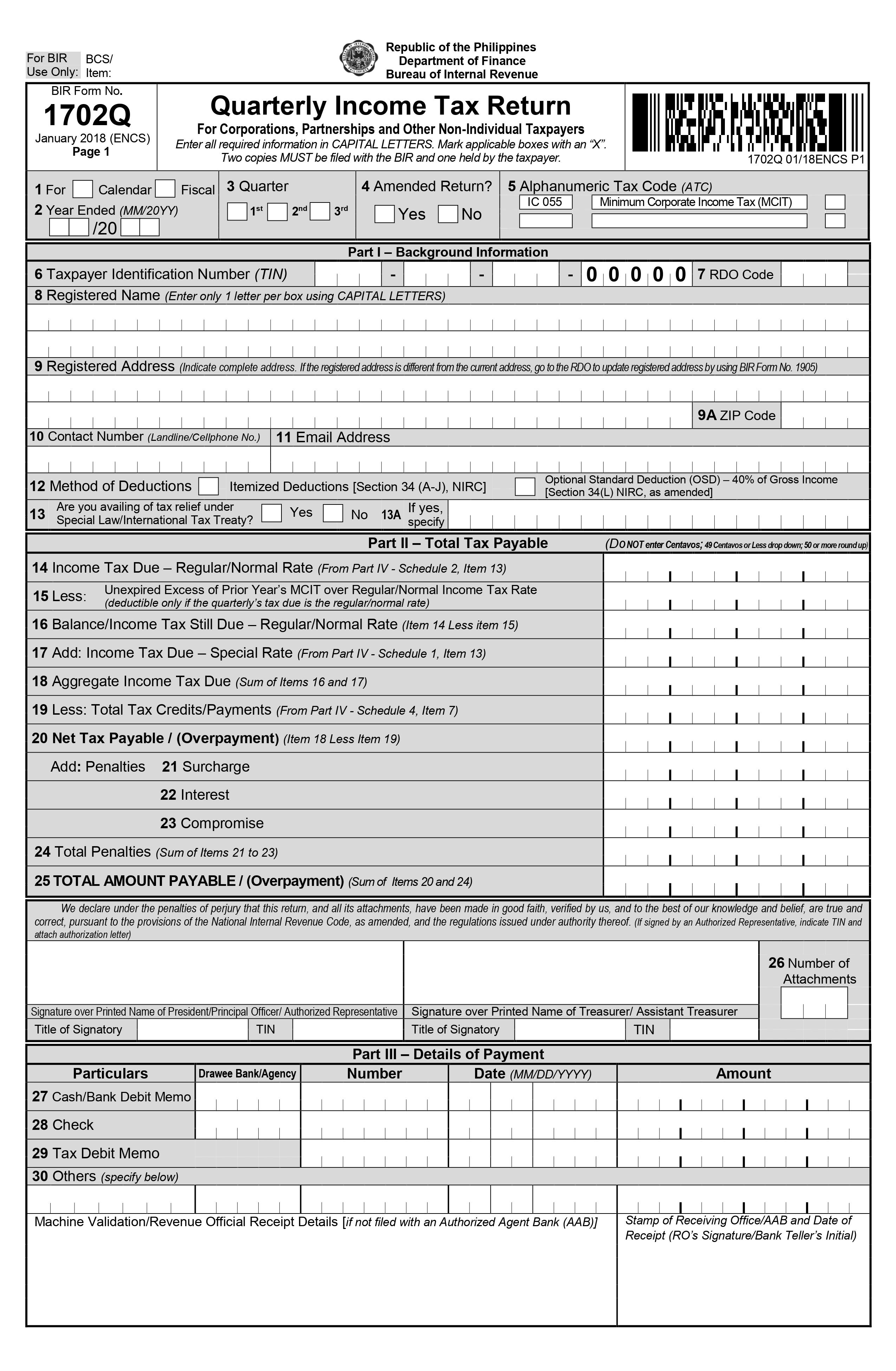

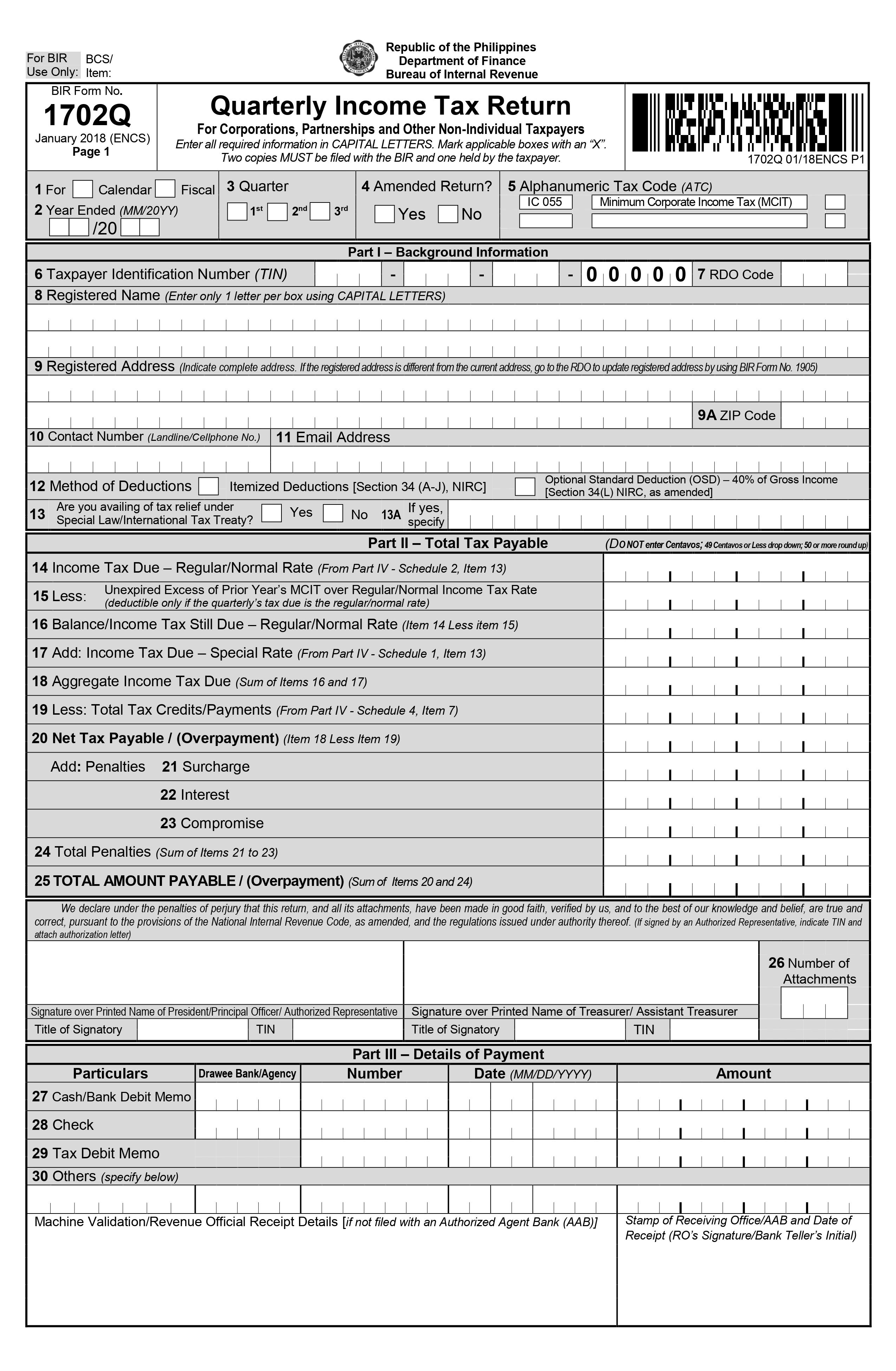

BIR form 1702Q, or also known as Quarterly Income Tax Return (For Corporations and Partnerships) is a tax return intended for corporations, partnerships and non-individual taxpayers.

FORM 1702Q

What is this form?

Available in:

Who needs to file?

This tax return shall be filed quarterly by any form of corporation, partnership, stock companies and associations which are engaged in a trade or business within the Philippines.

When to file?

Deadline for submission is on or before the 60th day following the close of each of the quarters of the taxable year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

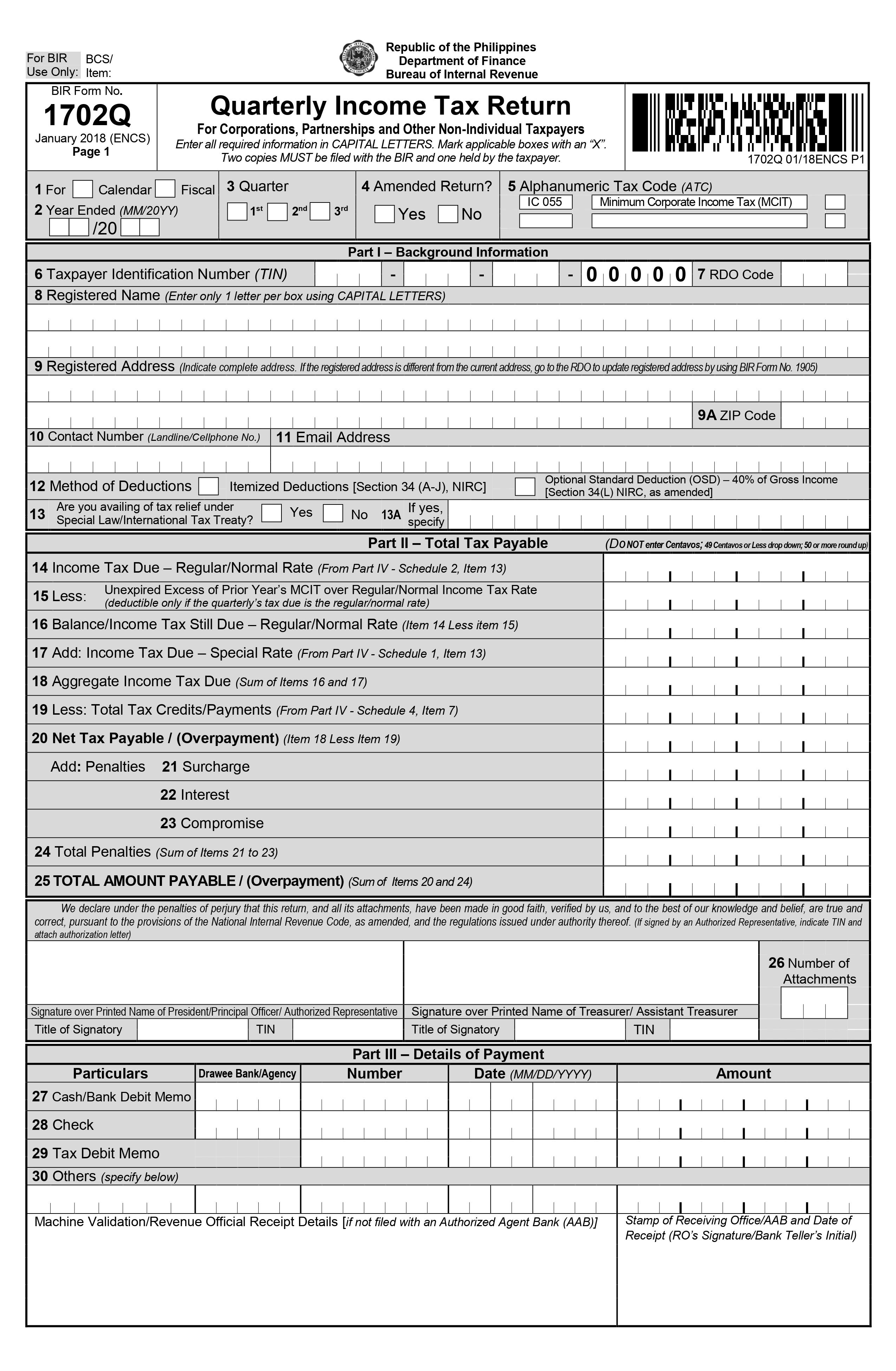

What is this form?

BIR form 1702Q, or also known as Quarterly Income Tax Return (For Corporations and Partnerships) is a tax return intended for corporations, partnerships and non-individual taxpayers.

Who needs to file?

This tax return shall be filed quarterly by any form of corporation, partnership, stock companies and associations which are engaged in a trade or business within the Philippines.

When to file?

Deadline for submission is on or before the 60th day following the close of each of the quarters of the taxable year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: