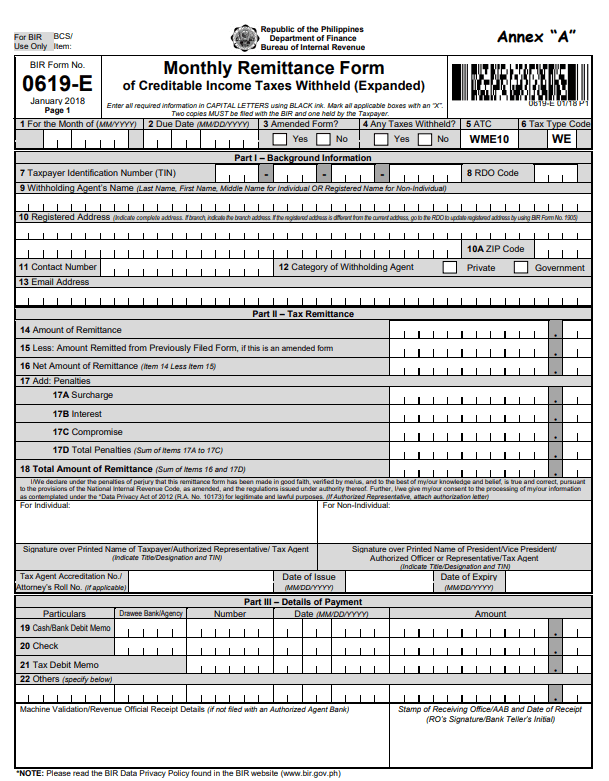

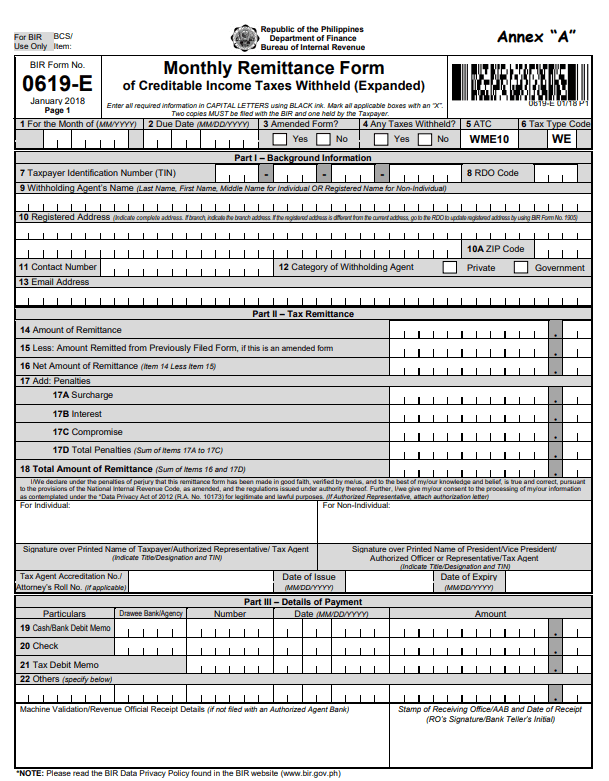

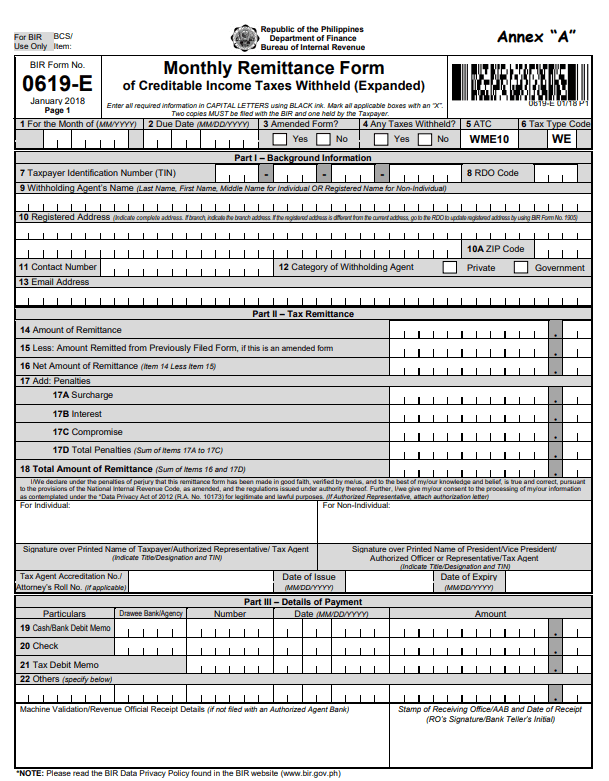

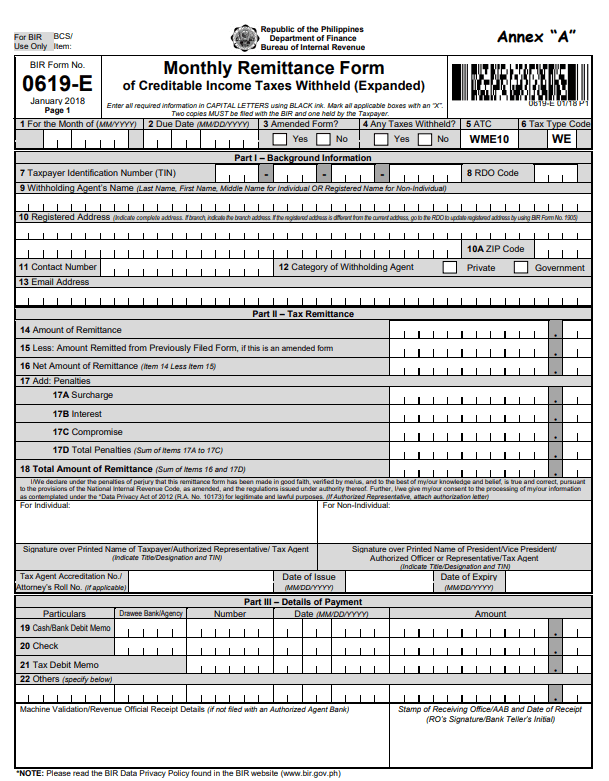

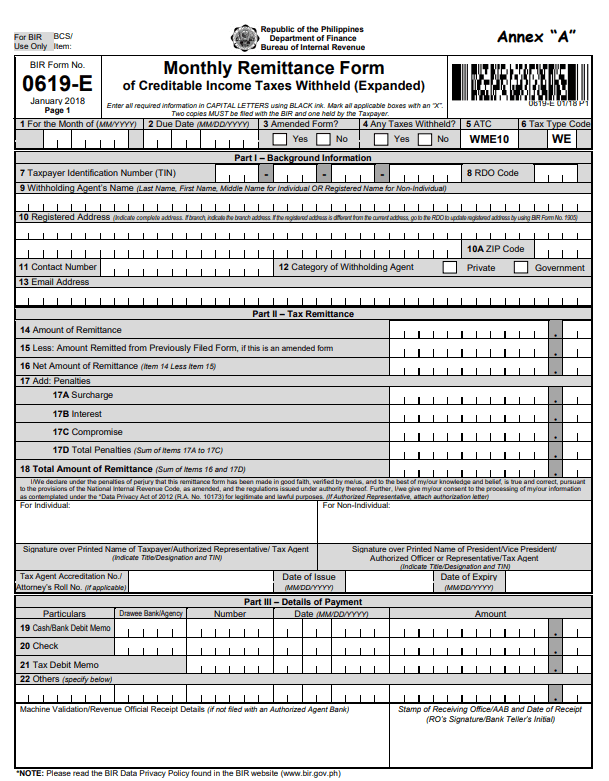

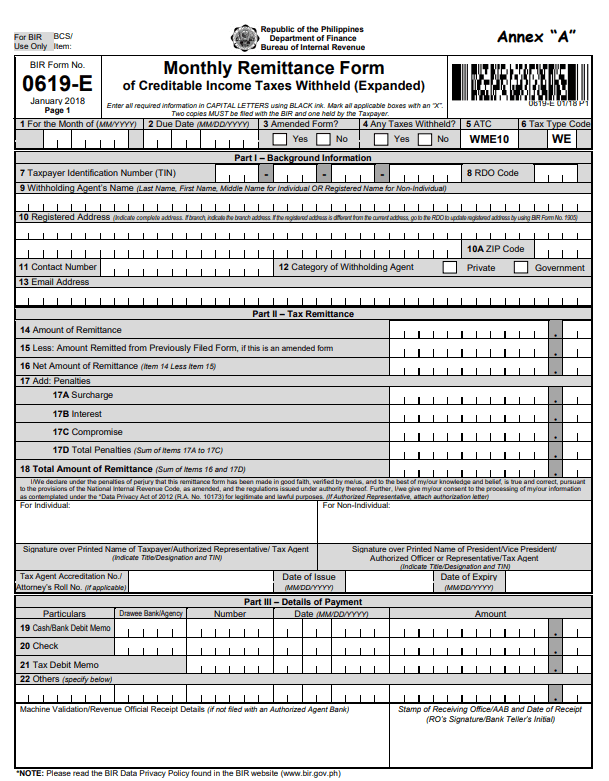

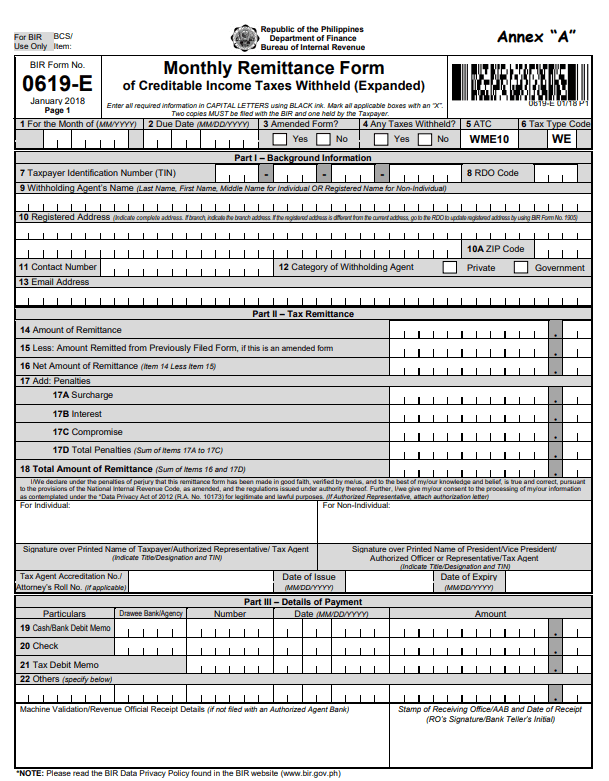

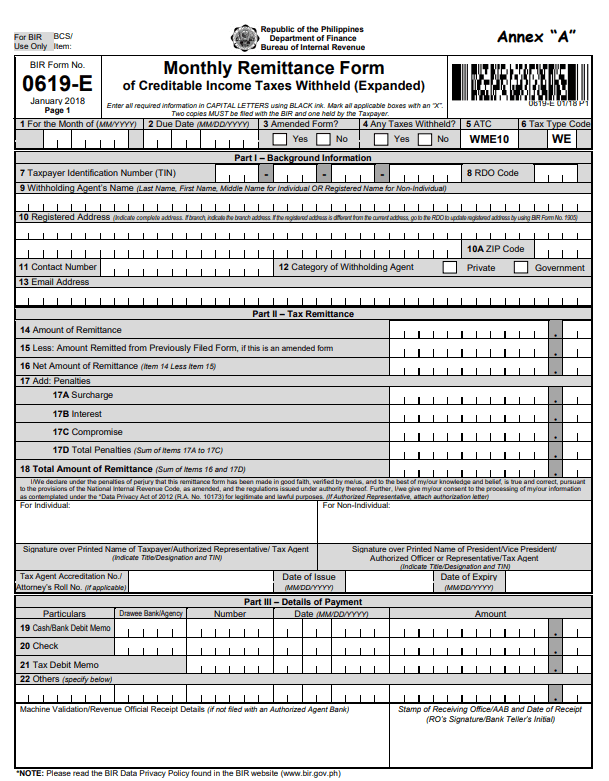

BIR Form 0619-E or Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) is a remittance form that is used for remittance of expanded withholding taxes, as mentioned within the provisions of Revenue Regulations No. 11-2018.

FORM 0619-E

What is this form?

Available in:

Who needs to file?

Any Individual/non-individual considered as a withholding agent who is required to withhold (and deduct) taxes that were paid to the authorized representative, in behalf of the taxpayer shall use this form to remit the creditable tax withheld. Now, if the agent required to withhold payments is a corporation, then the return shall be filed using the corporation’s name and should be verified by the president, vice president or authorized officer and signed by the appointed treasurer/assistant treasurer.

When to file?

Remittance forms such as 0619-E shall be filed every 10th day of the following month at which the withholding was made.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

What is this form?

BIR Form 0619-E or Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) is a remittance form that is used for remittance of expanded withholding taxes, as mentioned within the provisions of Revenue Regulations No. 11-2018.

Who needs to file?

Any Individual/non-individual considered as a withholding agent who is required to withhold (and deduct) taxes that were paid to the authorized representative, in behalf of the taxpayer shall use this form to remit the creditable tax withheld. Now, if the agent required to withhold payments is a corporation, then the return shall be filed using the corporation’s name and should be verified by the president, vice president or authorized officer and signed by the appointed treasurer/assistant treasurer.

When to file?

Remittance forms such as 0619-E shall be filed every 10th day of the following month at which the withholding was made.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: