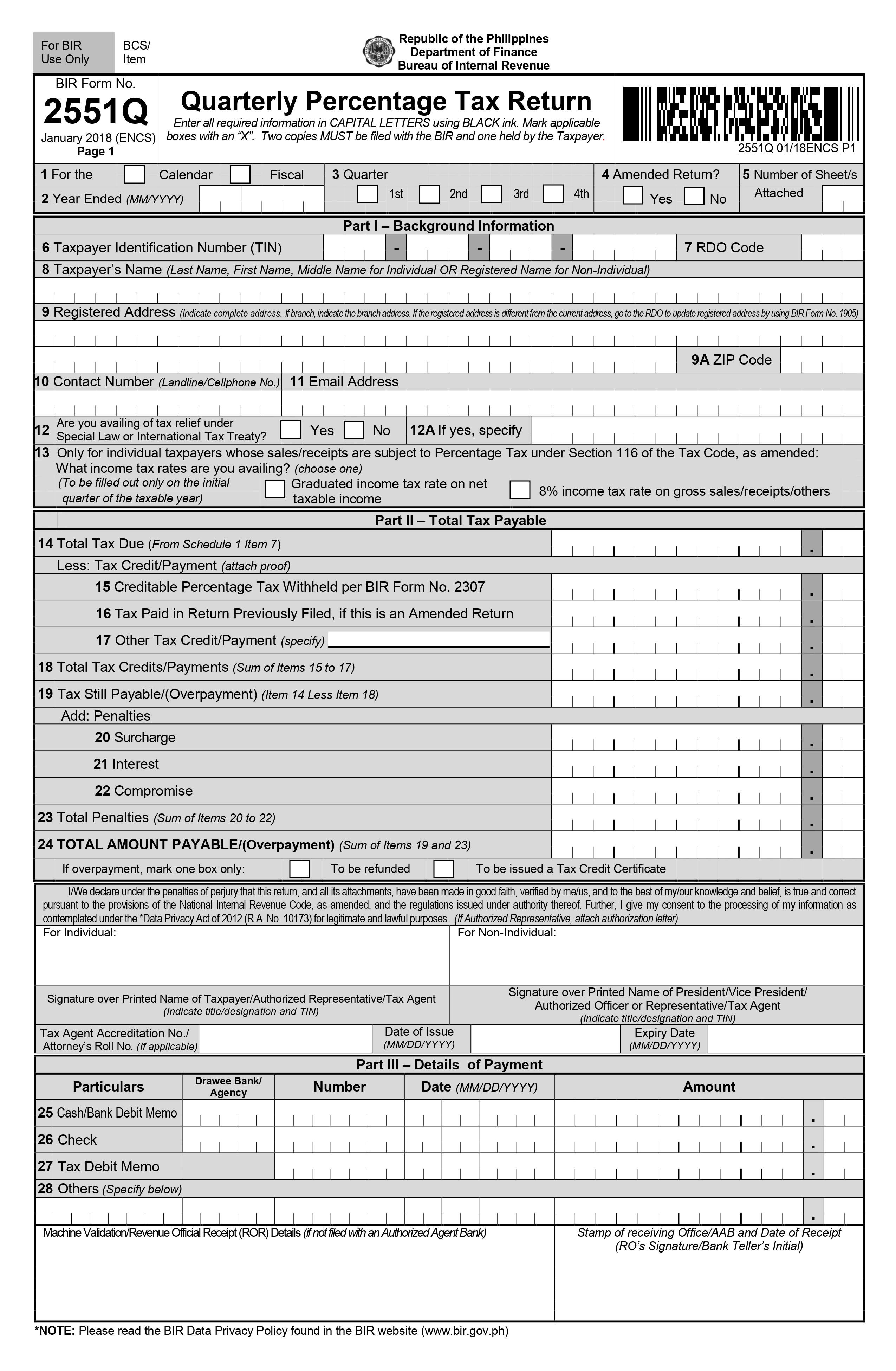

BIR Form 2551Q, or also known as Quarterly Percentage Tax Return are taxes imposed on individuals/businesses who sell/lease goods or services which are exempted from Value Added Tax (VAT) with annual sales not exceeding 3,000,000 PHP.

Currently, the updated version of this form comes with additional ATCs (Alphanumeric Tax Code) such as PT010, PT040 and many others.