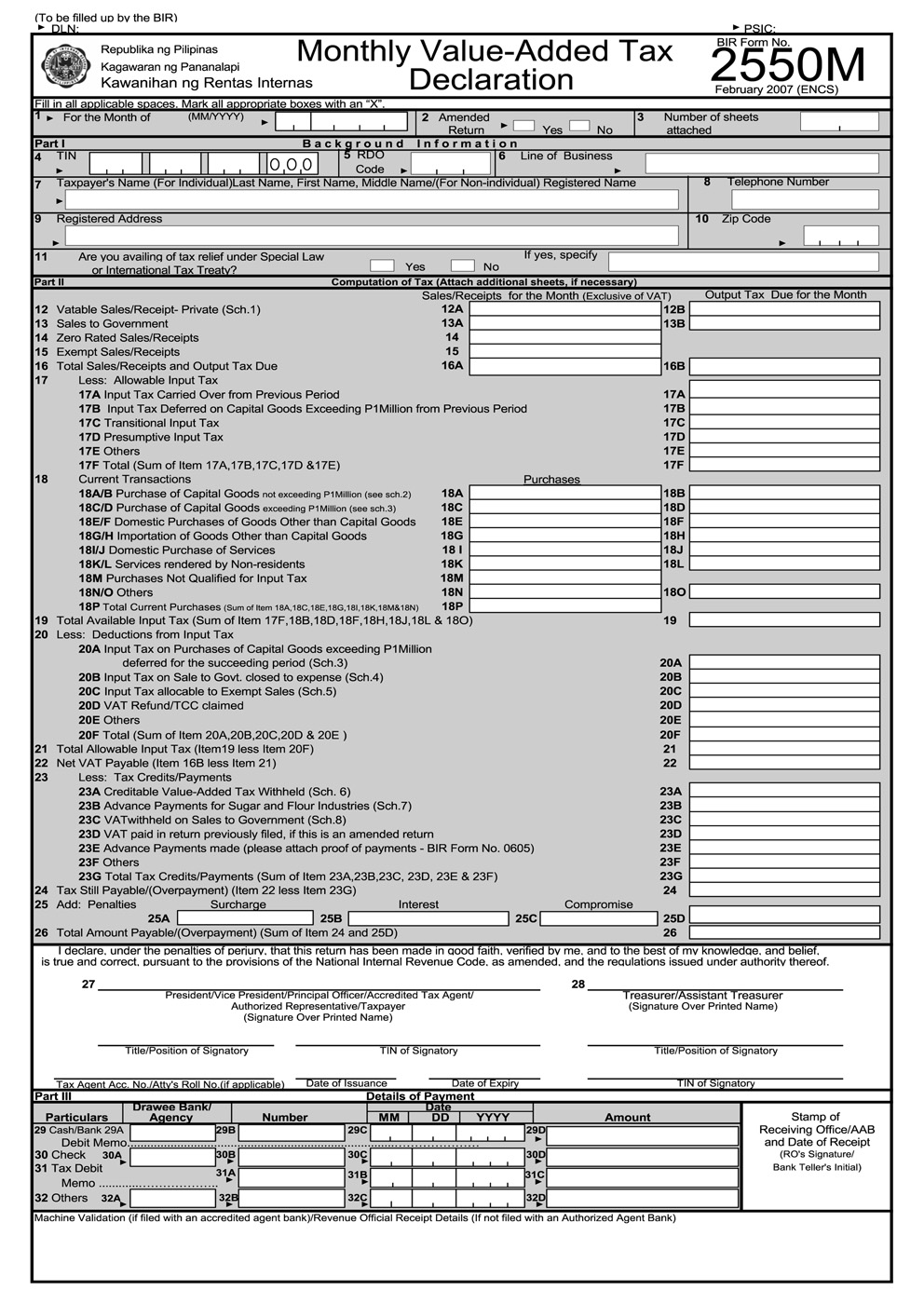

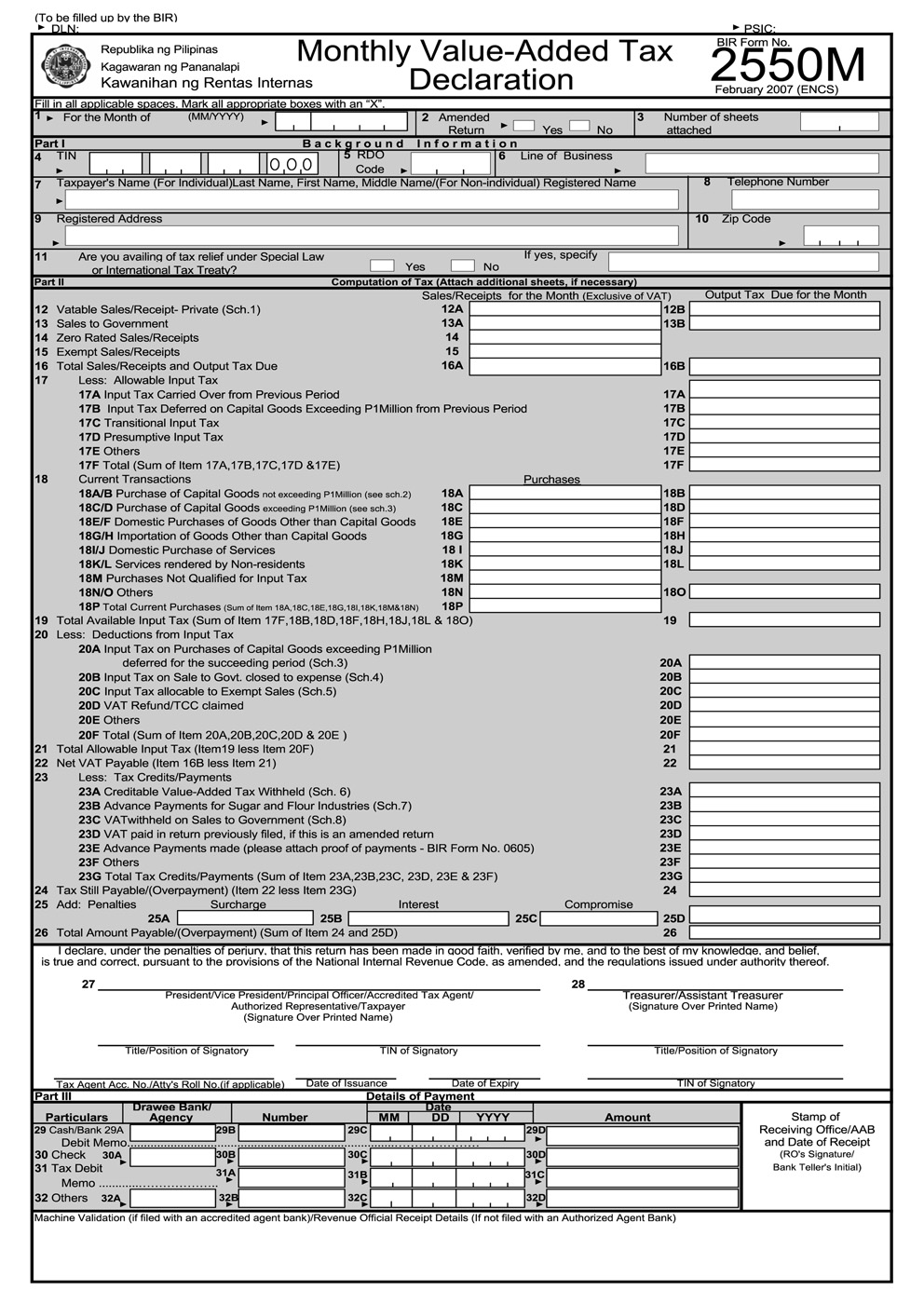

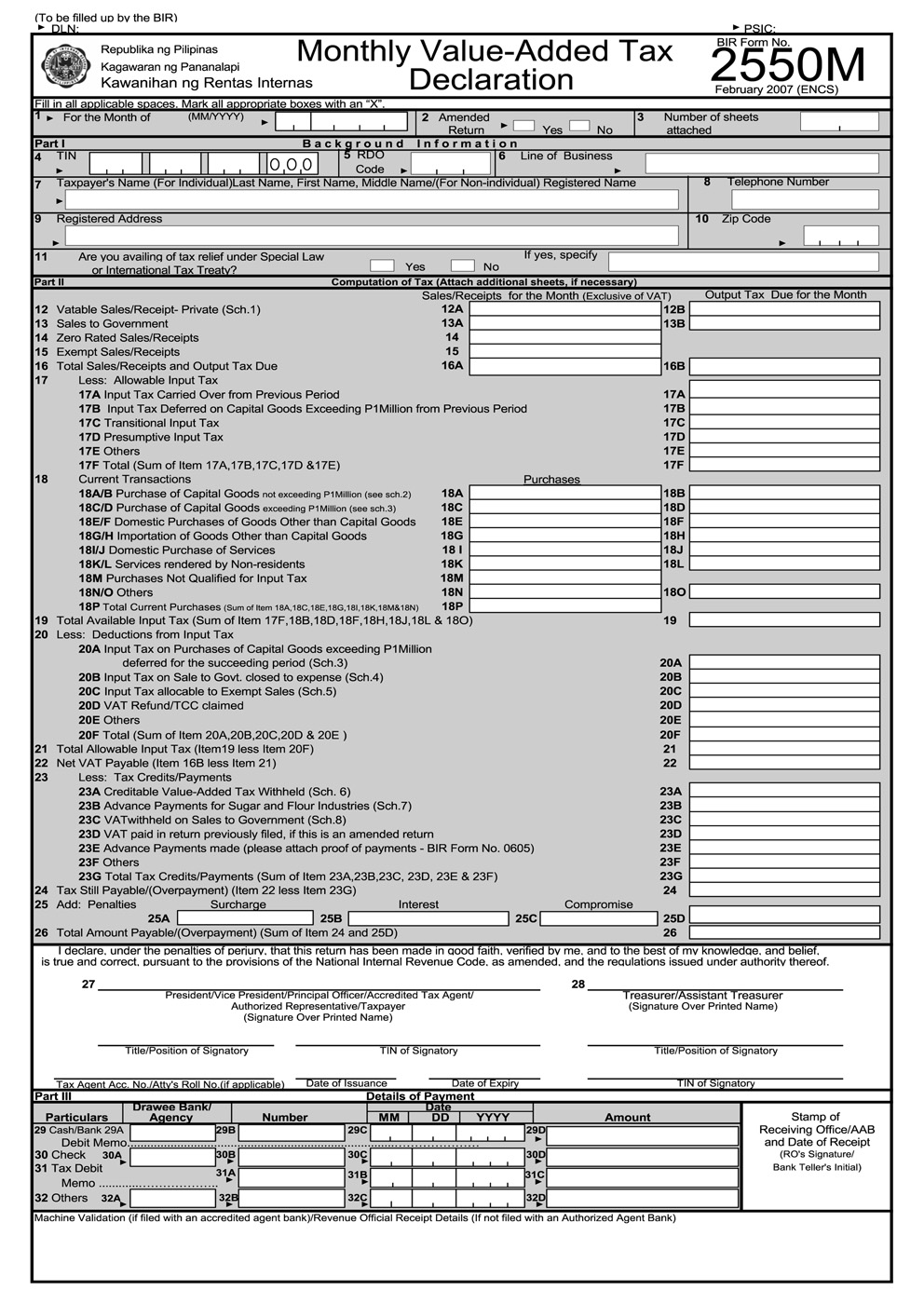

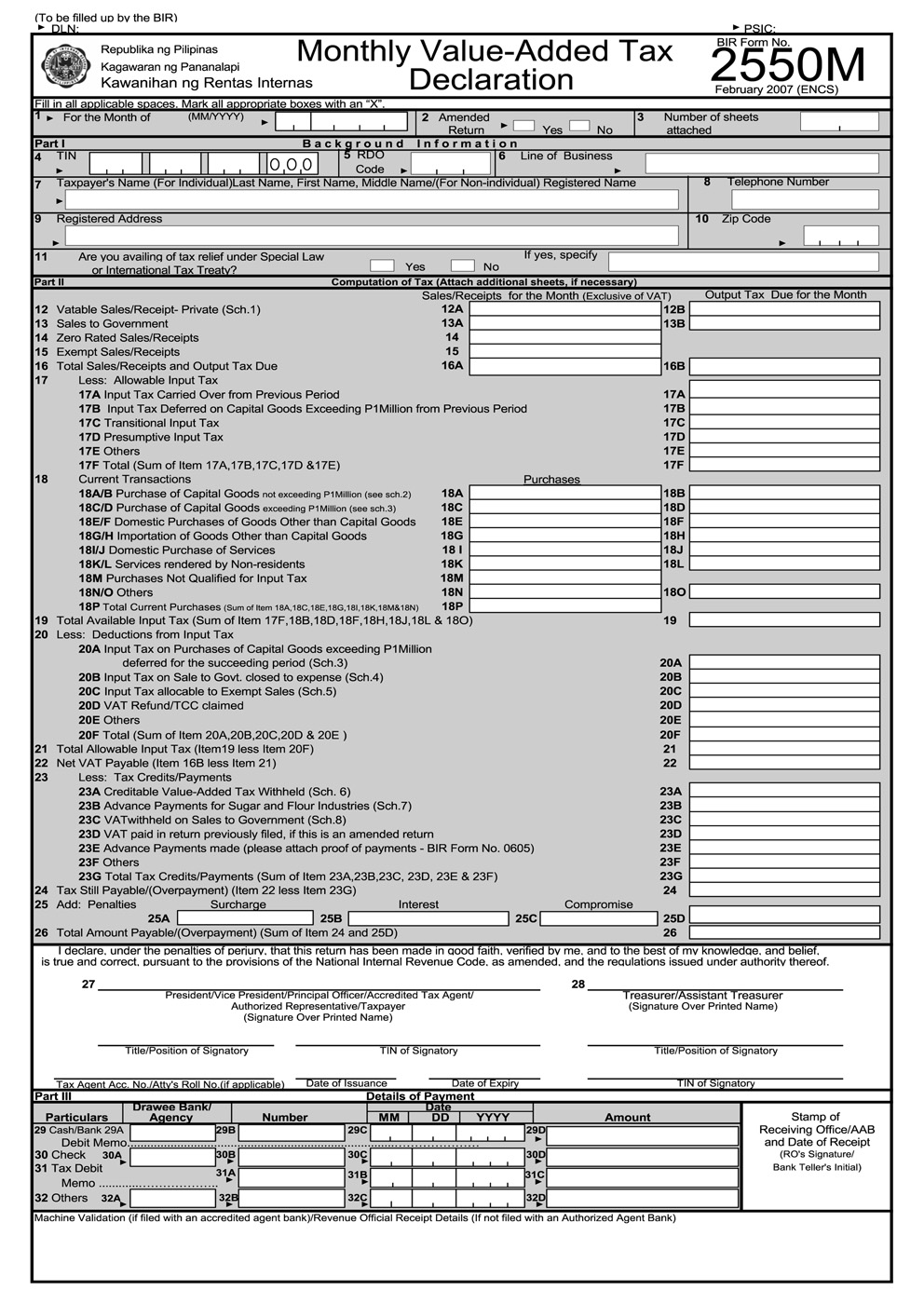

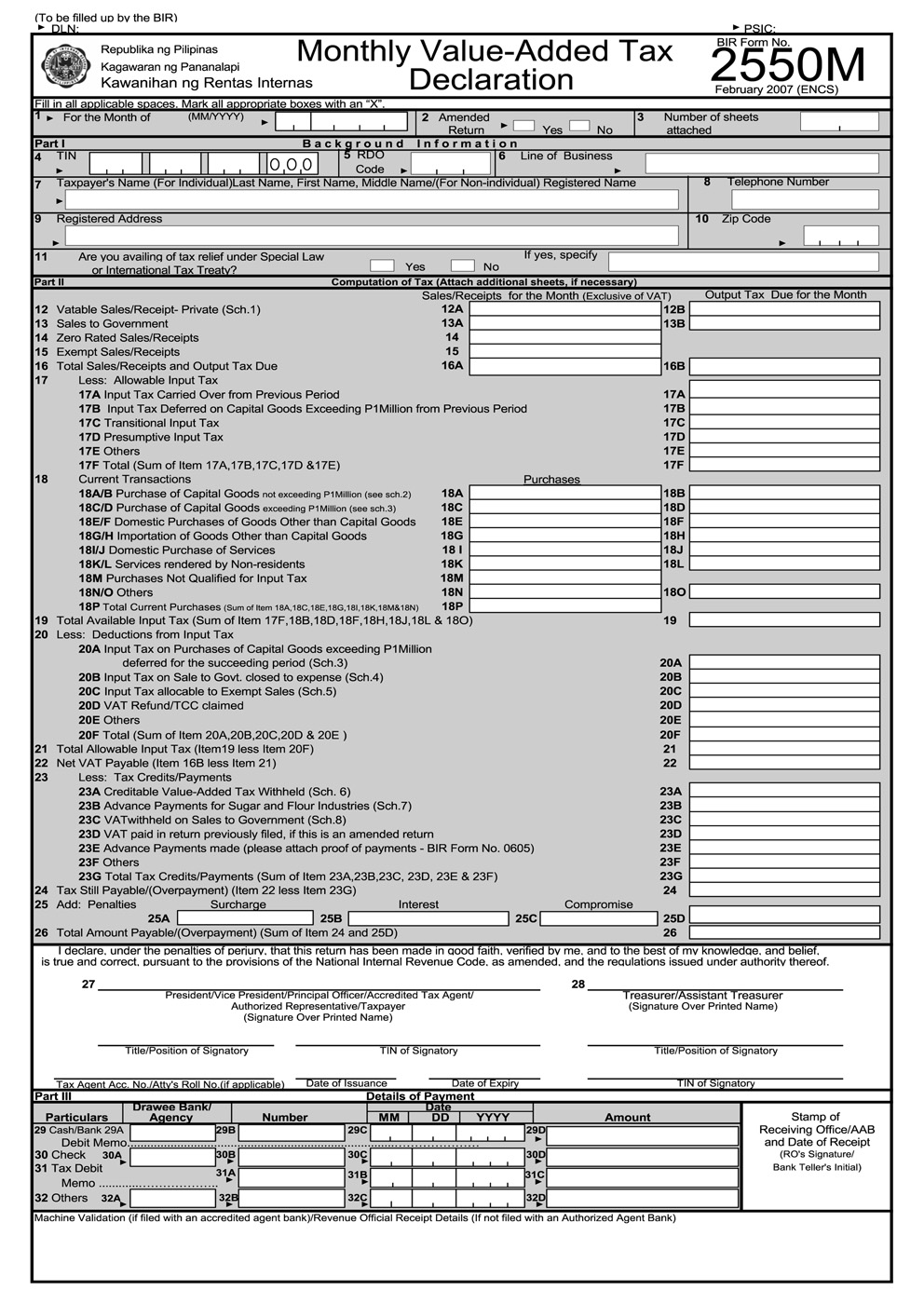

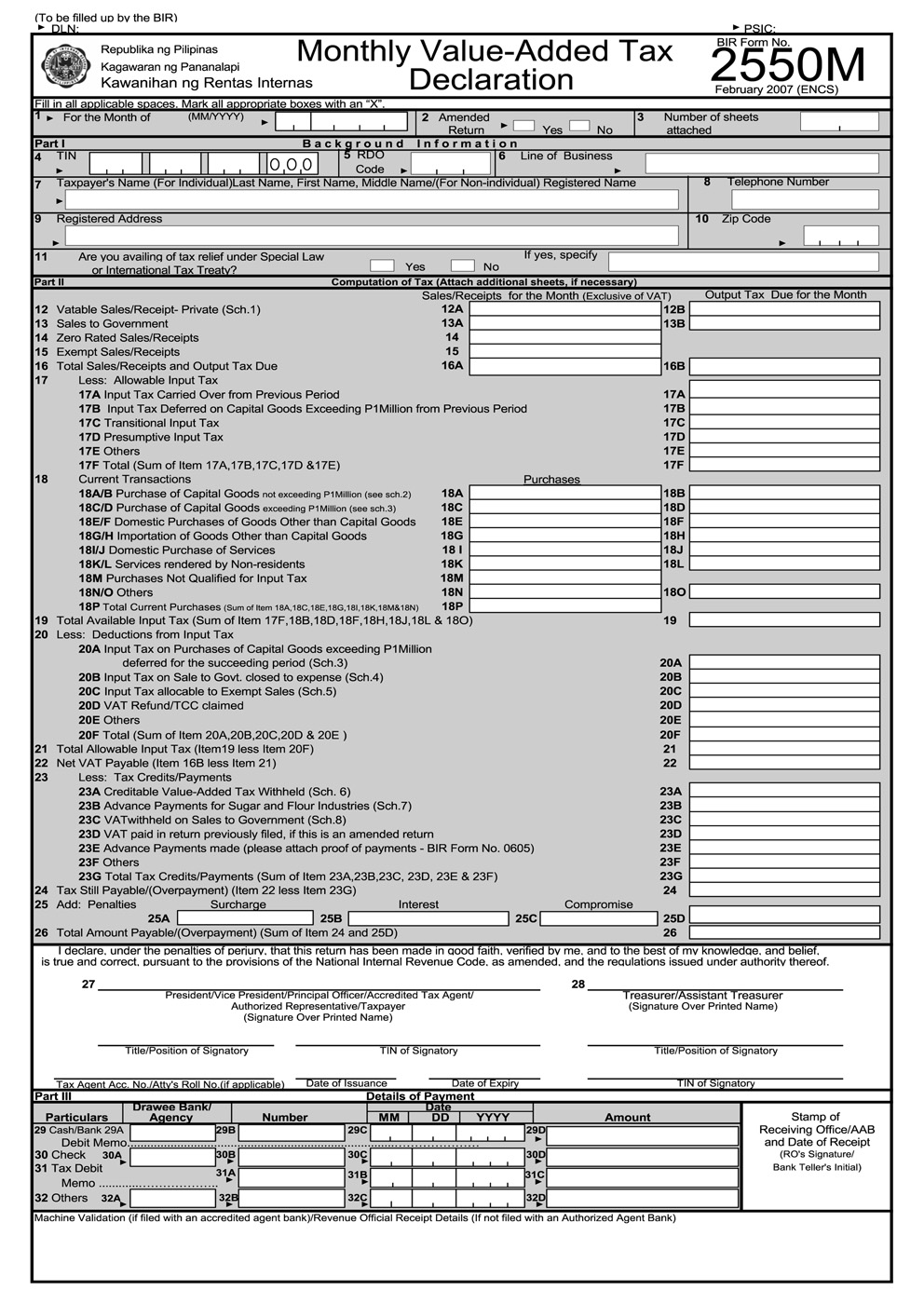

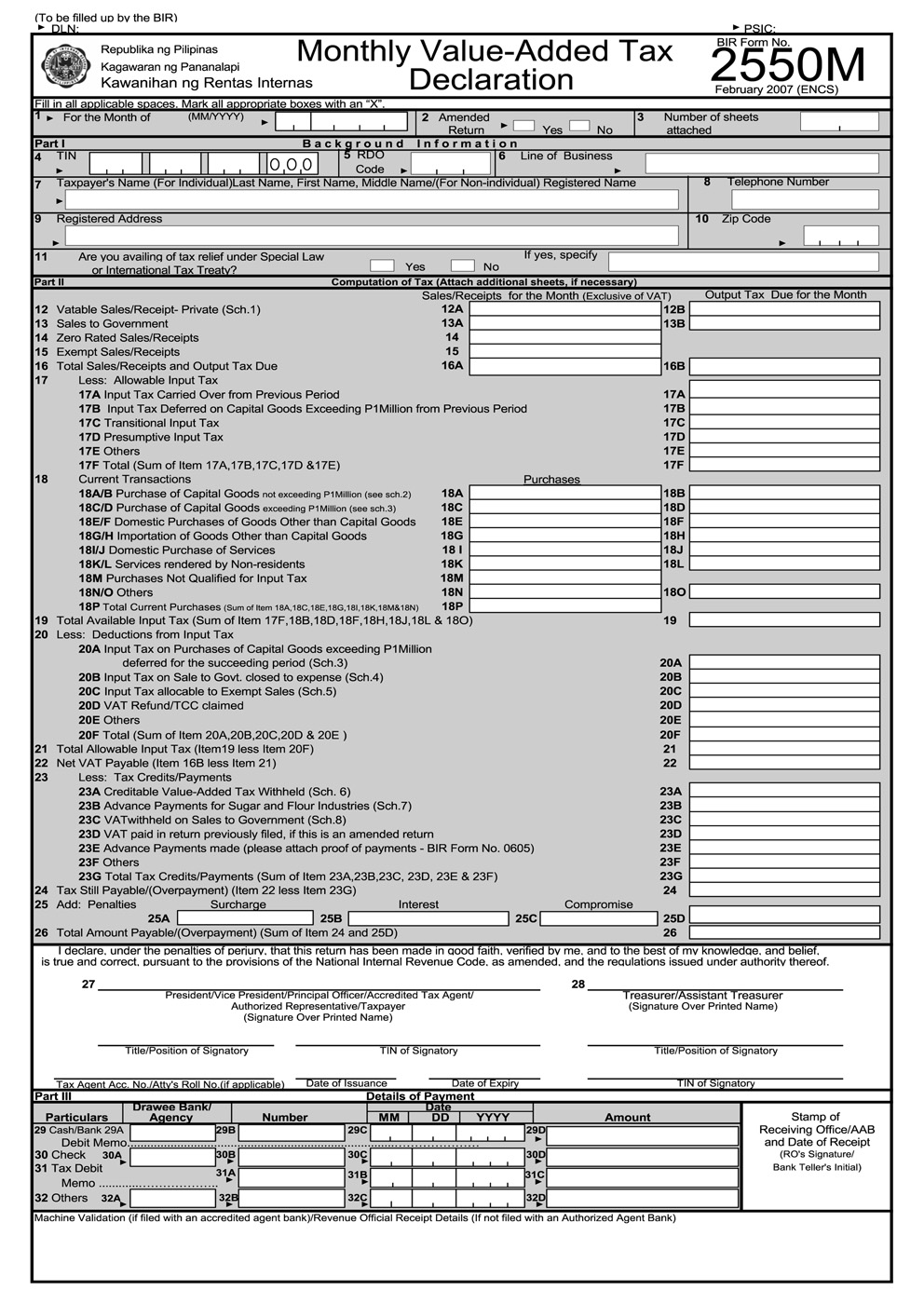

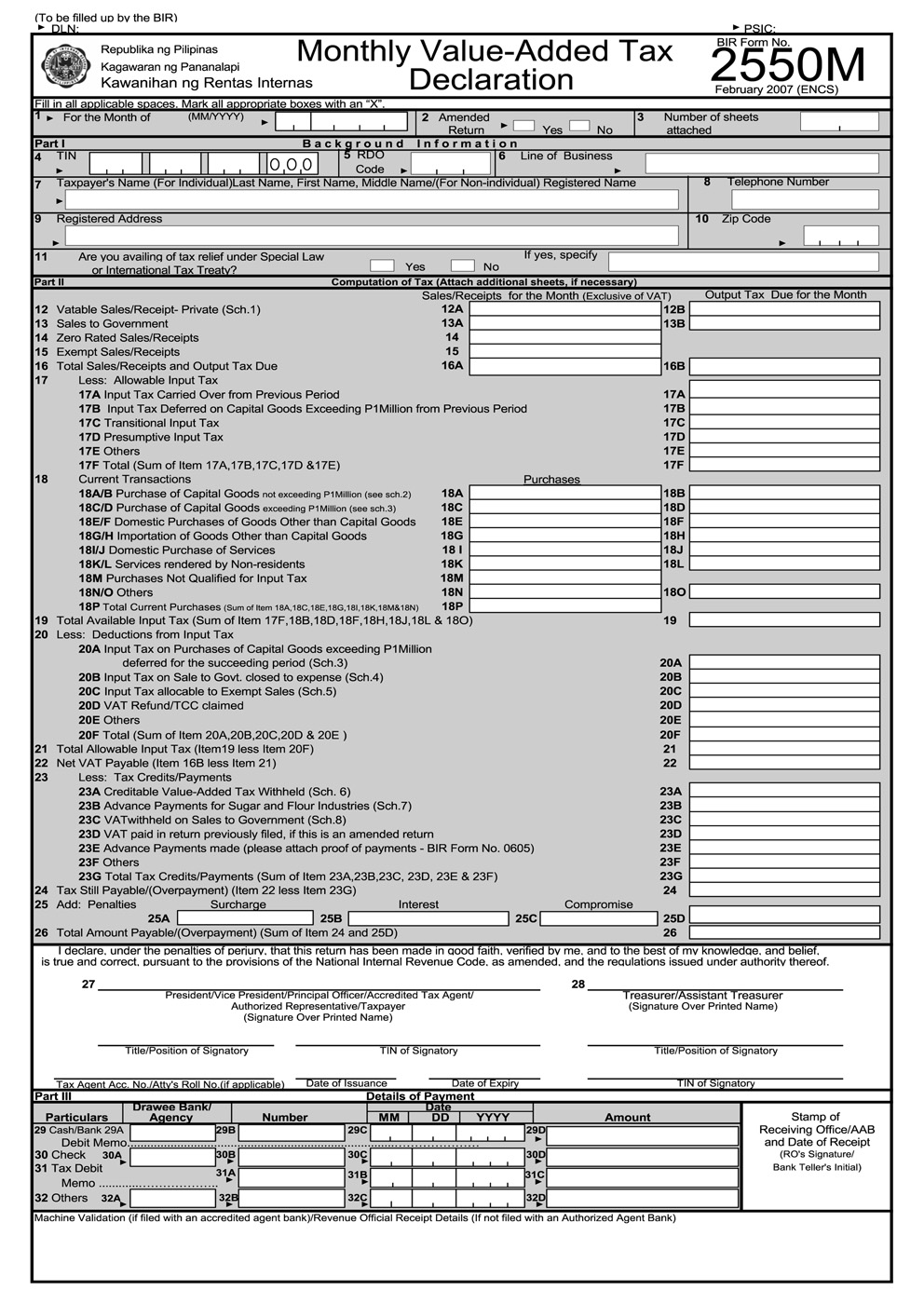

BIR Form 2550M, or also known as Monthly Value-Added Tax Declaration is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines. Serving as a form of indirect tax, VAT is passed on to the buyer which consumes the product/service.

FORM 2550M

Who needs to file?

Individuals or businesses which sell or lease goods or services which are subject to VAT, and if the amount of their actual gross sales/receipts exceeds up to P3,000,000.00.

When to file?

Not later than the 20th day following the end of each month.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

https://www.juan.tax/blog/extended-deadlines-of-tax-returns

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

What is this form?

BIR Form 2550M, or also known as Monthly Value-Added Tax Declaration is a form of sales tax which is imposed on sales or exchange of goods and services in the Philippines. Serving as a form of indirect tax, VAT is passed on to the buyer which consumes the product/service.

Related Articles

Who needs to file?

Individuals or businesses which sell or lease goods or services which are subject to VAT, and if the amount of their actual gross sales/receipts exceeds up to P3,000,000.00.

When to file?

Not later than the 20th day following the end of each month.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

https://www.juan.tax/blog/extended-deadlines-of-tax-returns

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: