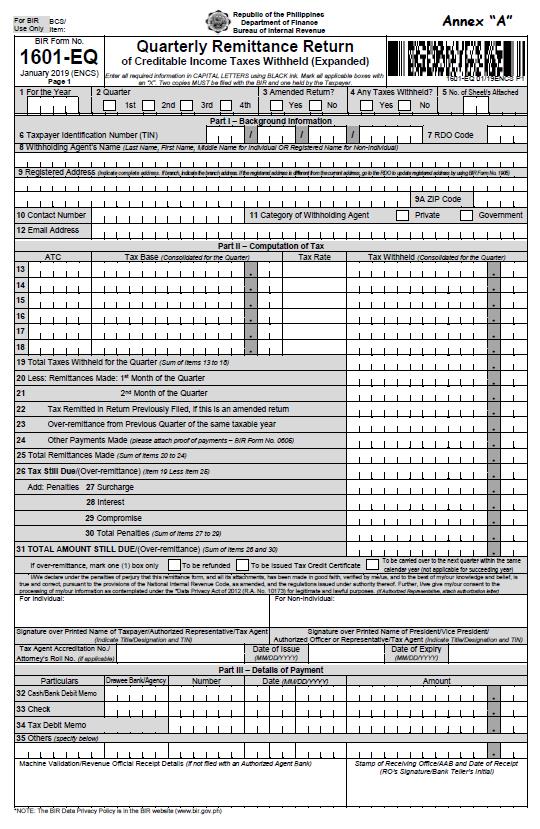

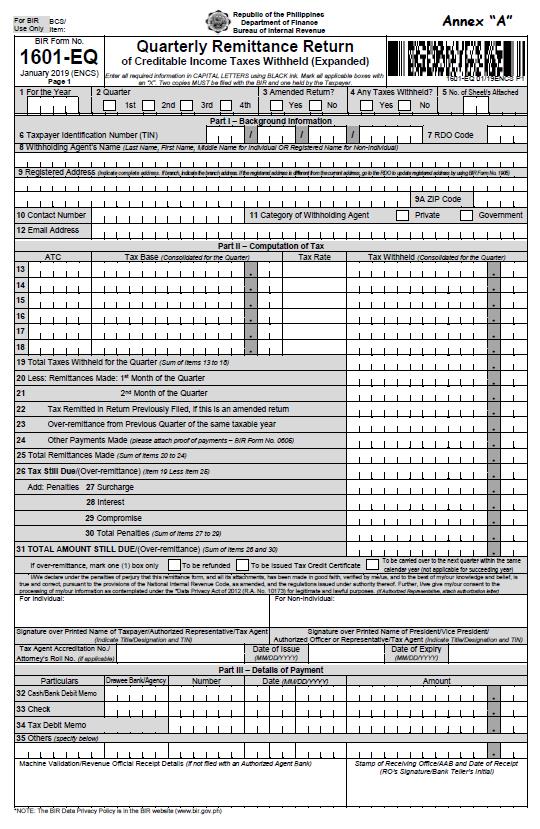

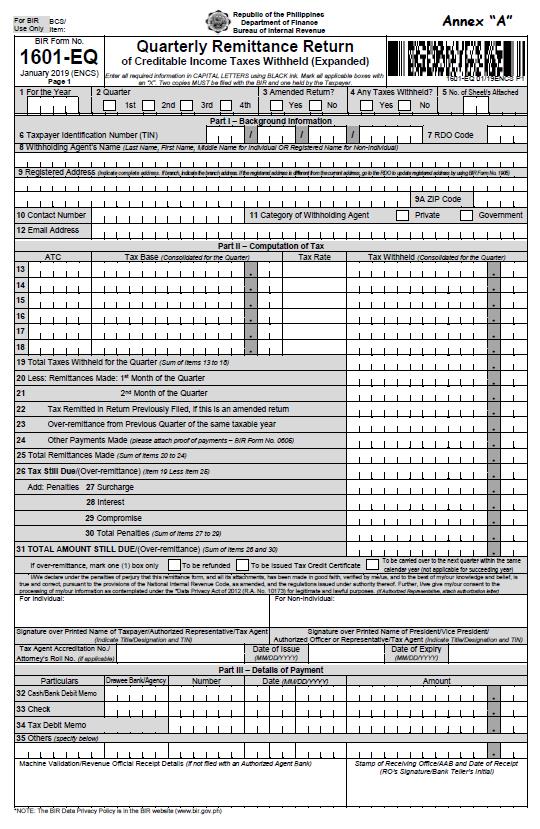

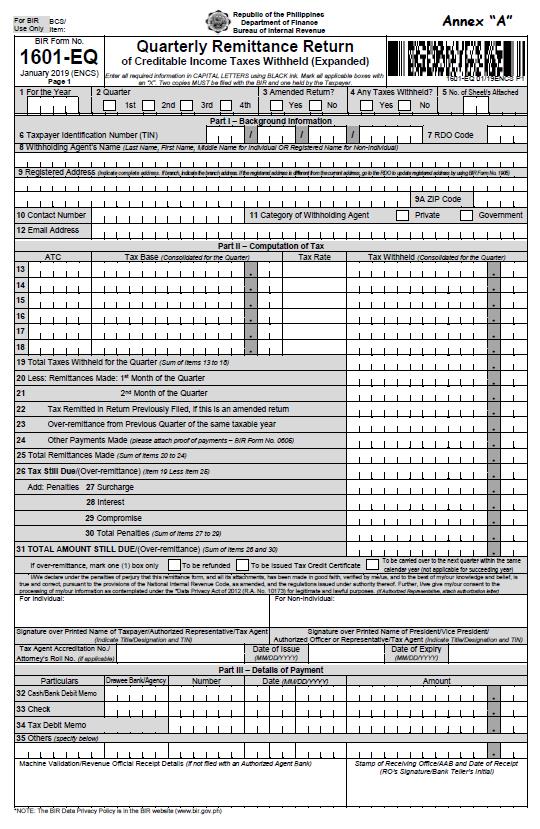

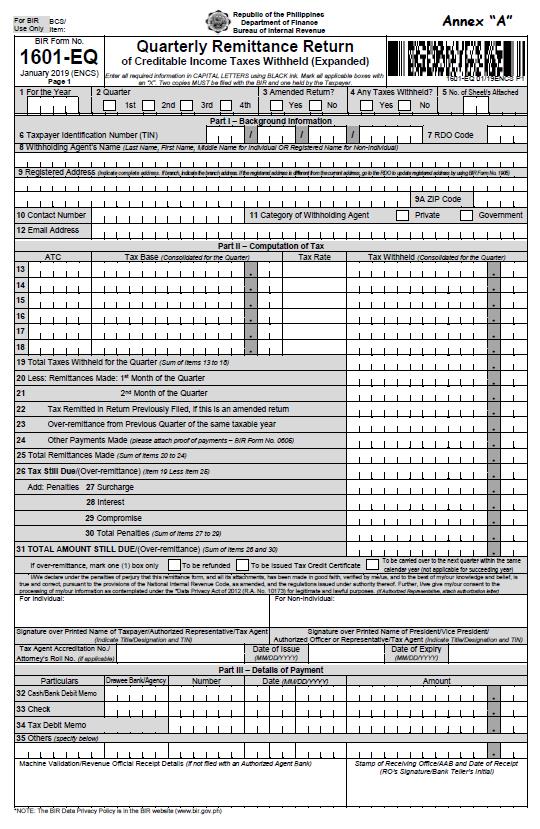

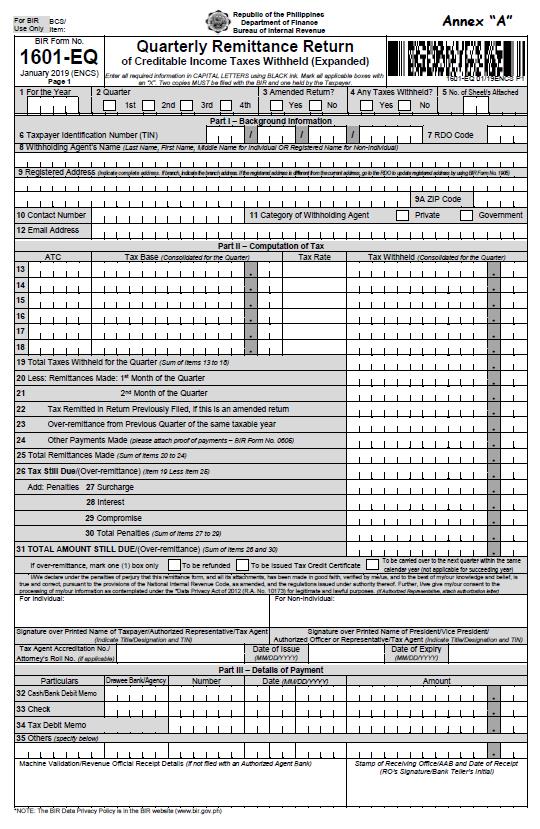

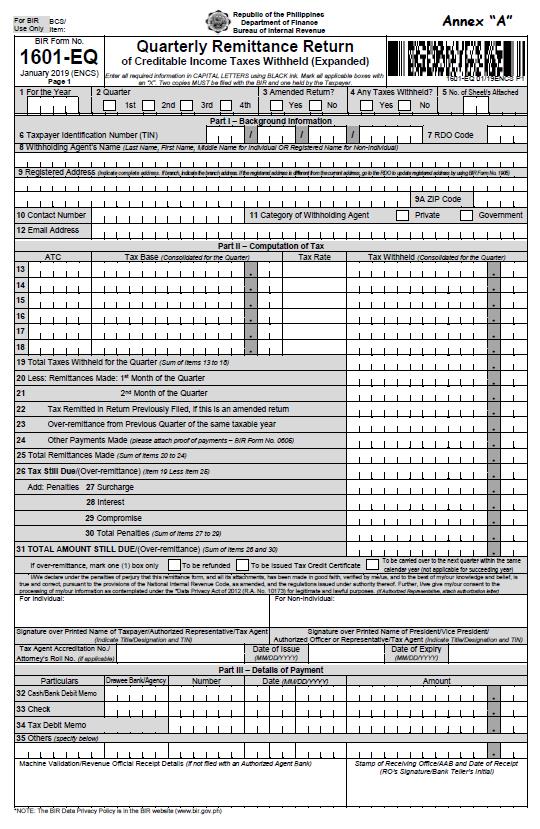

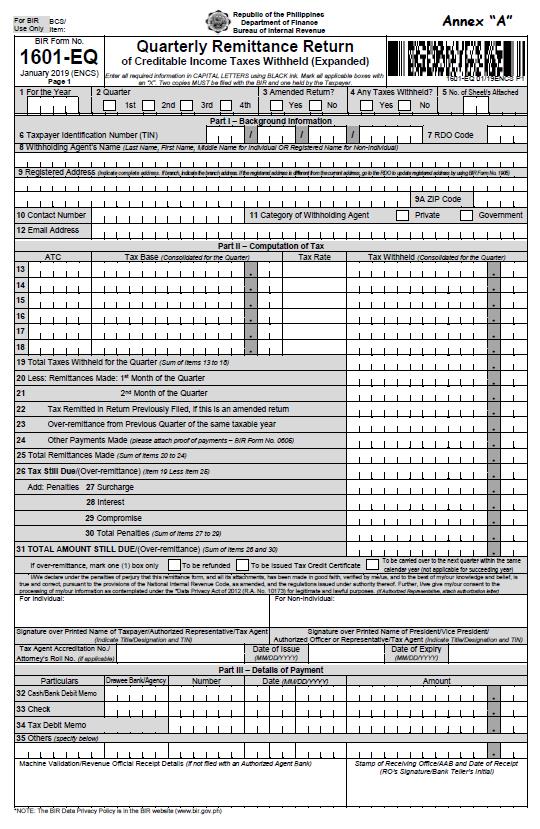

BIR Form 1601-EQ or the Quarterly Remittance Return of Creditable Income Taxes Withheld is used on remitting taxes that are withheld during the 3rd month of each taxable year.

FORM 1601-EQ

Who needs to file?

This quarterly withholding tax remittance return shall be filed by every Withholding Agent (WA)/payor required to deduct and withhold taxes on income payments subject to Expanded / Creditable Withholding Taxes.

When to file?

1601-EQ forms shall be filed not later than the last day of the month, following the end of the taxable quarter during which the withholding tax was made.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

What is this form?

BIR Form 1601-EQ or the Quarterly Remittance Return of Creditable Income Taxes Withheld is used on remitting taxes that are withheld during the 3rd month of each taxable year.

Related Articles:

Who needs to file?

This quarterly withholding tax remittance return shall be filed by every Withholding Agent (WA)/payor required to deduct and withhold taxes on income payments subject to Expanded / Creditable Withholding Taxes.

When to file?

1601-EQ forms shall be filed not later than the last day of the month, following the end of the taxable quarter during which the withholding tax was made.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: