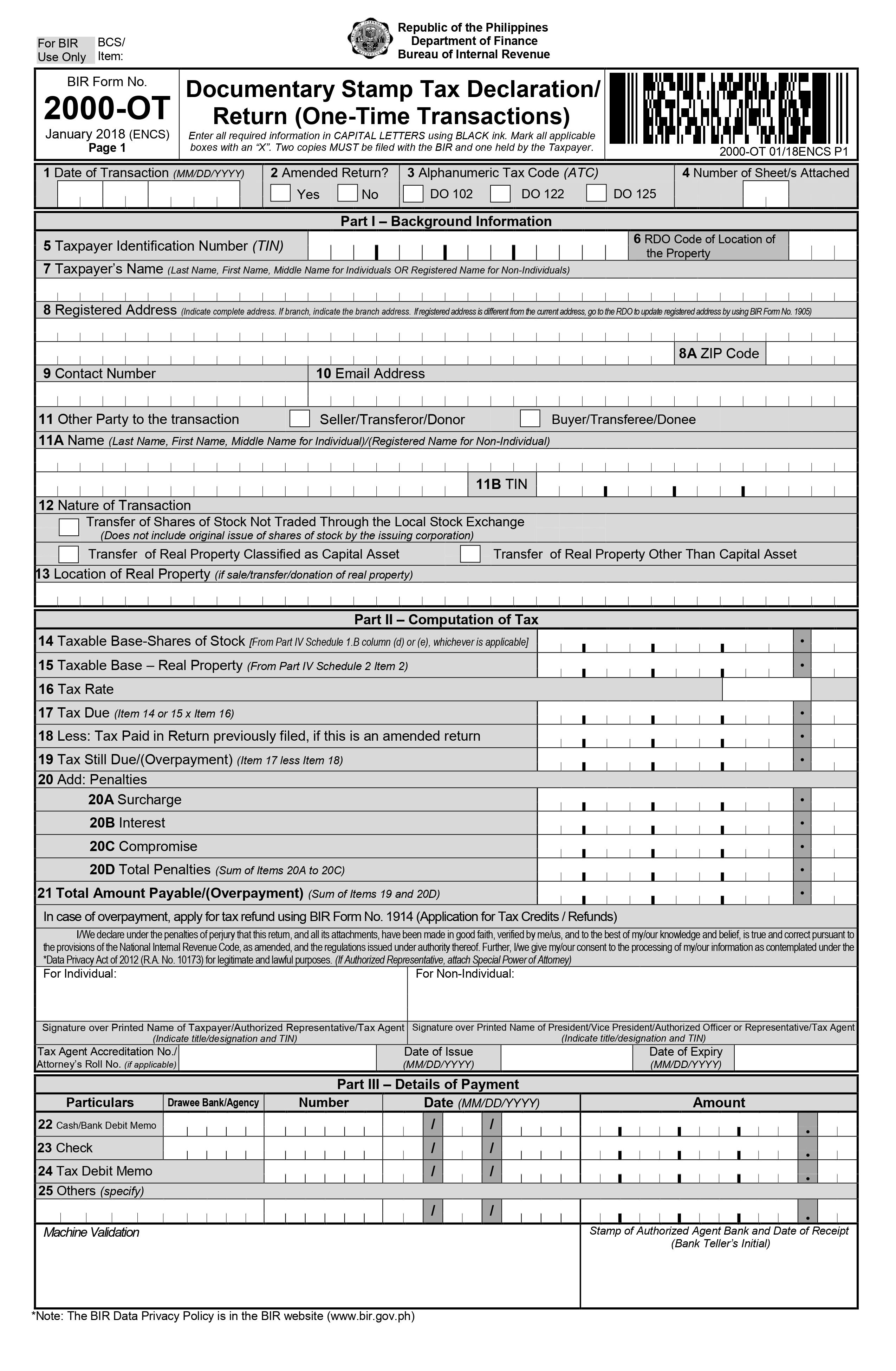

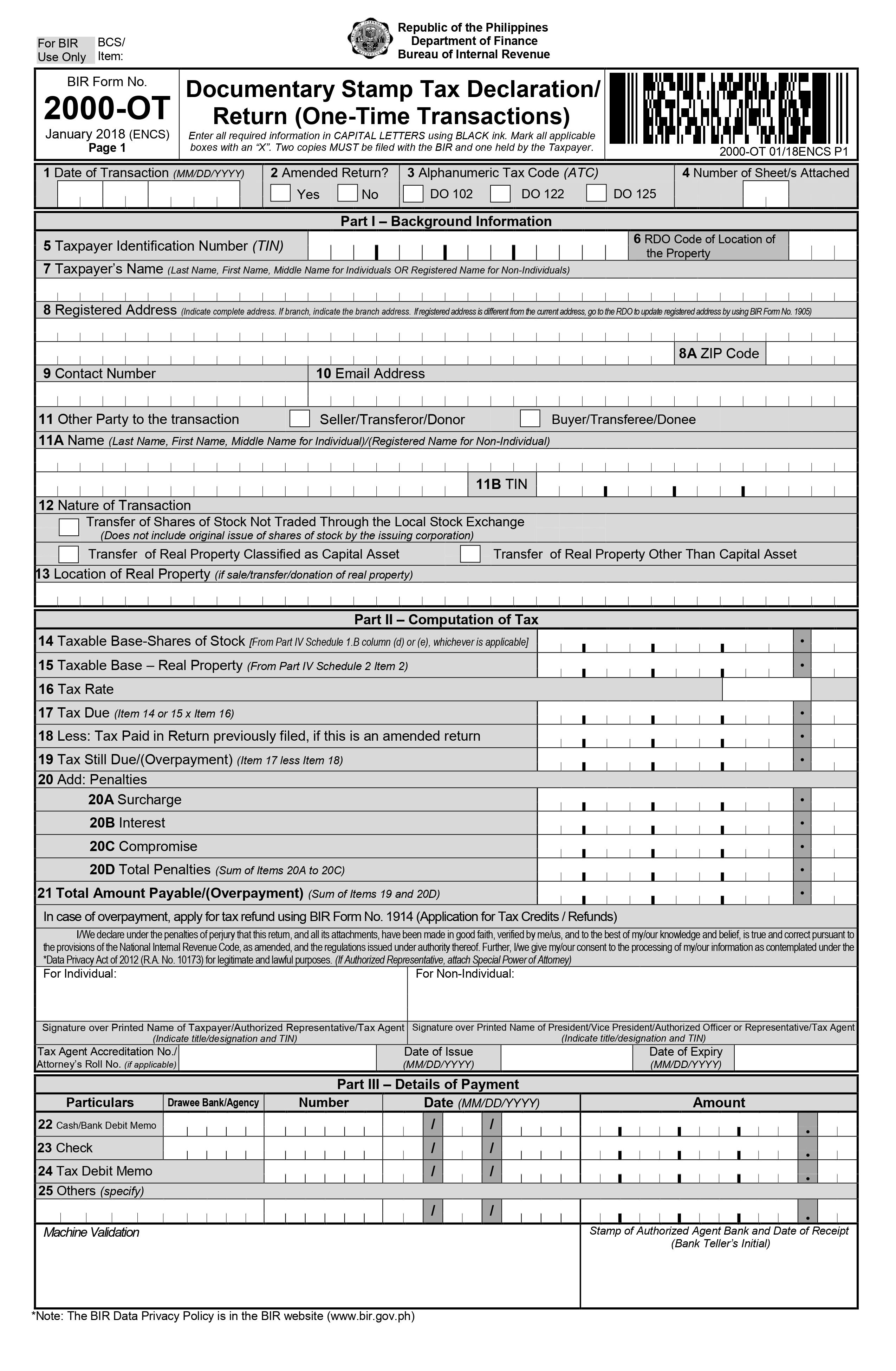

BIR Form 2000-OT or Documentary Stamp Tax Declaration/Return (One-Time Transactions)

FORM 2000-OT

What is this form?

Available in:

Who needs to file?

This return shall be filed in triplicate by the following person making, signing, issuing, accepting or transferring the document or facility evidencing Transaction:

- Every natural or juridical person, resident or non-resident, for donation, sale, barter, exchange or other onerous disposition of shares of stock in a domestic corporation, classified as capital asset, not traded in the local stock exchange;

- Every withholding agent/buyer/seller on the sale, transfer or exchange of real property classified as capital asset. The “sale” includes pacto de retro sale and other forms of conditional sale; and

- Every withholding agent/buyer/seller on the sale, transfer or exchange of real property other than capital asset.

- Every natural or juridical person, resident or non-resident, for donation of real properties.

When to file?

This return shall be filed and the tax paid within five (5) days after the close of the month when the taxable document was made, signed, issued, accepted or transferred.

How to file?

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

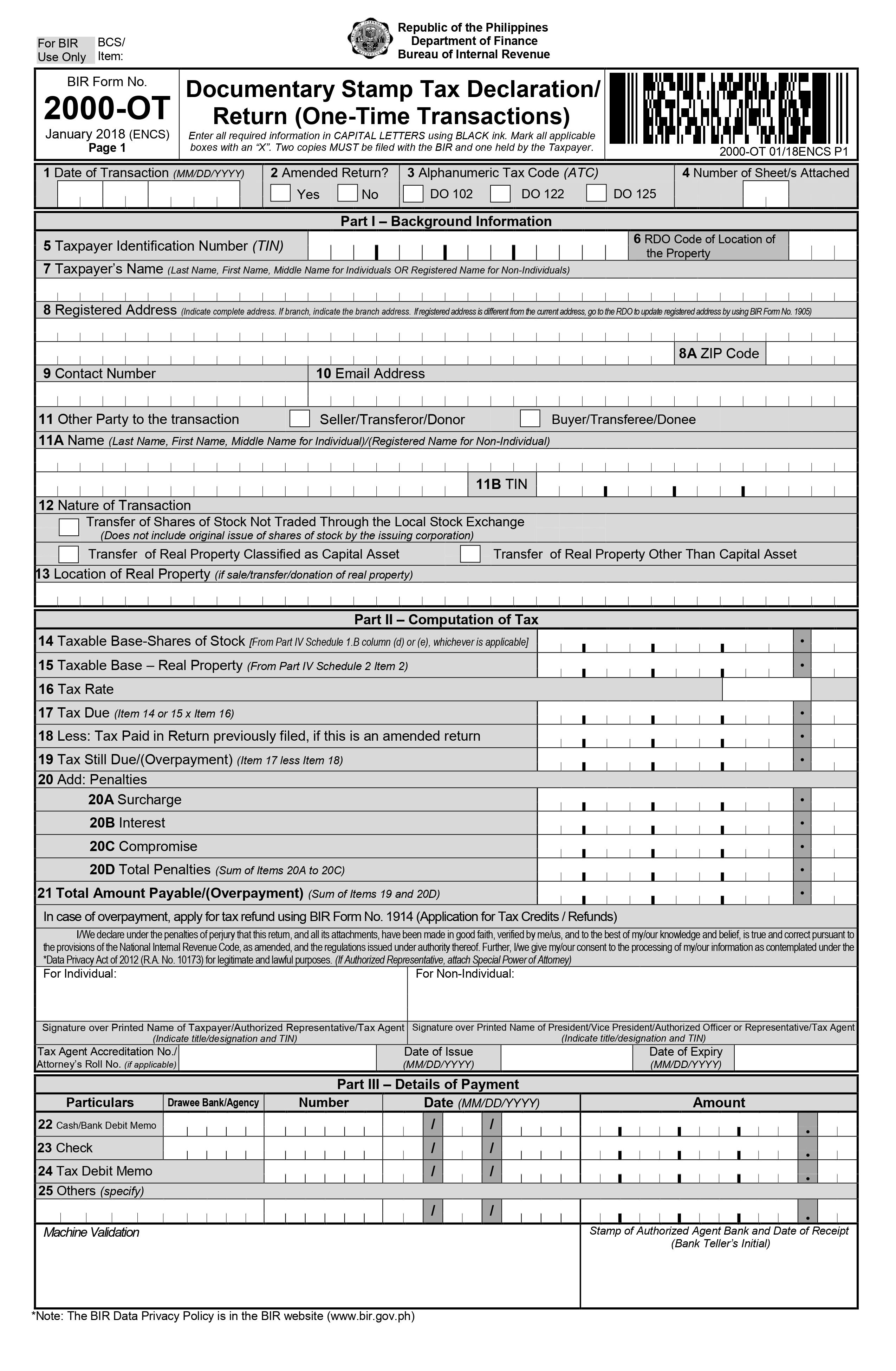

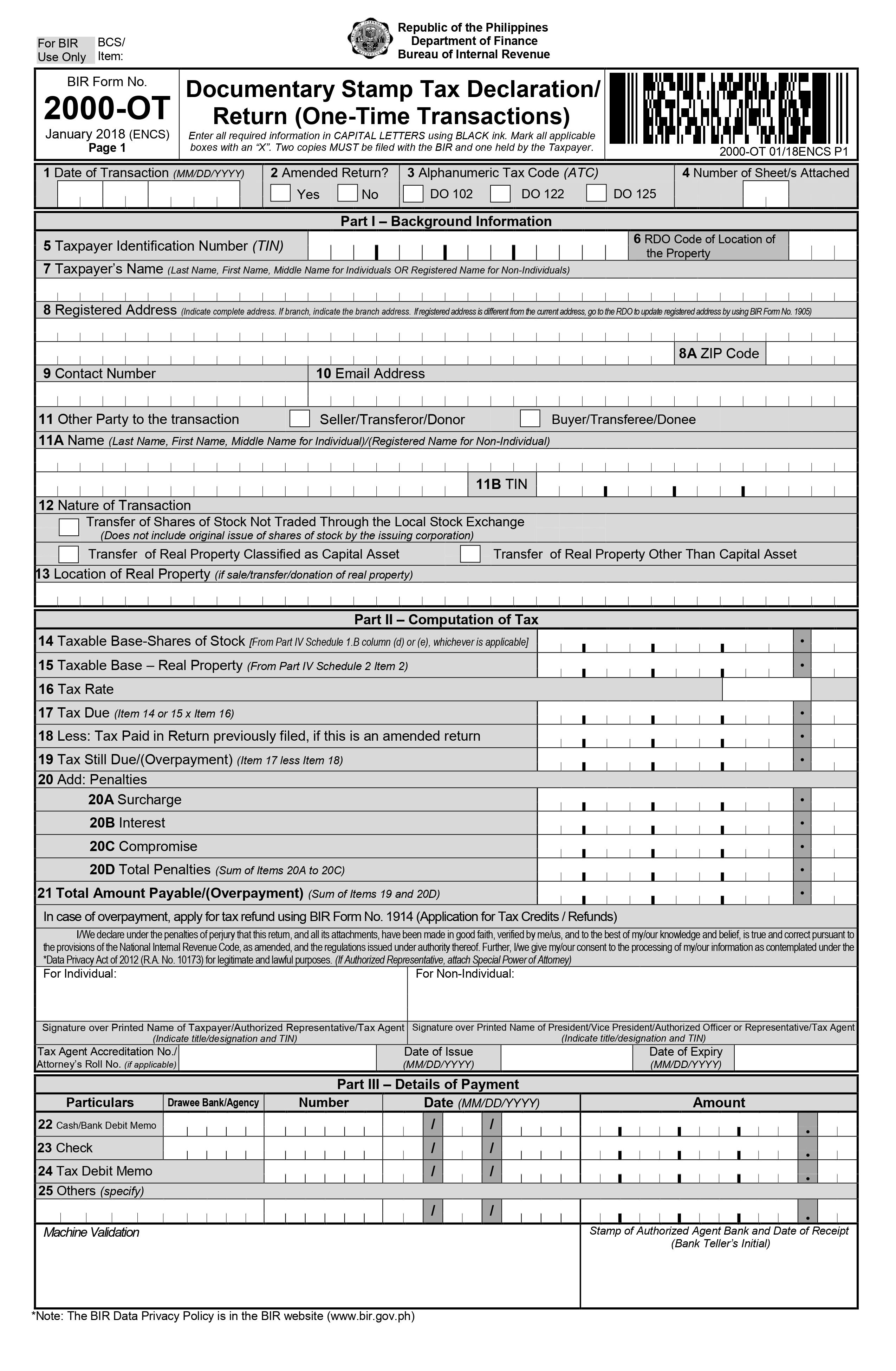

What is this form?

BIR Form 2000-OT or Documentary Stamp Tax Declaration/Return (One-Time Transactions)

Who needs to file?

This return shall be filed in triplicate by the following person making, signing, issuing, accepting or transferring the document or facility evidencing Transaction:

- Every natural or juridical person, resident or non-resident, for donation, sale, barter, exchange or other onerous disposition of shares of stock in a domestic corporation, classified as capital asset, not traded in the local stock exchange;

- Every withholding agent/buyer/seller on the sale, transfer or exchange of real property classified as capital asset. The “sale” includes pacto de retro sale and other forms of conditional sale; and

- Every withholding agent/buyer/seller on the sale, transfer or exchange of real property other than capital asset.

- Every natural or juridical person, resident or non-resident, for donation of real properties.

When to file?

This return shall be filed and the tax paid within five (5) days after the close of the month when the taxable document was made, signed, issued, accepted or transferred.

How to file?

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: