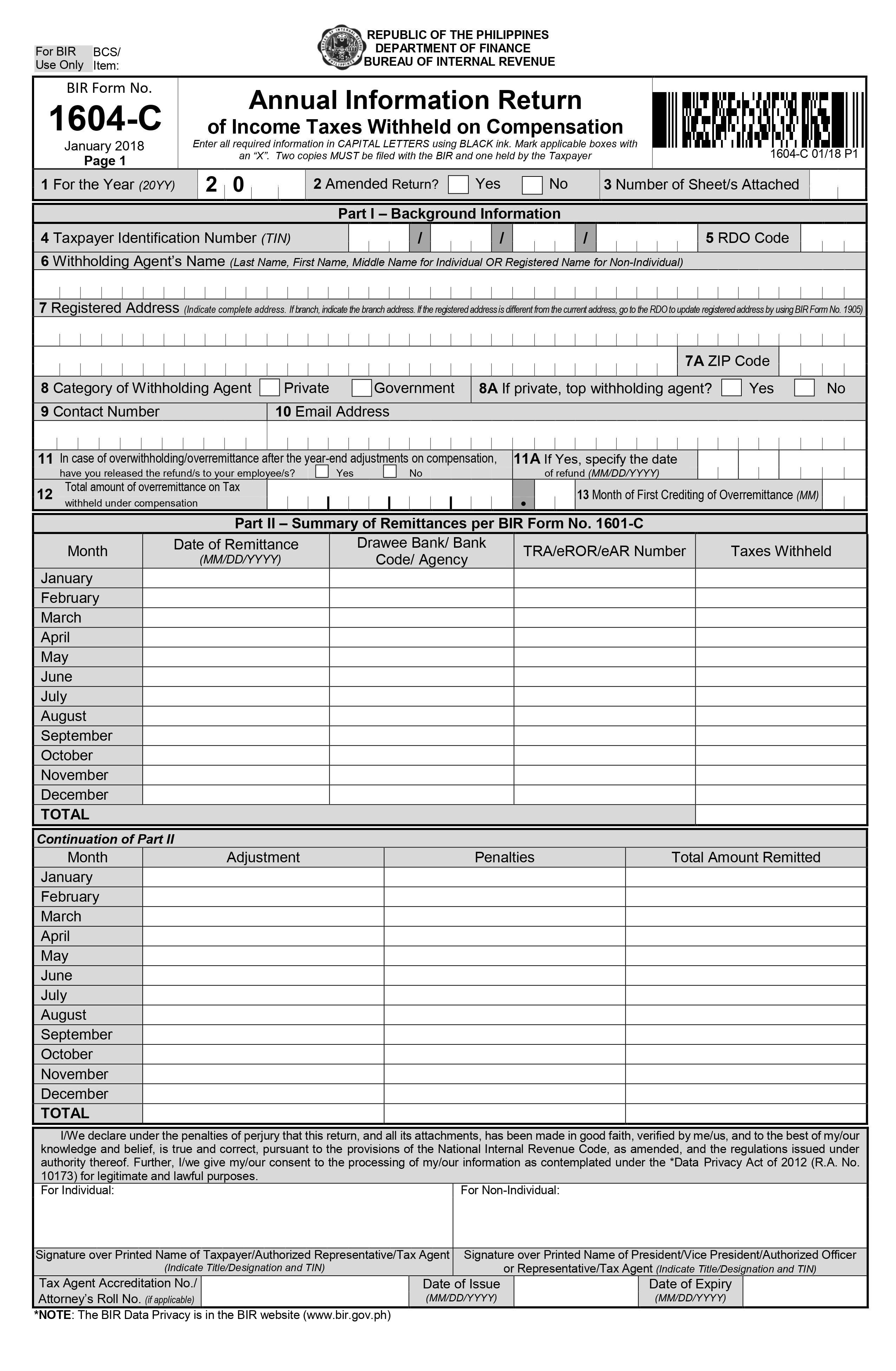

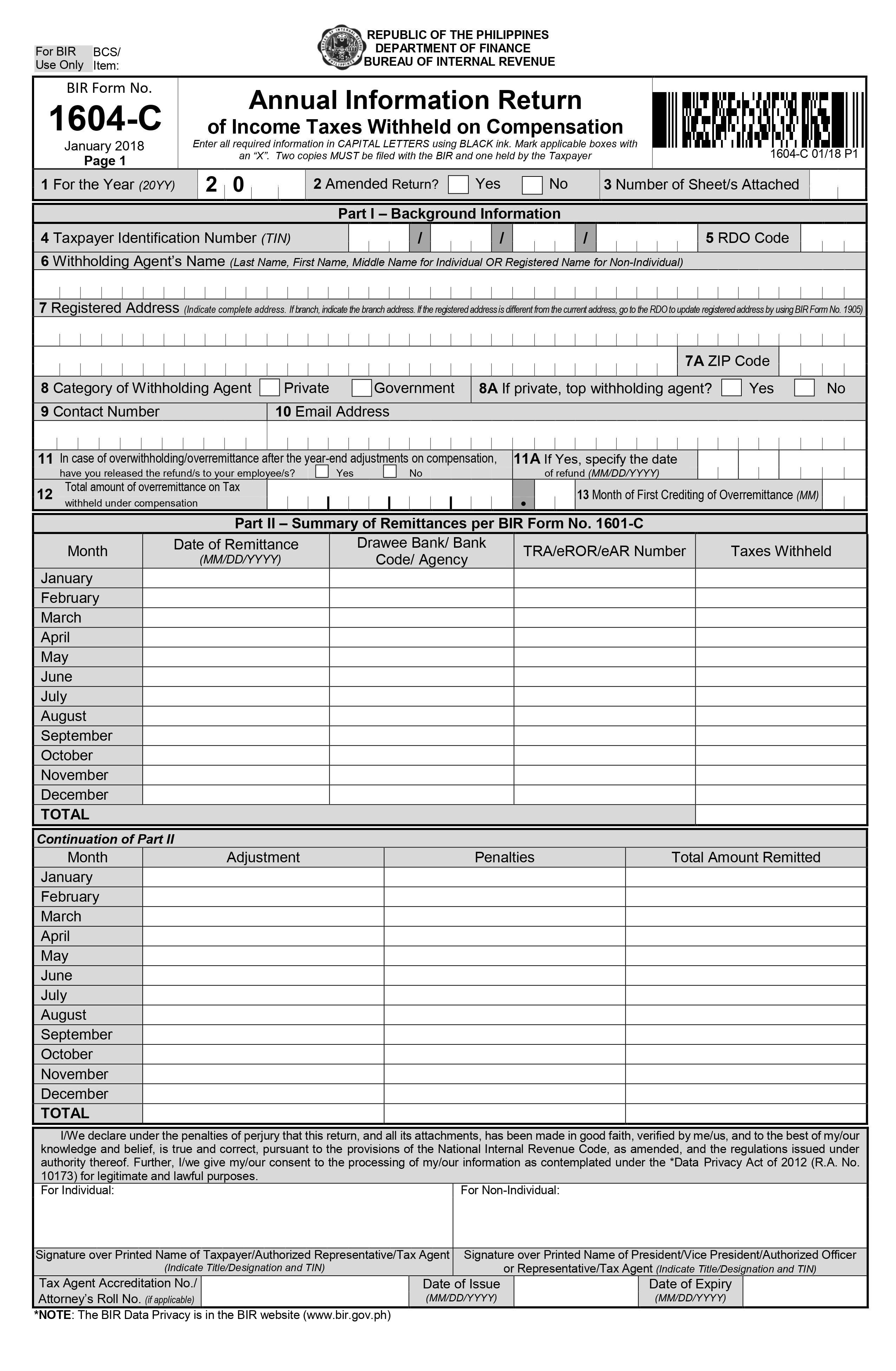

BIR Form 1604-C, also known as Annual Information Return of Income Taxes Withheld on Compensation is filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees.

FORM 1604-C

What is this form?

Related Articles:

BIR Form 1604-C – Annual Information Return of Income Taxes Withheld on Compensation

Generating 1604C

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Available in:

Who needs to file?

This return shall be filed by every employer or withholding agent/payor who is either an individual, estate, trust, partnership, corporation, government agency and instrumentality, government owned and controlled corporation, local government unit and other juridical entity required to deduct and withhold taxes on compensation paid to employees.

When to file?

The return shall be filed on or before January 31 of the year following the calendar year in which the compensation payment and other income payments were paid or accrued.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

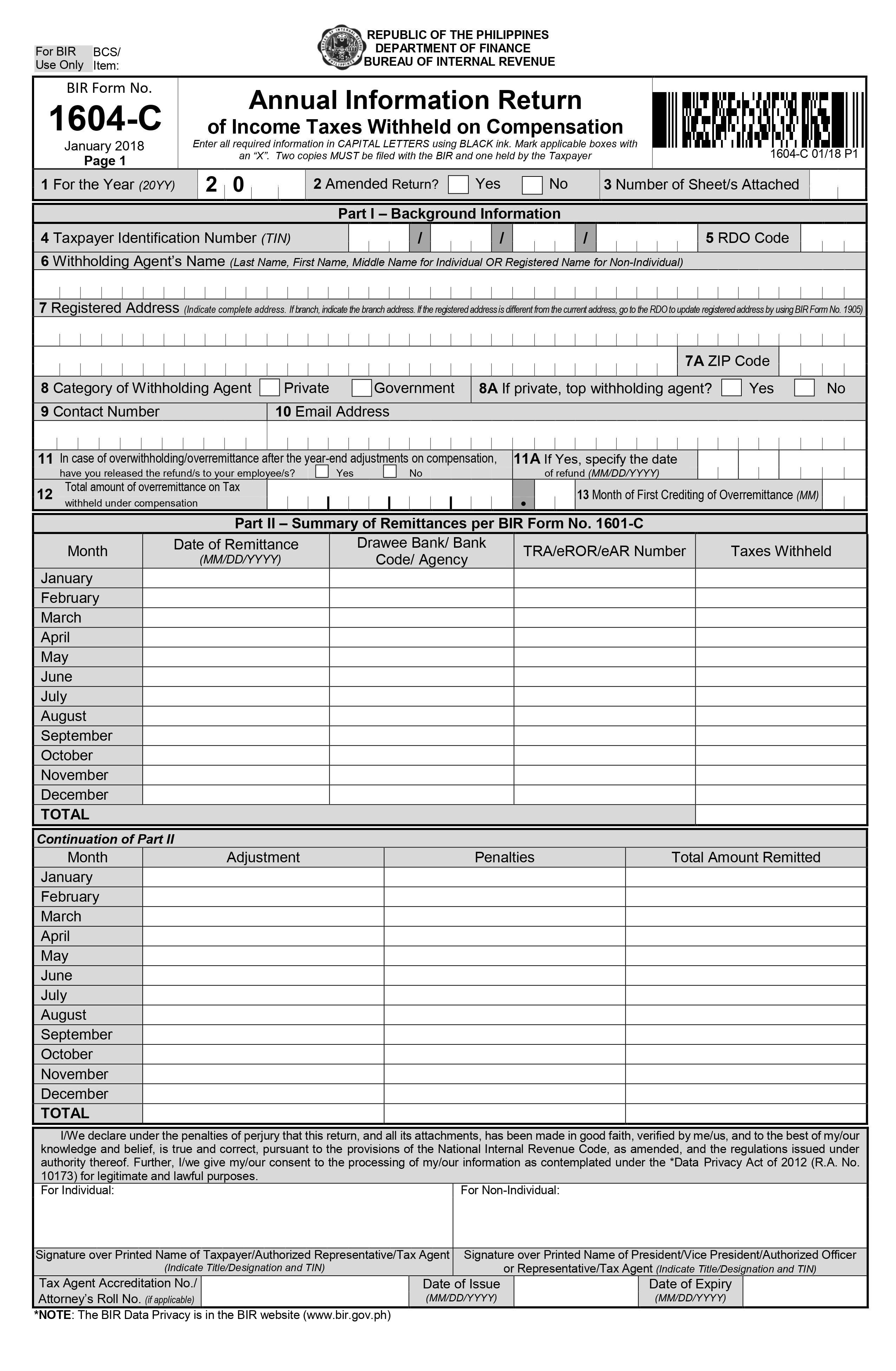

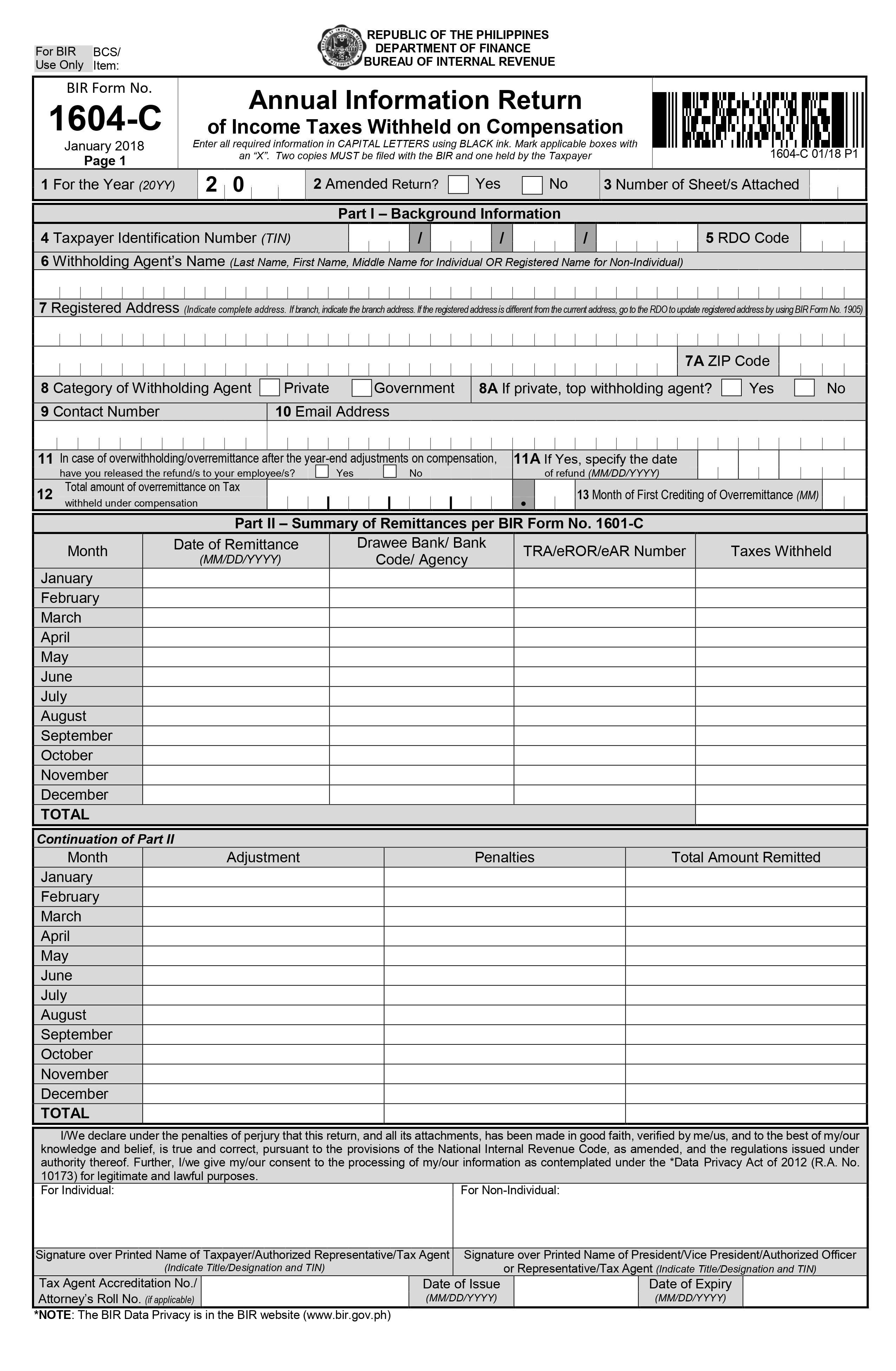

What is this form?

BIR Form 1604-C, also known as Annual Information Return of Income Taxes Withheld on Compensation is filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees.

Related Articles:

BIR Form 1604-C – Annual Information Return of Income Taxes Withheld on Compensation

Generating 1604C

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Who needs to file?

This return shall be filed by every employer or withholding agent/payor who is either an individual, estate, trust, partnership, corporation, government agency and instrumentality, government owned and controlled corporation, local government unit and other juridical entity required to deduct and withhold taxes on compensation paid to employees.

When to file?

The return shall be filed on or before January 31 of the year following the calendar year in which the compensation payment and other income payments were paid or accrued.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

Available in: