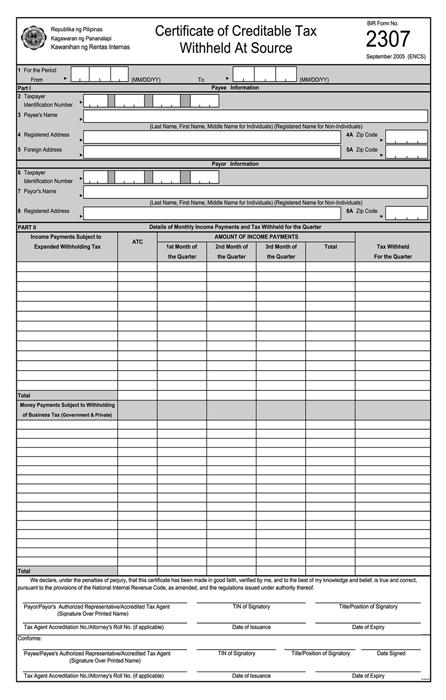

BIR Form 2307, or Certificate of Creditable Tax Withheld at Source is a tax certificate which needs to be accomplished by the withholding agent which shows the recipient of any income subject to expanded withholding tax.

For EWT – 2307 certificates shall be attached with the Quarterly/Annual Income Tax Return – BIR Forms 1701Q / 1701 for individuals, or BIR Form 1702Q/ 1702 for non-individuals.

Percentage Taxes on Government Money Payments – This Certificate needs to be attached with the Quarterly Percentage Tax return (BIR Form No. 2551M and 2551Q).

VAT Withholding – this tax certificate needs to be attached with the Monthly VAT Declaration (BIR Form No. 2550M) and Quarterly VAT Return (BIR Form No. 2550Q).