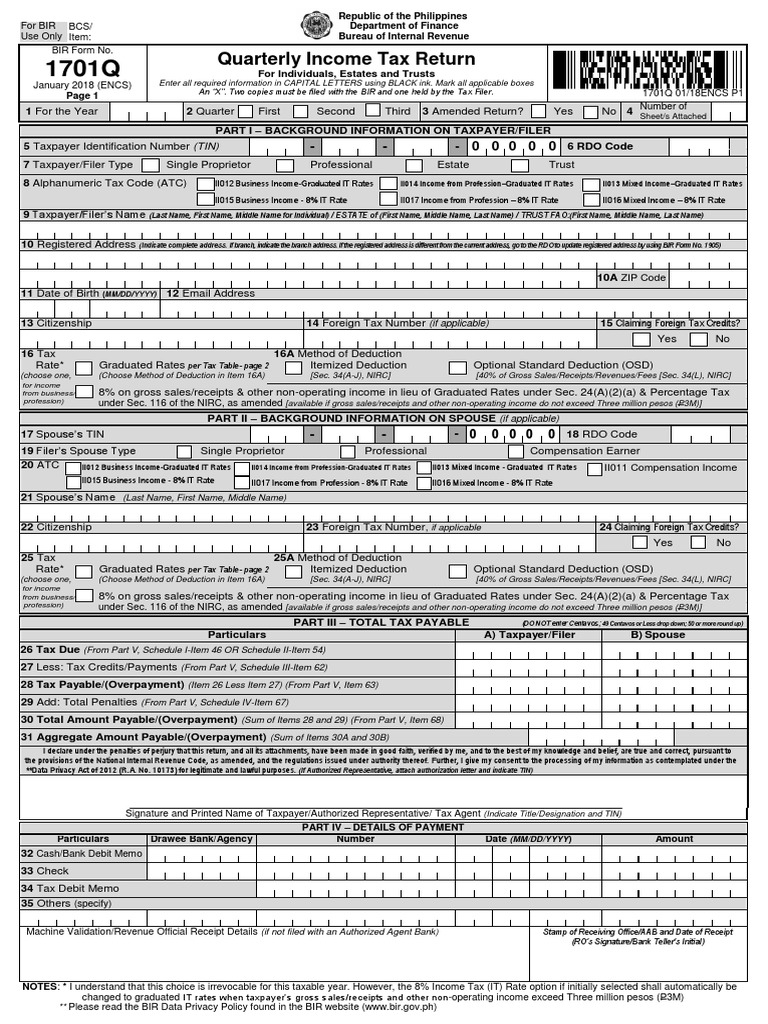

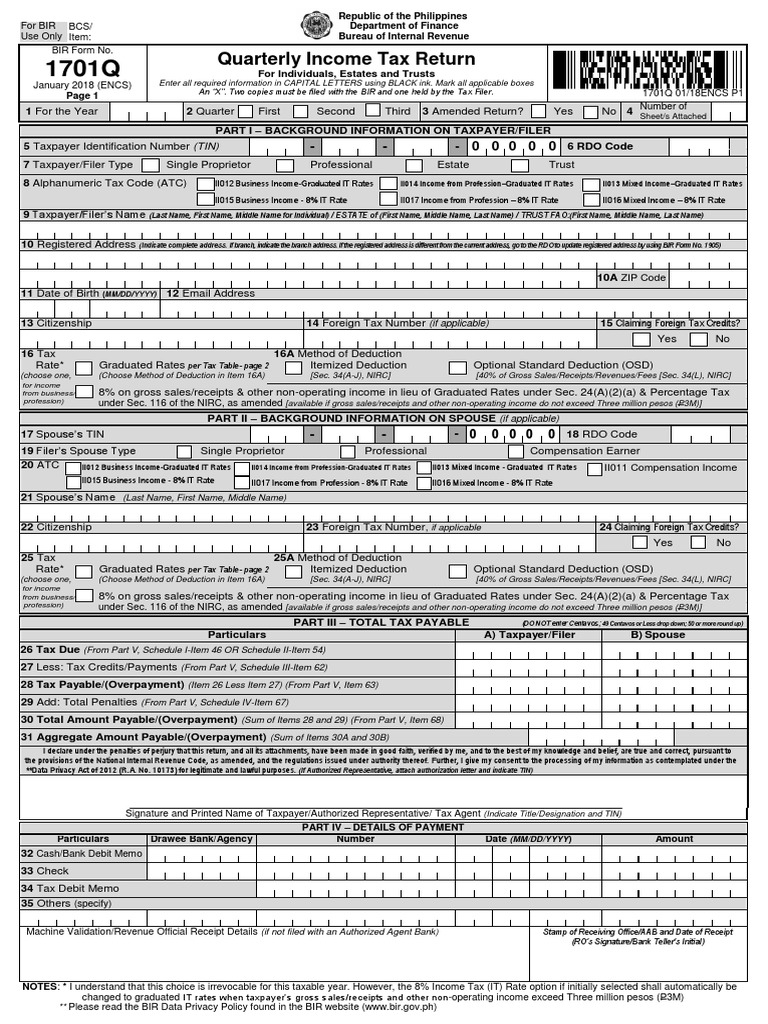

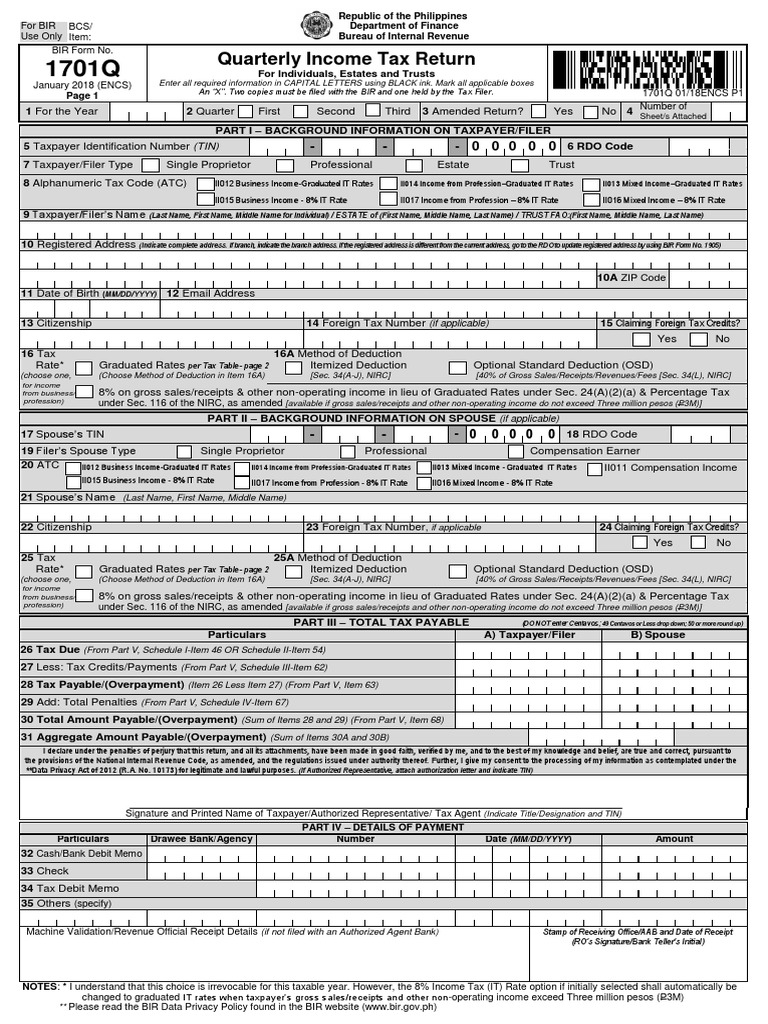

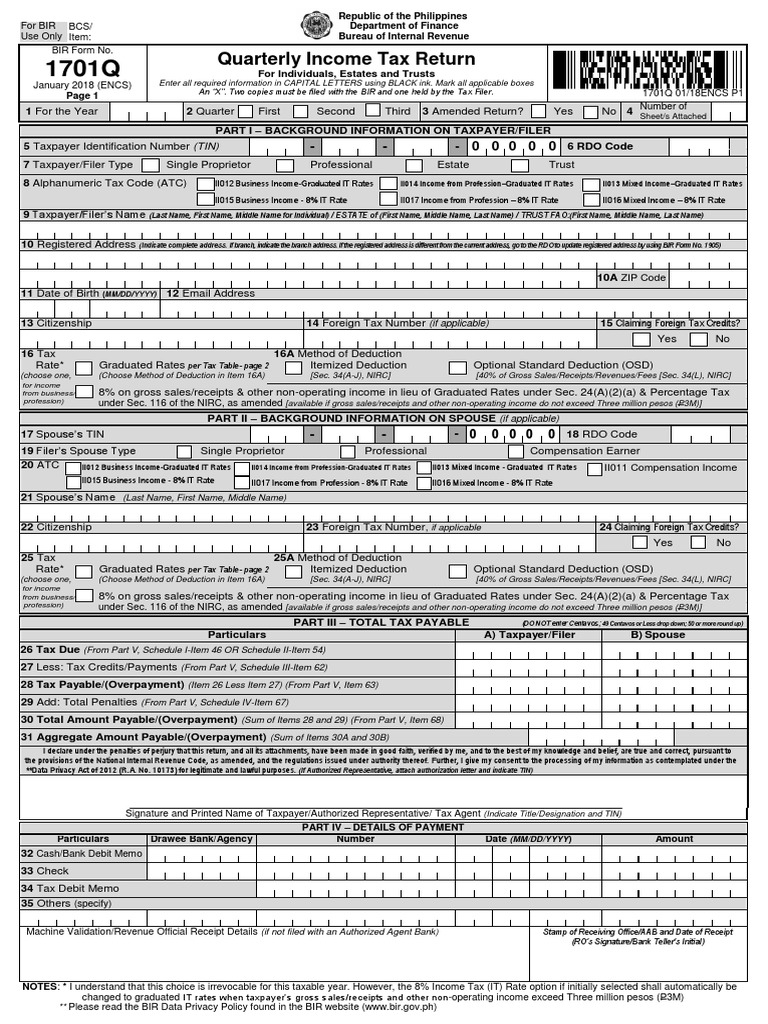

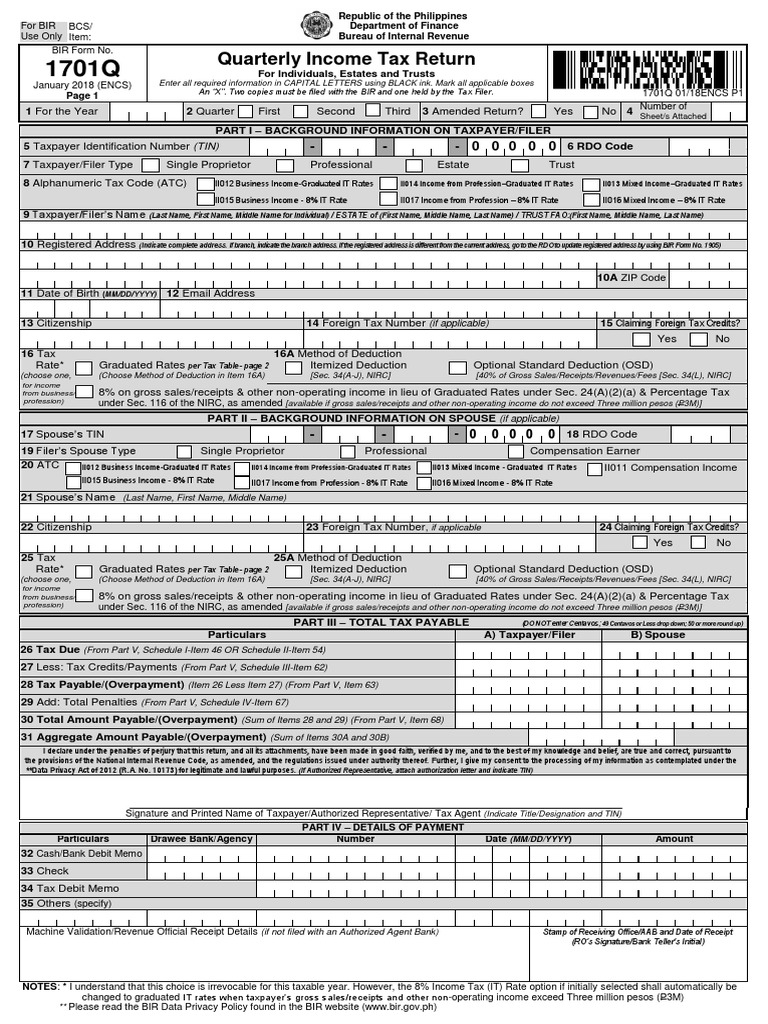

BIR Form 1701Q, also known as Quarterly Income Tax Return For Self-Employed Individuals, Estates and Trusts (Including those with both Business and Compensation Income) is a tax return intended for professionals and self-employed individuals who are engaged in a sole proprietorship business.

FORM 1701Q

What is this form?

Related Articles:

Generating 1701Q in Fast File

Generating Quarterly Income Tax Returns for Individuals (1701Q)

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Available in:

Who needs to file?

This return shall be filed by the following individuals listed below:

1) A resident citizen engaged in trade, business, or practice of profession within (or not within) the Philippines.

2) A resident alien, non-resident citizen or non-resident alien individual who engaged in business within the Philippines.

3) A trustee, guardian of a minor,administrator of an estate, or any individual(s) with fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

When to file?

The following deadlines apply for those individuals who wants to file this return:

- 1st qtr: On or before May 15 of the current taxable year

- 2nd qtr: On or before August 15 of the current taxable year

- 3rd qtr: On or before November 15 of the current taxable year

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

What is this form?

BIR Form 1701Q, also known as Quarterly Income Tax Return For Self-Employed Individuals, Estates and Trusts (Including those with both Business and Compensation Income) is a tax return intended for professionals and self-employed individuals who are engaged in a sole proprietorship business.

Related Articles:

Generating 1701Q in Fast File

Generating Quarterly Income Tax Returns for Individuals (1701Q)

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Who needs to file?

This return shall be filed by the following individuals listed below:

1) A resident citizen engaged in trade, business, or practice of profession within (or not within) the Philippines.

2) A resident alien, non-resident citizen or non-resident alien individual who engaged in business within the Philippines.

3) A trustee, guardian of a minor,administrator of an estate, or any individual(s) with fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

When to file?

The following deadlines apply for those individuals who wants to file this return:

- 1st qtr: On or before May 15 of the current taxable year

- 2nd qtr: On or before August 15 of the current taxable year

- 3rd qtr: On or before November 15 of the current taxable year

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: