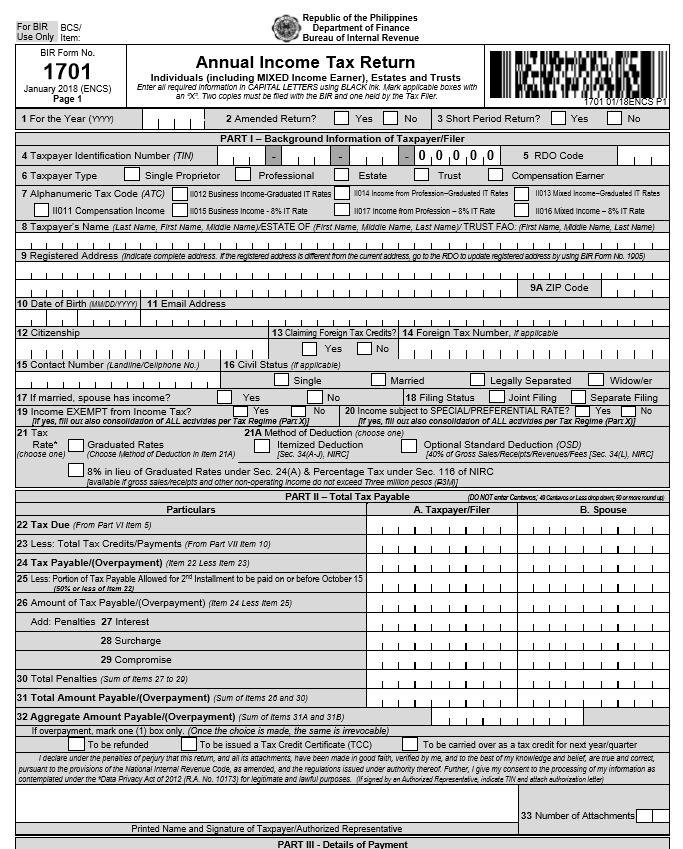

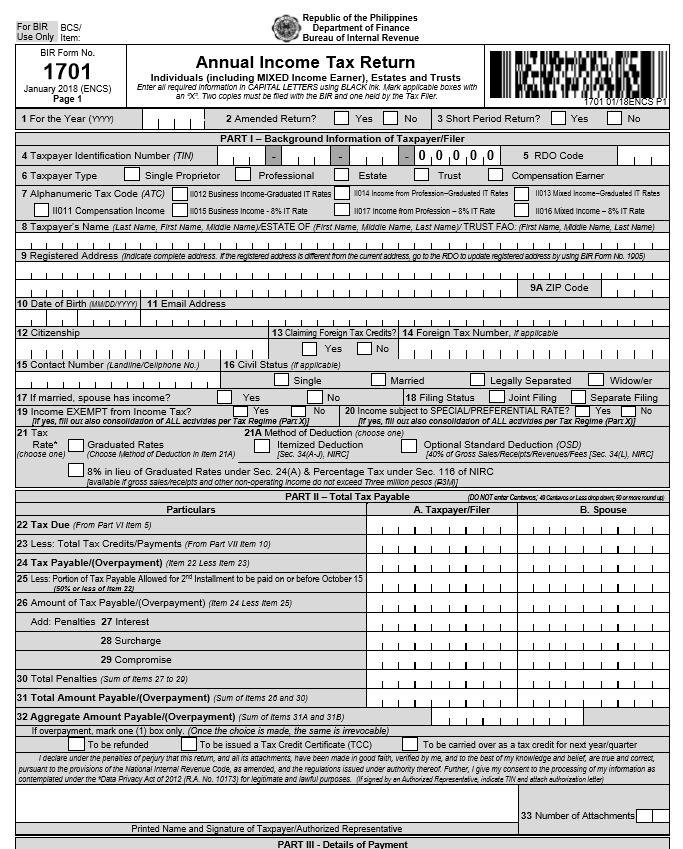

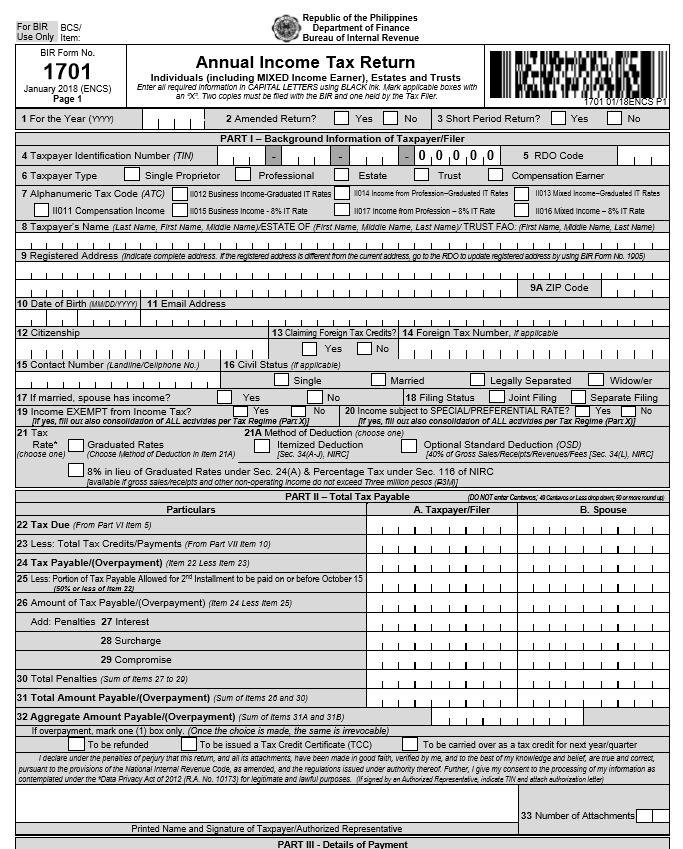

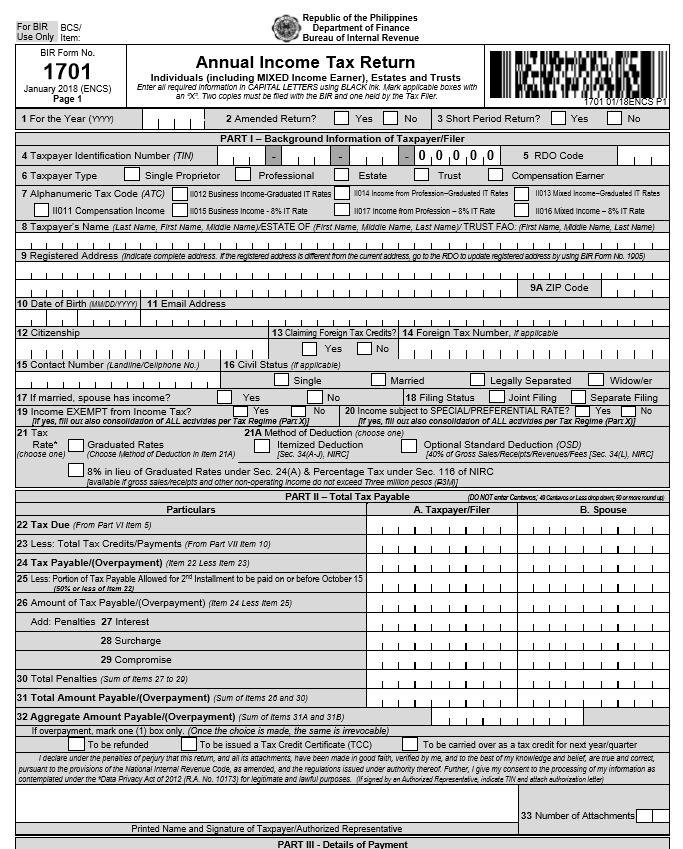

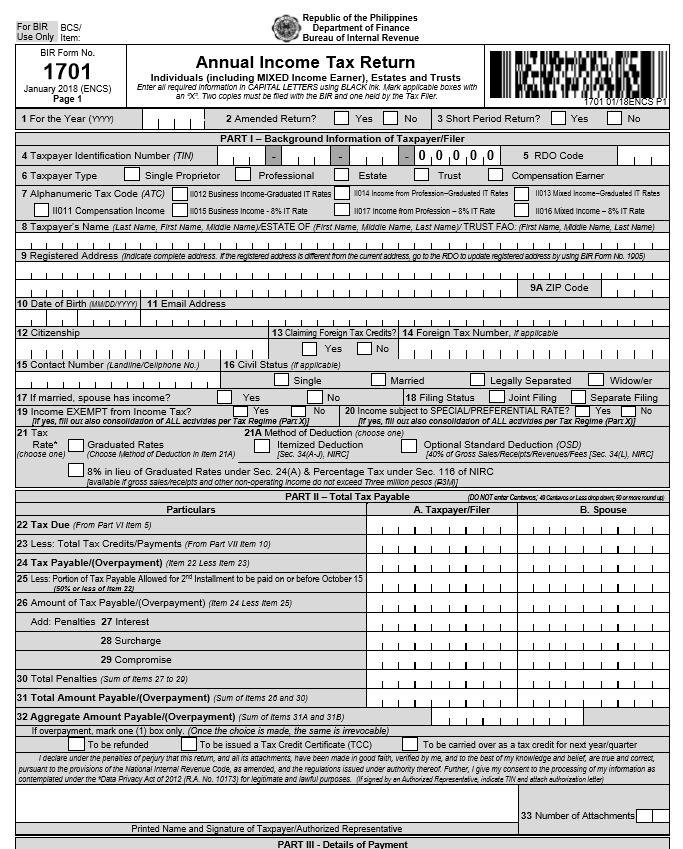

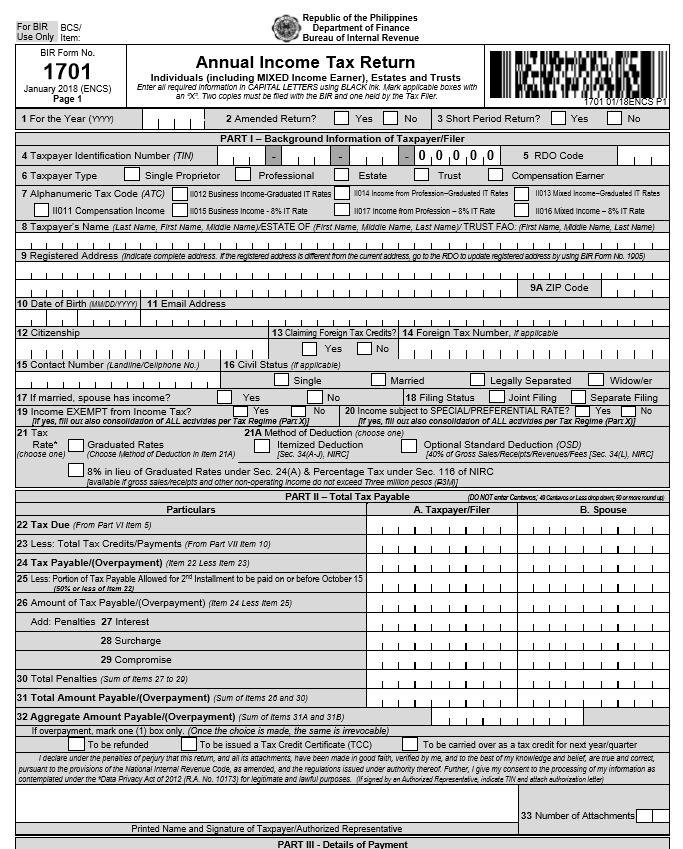

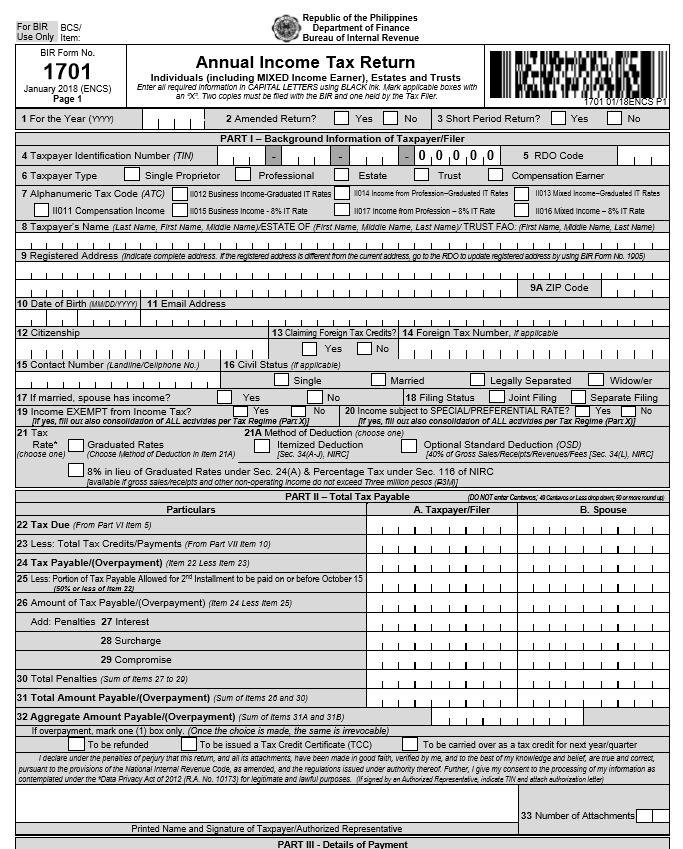

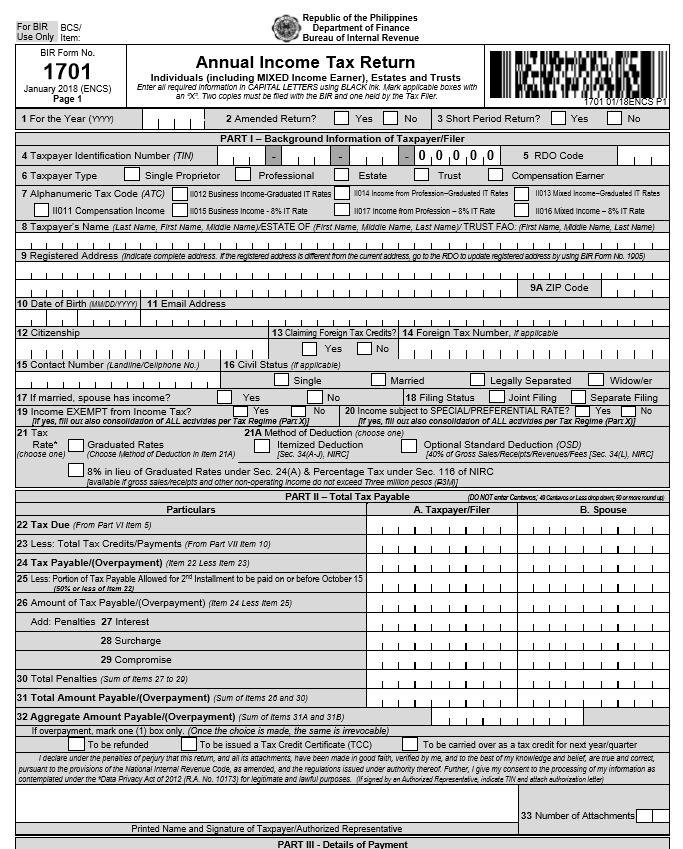

BIR Form 1701, also known as Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts is a tax form which summarizes all the transactions made over the tax calendar year.

FORM 1701

What is this form?

Related Articles:

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Available in:

Who needs to file?

This return needs to be filed by individuals listed below:

1. A resident who operates a business within (or not) in the Philippines.

2. A resident alien, or a non-resident citizen (or alien) operating a business in the Philippines

3. A trustee, guardian of a minor, estate administrator or individuals acting out as an administrator on behalf of a person whose operating a business.

When to file?

1701 form needs to be filed on or before April 15th annually, and it should cover all those income from the previous tax year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

What is this form?

BIR Form 1701, also known as Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts is a tax form which summarizes all the transactions made over the tax calendar year.

Related Articles:

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Who needs to file?

This return needs to be filed by individuals listed below:

1. A resident who operates a business within (or not) in the Philippines.

2. A resident alien, or a non-resident citizen (or alien) operating a business in the Philippines

3. A trustee, guardian of a minor, estate administrator or individuals acting out as an administrator on behalf of a person whose operating a business.

When to file?

1701 form needs to be filed on or before April 15th annually, and it should cover all those income from the previous tax year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: