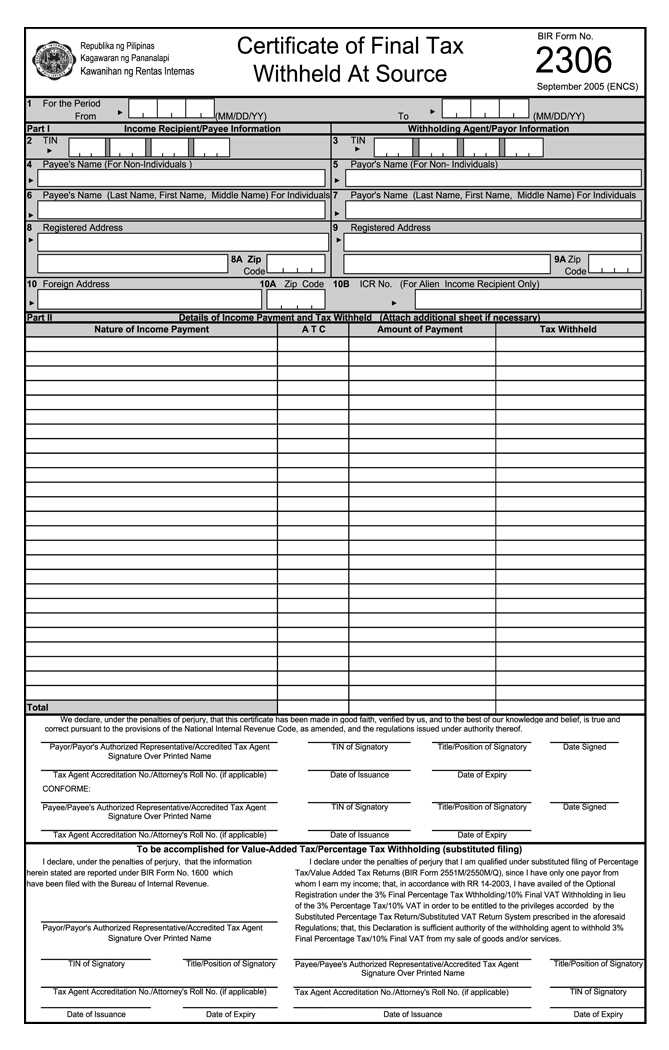

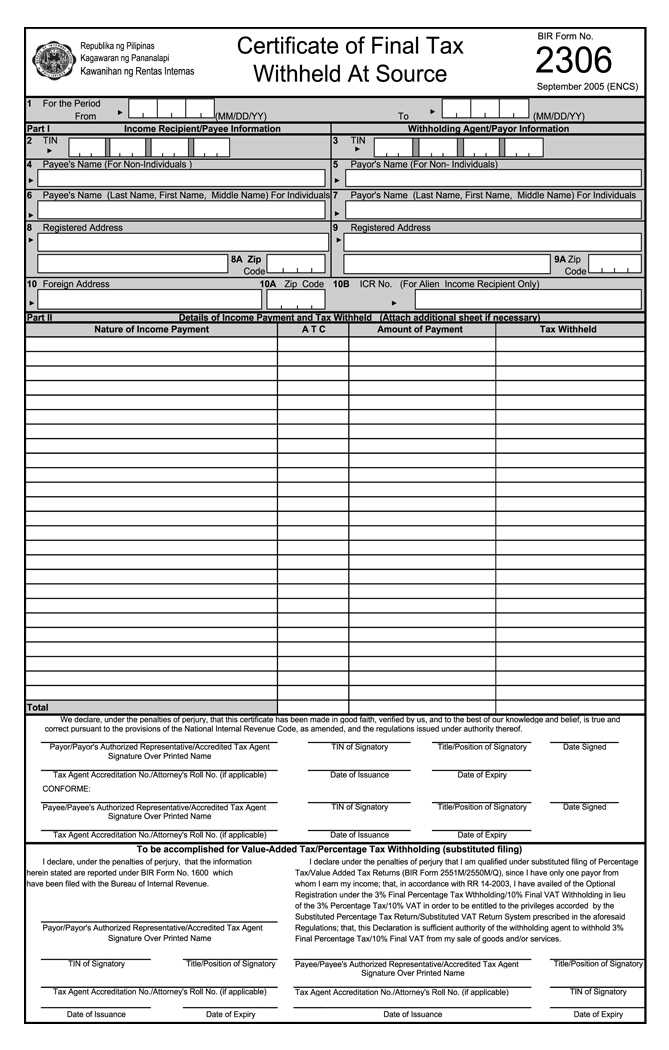

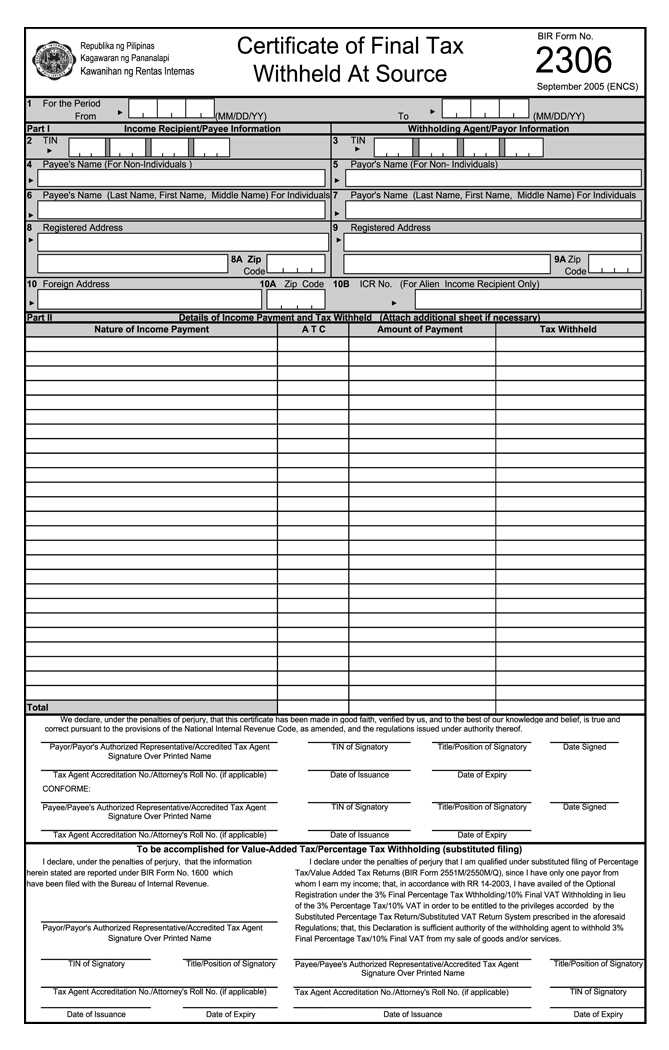

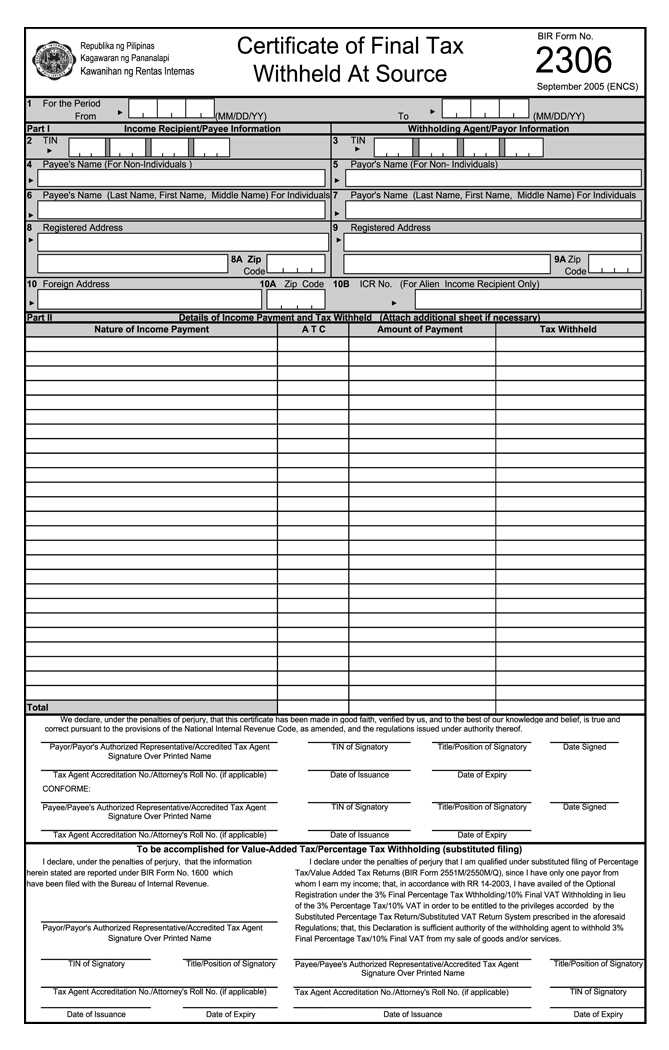

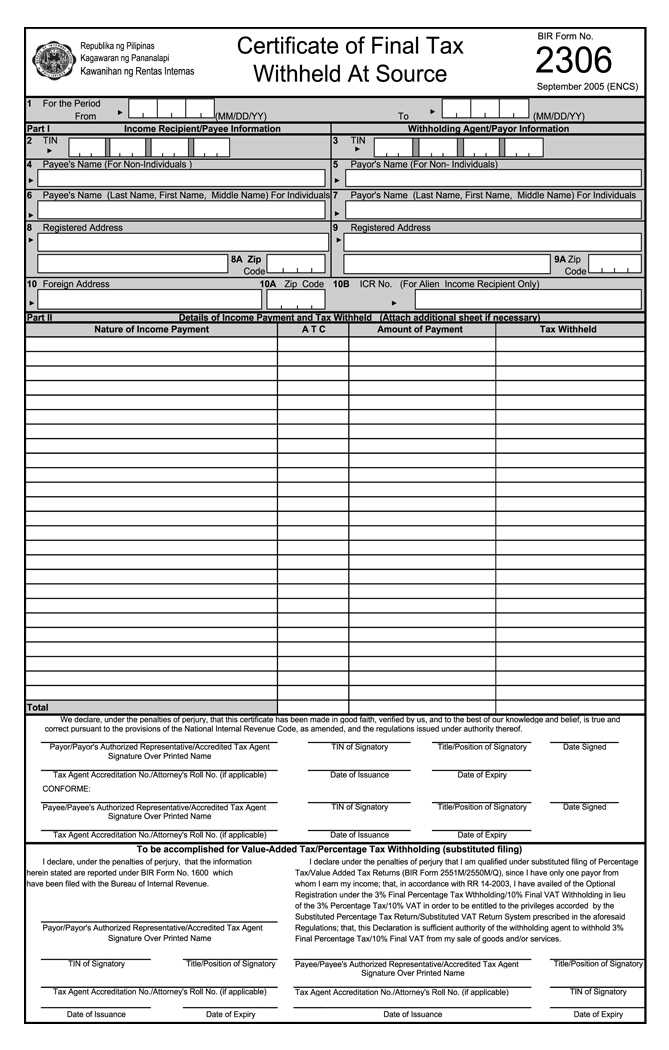

BIR Form 2306, or Certificate of Final Income Tax Withheld is a tax certificate which needs to be accomplished by a withholding agent to a specific recipient whose income is subject to final tax. Remember that the column amount of payment should include the total amount which is paid as well as the total taxes that is withheld during the period.

FORM 2306

Who needs to file?

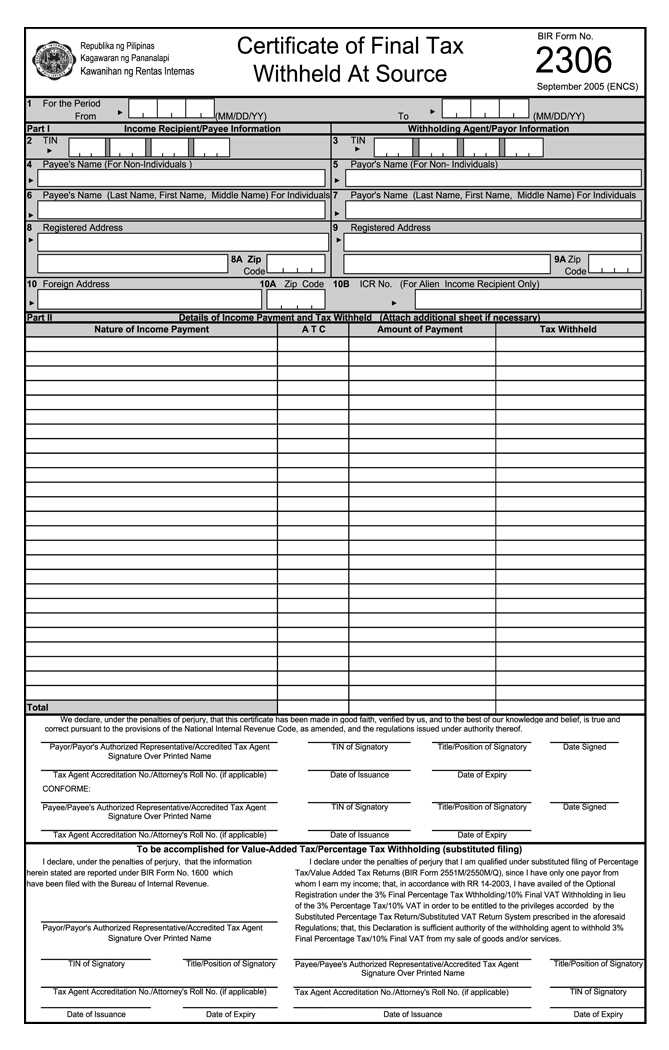

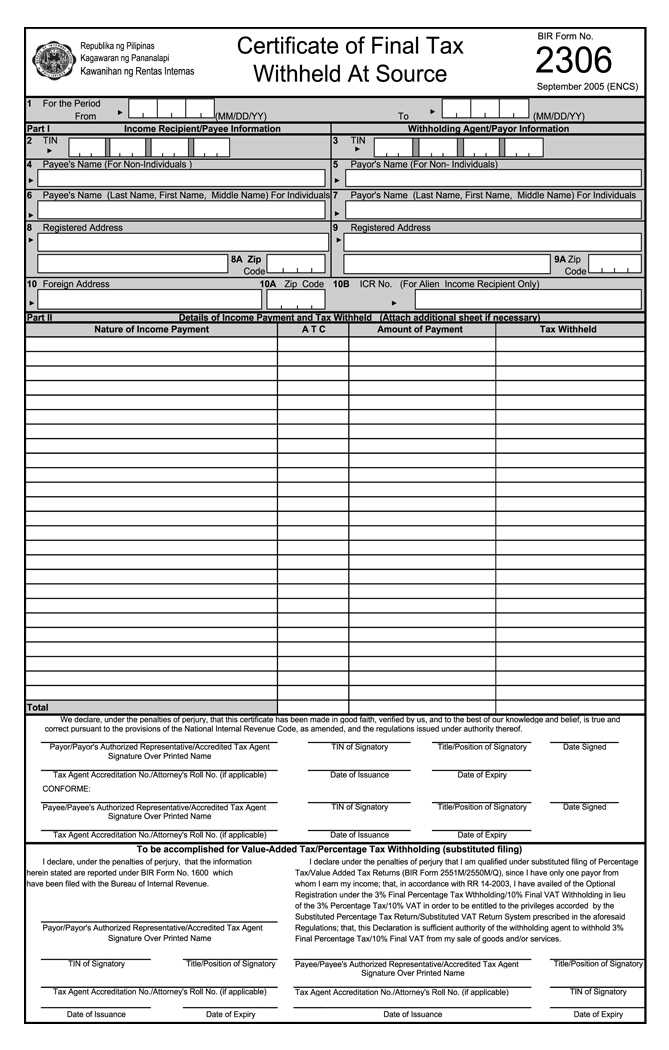

Form 2306 needs to be filed and accomplished by the payee (or considered as the withholding agent), in reference to the employer.

When to file?

This needs to be accomplished by the payee on or before January 31st of year in which income payment was made.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

What is this form?

BIR Form 2306, or Certificate of Final Income Tax Withheld is a tax certificate which needs to be accomplished by a withholding agent to a specific recipient whose income is subject to final tax. Remember that the column amount of payment should include the total amount which is paid as well as the total taxes that is withheld during the period.

Who needs to file?

Form 2306 needs to be filed and accomplished by the payee (or considered as the withholding agent), in reference to the employer.

When to file?

This needs to be accomplished by the payee on or before January 31st of year in which income payment was made.

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

For the updated tax deadline, please visit this page:

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.