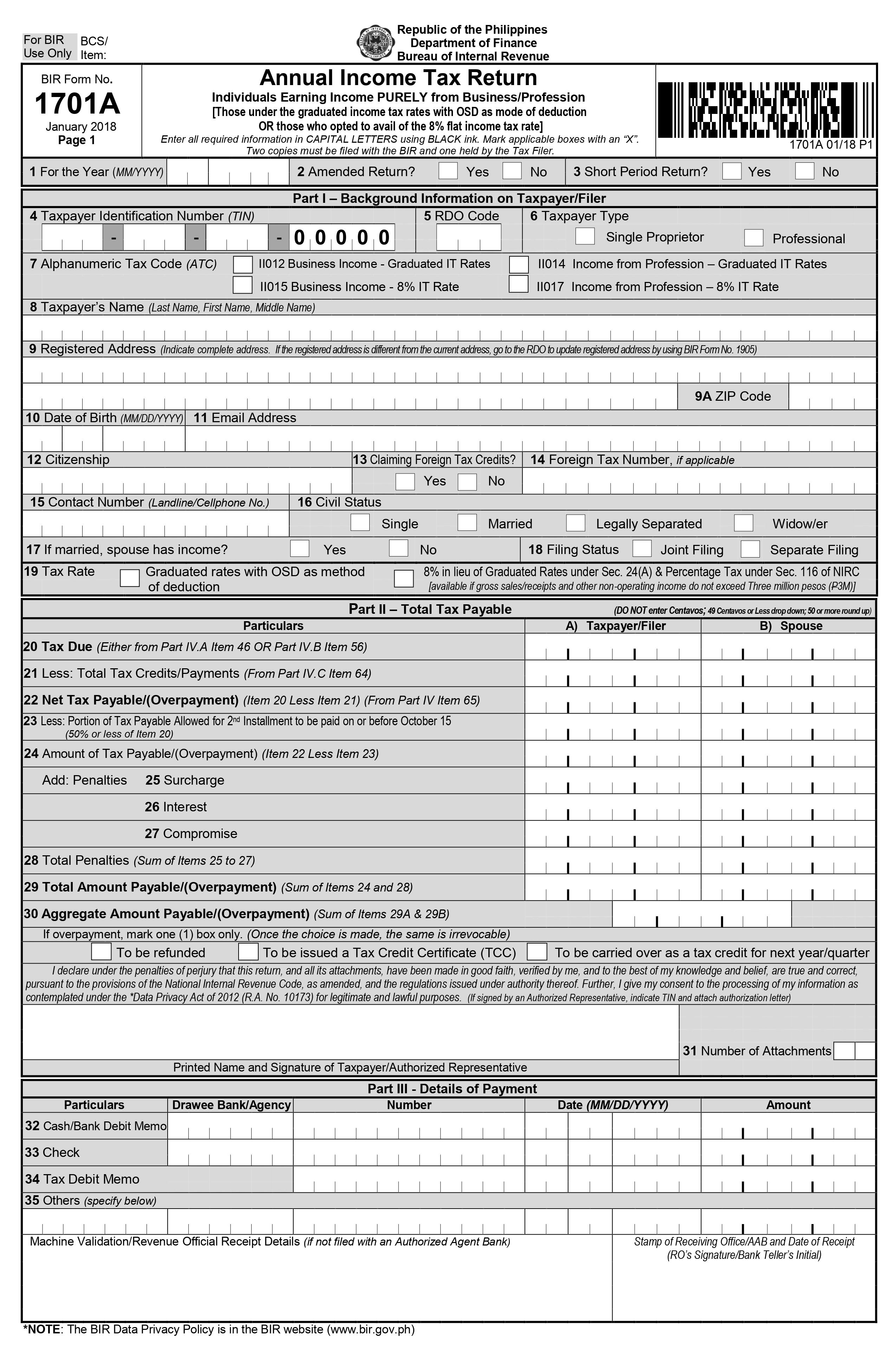

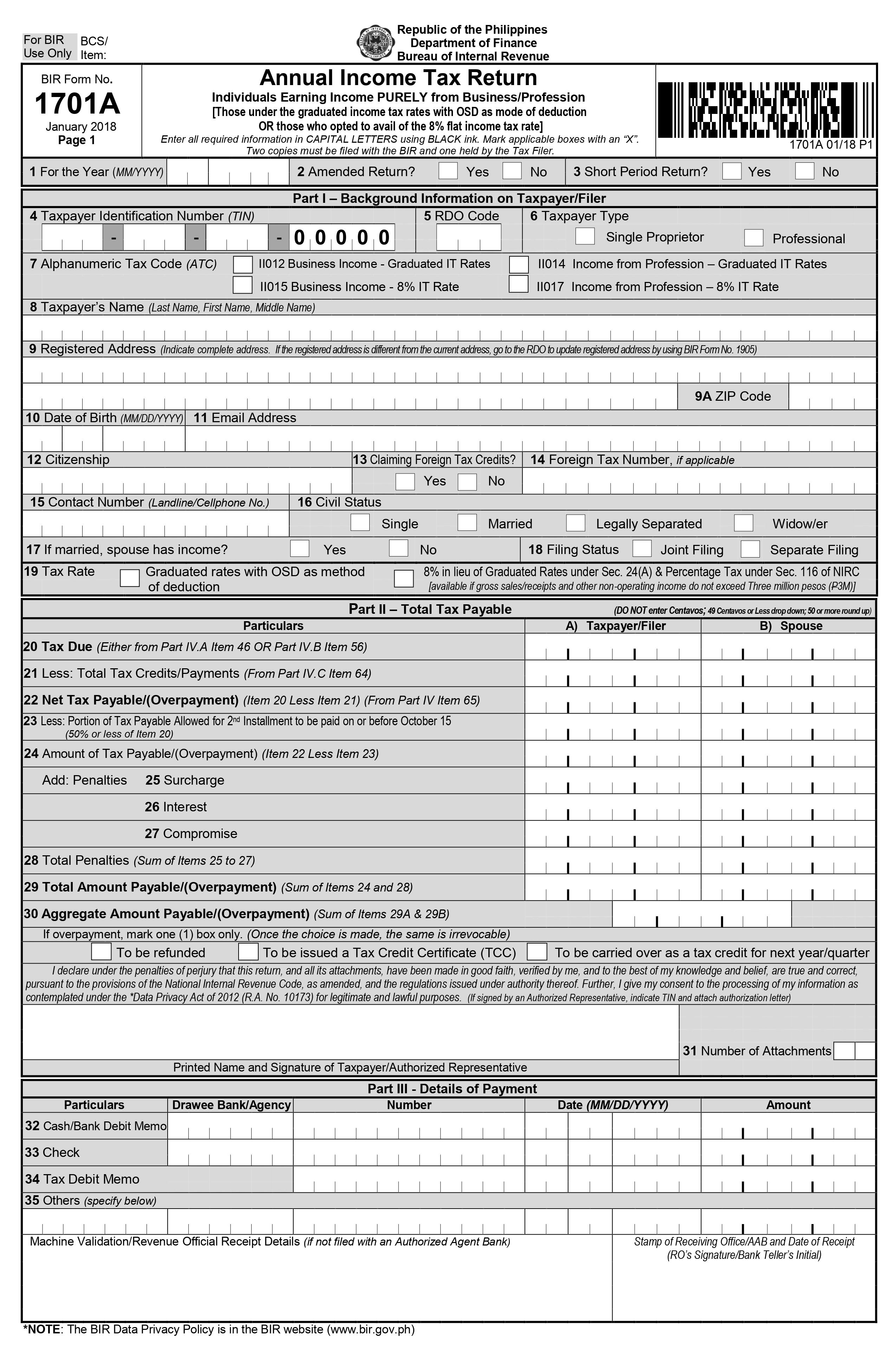

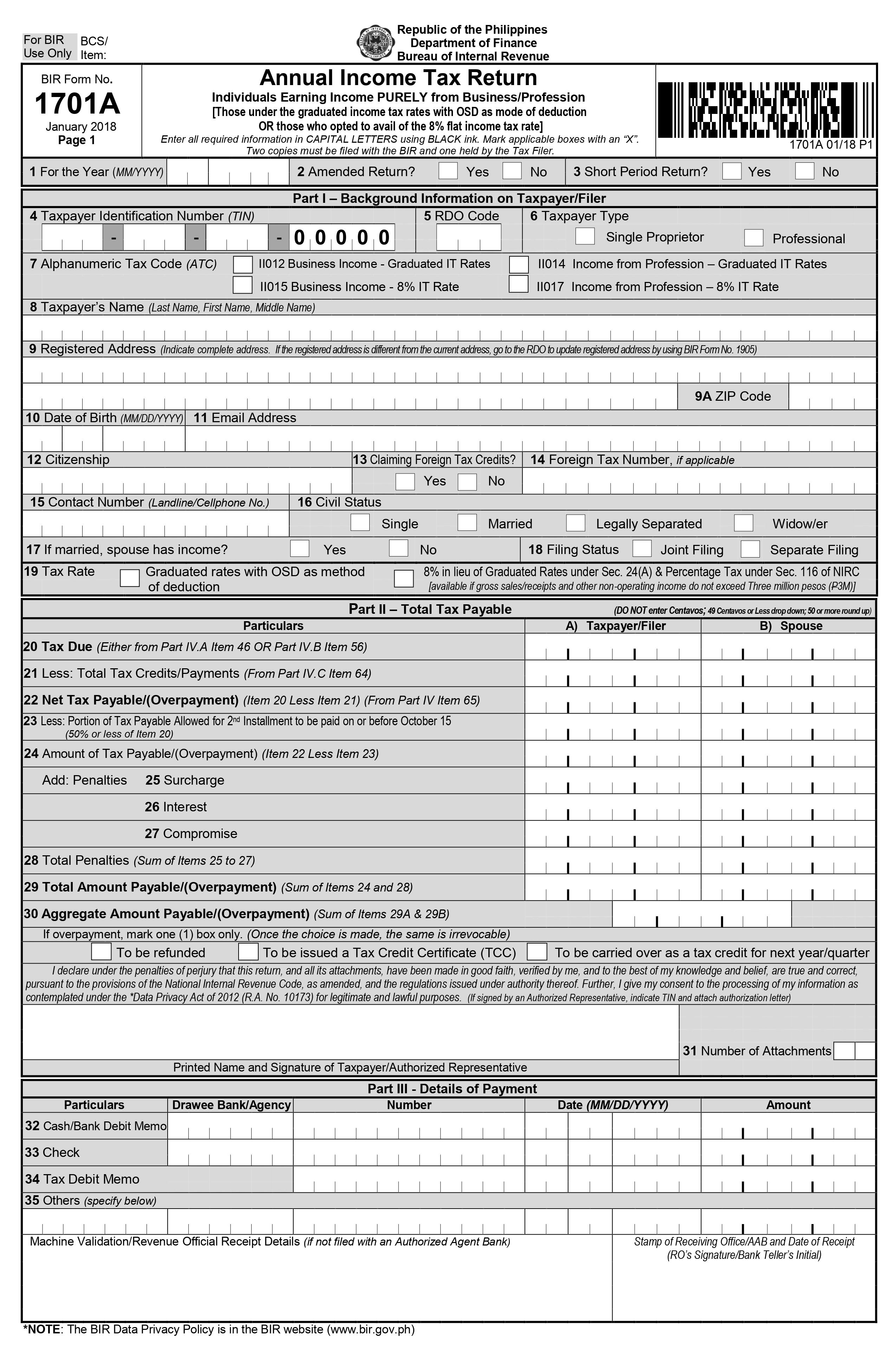

Annual Income Tax Return for Individuals Earning Income PURELY from Business/Profession (Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate).

FORM 1701A

What is this form?

Related Articles:

Form 1701A

Tax FAQ: Should I Use Form 1701 or 1701A?

BIR Form 1701A Released

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Available in:

Who needs to file?

The return shall be filed by individuals earning income PURELY from trade/business or from the practice of profession, to wit:

1. A resident citizen (within and without the Philippines);

2. A resident alien, non-resident citizen or non-resident alien (within the Philippines).

The return shall only be used by said individuals as follows:

A. Those subject to graduated income tax rates and availed of the optional standard deduction as method of deduction, regardless of the amount of sales/receipts and other non-operating income; OR

B. Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3M

When to file?

This return is filed on or before April 15 of each year covering income for the preceding taxable year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

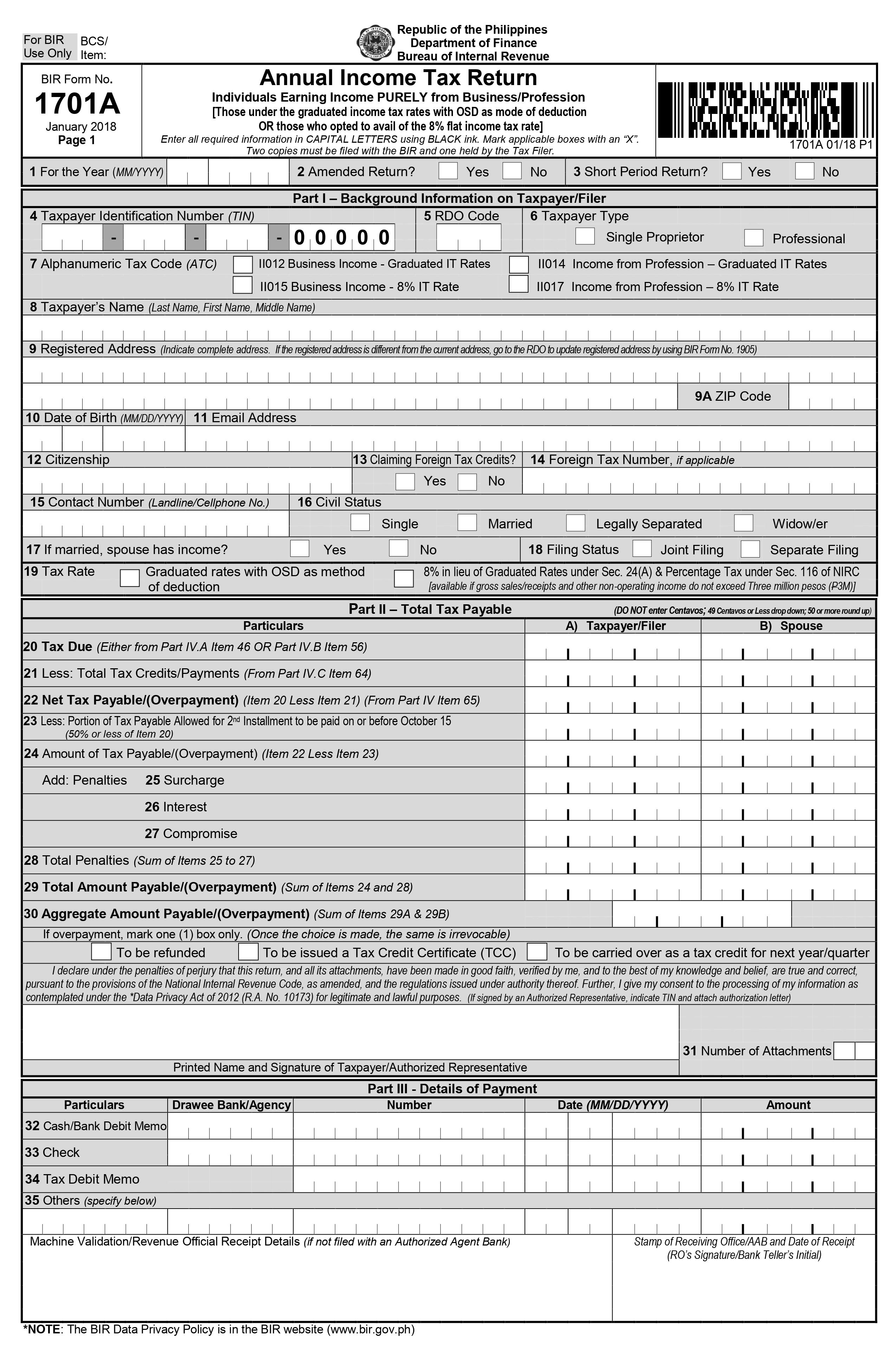

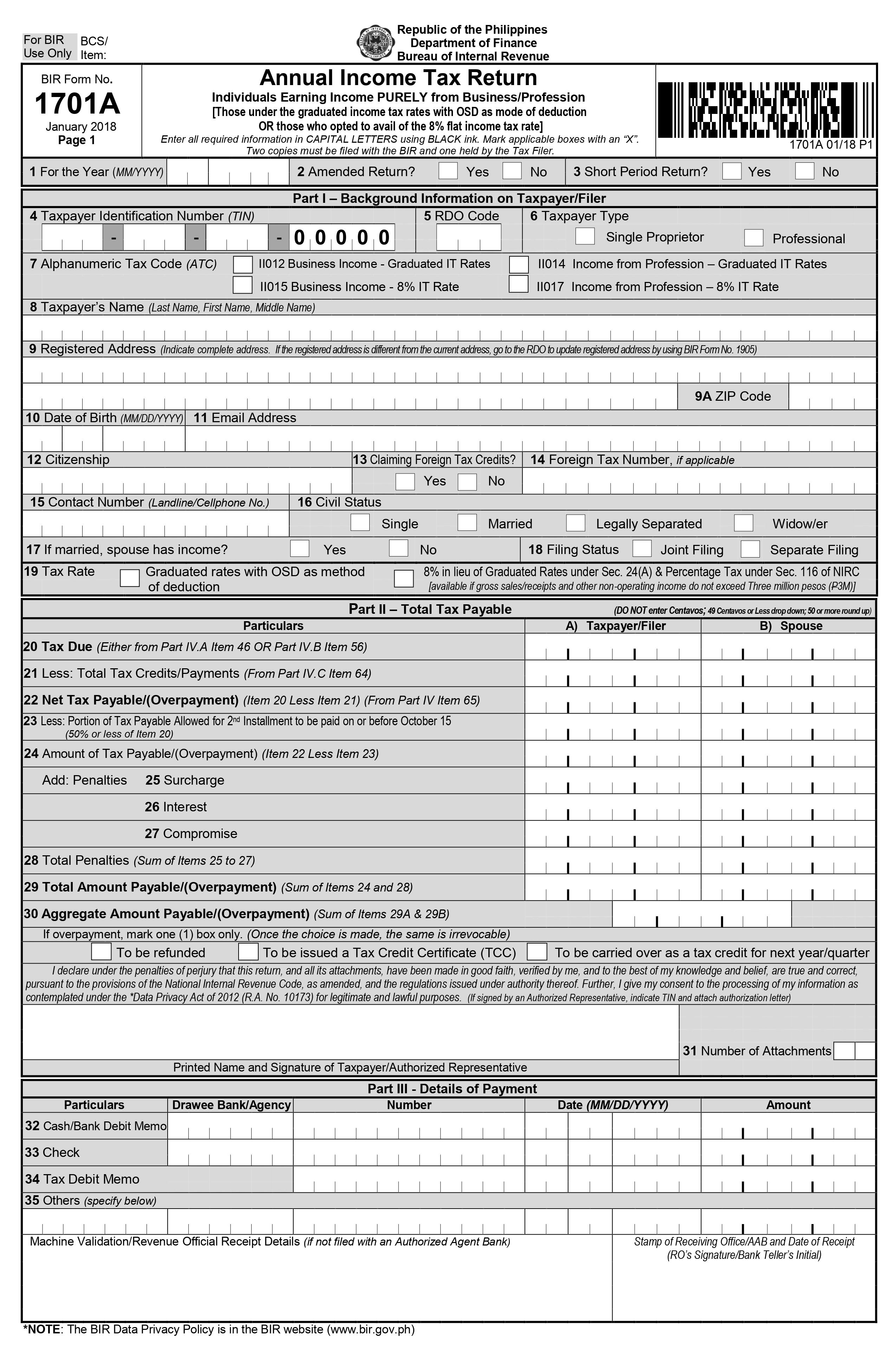

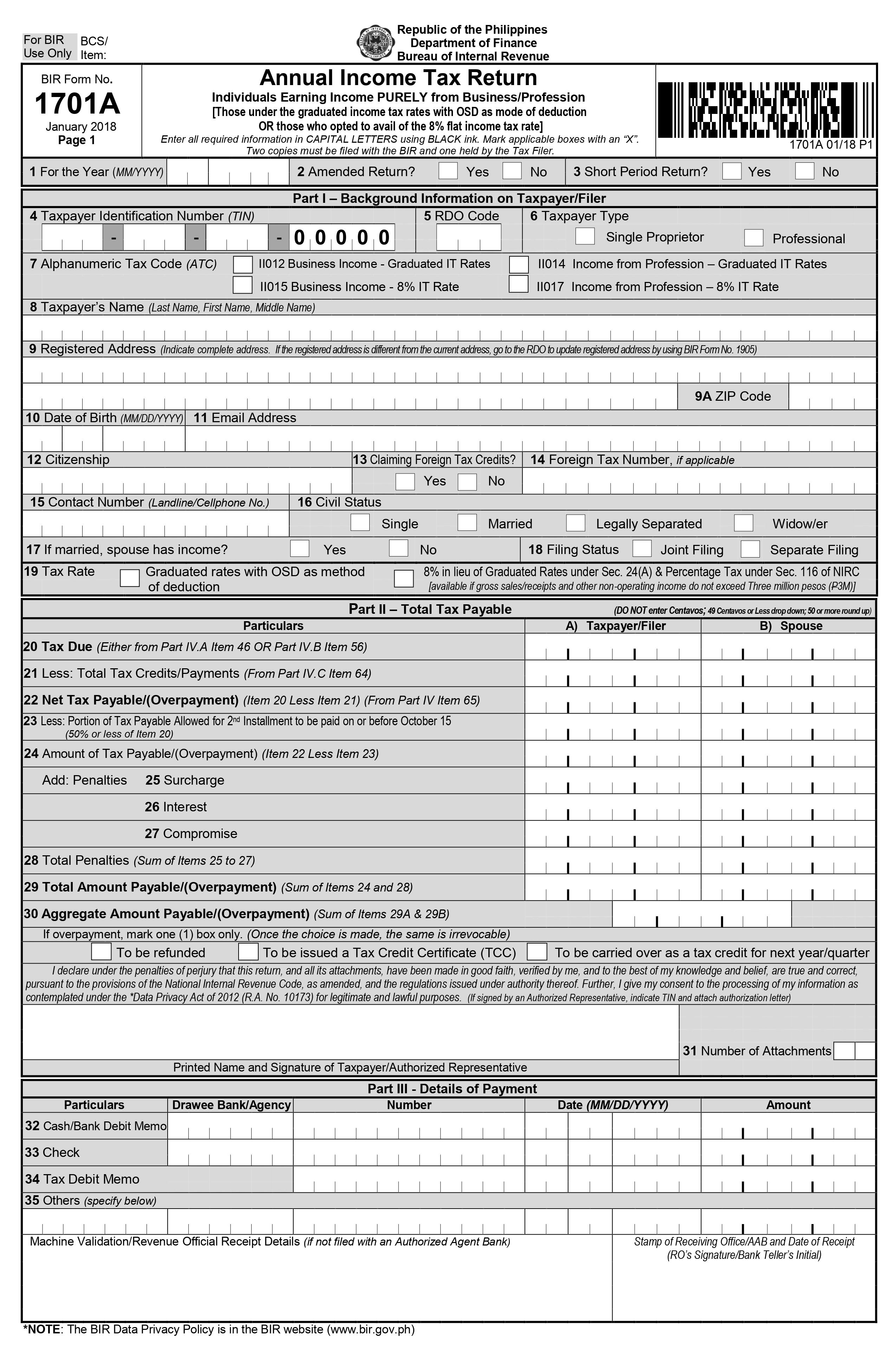

What is this form?

Annual Income Tax Return for Individuals Earning Income PURELY from Business/Profession (Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate).

Related Articles:

Form 1701A

Tax FAQ: Should I Use Form 1701 or 1701A?

BIR Form 1701A Released

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Who needs to file?

The return shall be filed by individuals earning income PURELY from trade/business or from the practice of profession, to wit:

1. A resident citizen (within and without the Philippines);

2. A resident alien, non-resident citizen or non-resident alien (within the Philippines).

The return shall only be used by said individuals as follows:

A. Those subject to graduated income tax rates and availed of the optional standard deduction as method of deduction, regardless of the amount of sales/receipts and other non-operating income; OR

B. Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3M

When to file?

This return is filed on or before April 15 of each year covering income for the preceding taxable year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: