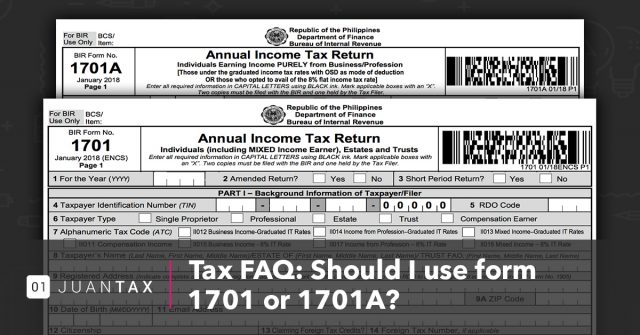

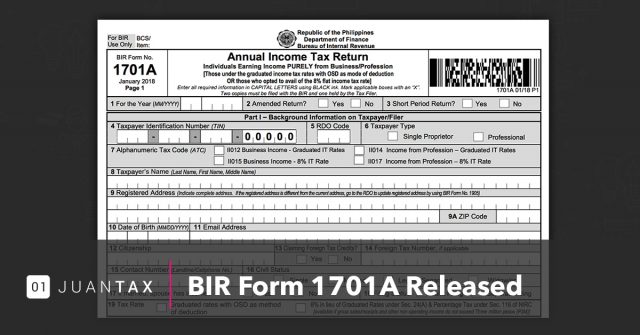

BIR’s RMC 73-74: A Deeper Look of Recent Form Changes

The implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) Law paved the way to a lot of changes in the economy. In providing better services to taxpayers and businesses, The Bureau of Internal Revenue embraced the change through constant improvement of its systems for better tax compliance. July 24, Wednesday, the BIR made…