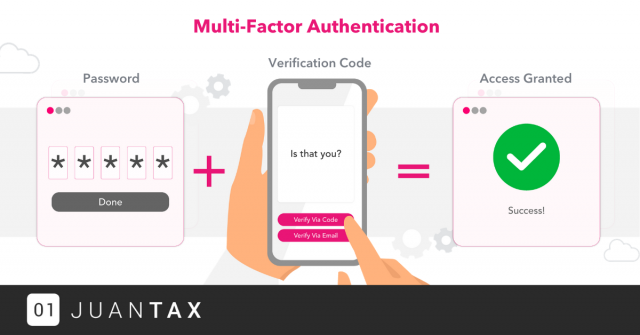

What is Multi-Factor Authentication and How Does it Work?

Learn more about MFA and how it keeps your credentials and your data safe. Follow the easy tips below to establish a secure account and keep your online life more protected. What is Multi-Factor Authentication (MFA)? Multi-Factor Authentication (MFA) is an online authentication method wherein the user is required to confirm their identity using two…