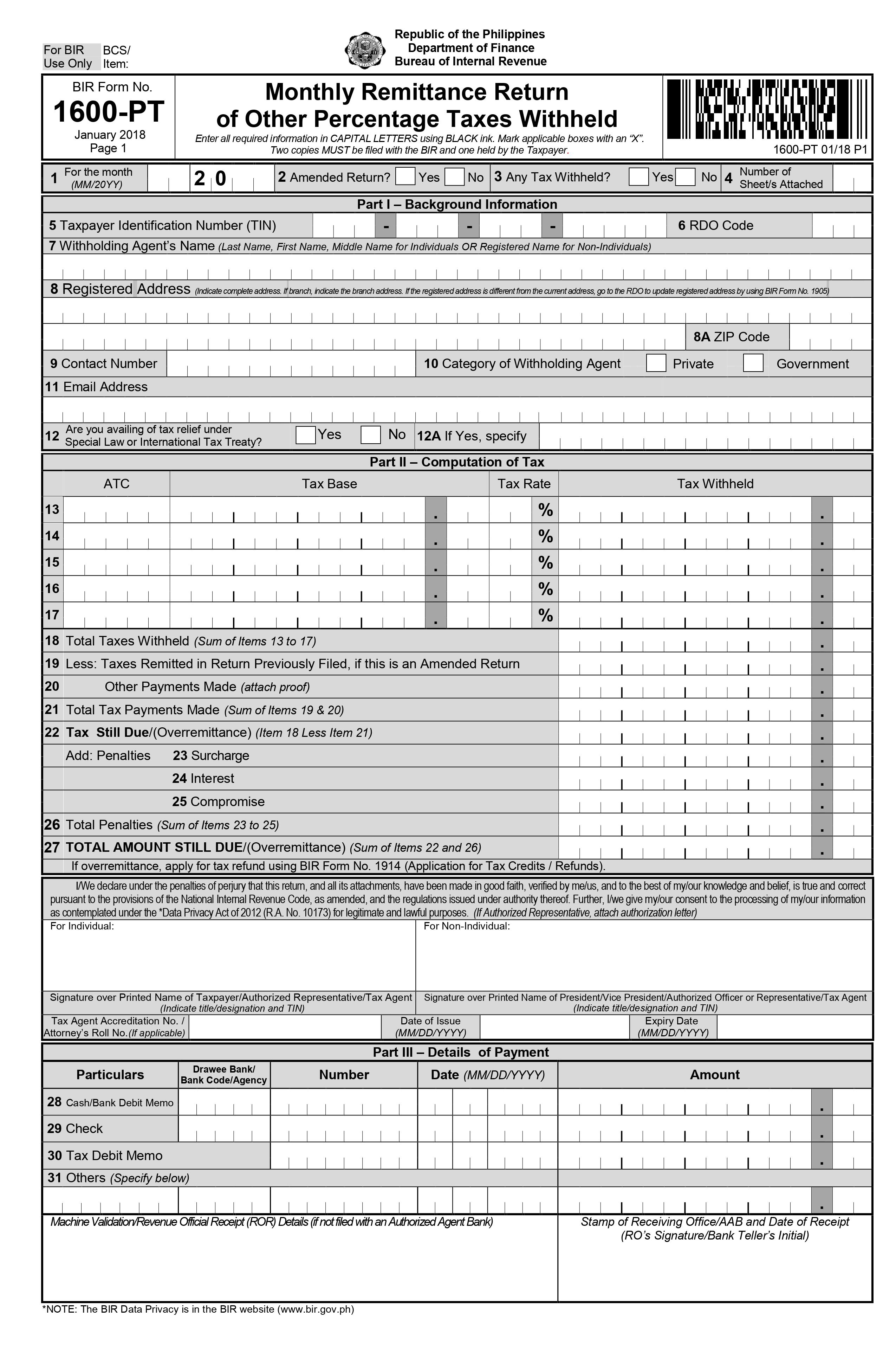

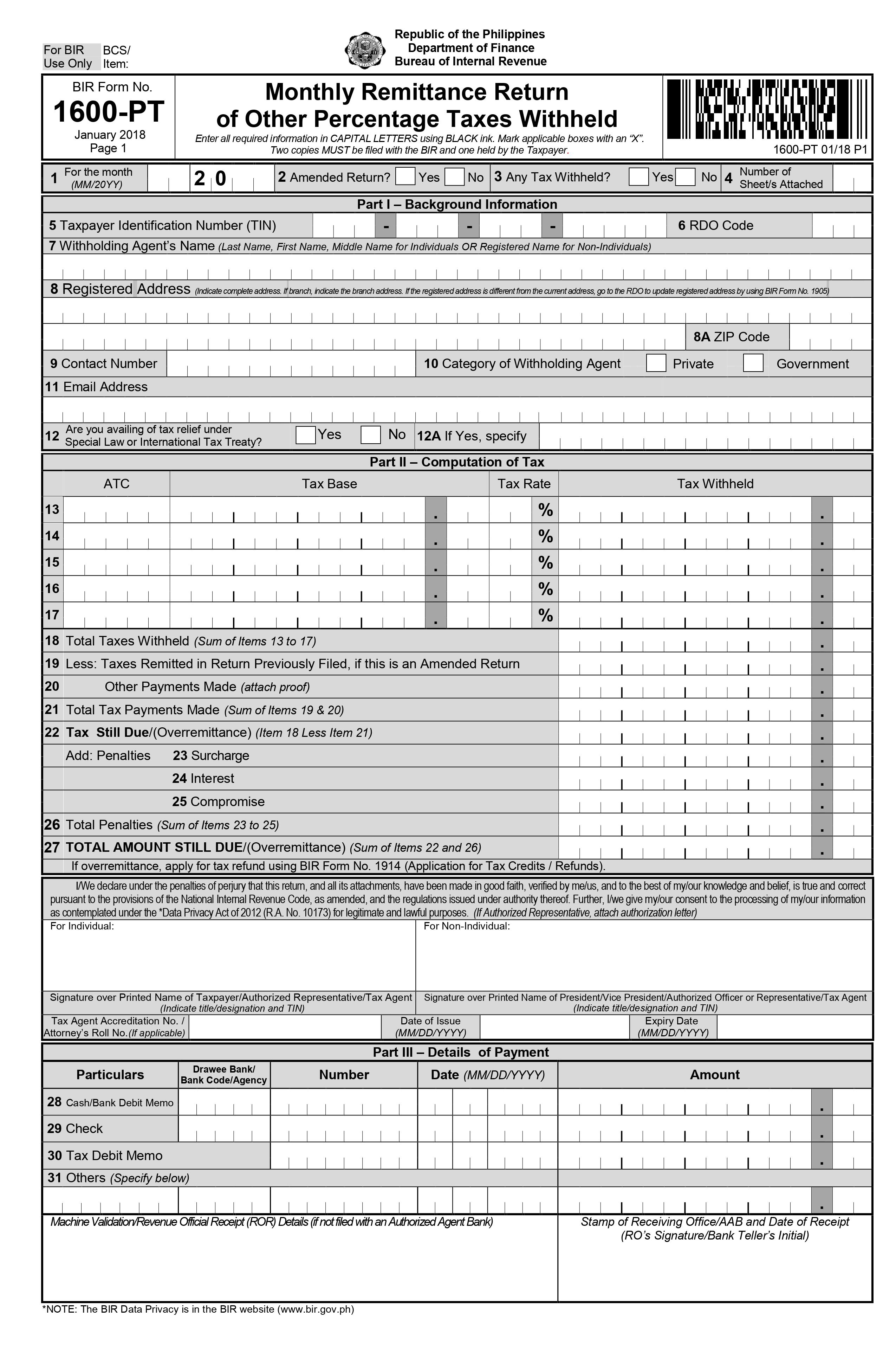

BIR Form 1600, also known as Monthly Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld.

FORM 1600

What is this form?

Available in:

Who needs to file?

- All government offices, bureaus, agencies/instrumentalities, local government units, government owned and controlled corporations on money payments made to private individuals, partnerships, and corporations.

- Payors to non-residents receiving income subject to VAT

- Payors to VAT registered taxpayers receiving income subject to VAT

- Payors to persons, natural or juridical, who are subject to percentage tax (ATC 082&084)

When to file?

This form shall be filed and paid for on or before the 10th day of the month following the month in which the withholding was made.

How to file?

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

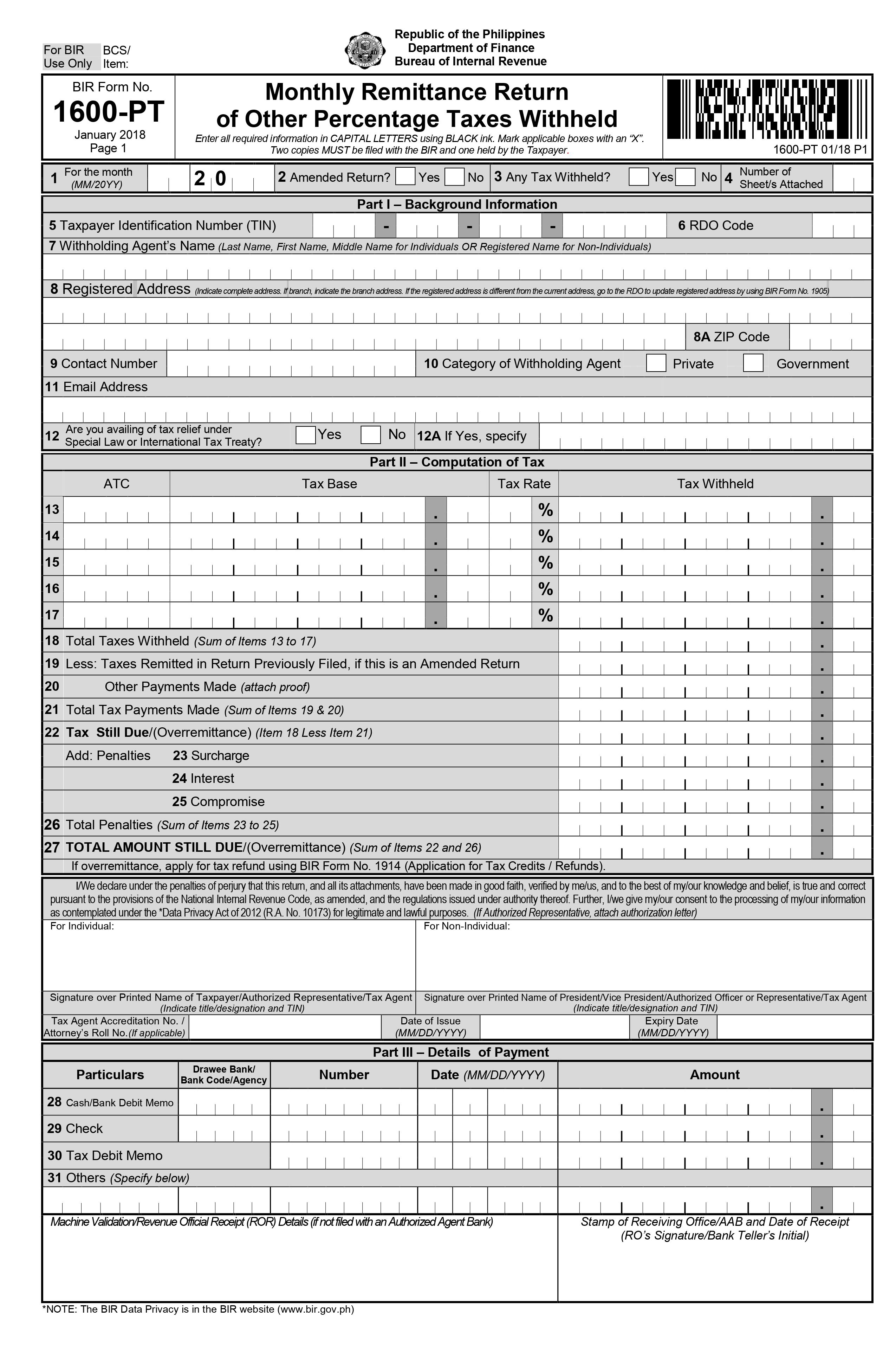

What is this form?

BIR Form 1600, also known as Monthly Remittance Return of Value-Added Tax and Other Percentage Taxes Withheld.

Who needs to file?

- All government offices, bureaus, agencies/instrumentalities, local government units, government owned and controlled corporations on money payments made to private individuals, partnerships, and corporations.

- Payors to non-residents receiving income subject to VAT

- Payors to VAT registered taxpayers receiving income subject to VAT

- Payors to persons, natural or juridical, who are subject to percentage tax (ATC 082&084)

When to file?

This form shall be filed and paid for on or before the 10th day of the month following the month in which the withholding was made.

How to file?

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: