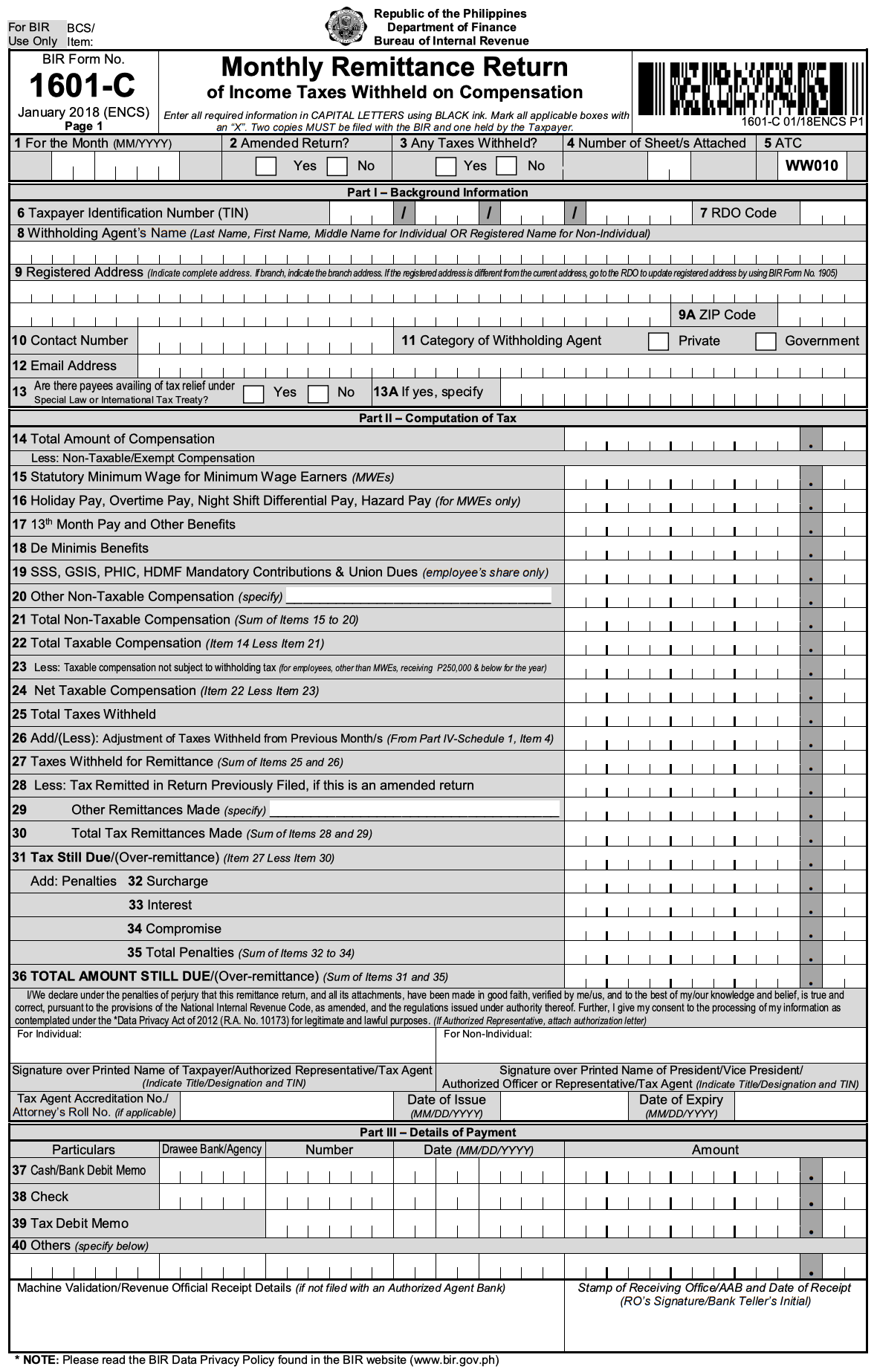

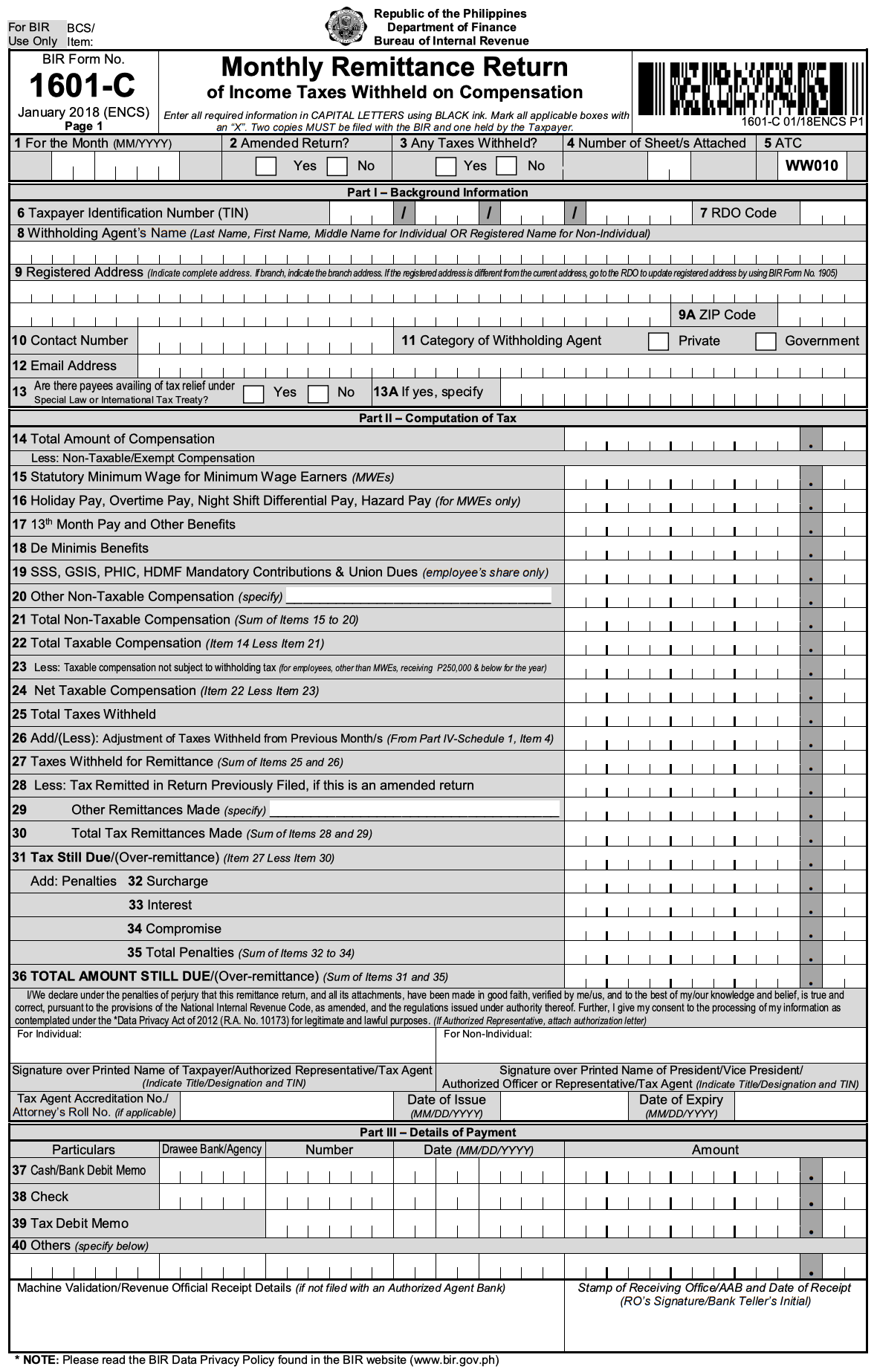

Form 1601-C or Monthly Remittance Return of Income Taxes Withheld on Compensation is filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees.

FORM 1601-C

What is this form?

Related Articles:

Generating 1601C

Adding Employees and Compensations for 1601C Forms

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Available in:

Who needs to file?

Filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees.

When to file?

For the months of January to November – on or before the 10th day of the following month.

For the month of December – on or before the 15th day of the following month.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

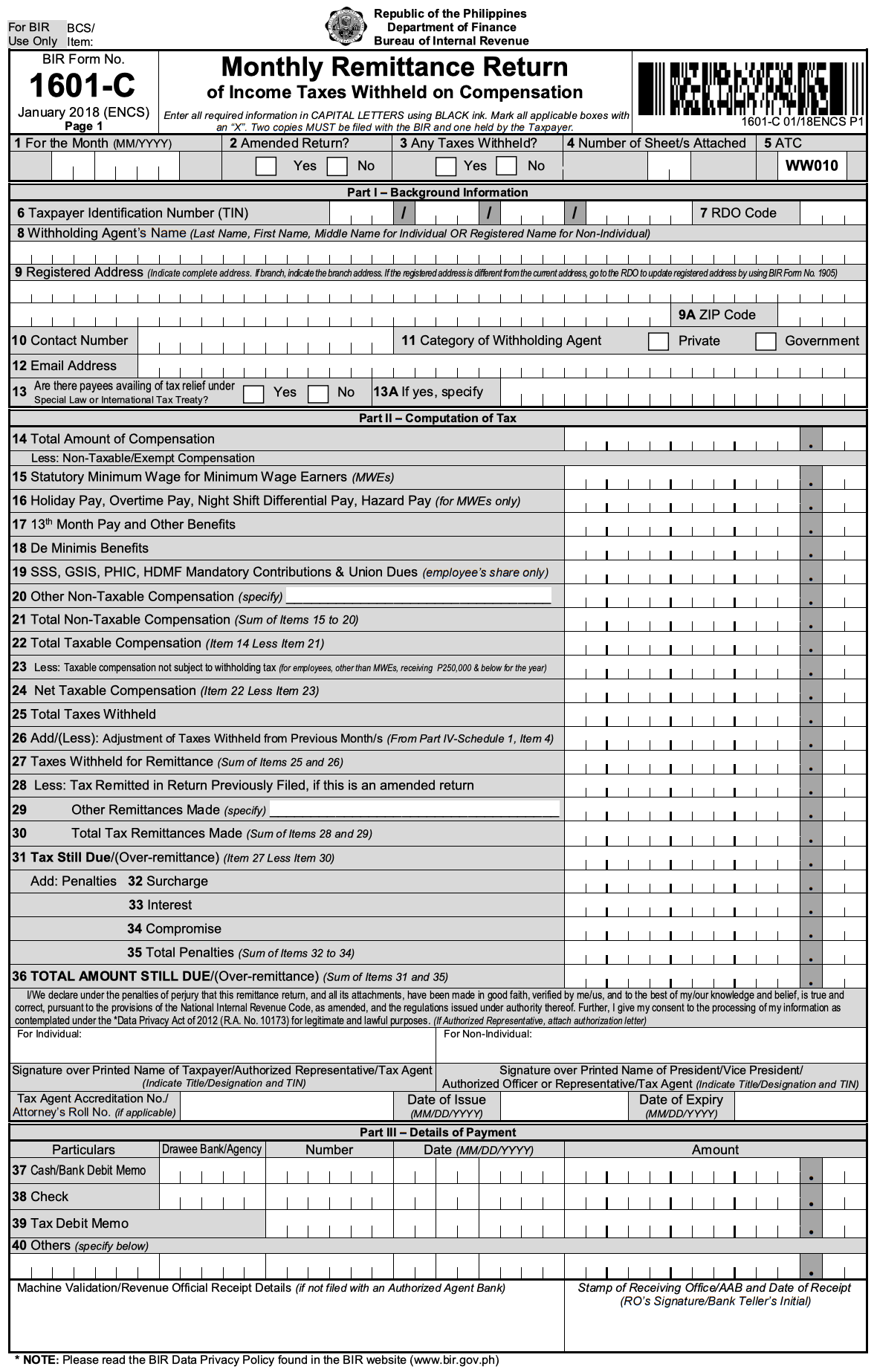

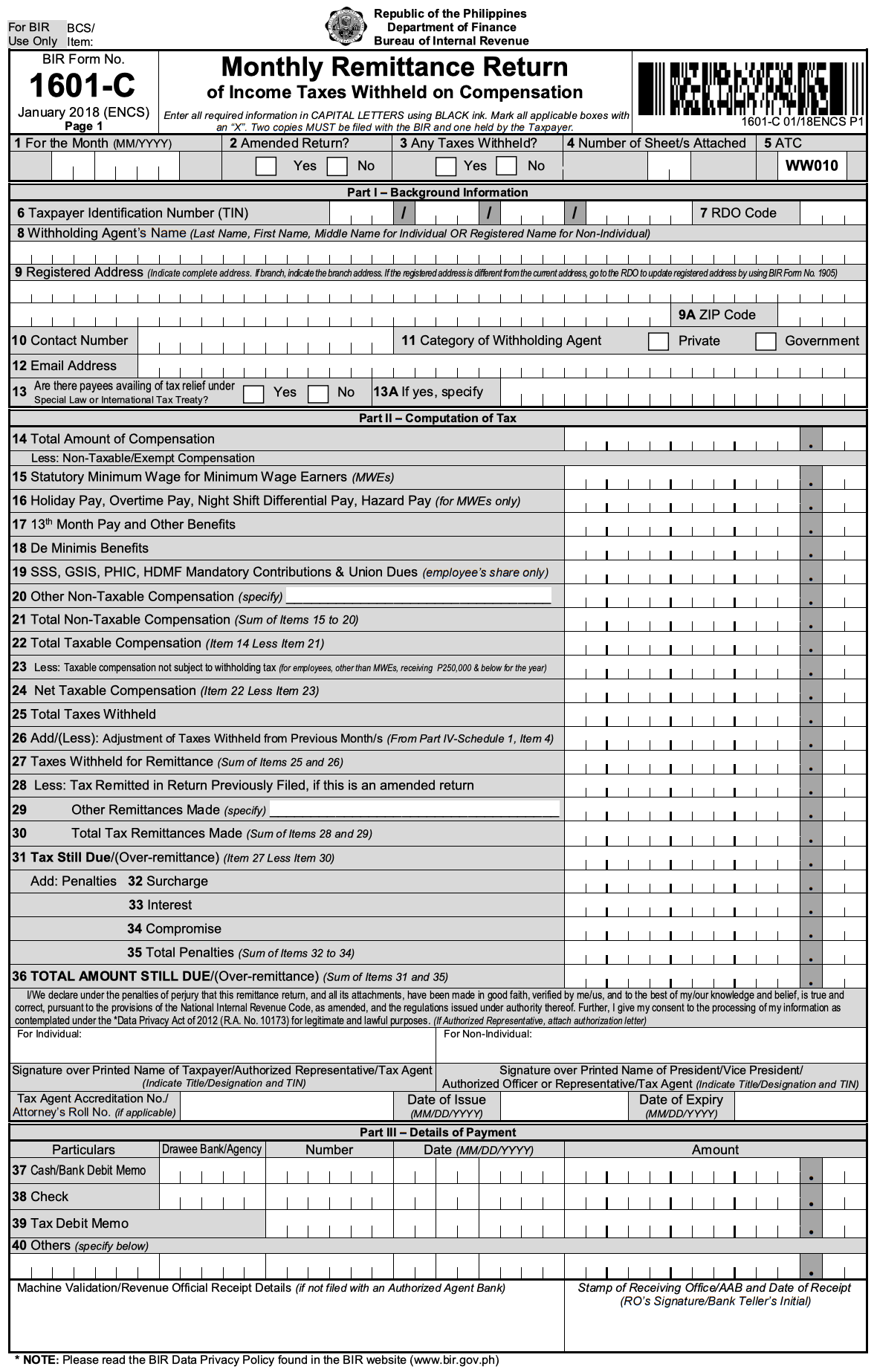

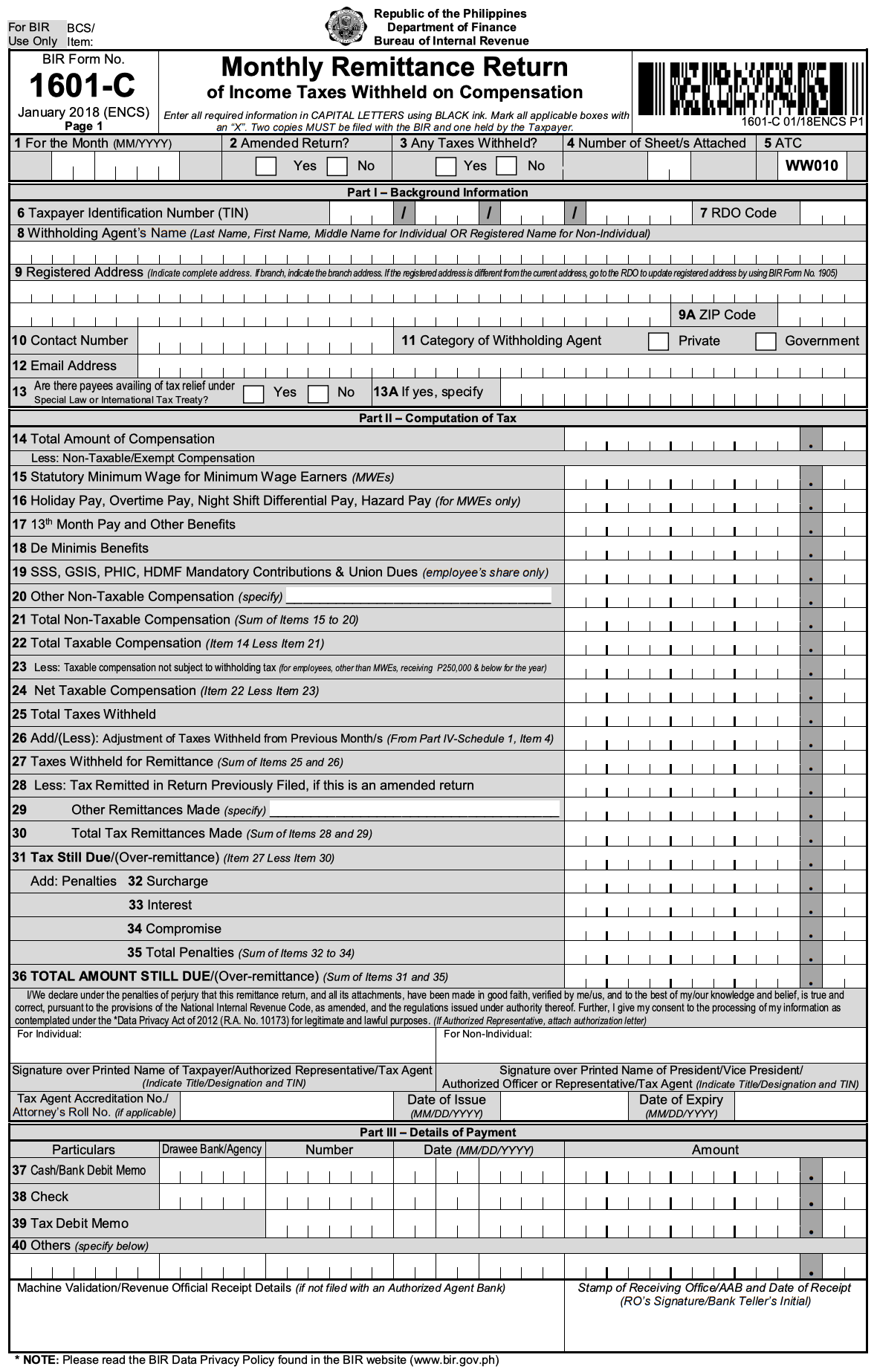

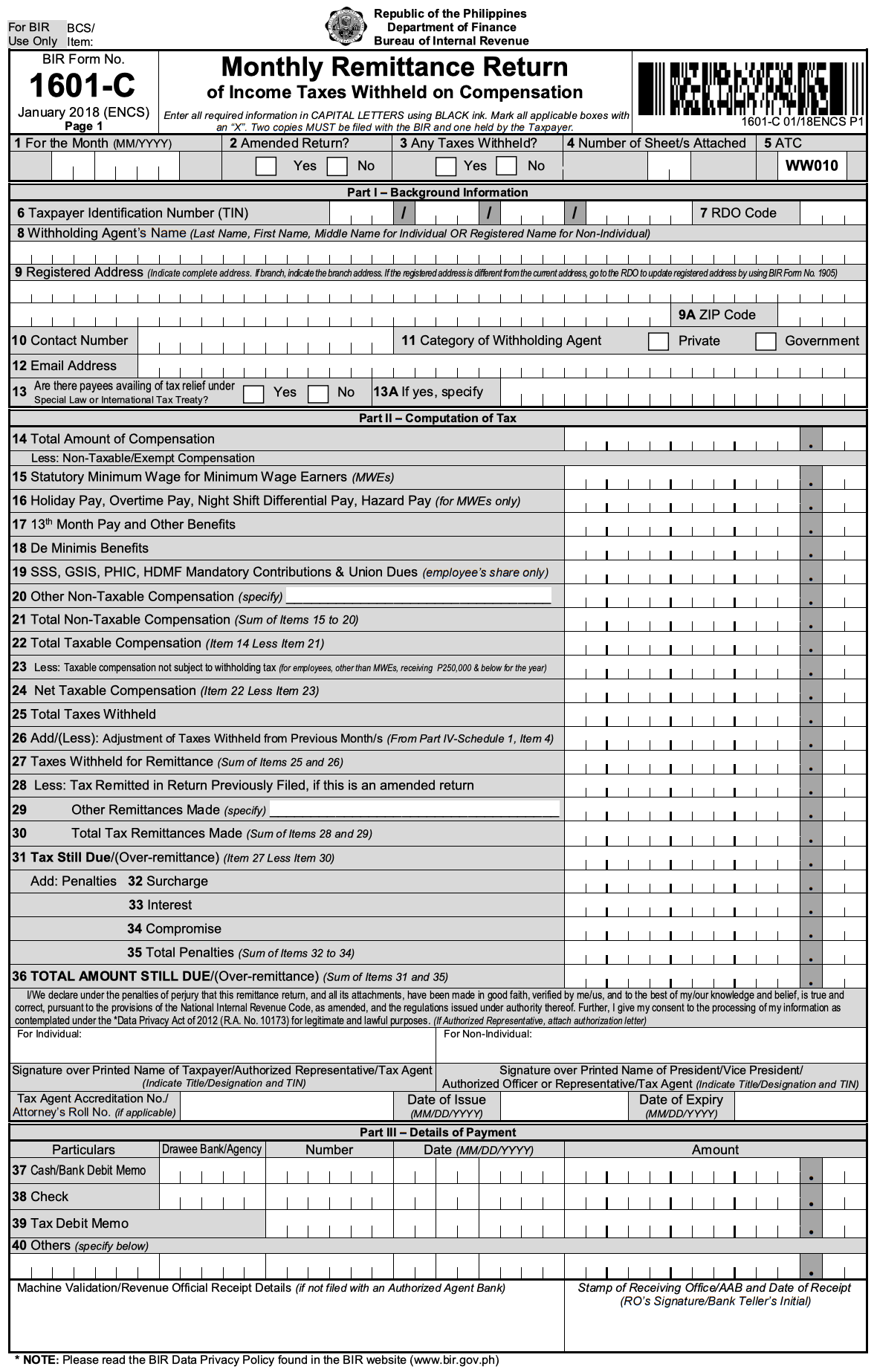

What is this form?

Form 1601-C or Monthly Remittance Return of Income Taxes Withheld on Compensation is filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees.

Related Articles:

Generating 1601C

Adding Employees and Compensations for 1601C Forms

Want to know more about this form and how to populate it? Check out this course from JuanTax Academy:

Who needs to file?

Filed by a Withholding Agent who deducts and withhold taxes on compensation paid to employees.

When to file?

For the months of January to November – on or before the 10th day of the following month.

For the month of December – on or before the 15th day of the following month.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: