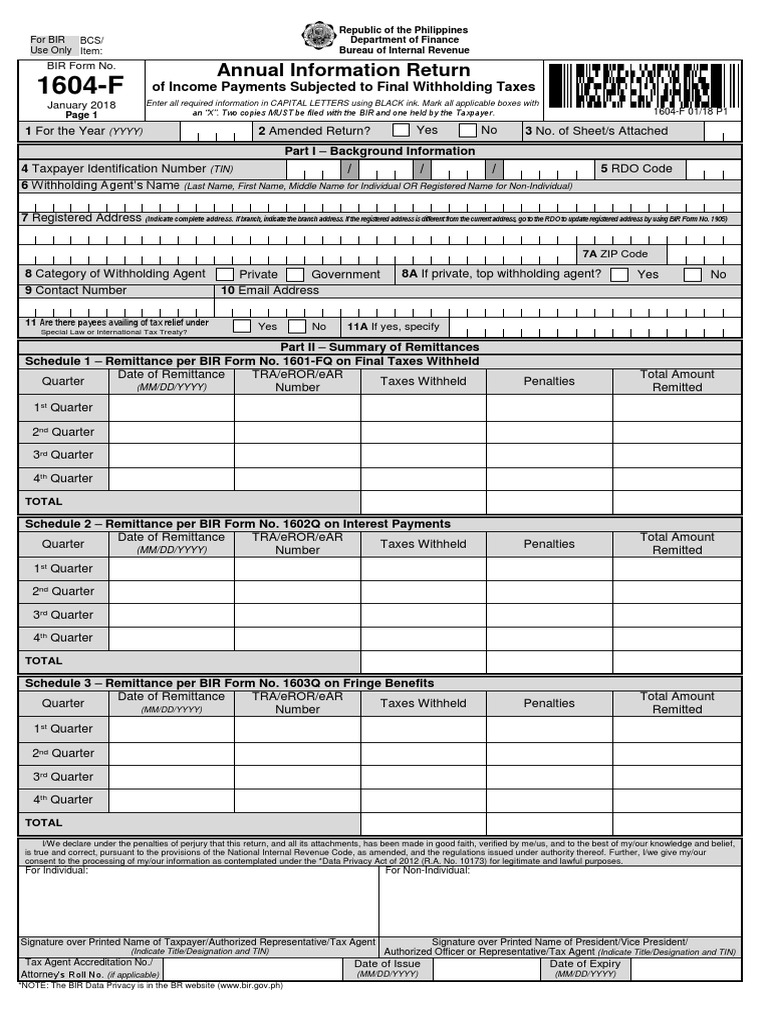

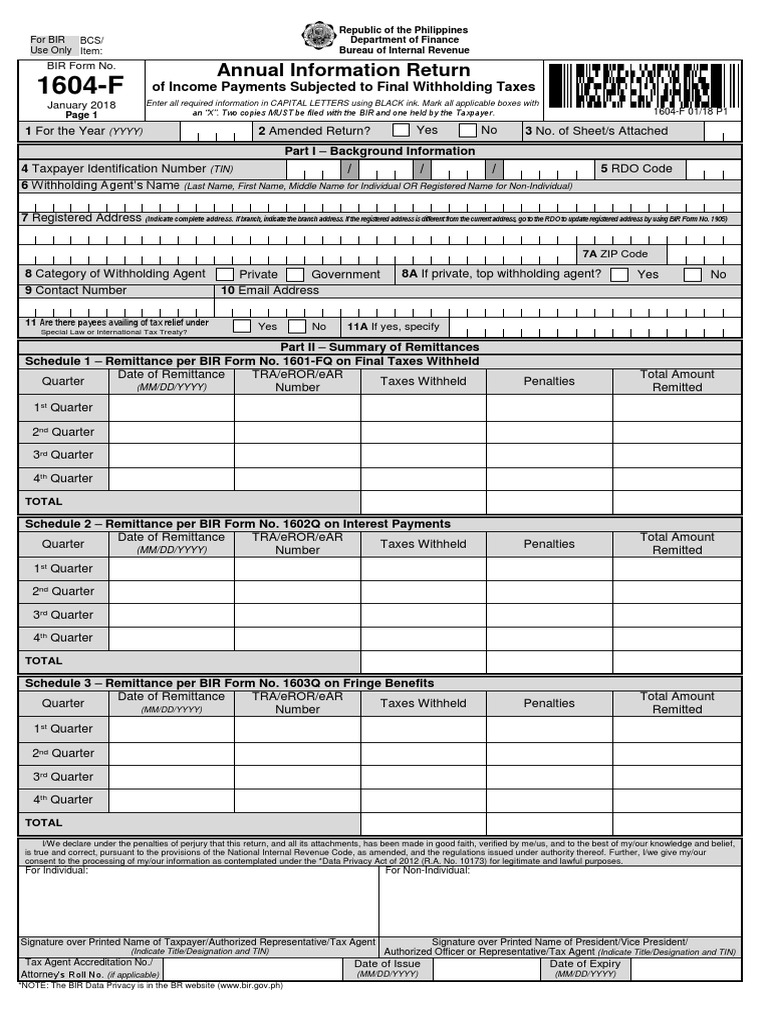

BIR Form 1604-F, also known as Annual Information Return of Income Payments Subjected to Final Withholding Taxes is filed by a Withholding Agent required to deduct and withhold taxes on income payments subject to Final Withholding Tax.

FORM 1604-F

What is this form?

Who needs to file?

This return shall be filed by every withholding agent/payor required to deduct and withhold taxes on income payments subject to Final Withholding Tax. The tax rates and nature of income payments subject to final withholding taxes are printed in BIR Form Nos. 1601-FQ, 1602Q and 1603Q respectively.

When to file?

On or before January 31 of the year following the calendar year in which the income payments subject to final withholding taxes were paid or accrued.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

What is this form?

BIR Form 1604-F, also known as Annual Information Return of Income Payments Subjected to Final Withholding Taxes is filed by a Withholding Agent required to deduct and withhold taxes on income payments subject to Final Withholding Tax.

Who needs to file?

This return shall be filed by every withholding agent/payor required to deduct and withhold taxes on income payments subject to Final Withholding Tax. The tax rates and nature of income payments subject to final withholding taxes are printed in BIR Form Nos. 1601-FQ, 1602Q and 1603Q respectively.

When to file?

On or before January 31 of the year following the calendar year in which the income payments subject to final withholding taxes were paid or accrued.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.