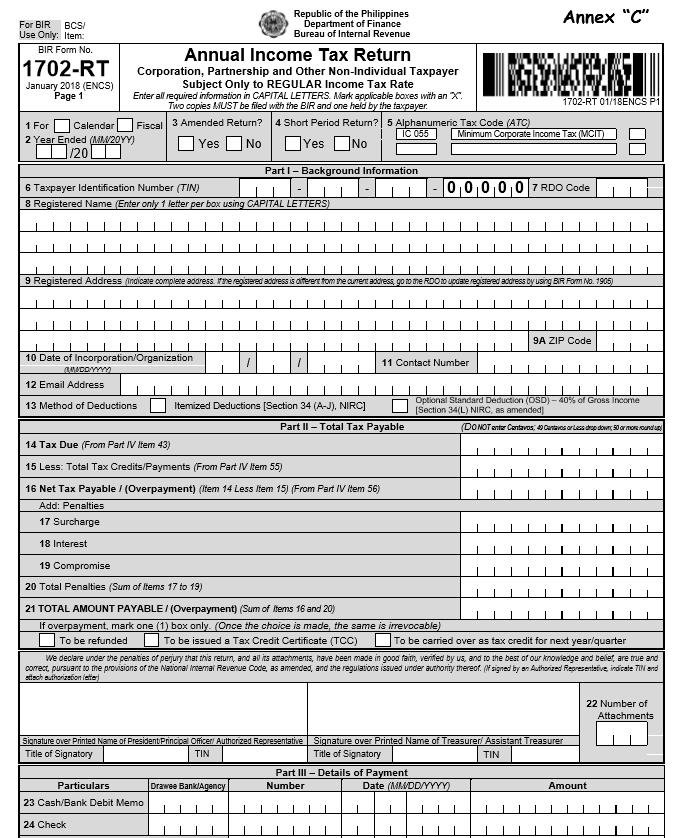

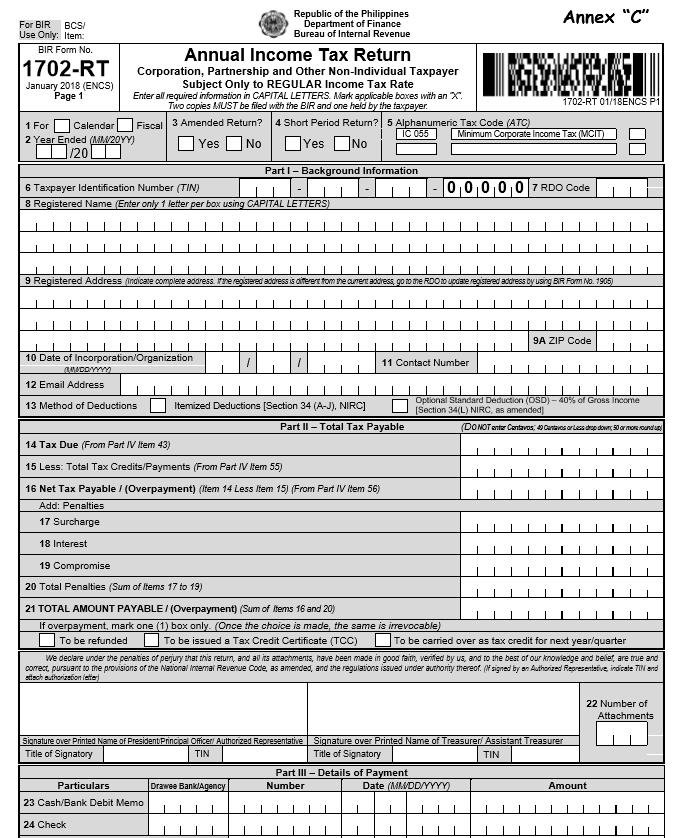

BIR form 1702-RT, or also known as Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate is a tax form which is filed by non-individual taxpayers whose earnings are subject to income tax rate of 30%.

FORM 1702-RT

What is this form?

Available in:

Who needs to file?

Returns like 1702RT needs to be filed by corporation, partnership and other forms of non-individual entities which involves construction projects, petroleum and other energy operations in accordance with the provisions listed within the tax code.

When to file?

BIR form 1702RT needs to be filed on or before the 15th day of the 4th month after the closing of the taxable year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

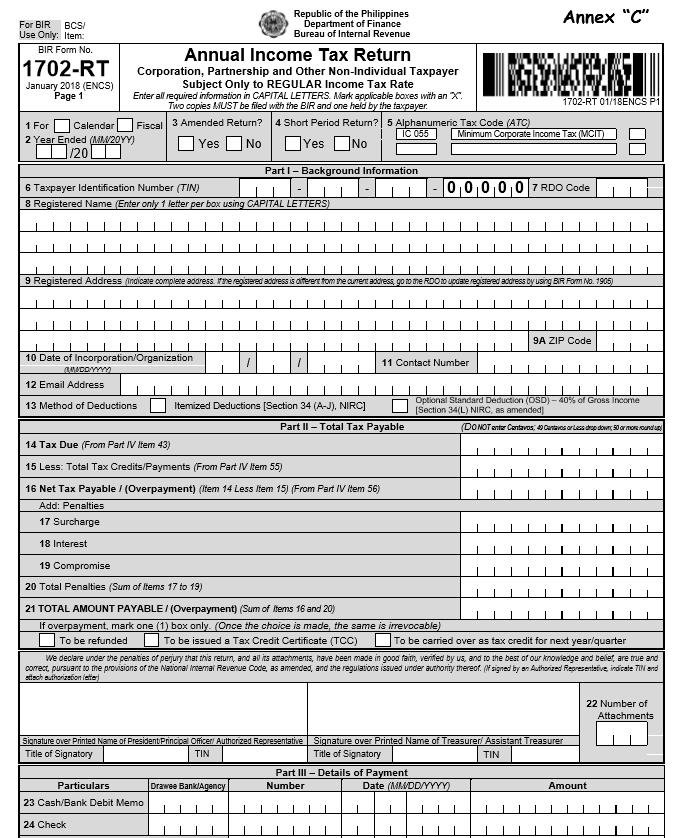

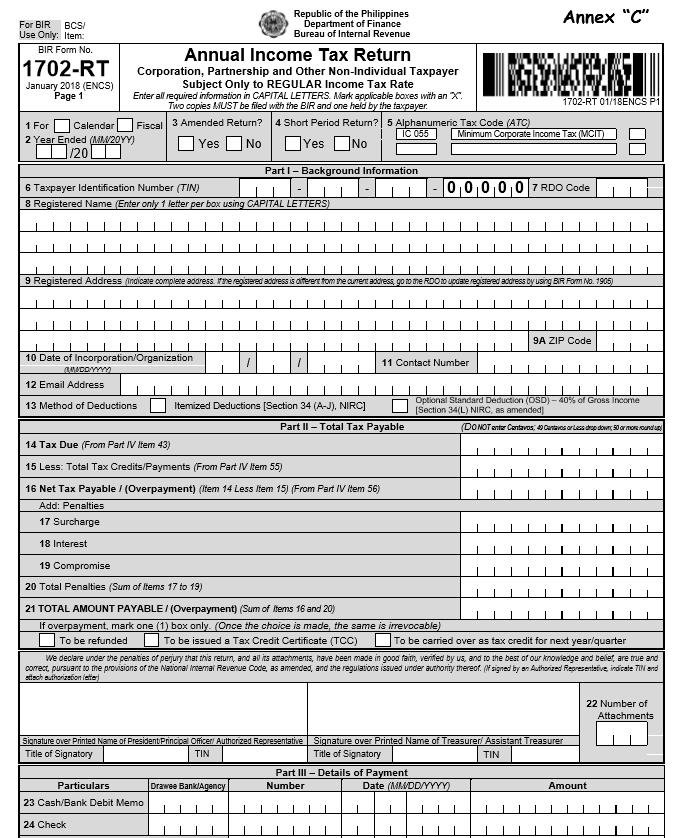

What is this form?

BIR form 1702-RT, or also known as Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate is a tax form which is filed by non-individual taxpayers whose earnings are subject to income tax rate of 30%.

Who needs to file?

Returns like 1702RT needs to be filed by corporation, partnership and other forms of non-individual entities which involves construction projects, petroleum and other energy operations in accordance with the provisions listed within the tax code.

When to file?

BIR form 1702RT needs to be filed on or before the 15th day of the 4th month after the closing of the taxable year.

How to file?

Just like any other tax form, you can e-file and e-pay forms for your clients using JuanTax. View this link from our Help Center to get started, Filing Taxes in JuanTax.

If you’re filing for a small business, as a freelancer, or as an individual, learn the step-by-step process for filing tax forms in Fast File. Visit this help article, instead: e-Filing your Taxes using Fast File.

Available in: