Income tax forms can get very complicated. What more when it comes to comparing different forms? We’ve listed down the necessary details you need to know about these three different ITR forms for individual taxpayers.

This article will answer these questions:

- What makes you an Individual Taxpayer?

- What are the forms for?

- What are the main differences between them?

- How do I know which one to file?

- How do I File and Pay?

What makes you an Individual Taxpayer?

- Resident citizens receiving income from sources within or outside the Philippines

- Employees deriving purely compensation income from two or more employers, concurrently or successively, at any time during the taxable year

- Employees deriving purely compensation income regardless of the amount, whether from a single or several employers during the calendar year, the income tax of which has not been withheld correctly (i.e. tax due is not equal to the tax withheld), resulting in a collectible or refundable return

- Self-employed individuals receiving income from the conduct of trade or business and/or practice of profession

- Individuals deriving mixed income, i.e., compensation income and income from the conduct of trade or business and/or practice of profession

- Individuals deriving other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax

- Individuals receiving purely compensation income from a single employer, although the income of which has been correctly withheld but whose spouse is not entitled to substituted filing

- Non-resident citizens receiving income from sources within the Philippines

- Aliens, whether resident or not, receiving income from sources within the Philippines

What are the forms for?

BIR Form No. 1700, also known as the Annual Income Tax Return for Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Related Income).

According to the BIR, this return shall be filed by every resident citizen deriving compensation income from all sources, or resident alien and non-resident citizen with respect to compensation income from within the Philippines, except the following:

- An individual whose gross compensation income does not exceed his total personal and additional exemptions.

- An individual with respect to pure compensation income, as defined in Section 32(A)(1) derived from sources within the Philippines, the income tax on which has been correctly withheld (tax due equals tax withheld) under the provisions of Section 79 of the Code: Provided, that an individual deriving compensation concurrently from two or more employers at any time during the taxable year shall file an income tax return.

- An individual whose income has been subjected to final withholding tax (alien employee as well as Filipino employee occupying the same position as that of the alien employee of regional or area headquarters and regional operating headquarters of multinational companies, petroleum service contractors and sub-contractors, and offshore banking units; non-resident alien not engaged in trade or business).

- A minimum wage earner or an individual who is exempt from income tax.

BIR Form No. 1701, also known as the Annual Income Tax Return for Individuals (including MIXED Income Earners), Estates, and Trusts. This shall be filed by individuals who are engaged in trade/business or the practice of profession, including those with mixed income (i.e., those engaged in the trade/business or profession who are also earning compensation income).

According to the BIR, this return shall be filed by the following individuals regardless of the amount of gross income:

- A resident citizen engaged in trade, business, or practice of profession within and without the Philippines.

- A resident alien, non-resident citizen, or non-resident alien individual engaged in trade, business, or practice of a profession within the Philippines.

- A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

- An individual engaged in trade or business or in the exercise of their profession and receiving compensation income as well.

BIR Form 1701A, also known as the Annual Income Tax Return for Individuals Earning Income PURELY from Business/Profession (Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate).

According to the BIR, this return shall be filed by individuals earning income PURELY from trade/business or from the practice of profession:

- A resident citizen (within and without the Philippines);

- A resident alien, non-resident citizen, or non-resident alien (within the Philippines).

According to the BIR, this return shall only be used by said individuals as follows:

- Those subject to graduated income tax rates and availed of the optional standard deduction as method of deduction, regardless of the amount of sales/receipts and other non-operating income; OR

- Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3M

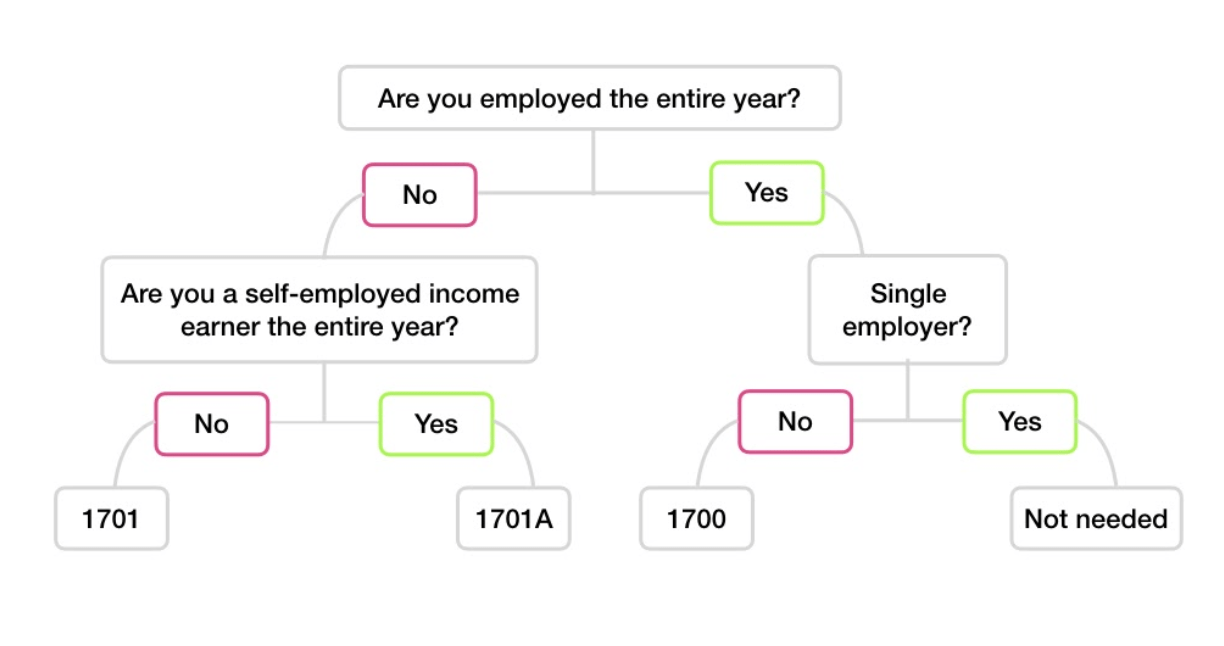

Here’s a diagram to guide you on which form to choose and show how each form is different:

Note: The Income Tax Return form that you are supposed to comply with is listed in your Certificate of Registration or COR (Form 2303)

These are simple guide questions in defining which ITR form you fall under. Let’s break it down one by one.

- Are you employed the entire year?

- If no…, are you a self-employed income earner the entire year?

- If no… then ITR form 1701 is for you

- If yes… then consider ITR form 1701A

- If you are employed the entire year, “Do I have a single employer?”

- If no… ITR form 1700 might be for you

- If yes… you might be needing it (this is possible if you are qualified for substituted filing. You might want to consult your account on this.)

- If no…, are you a self-employed income earner the entire year?

Income Tax compliance can get complicated. We got you covered.

Understanding the basics of Income Tax Return requirements is already challenging; what more when it comes to computation, filing, and payment of tax dues? There are a few e-solutions for ITR filing and payment in the market, but no one does it like JuanTax.

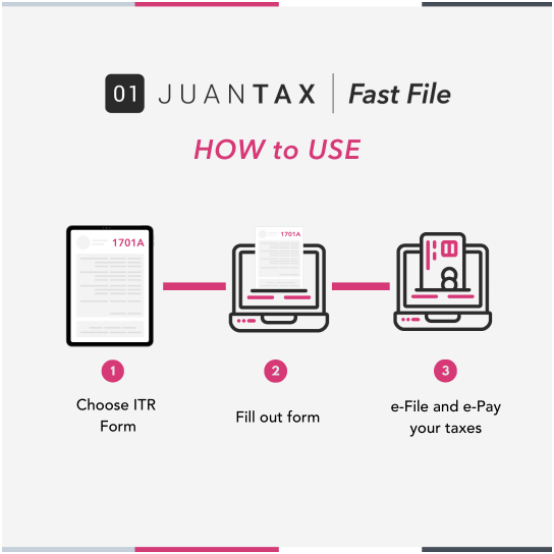

JuanTax’s Fast File is the File and Pay e-Solution for your Income Tax Returns. This system is made possible with the BIR and PayMaya. Fast File lets you be tax compliant from the safety and convenience of your home.

Here’s how it works:

Easily be tax compliant in 3 steps! On top of it, taxpayers get the benefit of Tax Form Advisory from a seasoned team ready to guide them in their tax compliance experience.

Easily be tax compliant in 3 steps! On top of it, taxpayers get the benefit of Tax Form Advisory from a seasoned team ready to guide them in their tax compliance experience.

Make your taxes count with Fast File. Got some unanswered questions from the article? Talk to our team by clicking the chat button located at the lower right corner of your screen!

Are you planning to file your BIR Forms 1701 or 1701A soon?

Make tax compliance easier with Juan Accounting Software!

Juan integrates accounting, payments, financial reporting, and tax compliance with JuanTax into one complete solution, perfect for PH businesses. Experience all-in-Juan accounting and tax at https://www.juan.ac/.