What is the BIR Form 1701?

BIR Form 1701, also known as the Annual Income Tax Return for Self-Employed Individuals, Mixed Income Earners, Estates, and Trusts, is a tax form that summarizes all the transactions made over the tax calendar year.

According to the BIR, this form needs to be filed by individuals listed below:

- A resident citizen engaged in trade, business, or practice of profession within and without the Philippines.

- A resident alien, non-resident citizen, or non-resident alien individual engaged in trade, business, or practice of a profession within the Philippines.

- A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

- An individual engaged in trade or business or in the exercise of their profession and receiving compensation income as well.

What is the BIR Form 1701A?

BIR Form 1701A, also known as the Annual Income Tax Return for Individuals Earning Income PURELY from Business/Profession (Those under the graduated income tax rates with OSD as mode of deduction OR those who opted to avail of the 8% flat income tax rate)

According to the BIR, this form needs to be filed by individuals earning income PURELY from trade, business, or profession:

- A resident citizen (within and without the Philippines);

- A resident alien, non-resident citizen, or non-resident alien (within the Philippines).

- Those subject to graduated income tax rates and availed of the optional standard deduction as method of deduction, regardless of the amount of sales/receipts and other non-operating income

- Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3M

What’s the difference between 1701 and 1701A?

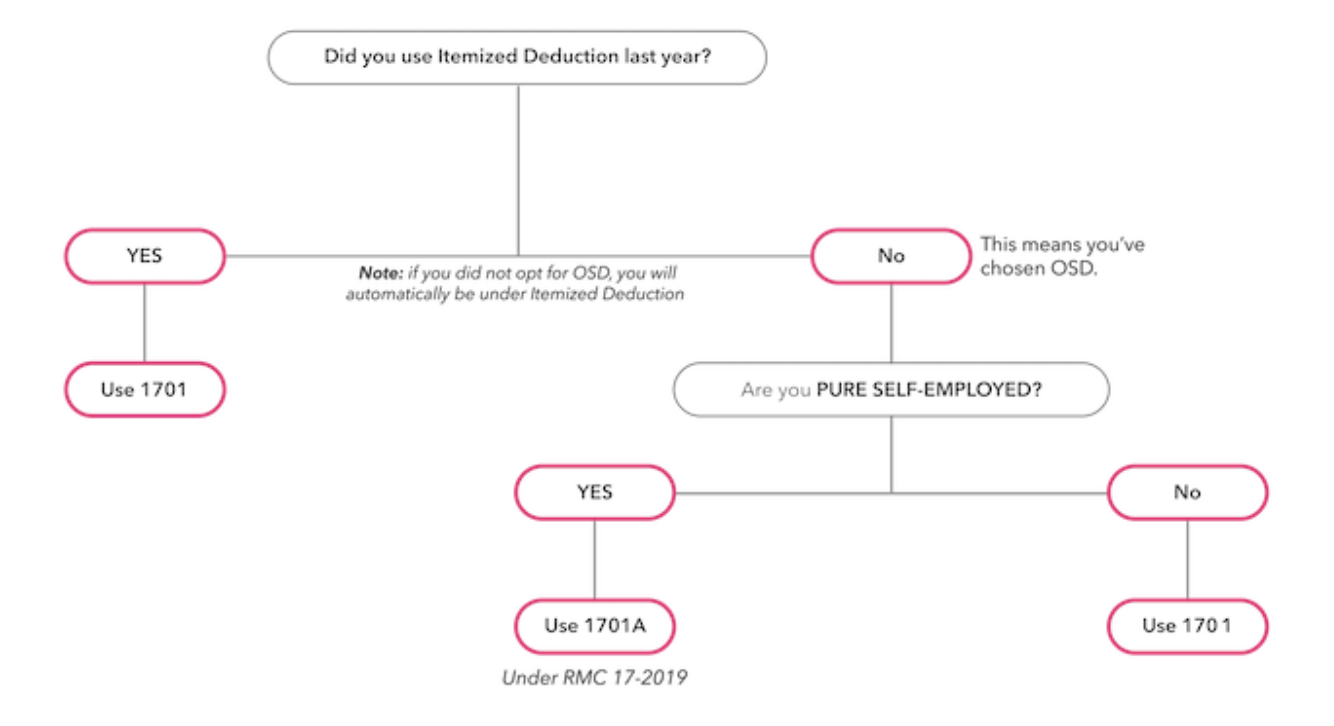

The main difference between the forms is that BIR Form No. 1701 is for those with mixed income (eg. someone who is both a freelance writer and a teacher), while 1701A is for those whose income is only coming from his/her business or profession (eg. a full-time freelance writer or a bakery owner).

Here’s a diagram to guide you on what you should file:

Making things easier for you

We’ve created Fast File for all your Income Tax Return compliance needs. Easily and conveniently e-file and pay your tax dues from home, all on one platform. Visit Fast File to know more.

Still confused which ITR form to use? We’re here to help. Simply ask our team by clicking the messenger button on the bottom right of your screen. Let’s get the conversation going!

Are you planning to file your BIR Forms 1701 or 1701A soon?

Make tax compliance easier with Juan Accounting Software!

Juan integrates accounting, payments, financial reporting, and tax compliance with JuanTax into one complete solution, perfect for PH businesses. Experience all-in-Juan accounting and tax at https://www.juan.ac/.