This article contains all you need to know about BIR Forms 1702-RT and 1702-MX as a Non-Individual Taxpayer. The BIR provided the necessary details to taxpayers in relation to these forms.

Here’s what you need to know:

BIR FORM 1702-RT

What is this form?

1702-RT also known as, Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate of 30%.

Who needs to file this?

Returns like 1702RT needs to be filed by corporation, partnership and other forms of non-individual entities which involves construction projects, petroleum and other energy operations in accordance with the provisions listed within the tax code

When to file

BIR form 1702RT needs to be filed on or before the 15th day of the 4th month after the closing of the taxable year.

BIR FORM 1702-MX

What is this form?

Annual Income Tax Return for Corporation, Partnership and Other Non-Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE

Who needs to file this?

This return shall be filed by every Corporation, Partnership and Other Non-Individual Taxpayer with MIXED Income subject to MULTIPLE INCOME TAX RATES or with income subject to SPECIAL/PREFERENTIAL RATE.

When to file

This return is filed, with or without payment, on or before the 15th day of the 4th month following the close of the taxpayer’s taxable year.

BIR FORM 1702-RT and 1702-MX Compared

The biggest difference between these 2 forms is the taxpayers tax rate. Form 1702-RT should be used by taxpayers who only have one source of income which is subject to regular tax rate of 30%. On the other hand, Form 1702-MX should be used by taxpayers who have multiple sources of income which are subjected to different tax rates or with income subject to special/preferential rates.

Manually filing these forms can be very timely. We got you covered though!

Understanding the forms filling it up, and filing the forms is already challenging, what more when it comes to computation, filing and payment of tax dues manually? There are a few e-Solutions for ITR filing and payment in the market but no one does it like JuanTax.

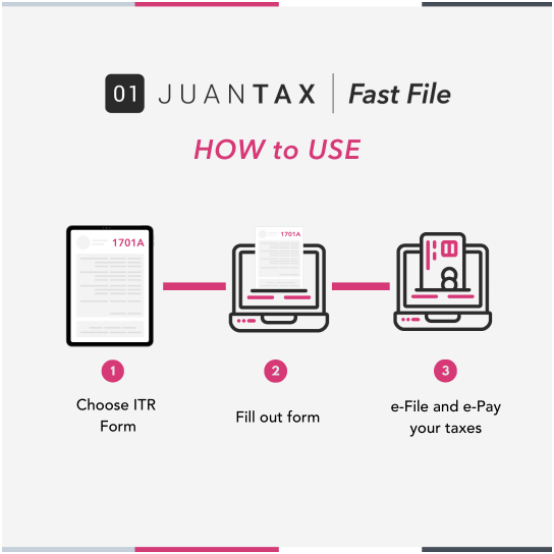

JuanTax’s Fast File is the File and Pay e-Solution for your Income Tax Returns. This system is made possible with the BIR and PayMaya. Fast File lets you be tax compliant from the safety and convenience of your home.

Easily be tax compliant in 3 steps! On top of it, taxpayers get the benefit of Tax Form Advisory from a seasoned team ready to guide them in their tax compliance experience. Here’s how it works:

Make your taxes count with Fast File. Got some unanswered questions from the article? Talk to our team by clicking the chat button located at the lower right corner of your screen!