This article is about the following forms:

- What makes you a Non-Individual Taxpayer?

- What are the forms for?

- What are the main differences between them?

- How do I know which one to file?

- How do I File and Pay?

What makes you a Non-Individual Taxpayer?

- Corporations and partnerships, no matter how created or organized.

- Domestic corporations receiving income from sources within and outside the Philippines

- Foreign corporations receiving income from sources within the Philippines

- Estates and trusts engaged in trade or business

Form 1702-EX

What is it?

- Also known as, Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT

Who will file it?

- According to the BIR this return shall be filed by a Corporation, Partnership and Other Non-Individual Taxpayer EXEMPT under the Tax Code, as amended [Sec. 30 and those exempted in Sec. 27(C)] and other Special Laws WITH NO OTHER TAXABLE INCOME such as but not limited to foundations, cooperatives, charitable institutions, non-stock and non-profit educational institutions, General Professional Partnership (GPP) etc.

When should it be filed?

- This return is filed on or before the 15th day of the 4th month following the close of the taxpayer’s taxable year.

Form 1702-MX

What is it?

- Also known as, Annual Income Tax Return for Corporation, Partnership and Other Non-Individual with MIXED Income Subject to Multiple Income Tax Rates or with Income Subject to SPECIAL/PREFERENTIAL RATE

Who will file it?

- According to the BIR this return shall be filed by every Corporation, Partnership and Other Non-Individual Taxpayer with MIXED Income subject to MULTIPLE INCOME TAX RATES or with income subject to SPECIAL/PREFERENTIAL RATE

When should it be filed?

- This return is filed, with or without payment, on or before the 15th day of the 4th month following the close of the taxpayer’s taxable year.

Form 1702-RT

What is it?

- Also known as, Annual Income Tax Return For Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate

Who will file it?

- According to the BIR this return shall be filed by Corporation, Partnership and other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate of 30%. Every corporation, partnership no matter how created or organized, joint stock companies, joint accounts, associations (except foreign corporation not engaged in trade or business in the Philippines and joint venture or consortium formed for the purpose of undertaking construction projects or engaging in petroleum, coal, geothermal and other energy operations), government-owned or controlled corporations, agencies and instrumentalities shall render a true and accurate income tax return in accordance with the provisions of the Tax Code.

When should it be filed?

- This return is filed, with or without payment, on or before the 15th day of the 4th month following the close of the taxpayer’s taxable year.

Here’s a quick comparison of the 3 non-individual forms:

| FORM | Taxpayer | Tax Rate |

| 1702-EX | Non-Individuals who are Exempt | Exempt |

| 1702-MX | Non-Individuals with Mixed Incomes | Multiple income rates or Special/ Preferential Rate |

| 1702-RT | Non-Individual Taxpayer | Regular Income Tax Rate of 30% |

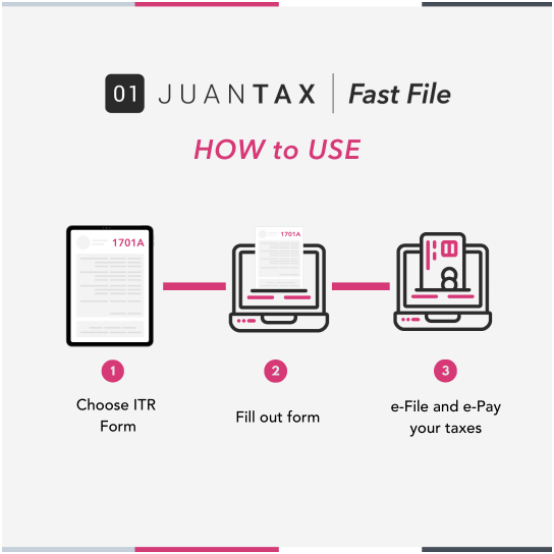

What is Fast File?

- JuanTax Fast File is a tax solution filing and payment platform which is recognized by the BIR as an electronic solution that enables taxpayers to be tax compliant from home with ease and convenience.

How do we file these forms using Fast File?

To learn more about Fast File visit our website

To learn how to set up your account visit

To learn more on how to e-file and e-pay