A list of important things you need to know about Percentage Tax

- Percentage Tax is a business tax regulated in our country

- Taxpayers who are Non-VAT with annual revenues less than PHP 3M

- Filing of 2551Q is on or before the 25th day after the last quarter

- Failure to pay BIR form 2551Q, individual will incur 12% interest based on their tax payables

Percentage Tax is a business tax regulated in the Philippines that is imposed on individuals or businesses that sell/lease goods and services with annual sales not exceeding PHP 3 million and is not VAT registered.

Those who need to file percentage tax are any of the following individuals or businesses listed below:

- Individuals who are not VAT-registered with annual gross sales/receipts not more than Php 3,000,000

*If you opted for the 8% tax rate at the beginning of the year, you are no longer required to file 2551-Qs in the succeeding quarters. To learn more about 8% tax rate guidelines, check out this blog: Know Your Taxes: The 8% Income Tax Rate. - Individuals who lease residential units where monthly rentals exceed Php 15,000 but the aggregate of rentals is not more than Php 3,000,000

- Individuals engaged in the following industries:

- Franchise grantees of gas/water utilities, radio/TV broadcasting with revenue not more than Php 10,000,000 Million and did not opt to register as VAT

- Cars for rent and hire

- Domestic and international air/shipping carriers

- Banks and Non-Bank intermediaries

- Individuals, companies, or corporations doing life insurance

- Fire, marine, or agents of foreign insurance companies

- Operators and/or lessees of cockpits, clubs, exhibitions, pro-basketball games, racetracks, Jai-Alai, and music lounges under the RMC No. 18-2010

Please note that under (RA) No. 11534 CREATE Law, percentage tax under Sec. 116 / Person exempt from VAT, effective July 1, 2020, until June 30, 2023, the rate shall be one percent (1%).

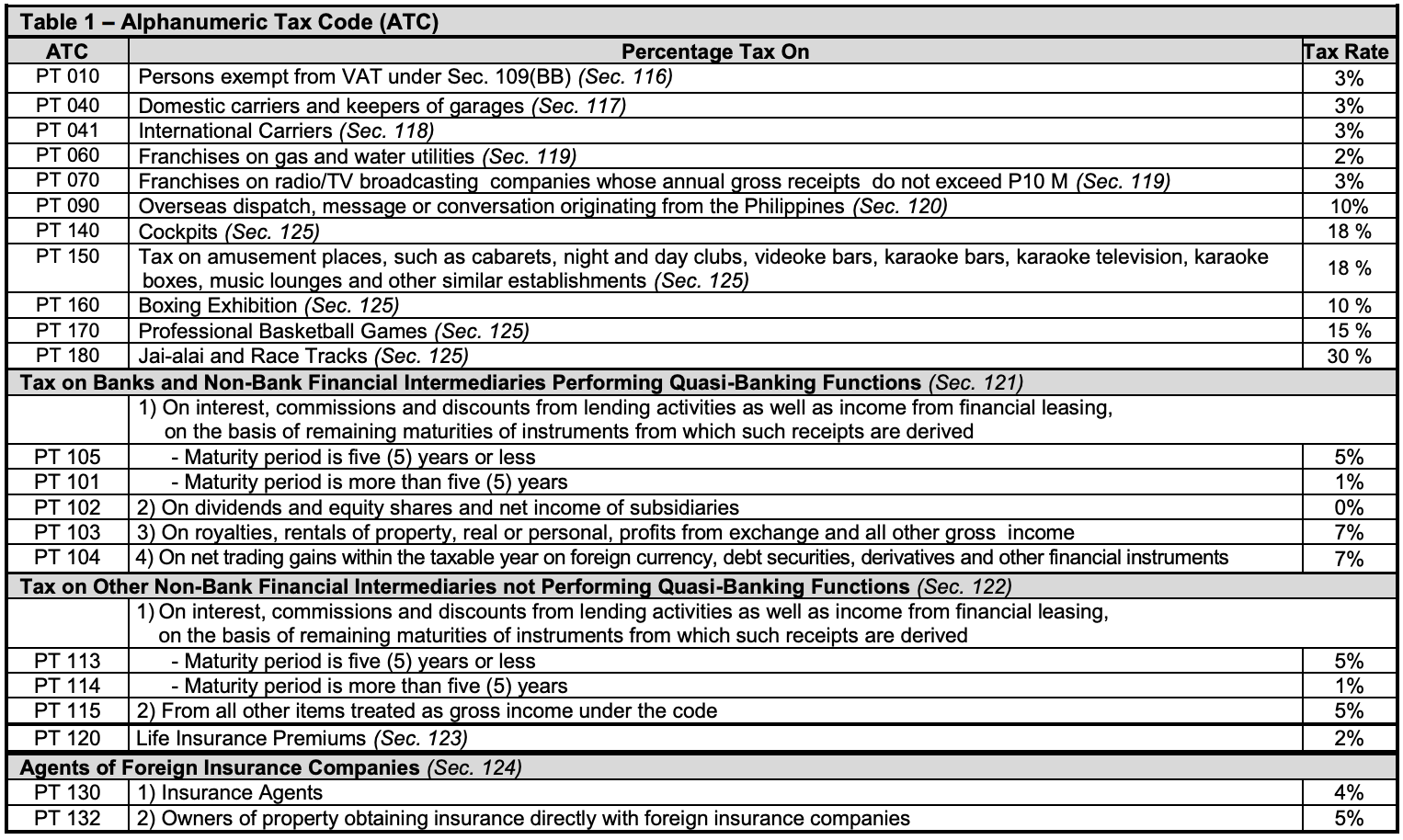

Quarterly Percentage Tax Rates Table

Quarterly Percentage Tax Return 2551Q Table 1.

(Source of Table: Percentage Tax BIR https://tini.to/ia3 )

Transactions/Industries Included

The Bureau of Internal Revenue (BIR) has also provided a detailed list of transactions and industries that taxpayers should have been engaging with to qualify for filing of Percentage Tax. See the full list here.

Filing of Percentage Taxes

Per BIR’s tax advisory, percentage taxes shall now be processed quarterly using BIR Form 2551Q (Quarterly Percentage Tax Return). An updated version of the form also comes with additional ATCs (Alphanumeric Tax Code) such as PT010, PT040, and many others, with the provisions of the TRAIN Law (Tax Reform for Acceleration and Inclusion).

When to File BIR Form 2551Q?

As per tax deadlines, Quarterly Percentage Taxes shall be filed on or before the 25th day after the taxable quarter.

Penalties for the failure of filing BIR form 2551Q?

The individual will incur interest of 12%, surcharge, and compromised penalty in these cases:

- Failure to file and pay quarterly percentage tax return on or before the deadline

- Filed a return in the wrong venue (RDO Offices)

- Failure to pay the full or part of the amount of tax due

- Failure to pay the deficit tax

- Filed a false/fraudulent tax return

Need to file BIR form 2551Q? Let JuanTax help you in filing your Percentage Tax returns! Visit our website at https://juan.tax/ and Sign up today for a free trial.

Are you planning to file your BIR Form 2551Q soon?

Make tax compliance easier with Juan Accounting Software!

Juan integrates accounting, payments, financial reporting, and tax compliance with JuanTax into one complete solution, perfect for PH businesses. Experience all-in-Juan accounting and tax at https://www.juan.ac/.