This article is about

- What is Form 1700?

- Who needs to file it?

- When does it need to be filed?

- What is JuanTax Fast File?

- How to file Form 1700 using Fast File?

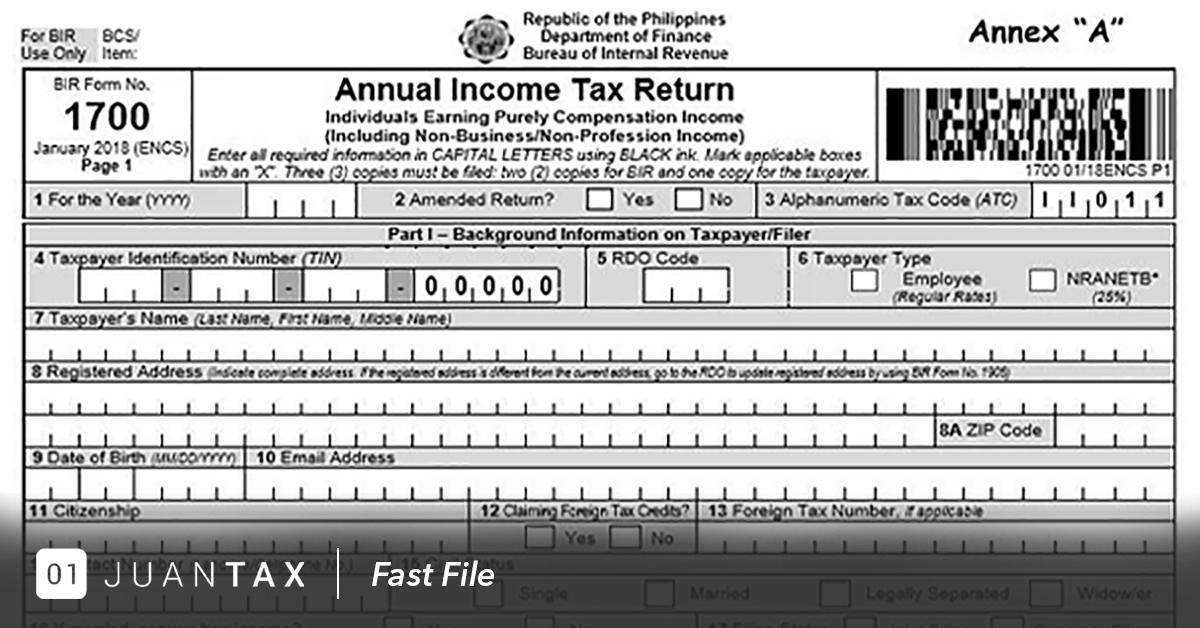

What is it?

BIR Form No. 1700, also known as, Annual Income Tax Return For Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession Related Income)

Who needs to file it?

According to the BIR this return shall be filed by every resident citizen deriving compensation income from all sources, or resident alien and non-resident citizen with respect to compensation income from within the Philippines, except the following:

- An individual whose gross compensation income does not exceed his total personal and additional exemptions.

- An individual with respect to pure compensation income, as defined in Section 32(A)(1) derived from sources within the Philippines, the income tax on which has been correctly withheld (tax due equals tax withheld) under the provisions of Section 79 of the Code: Provided, that an individual deriving compensation concurrently from two or more employers at any time during the taxable year shall file an income tax return.

- An individual whose income has been subjected to final withholding tax (alien employee as well as Filipino employee occupying the same position as that of the alien employee of regional or area headquarters and regional operating headquarters of multinational companies, petroleum service contractors and sub-contractors, and offshore banking units; non-resident alien not engaged in trade or business).

- A minimum wage earner or an individual who is exempt from income tax.

What is Substituted Filing?

Substituted Filing is when your employer files your ITR for you. How do you know your eligibility for this?

Here is a checklist:

- During the taxable year you received PURELY COMPENSATION INCOME

- During the taxable year you received compensation from ONLY ONE employer

- The amount of tax youre supposed to pay is equivalent to the taxes withheld by your employer.

- Your employer gave you Form 2306 or Form 2316

- Your employer files for Form 1604C also known as Annual Income Tax Return of Income Taxes Withheld on Compensation

When do you file it?

- This return is filed on or before April 15 of each year covering income for the preceding taxable year.

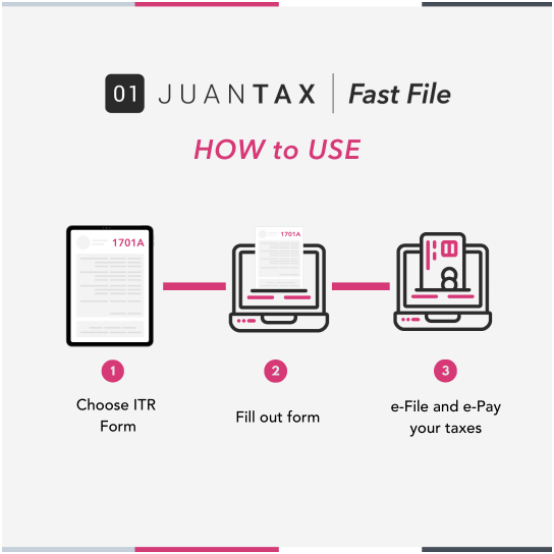

What is Fast File?

- JuanTax Fast File is a tax solution filing and payment platform which is recognized by the BIR as an electronic solution that enables taxpayers to be tax compliant from home with ease and convenience.

How do you file Form 1700 in fast file?

To learn more about Fast File visit our website

To learn how to set up your account visit

To learn more on how to e-file and e-pay