On April 8, 2021, the Bureau of Internal Revenue (BIR) released Revenue Regulation 5-2021

What is the C.R.E.A.T.E. Law

On March 26, 2021, a new bill was signed by President Duterte, known as the Corporate Recovery and Tax Incentives for Enterprises (C.R.E.A.T.E.), which is now Republic Act No. 11534.

With the new law in force, corporate income tax in the country, currently at 30%, is now a two-tiered system lowered to general tax rate of 25% and 20% for qualified small businesses*.

*With net taxable income not exceeding P5,000,000.00 AND with total assets not exceeding P100,000,000.00 million. Excluding land on which your business office, plant and equipment are located.

How Our Systems Have Adapted to the C.R.E.A.T.E. Law

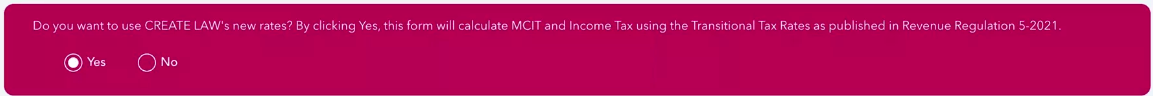

We have already adjusted to the changes implemented with Revenue Regulation 5-2021. With 2 simple clicks before filling out the form, changes to taxes with the C.R.E.A.T.E. Law will be automatically adjusted and calculated for you based on the transitory rates* provided in the regulation.

*Transitory Rates are calculated depending on your chosen accounting period (Calendar or Fiscal)

When filing BIR Form 1702-RT, you will be met with new options when computing your taxes

- Compute taxes with C.R.E.A.T.E. Law Tax Rates (If you choose Yes)

- Compute taxes with pre-C.R.E.A.T.E. Law Tax Rates, 30% (If you choose No)

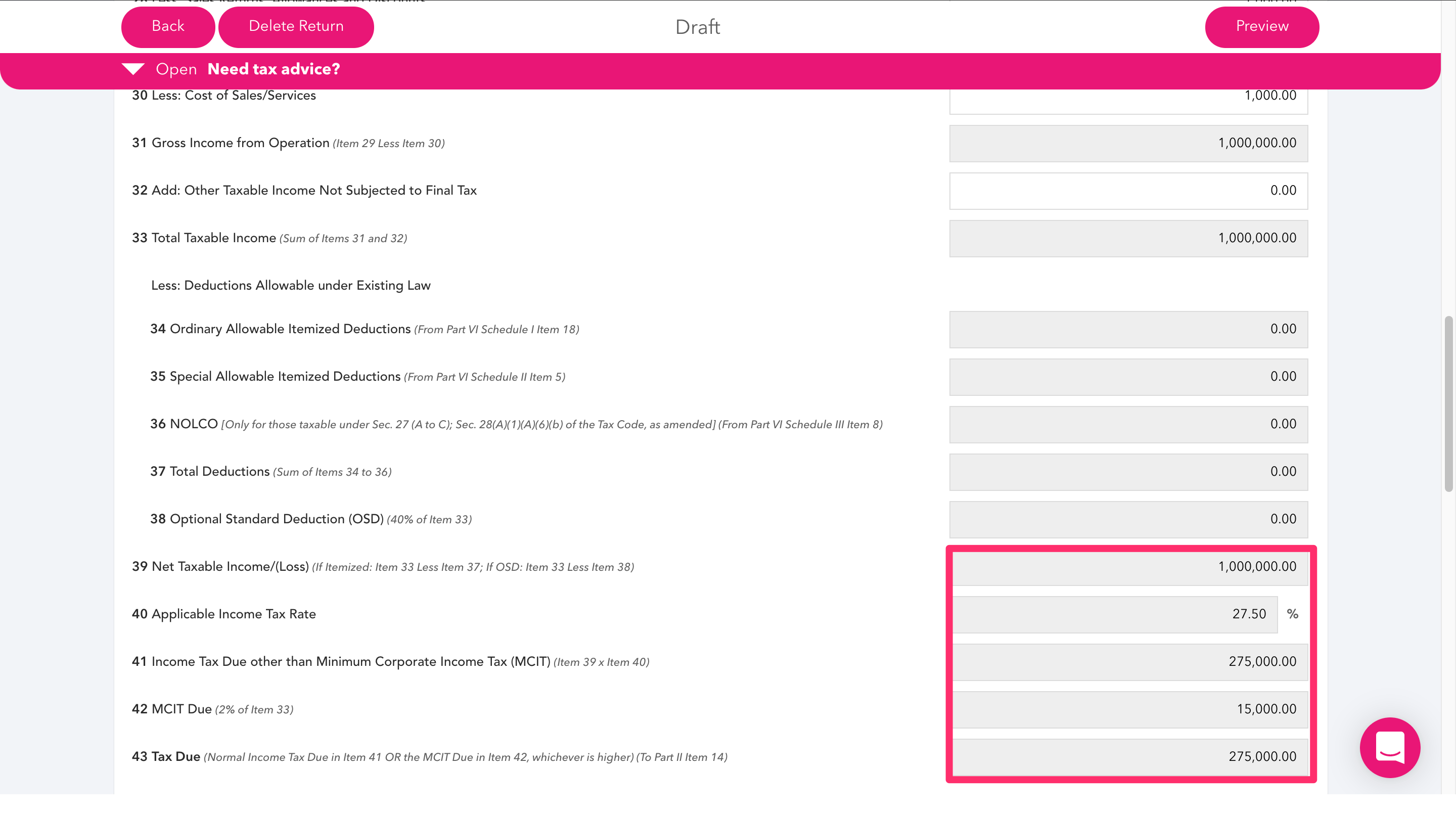

If you choose to compute your taxes using C.R.E.A.T.E. Law’s tax rates, Minimum Corporate Income Tax (MCIT) will be set at 1% and Income Tax will be set at 25% or 20% respectively. On the other hand, if you choose to compute your taxes using pre-C.R.E.A.T.E. Law, tax rates will remain the same. MCIT will remain at 2% and Income Tax Rate will remain at 30%.

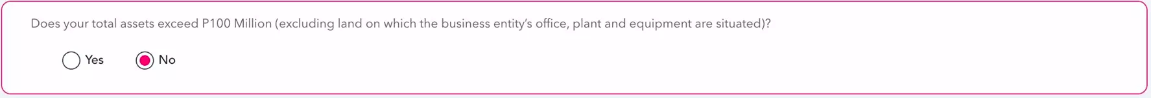

To clarify which Income Tax will apply to your business under C.R.E.A.T.E. Law, a second banner will appear to determine if your total assets exceed PHP 100,000,000.

- If total assets exceed PHP 100,000,000, the Income Tax will be set at 25%.

- If total assets do NOT exceed PHP 100,000,000, and net taxable income do NOT exceed PHP 5,000,000.00, the Income Tax will be set at 20%

*27.5% is the cumulative calculation done by JuanTax with Transitory Rates applied.

Stay one step ahead with your business using JuanTax, your digital tax compliance solution. Our all-in-one cloud-based platform makes electronically filing and paying your taxes easier. Find out more about how you can use JuanTax to file in time for the April 15 deadline and sign up for FREE today.