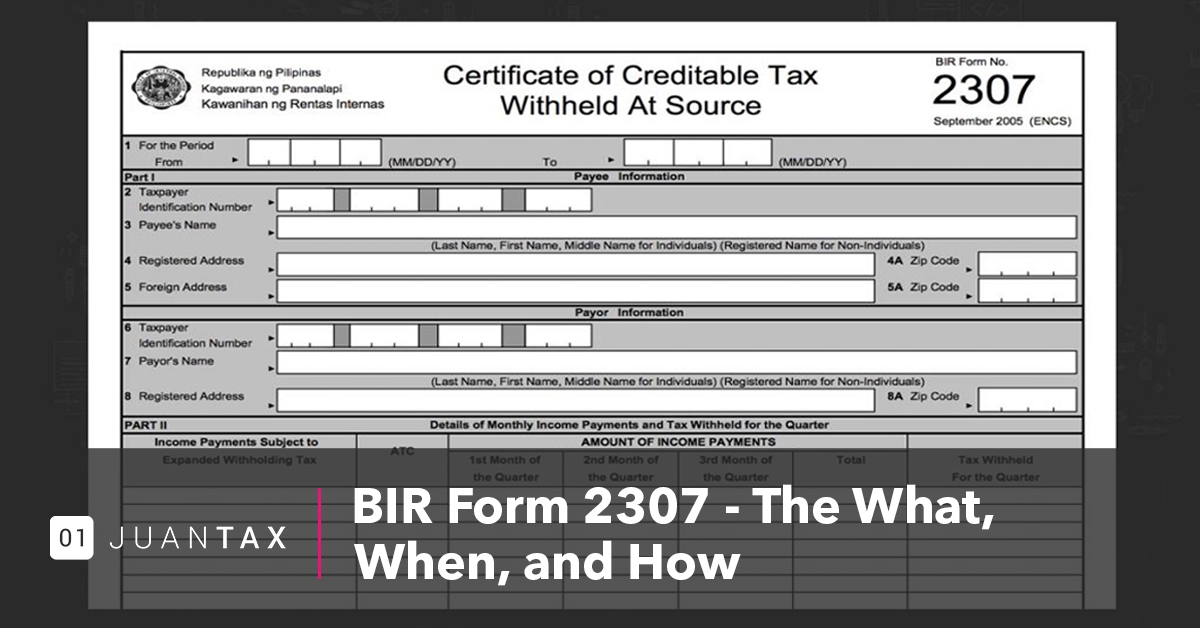

Commonly referred to as the Certificate of Creditable Tax Withheld At Source, the BIR Form 2307 presents the income that’s subjected to Expanded Withholding Tax (EWT) paid by the withholding agent.

In the accounting books of the taxpayer, it is included under the assets section, as Form 2307 is reflected as income tax pre-payments. The income tax pre-payments are deductible from your income tax during the quarterly and annual income tax return. Since Form 2307 functions as income tax credits, it is imperative that the payee takes note of it when accomplishing Income Tax Returns as it is a legit proof of the withholding tax. Otherwise, you will not be permitted to claim your tax credit.

Who are required to withhold the EWT?

All registered taxpayers are required to withhold following the items subject for EWT.

Aside from that, Revenue Regulations (RR) No. 11-2018 basically provides the list of taxpayers directed to withhold the EWT from the income payments to regular suppliers at 2% on services and 1% on goods. These taxpayers are identified as the Top Withholding Agents (TWA).

If you received BIR Form 2307, here’s what you need to do.

To ensure that the amount of withholding tax will be properly accepted as a tax credit on the income tax liability, make sure that you duly submit Form 2307 along with the Quarterly/Annual Income Tax Return. Always take note of the deadlines.

Below are the forms to which the certificate should be attached:

- Income Tax Returns

- Expanded Withholding Tax (EWT)

- Percentage Tax

- VAT Withholding

On top of this, you need to enter this in your SAWT or Summary of Alphalist of Withholding Tax at Source which is done on a monthly basis. This serves as the detail list of certificates your company received for the month.

My company was the one who issued the 2307 form. Are we done then?

Nope. As the withholding agent, there are still quite a few forms that you need to accomplish and submit the following:

1. 0619E – Monthly Remittance of Creditable Income Tax Withheld

So you withheld taxes. That’s not yours to keep. You need to remit the money together with this payment form through BIR’s authorized agent banks.

2. 1601-EQ – Quarterly Remittance Return of Creditable Income Taxes Withheld

This is the summarized quarterly version of taxes withheld.

3. QAP – Quartelry Alphalist of Payees

You also need to provide details of the summarized quarterly version, what is usually called an alphalist of payees from which you withheld taxes. This is what they call the attachment or supporting list for the 1601-EQ. If you add the transaction totals of the QAP, it should match the numbers reported on the 1601-EQ.

4. 1604-E – Annual Information Return of Creditable Income Tax Withheld (Expanded) / Income Payments Exempt from Withholding Taxes

This is the annualized version of the taxes withheld for the year.

5. Alphalist of Payees – Annualized

At the end of the year, you need to submit to the government the Alphalist of Payees that was paid for the whole year.

How can we automate the tedious task of entering and generating these reports?

Yes, we understand how difficult and time-consuming these tasks are, but it’s the law and you need to abide by it. However, we can actually make things easier for you!

How?

Here at JuanTax, all you need to do is just enter or upload a particular transaction/s once. Once we have the required information, everything will be automated. No need for you to track these confusing forms. We can even file the reports electronically for you!