RA 11534, or the Corporate Recovery and Tax Incentives for Enterprises Act, better known as the C.R.E.A.T.E. Law, was signed on March 26, 2021.

Issued primarily to help ease the burden on corporate taxpayers during the current pandemic, C.R.E.A.T.E. affects how tax calculations are to be carried out going forward—including the calculation of percentage tax.

Note that provisions of RA 11534 relative to percentage tax are “temporary,” and they are only effective from July 1, 2020, through June 30, 2023.

In this post, we’ll focus on how RA 11534 affects the calculation of percentage taxes, particularly for individuals and non-individuals. We’ll also highlight the changes we’ve made to the form you’ll be using when entering transactions into our transactions module to help guide you along the way.

Then we’ll go into the changes in the 2551Q return in JuanTax Fast File, as well as how overpayments will be treated under RR 4-2021 as a result of the retroactive effect of the temporary tax rate adjustment.

How JuanTax Has Adapted to the Changes Brought About by C.R.E.A.T.E.

C.R.E.A.T.E. Law affects tax calculation, filing, and payment of Annual Income Tax Returns by non-individual taxpayers. These taxpayers may use the new transitory rates as published in Revenue Regulation 5-2021 on or before April 15th 2021 for the taxable year ending December 31st 2020.

Another tax affected by C.R.E.A.T.E. law is the percentage tax with the introduction of a temporary rate adjustment, reducing percentage tax rates from 3% to 1% effective July 1, 2020 through June 30, 2023.

To help percentage tax filers who choose to use the new, temporary rate adjustment, JuanTax has adapted in terms of filing 2551Q by making changes to its platform that make tax calculation easier for accounting firms as well as individuals.

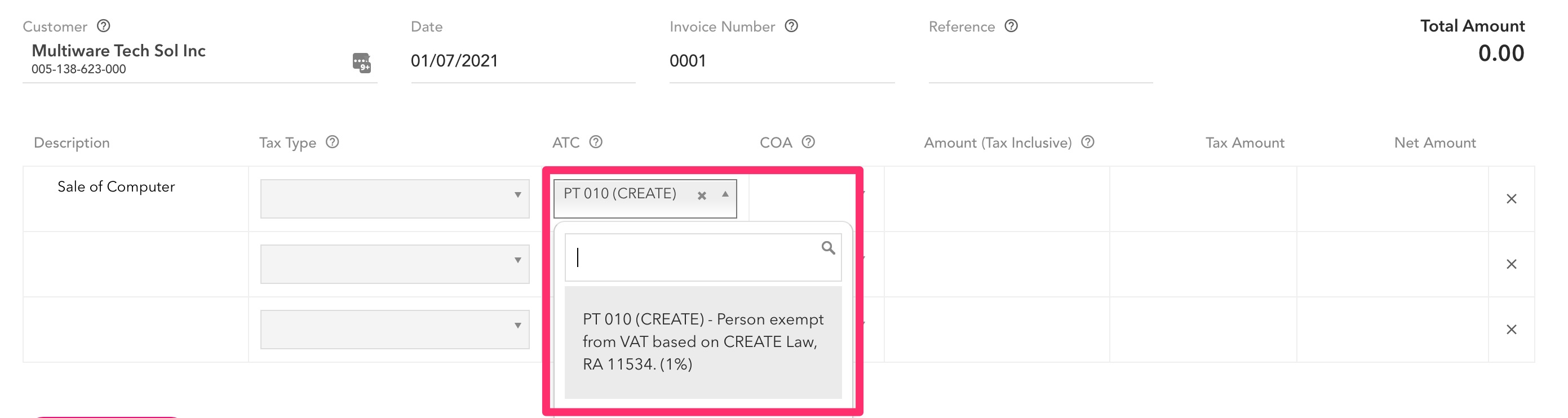

These changes will be found in our transactions module, specifically in the section where transactions are entered as shown below:

You’ll find a new PT010 (C.R.E.A.T.E.) option included in the ATC Codes, which will expire on June 30, 2023.

When generating or opening an unfiled Percentage Tax Return (Form 2551Q), JuanTax will automatically determine if the transactions are within the covered period (July 1, 2020 through June 30, 2023) and will automatically assign the correct ATC code PT 010 (C.R.E.A.T.E.).

How JuanTax Fast File Has Adapted to C.R.E.A.T.E.

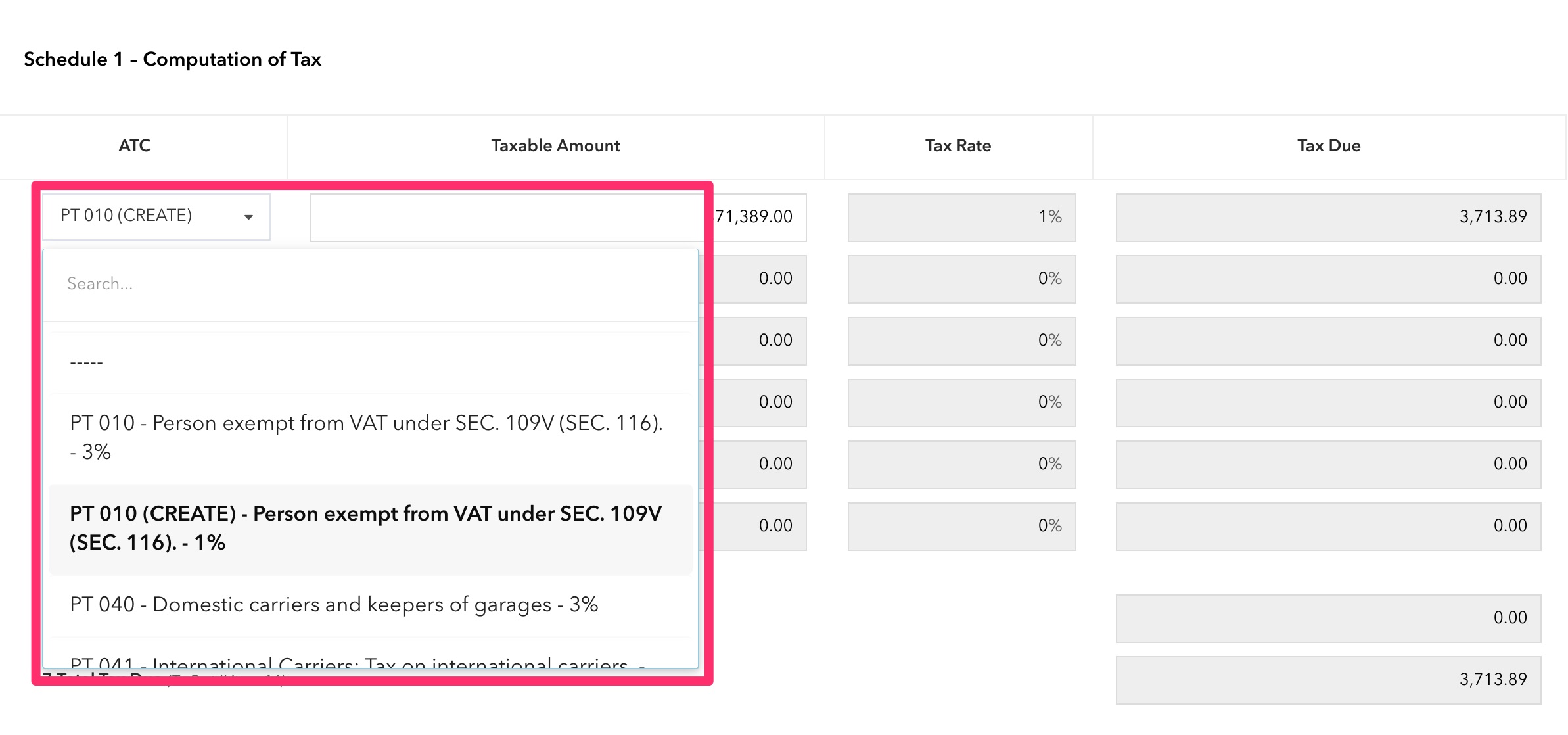

In Fast File, we have adapted by adding a new percentage tax code, PT 010 (C.R.E.A.T.E.) which can be selected in completing your 2021 quarterly tax returns.

How JuanTax Helps Accounting Firms and Individual Filers

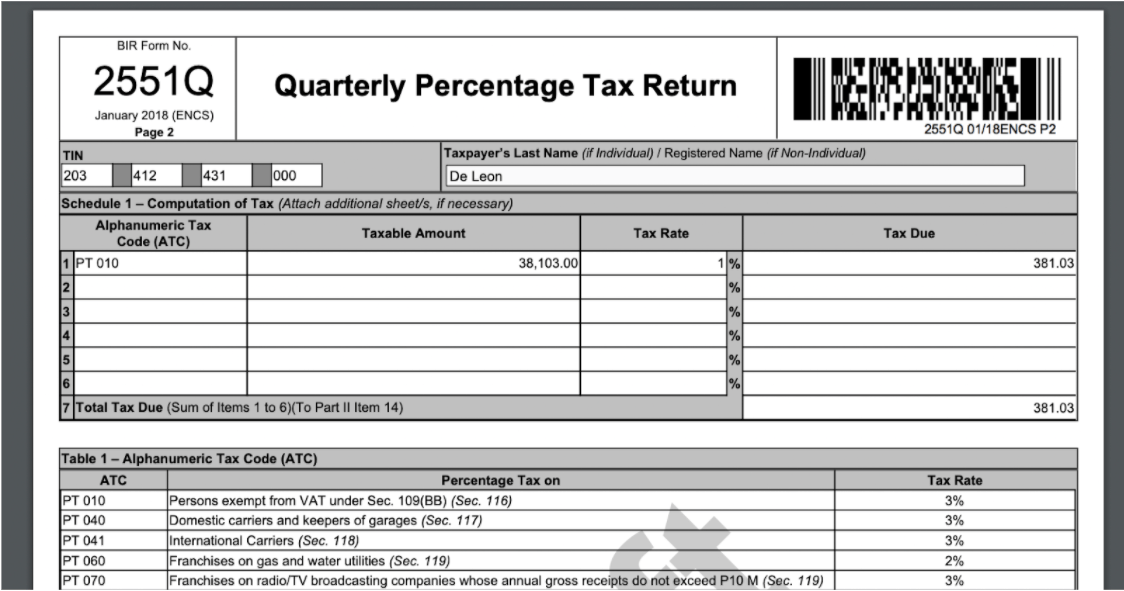

Under the temporary rate adjustment, where the percentage tax was formerly 3%, the tax rate is now at 1%. This change takes effect retroactively from July 1, 2020, and is good for three years.

Should you choose to use the temporary rate adjustment under the C.R.E.A.T.E. law, those rates will now be used as you populate the 2551Q form.

How Overpayments Will Be Treated as a Result of the Retroactive Effect of the Temporary Tax Rate Adjustment

Released on April 8, 2021, RR 4-2021 explains that taxpayers should calculate their overpayment from the previous quarters (Quarter 3 and 4 of 2020) and carry over the excess payment when filing their Q1 2021 tax return. Overpayment should be inserted into line number 17 of the Percentage Tax Form 2551Q.

Assuming that the taxpayer did NOT entirely consume the excess payment, the taxpayer can continuously carry over the excess payment until there is no more remaining balance.

In JuanTax Fast File, you need to manually enter the excess payment you computed from Quarters 3 and 4 of 2020 and insert it into line number 17 of the 2551Q tax form.

Once your 2551Q form has been filled out and filed successfully, you’ll be able to go straight to payment without having to leave JuanTax. We have a series of Help Center Articles to show you how to do just that.

It will take some time for all of us to adjust to the new calculations under C.R.E.A.T.E.. But whether you’re an accounting firm filing for your clients using JuanTax, or filing for your own business using JuanTax Fast File, you’re not alone.

If you need extra help in calculating percentage taxes using the new temporary rates under C.R.E.A.T.E., you can reach out to our support team any time by clicking the chat icon in the lowermost right corner of your screen. You can also schedule a call with any of our Partner Firms for personalized advice today.

Are you planning to file your BIR Form 2551Q soon?

Make tax compliance easier with Juan Accounting Software!

Juan integrates accounting, payments, financial reporting, and tax compliance with JuanTax into one complete solution, perfect for PH businesses. Experience all-in-Juan accounting and tax at https://www.juan.ac/.