The implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) Law paved the way to a lot of changes in the economy. In providing better services to taxpayers and businesses, The Bureau of Internal Revenue embraced the change through constant improvement of its systems for better tax compliance.

July 24, Wednesday, the BIR made public RMCs 73-74 Series of 2019 wherein forms provided below were improved.

Forms:

1604C: Compensation and Final Withholding

1604E: Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax

1604F: Annual Information Return of Income Payments Subjected to Final Withholding Taxes

2306: Certificate of Final Tax Withheld

2307: Certificate of Creditable Tax Withheld

Here’s a deeper look to the changes of the listed forms.

RMC 73:

1604C – New form. Old form was 1604CF which is a combination of Compensation and Final Withholding.

1604F – New form. Old form was 1604CF which is a combination of Compensation and Final Withholding.

1604E – Revised form.

Update:

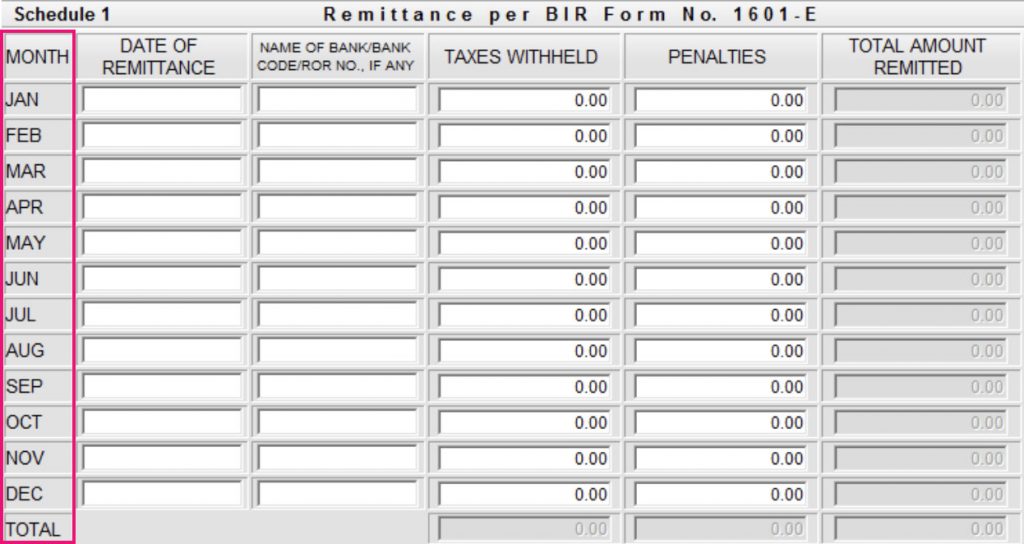

On the old form, Schedule 1 – Remittance per BIR Form No. 1601E are entered per month.

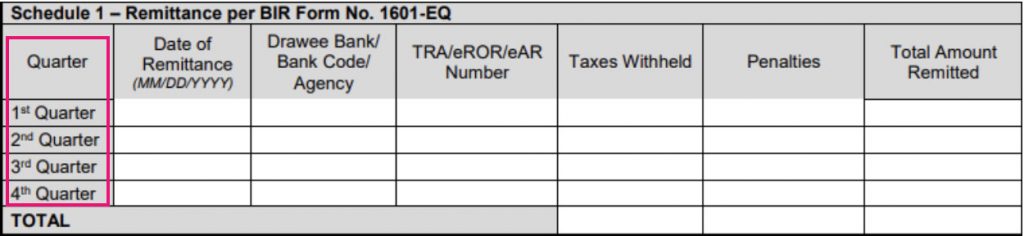

On the new form, Schedule 1 – Remittance per BIR Form No. 1601EQ are now entered per quarter.

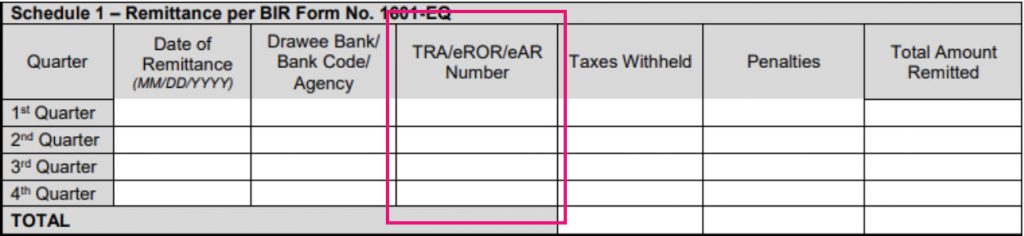

New column was added on the Remittances section for these (3) forms.

RMC 74:

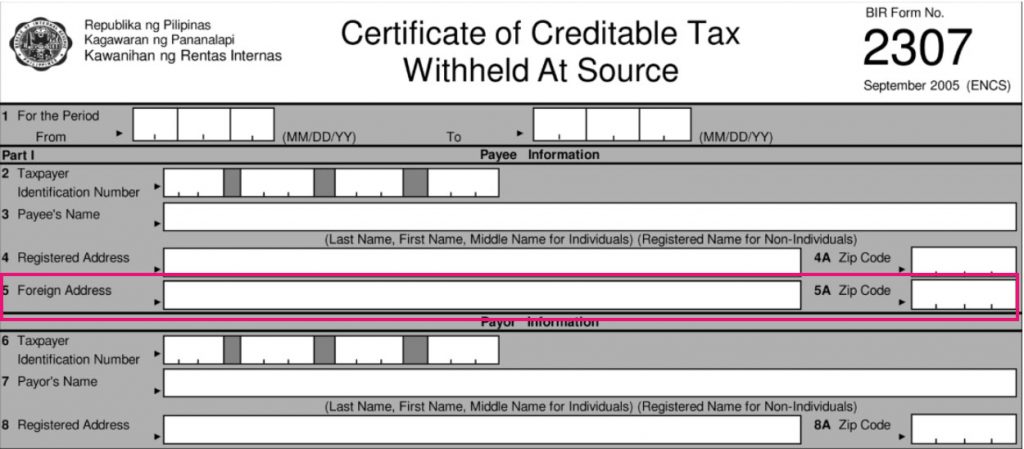

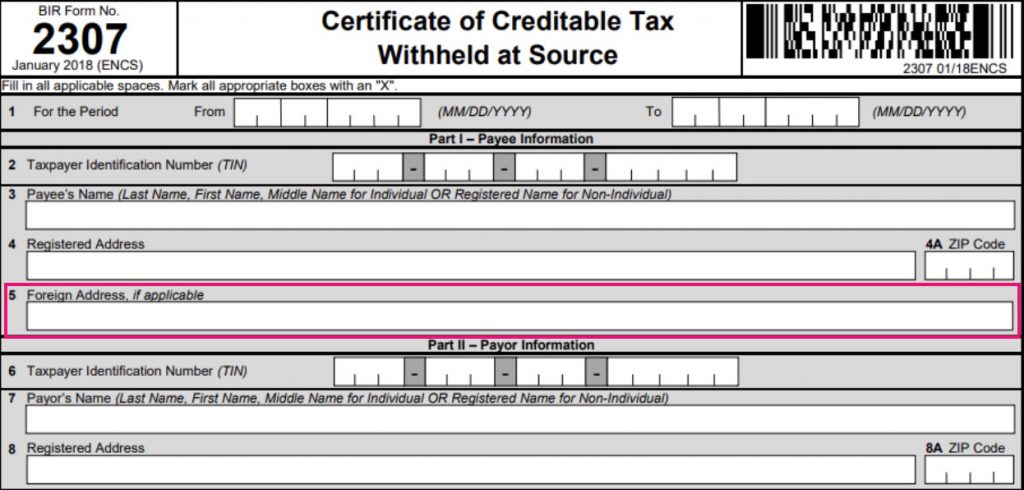

2307

Old version:

Revised version:

Minor Change. Removed 5A field on Payee Information section.

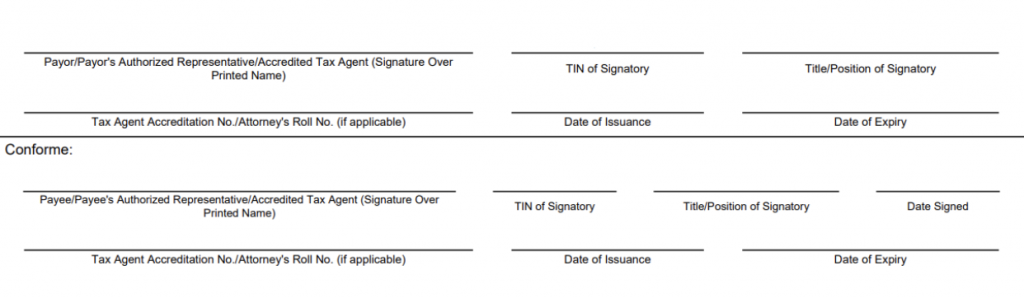

Signatories

Old version:

Revised version:

Minor Change. Signature, Name of Payor/Payor’s Authorized Representative/Tax Agent. Title/Designation and TIN are all combined in one portion of the Signatory.

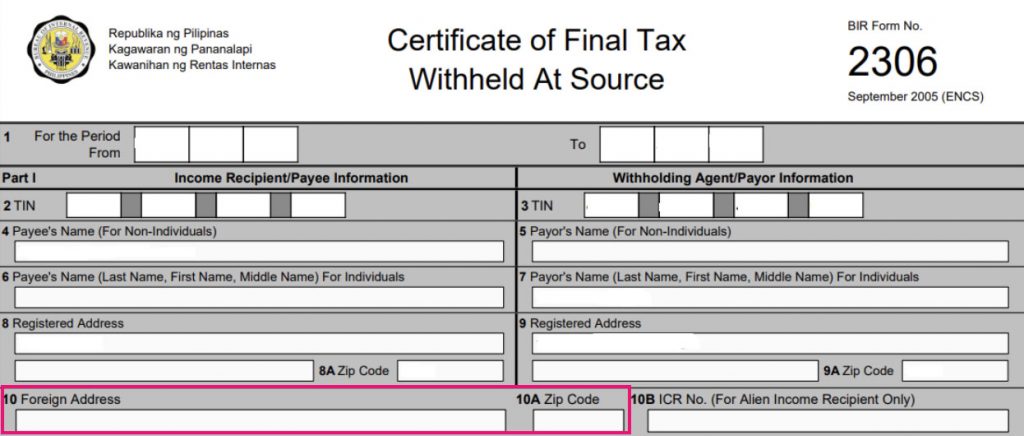

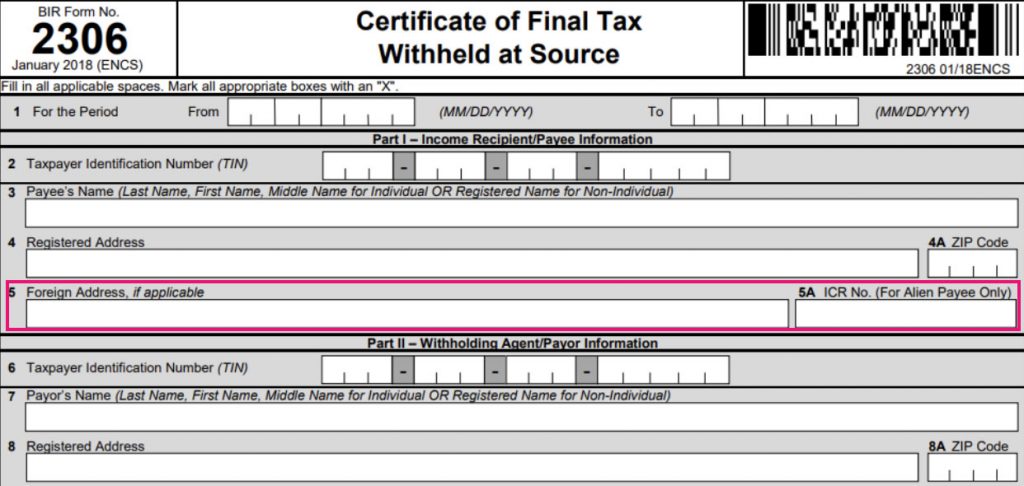

2306

Old version:

Revised version:

Updated UI. Removed some line number fields, now only up to 8A for Parts 1 & 2. Removed Zip Code for Foreign Address.

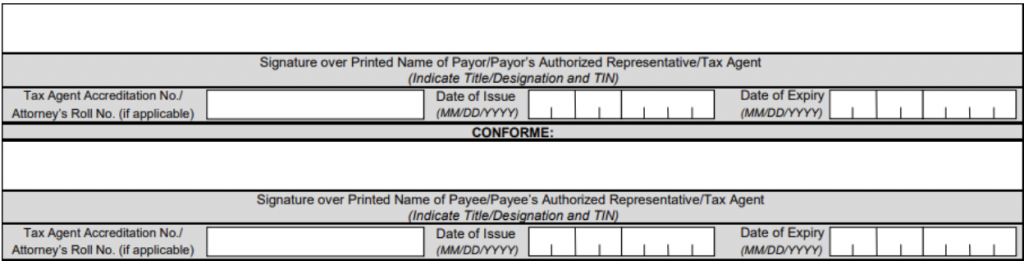

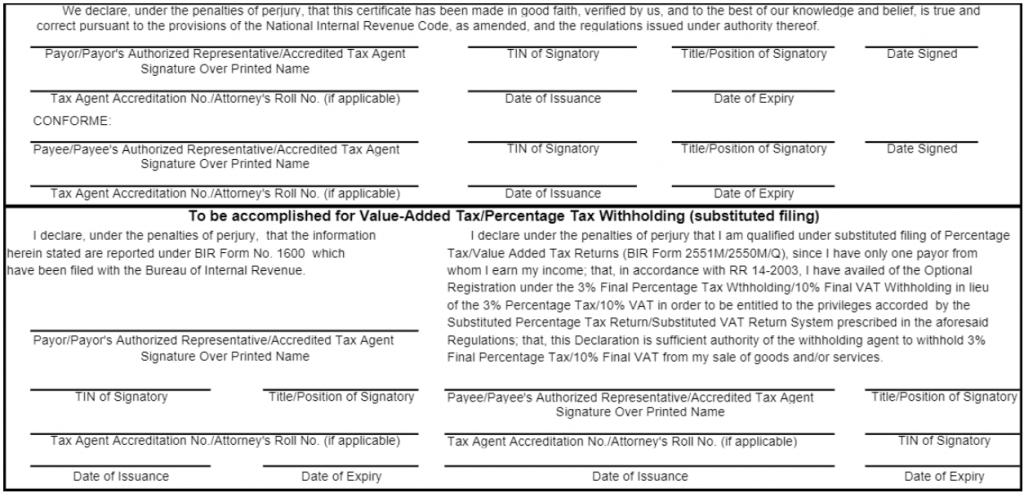

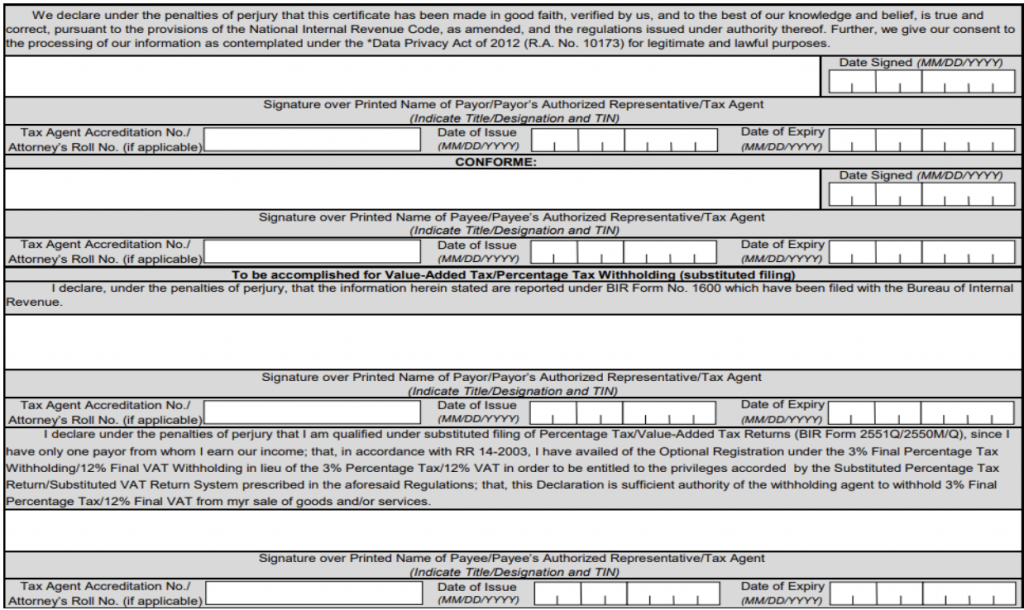

Signatories

Old version:

Revised version:

Minor Change. Signature, Name of Payor/Payor’s Authorized Representative/Tax Agent. Title/Designation and TIN are all combined in one portion of the Signatory.

These changes are still on the works to be applied in electronic filing. Once these forms are available in eFPS or inclusion in the new Offline eBIRForms Package, an issuance will be released to the public.

As per BIR’s advice, it is encouraged to spread the word about these changes and help the industry move forward for better tax solutions and compliance.

Analysis by Kaye Estanislao, JuanTax Customer Experience Specialist