The House Bill No. 5636, also known as TRAIN (Tax Reform for Acceleration and Inclusion) is one of the most talked about bill this year. After being approved by the House of Representatives for the third and final reading, this “comprehensive tax reform package” will soon become a law to be embraced by PH taxpayers. In this article, we’ll take a closer look on what exactly does this tax reform bill contain, and how will it affect you as a taxpayer.

About TRAIN

In an interview on ANC Headstart’s Hot Copy, House Representative Dakila Cua, one of the main authors of this tax reform bill, mentioned that the main benefit of this bill is to lower income taxes.

“Dun sa tax reform, yung pinakabenepisyo niya, or the most important part of this is really yung pagbaba ng income taxes. So with this new bill, or with this new measure that has just passed the lower house, lahat ng fixed income earners will now get a benefit of two hundred fifty thousand (P250,000) tax-free.”

Cua also added:

“And then everybody else who earn above that, would also have that “250” tax-free. So the difference now is if you’re a married couple and have a family, you have a total of P500 000 or half a million na hindi mo babayaran ang tax, so that’s more money for the family, for investments in their homes, in their education, and many people are dreaming of sending their kids to better schools, so this will help them really pursue their dreams..”

Simplifying Personal Income Tax

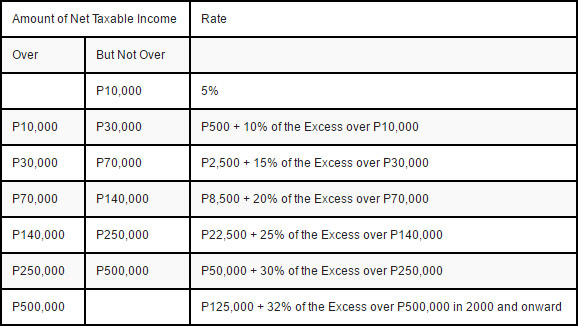

Ever since the Tax Reform Act of 1997, people just go along with the personal income tax system’s flow, and what other tax experts fear about is that there will be confusions once this new law comes into play.

So let’s take a look on the differences between the two tax systems:

Old VS. New PH Tax System

Under the current (old) tax system for personal income taxes, if you’re an individual who earns P10,000 to P30,000 per year, you will be taxed P500 + 10% of the excess over P10,000.

Bureau of Internal Revenue

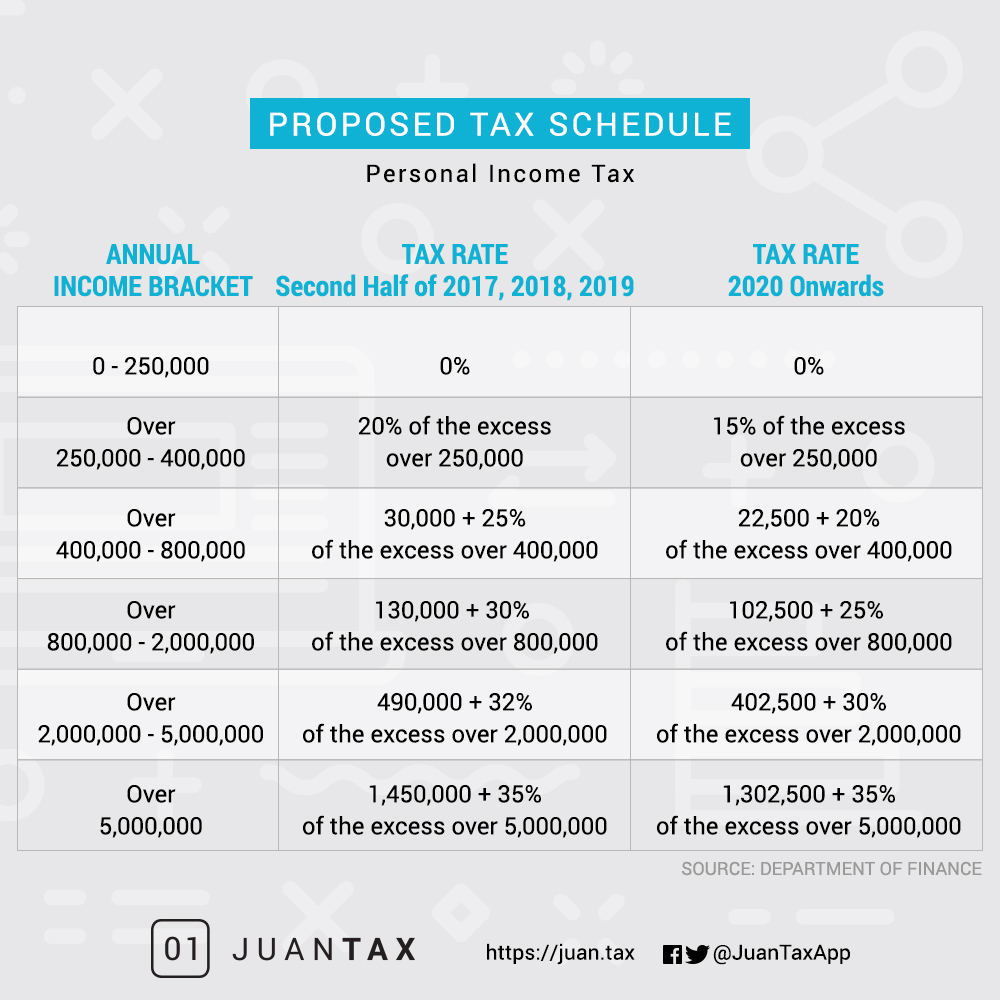

The proposed tax reform bill however, focuses more on lowering income tax:

This means that for example if you’re earning a total of P500,000 annual income, then under this new tax system, you’ll only be taxed with P55,000.

Self employed or professionals whose gross sales don’t exceed the threshold will pay 8% income tax on gross sales or gross receipts in excess of P250,000.

Aside from lowering income taxes, there are other agendas that comes along with this tax reform proposal:

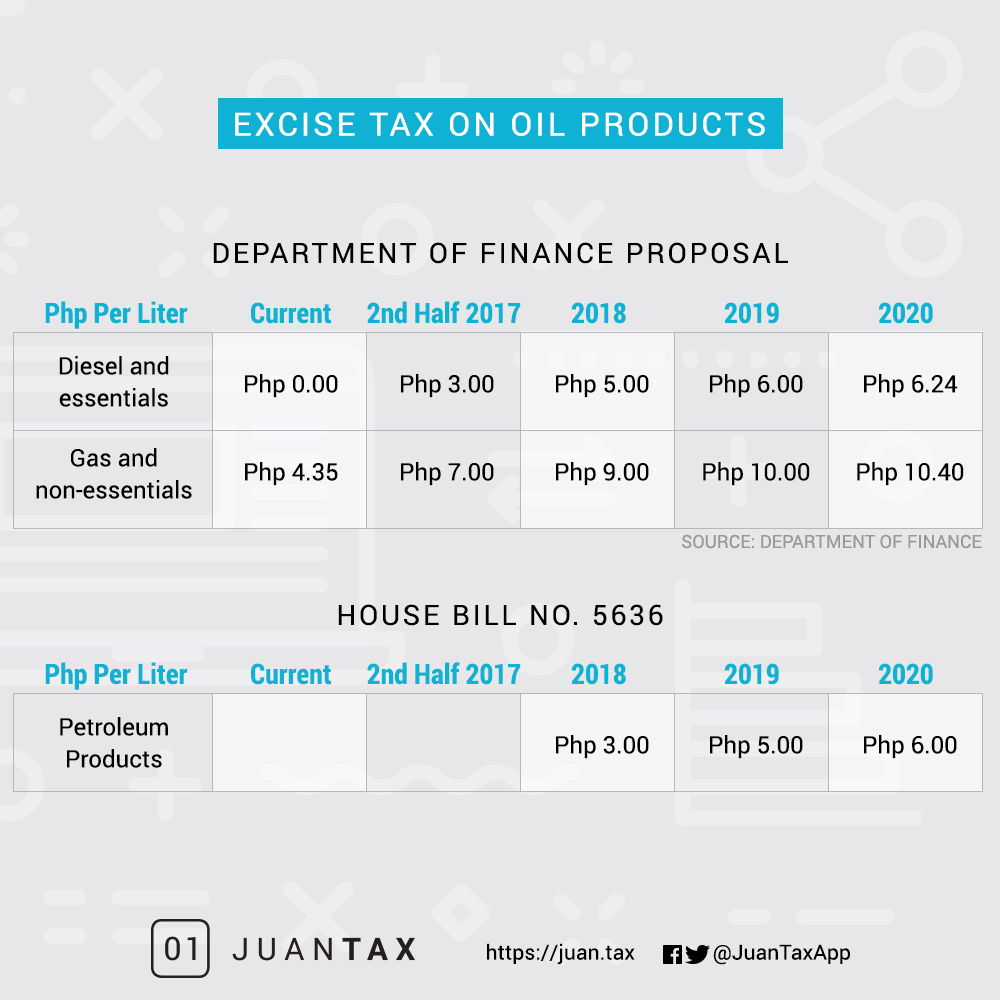

Impose Higher Taxes on Oil Products

The main consequence attached to this tax proposal is that lower personal income taxes could lead to great risk when it comes to revenue. That’s why the DOF (Department of Finance) proposes to collect taxes from other sources.

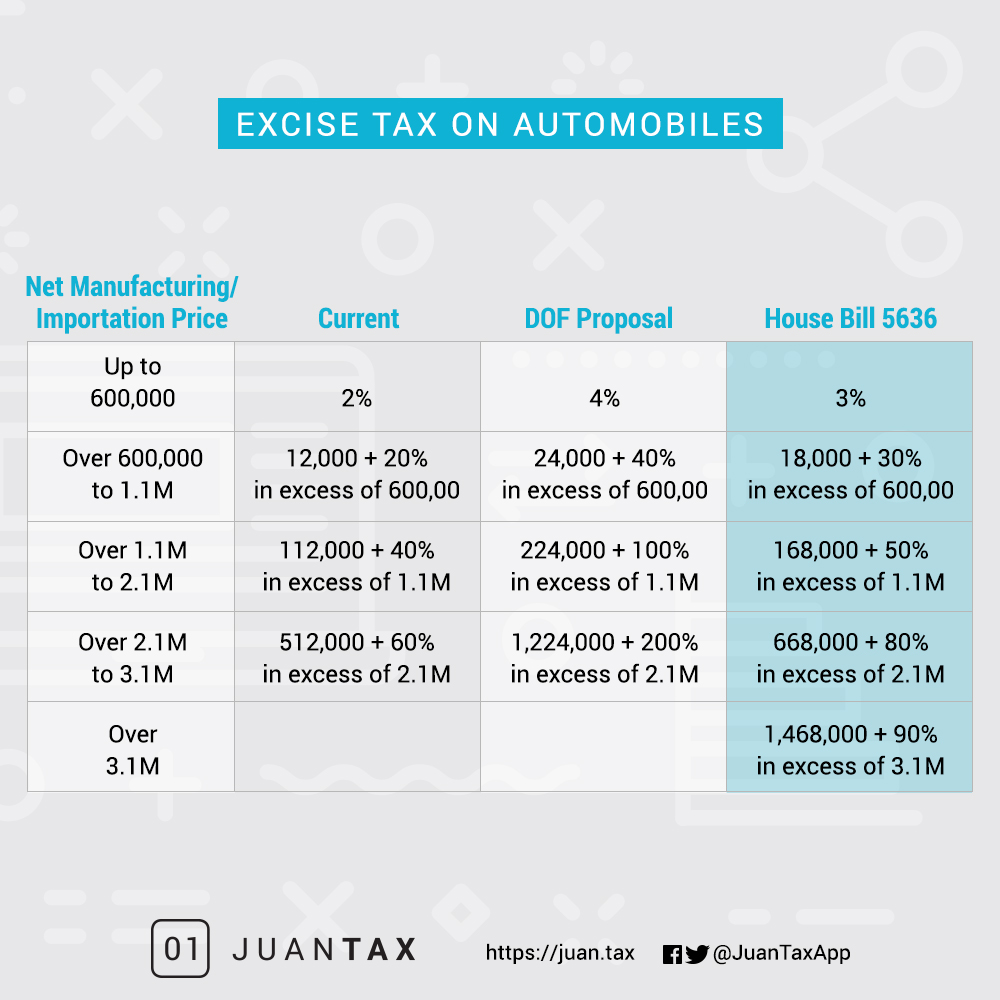

Higher Automobile Excise Tax

Although there are taxes that were already imposed to cars and automobiles, expect higher excise tax rates for vehicles once this new tax law takes place.

When it Comes to Exemptions….

As for other exemptions, bonuses below P100,000 will become tax exempt, this includes 13th month pay, christmas bonus and other productivity incentives.

Sources: Department of Finance, Bureau of Internal Revenue, PinoyMoneyTalk, ABS-CBN News, Youtube and Philippine Primer