BIR Payment/Remittance Form 1601-FQ – All you need to know

Summary:

- What is form 1601-FQ?

- Who needs to file Form 1601-FQ?

- When to file Form 1601-FQ

- What is JuanTax Fast File?

- How to file using JuanTax Fast File?

We’ve prepared all the necessary details you need to know to comply with your BIR Form 1601-FQ. Check out the important information on who needs to file, when to file, and how to file using JuanTax.

What is it?

BIR Form 1601-FQ is a tax form that is used to remit all other forms of final withholding taxes. Much like form 1601EQ, 1601-FQ forms can be used in remitting taxes withheld for the 3rd month of the quarter, in accordance with the provisions listed within the TRAIN law.

Who needs to file it?

Any Individual/non-individual considered as a withholding agent who is required to withhold (and deduct) taxes that were paid to employees. Now, if the agent required to withhold payments is a corporation, then the return shall be filed using the corporation’s name and should be verified by the president, vice president or authorized officer and signed by the appointed treasurer/assistant treasurer.

When do you file it?

Form 1601-FQ shall be filled not later than the last day of the month, following the end of the taxable quarter during which the withholding tax was made.

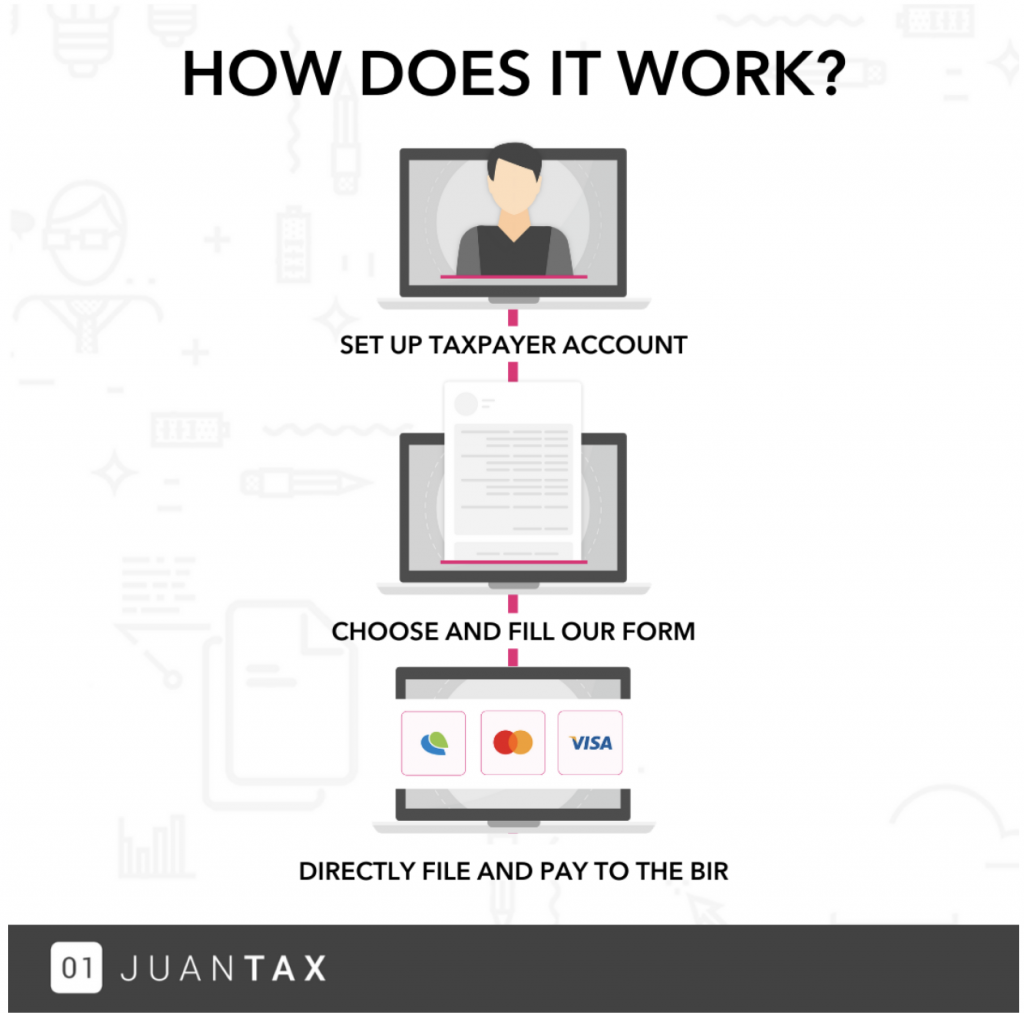

What is JuanTax Fast File?

JuanTax Fast File is a tax solution filing and payment platform which is recognized by the BIR as an electronic solution that enables taxpayers to be tax compliant from home with ease and convenience.

How to File with JuanTax Fast File?

Now that you know the important details of complying with your BIR Form 1601-FQ, e-File and e-Pay this form in minutes through JuanTax.

Related Articles:Form 1601-EQ – All you need to know