December 13, 2018 — Have you noticed something different lately when preparing form 2551Q or Quarterly Percentage tax returns in eBIRForms 7.2? Well you’re not alone, for we are also aware of this situation that’s happening inside the software.

What Just Happened?

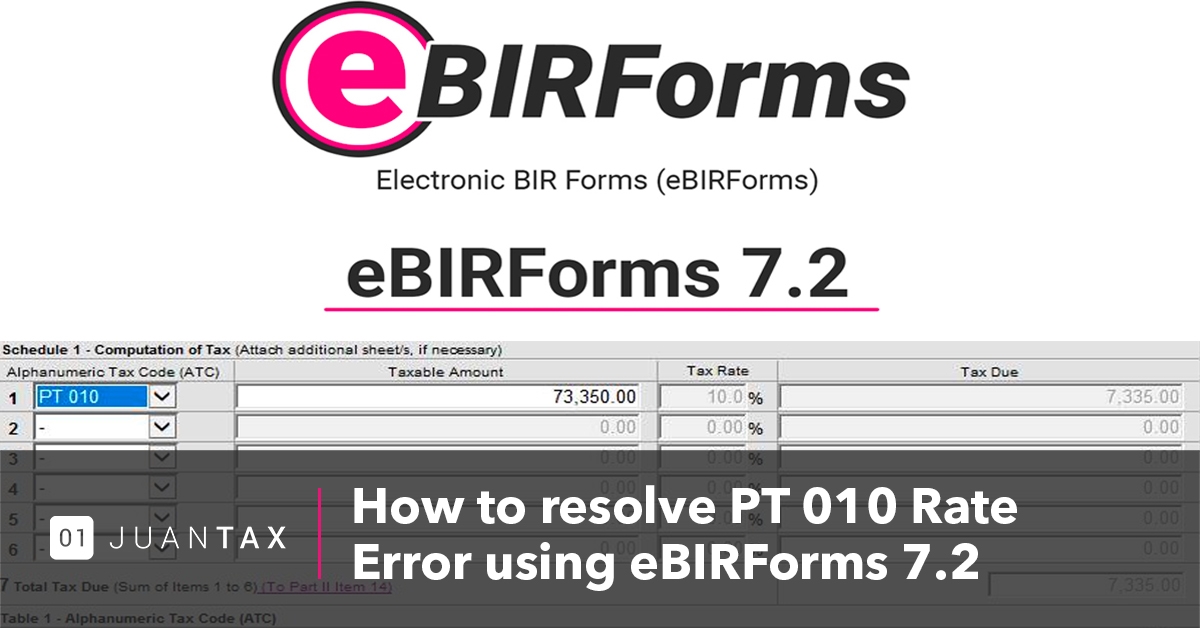

During the BIR’s recent release of the 7.2 version of the software last November 5, they’ve also provided a new look to one of their forms which is the 2551Q (Quarterly Percentage Taxes), along with a 3% tax rate within the ATC section of Schedule 1 – Computation of Tax.

The problem? We noticed that the PT 010 ATC code reflects a rate of 10% and not the supposed 3%.

How to Solve the Problem?

Users who have just downloaded the latest version of the package last November 23 would not see this error, but for those who have obtained the version of eBIRForms during its initial release, then you’ll need to re-install the program In order for you to fix the Percentage Tax ATC.

Go to your computer’s Local Disk (C:) and delete the eBIRForms folder, but nonetheless, steps for downloading and installing the platform are still the same.

Use JuanTax as Alternative

Remember that you can always use JuanTax as an alternative in filing your taxes with the BIR.

With JuanTax, there’s no need for you to do any download and even installation — all you have to do is generate, enter transactions and file those returns.

We also have a mobile app which lets you take images of your invoices and receipts that would automatically flow within the Transactions Module for both web and mobile versions of our tax software, which means you would be able to do your taxes right anytime and anywhere!

JuanTax is a Philippine-based cloud tax software which helps businesses in achieving compliance with the Bureau of Internal Revenue (BIR) when it comes to transactional taxes including VAT, Percentage Tax, and Expanded Withholding Tax.

Want to learn more about how JuanTax can help you in filing and paying taxes? Visit our website at https://juan.tax/ and Sign up today!