This article contains all you need to know about Income Tax Returns as a Filipino Taxpayer. The Bureau provided

- What is Income Tax?

- Who are required to file for Income Tax?

- Who are not required to file for Income Tax?

- Who are exempt from Income Tax?

- What is JuanTax Fast File?

- How can you use it to pay for your Income Tax?

The BIR provided the necessary details to taxpayers in relation to Income Tax Returns. Here are the key details that every Filipino taxpayer need to know.

What is Income Tax?

According to the BIR, Income Tax “is a tax on a person’s income, emoluments, profits arising from property, practice of profession, conduct of trade or on the pertinent items of gross income.

Who are Required to File Income Tax Returns?

Individuals who are the following:

- Resident citizens receiving income from sources within or outside the Philippines

- Employees who acquire purely compensation income from two or more employers, concurrently or successively at any time during the taxable year

- Employees who acquire purely compensation income regardless of the amount, whether from a single or several employers during the calendar year, the income tax of which has not been withheld correctly (i.e. tax due is not equal to the tax withheld) resulting to collectible or refundable return

- Self-employed individuals receiving income from the conduct of trade or business and/or practice of profession

- Individuals who acquire mixed income, i.e., compensation income and income from the conduct of trade or business and/or practice of profession

- Individuals who acquire other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax

- Individuals receiving purely compensation income from a single employer, although the income of which has been correctly withheld, but whose spouse is not entitled to substituted filing

- Non-resident citizens receiving income from sources within the Philippines

- Aliens, whether resident or not, receiving income from sources within the Philippines

Non-Individuals that are the following:

- Corporations and partnerships, no matter how created or organized.

- Domestic corporations receiving income from sources in and out the Philippines

- Foreign corporations receiving income from sources inside the Philippines

- Estates and trusts engaged in trade or business

Who are not required to file Income Tax returns?

- An individual earning purely compensation income whose taxable income does not exceed P250,000.00

- An individual whose income tax has been withheld correctly by his employer, provided that such individual has only one employer for the taxable year

- An individual whose sole income has been subjected to final withholding tax or who is exempt from income tax pursuant to the Tax Code and other special laws.

- An individual who is a minimum wage earner

- Those who are qualified under “substituted filing”. However, substituted filing applies only if all of the following requirements are present:

- the employee received purely compensation income (regardless of amount) during the taxable year;

- the employee received the income from only one employer in the Philippines during the taxable year;

- the amount of tax due from the employee at the end of the year equals the amount of tax withheld by the employer;

- the employee’s spouse also complies with all 3 conditions stated above;

- the employer files the annual information return (BIR Form No. 1604-CF); and

- the employer issues BIR Form No. 2316 to each employee.

Who are exempt from Income Tax?

- Income from abroad of a non-resident citizen who is:

- A citizen of the Philippines who establishes to the satisfaction of the Commissioner the fact of his physical presence abroad with a definite intention to reside therein

- A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad, either as an immigrant or for employment on a permanent basis

- A citizen of the Philippines who works and derives income from abroad and whose employment thereat requires him to be physically present abroad most of the time during the taxable year

- A citizen who has been previously considered as a non-resident citizen and who arrives in the Philippines at any time during the year to reside permanently in the Philippines will likewise be treated as a non-resident citizen during the taxable year in which he arrives in the Philippines, with respect to his income derived from sources abroad until the date of his arrival in the Philippines.

- Overseas Filipino Worker, including overseas seaman

- An individual citizen of the Philippines who is working and deriving income from abroad as an overseas Filipino worker is taxable only on income from sources within the Philippines; provided, that a seaman who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of the complement of a vessel engaged exclusively in international trade will be treated as an overseas Filipino worker.

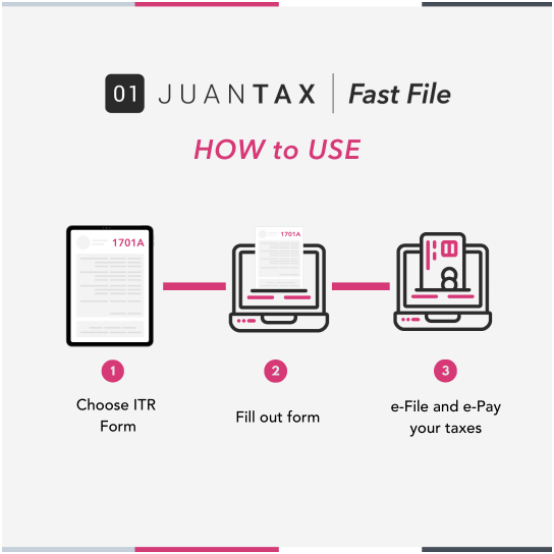

What is JuanTax Fast File?

JuanTax Fast File is a tax solution filing and payment platform which is recognized by the BIR as an electronic solution that enables taxpayers to be tax compliant from home with ease and convenience.

How to file Income Tax with JuanTax Fast File?

It’s simple and easy! You can file your ITR within minutes!