On April 30, 2021, the Bureau of Internal Revenue (BIR) released Revenue Memorandum Circular No. 65-2021.

This RMC was shared to describe the guidelines required in order to file for amendments to Quarterly Percentage Tax Returns. This was due to the change in tax rate from 3% to 1% following the Corporate Recovery and Tax Incentives for Enterprise Act. (C.R.E.A.T.E. Law).

JuanTax has already adapted to these changes in e-filing BIR Form 2551Q. Read more on this here BIR Form 2551Q (C.R.E.A.T.E. Law).

Amendments Guidelines Example

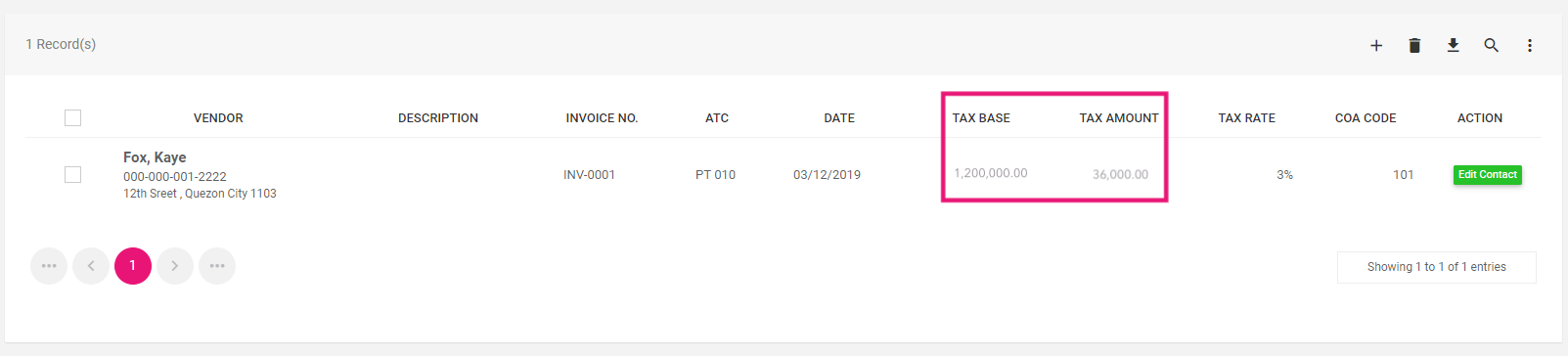

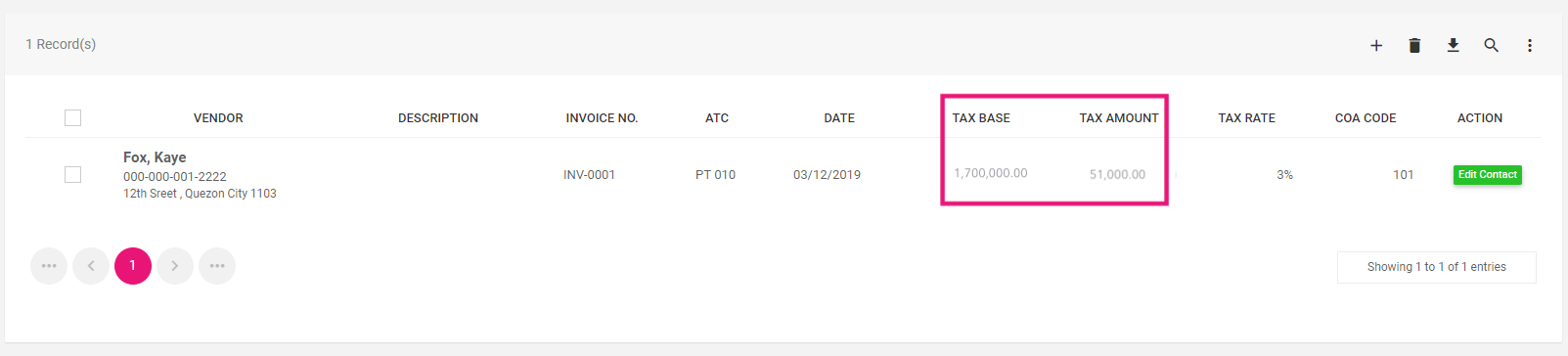

For this example, we’ll be using Juan as a Filipino Taxpayer who recently filed his Income Tax Returns using the old 3% Percentage Tax rate for the 3rd and 4th quarter of 2020:

| Subject Line | 3rd Quarter of 2020 | 4th Quarter of 2020 |

| Total Income/Receipts | PHP 1,200,000 | PHP 1,700,000 |

| Percentage Tax Paid | PHP 36,000 | PHP 51,000 |

With the decrease in tax rate from 3% to 1%, Juan wanted to amend this return to get the excess tax paid back to him.

As illustrated in the image above, using the 3% tax rate, Juan had paid PHP 36,000 when filing for the 3rd Quarter of 2020.

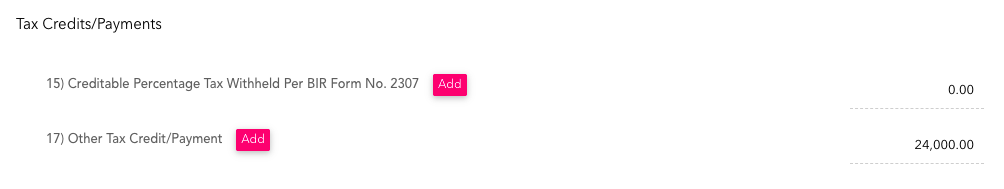

As illustrated in the image above, Juan will use line 17 to reflect the overpayment amount from the 3rd Quarter of 2020. This is because Juan had paid PHP 36,000 due to the 3% tax rate, but with the new 1% tax rate, he should have only paid PHP 12,000. So his overpayment amounts to PHP 24,000.

Assuming that Juan did NOT entirely consume the excess payment, he can continue to carry over the excess payment until there is no more remaining balance.

Need Help? We’ve Got You Covered.

For users who were not able to file with these changes in the past, you still have time to e-File amendments to Annual Income Tax Returns using JuanTax Fast File. Read our Help Centre article to learn more on how to amend tax reports.

If you need extra help in calculating percentage taxes using the new temporary rates under C.R.E.A.T.E., you can reach out to our support team any time by clicking on the chat icon in the lowermost right corner of your screen. You can also schedule a call with any of our Partner Firms for personalized advice, today.