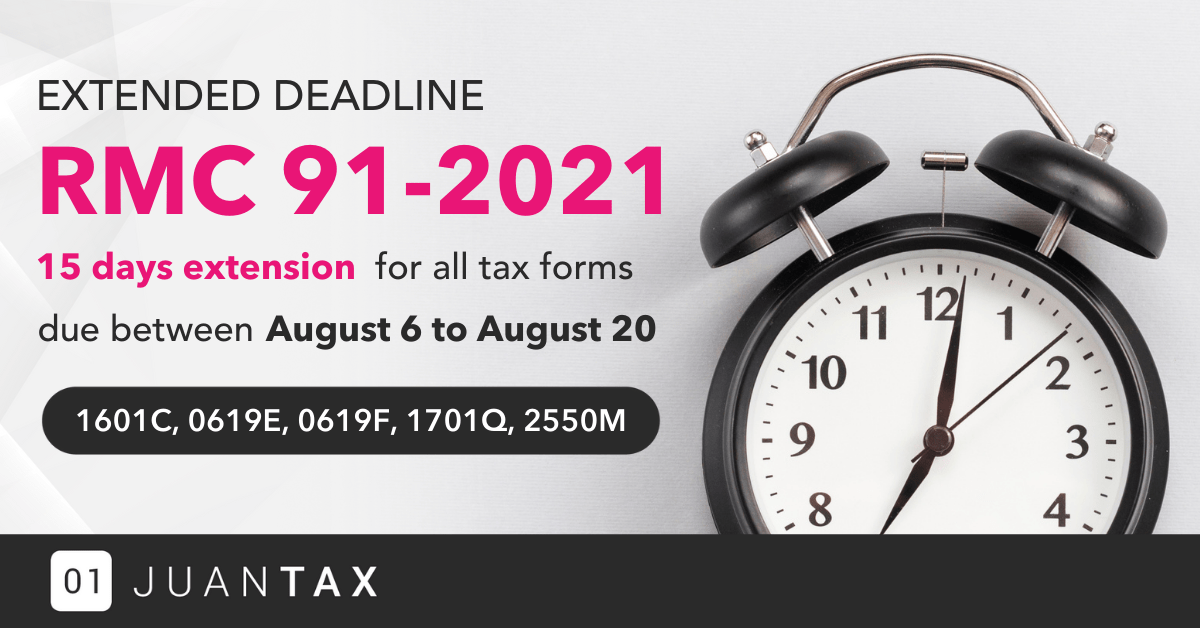

In consideration of the upcoming implementation of Enhanced Community Quarantine (ECQ) and Modified Enhanced Community Quarantine (MECQ) in the National Capital Region (NCR) and several provinces in the Philippines due to the incessantly rising cases of Delta variant, the Bureau of Internal Revenue (BIR) has released a memorandum notifying concerned taxpayers about its decision to extend the deadline of taxes scheduled within the period of August 6, 2021, to August 20, 2021, for taxpayers under the ECQ and MECQ areas.

The BIR has announced that in cases where the ECQ and/or MECQ remain effective for another couple of days or weeks, the taxpayers will be given an additional 15-day extension after the imposition of ECQ and MECQ has been lifted. This is to give them ample time to file their returns, pay their taxes, and submit their reports, and attachments.

To simplify, the 15-day extension will start from August 20 and will end on September 4 but since it’s a weekend, the deadline will be automatically moved to the next business day which is on September 6.

Note: As per BIR’s policy, if the extended deadline falls on a weekend or a holiday, it will be moved to the next working day.

What forms need to be filed during this period?

The Bureau has reminded affected taxpayers to prepare and settle their taxes on the given period for the following BIR forms:

- 1601C or Monthly Remittance Return of Income Taxes Withheld on Compensation

- 0619E or Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded)

- 0619F or Monthly Remittance Form for Final Income Taxes Withheld

- 1701Q or Quarterly Income Tax Return

- 2550M or Monthly Value-Added Tax Declaration

- 1606 or Withholding Tax Remittance Return For Onerous Transfer of Real Property Other Than Capital Asset (Including Taxable and Exempt)

- 1600 or Monthly Remittance Return of Value-Added Tax Withheld and Other Percentage Taxes Withheld

What can taxpayers do during the 15-day extension period?

- Taxpayers may pay their taxes at the nearest Authorized Agent Banks (AABs), notwithstanding RDO jurisdiction

- File and pay their taxes to the respective Revenue Collection Officers (RCOs) of the nearest Revenue District Office (RDO).

Note: The cash payment for taxes should not exceed P20,000 while there’s no limitation on the amount for check payment. In addition, all check payments should be payable to the Bureau of Internal Revenue. - Pay taxes through the following online payment channels:

- Land Bank of the Philippines (LBP) Link.Biz Portal

- Development Bank of the Philippines (DBP) Pay Tax Online

- Union Bank Online Web and Mobile Payment Facility

- GCash/PayMaya

Want to stay COVID-free while being tax compliant?

No worries! JuanTax understands your predicament. You can e-file and e-pay your taxes easily and instantly without worrying about your safety and health during this community quarantine period. Visit JuanTax to know the best platform for your tax filing needs!

Learn more about BIR forms and their relevance to you, as well as other tax-related matters at Learn at Juan.