BIR revised Checklist of Documentary Requirements for Business Registration

BIR removes mayor’s permit as mandatory document

Summary:

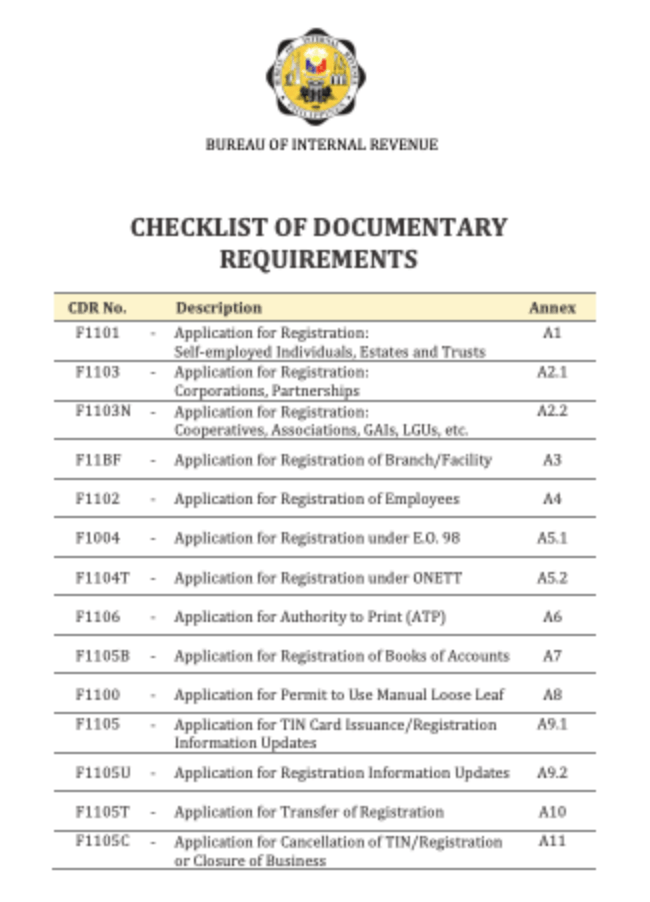

- Checklist of Documentary Requirements

- Removal of Mayor’s Permit as a mandatory requirement

The Bureau of Internal Revenue has directed online sellers to register their business activities and settle their taxes not later than July 31,2020. Those business owners who register their business activities or update their registration status not later than July 31,2020 will not be imposed with any form of penalty for late registration. They also encourage all business owners to voluntarily declare their past transactions subject to pertinent taxes and pay due taxes without corresponding penalty when declared and paid on or before July 31,2020.

The Bureau of Internal Revenue (BIR) as of June 9 2020, gave Revenue Memorandum Circular No. 57-2020 (RMC No. 57-2020), which was effective immediately. The subject of this memorandum is “Streamlining of Business Registration Requirements and Revised Checklist of Documentary Requirements ”.

This circular was issued to provide taxpayers the requirements for registering a new business with the BIR which have been streamlined by removing the Mayor’s Permit as one of the mandatory requirements.

The BIR shall not process applications or requests with deficient or incomplete documentary requirements and shall process only those applications or requests with complete documentary requirements.

Checklist of Documentary Requirements:

The BIR has made business registration for online sellers a little less complex. To learn more about the basic registration guidelines view this article on RMC 60-2020.