The Bureau of Internal Revenue (BIR) has recently issued Revenue Regulations (RR) No. 21-2021 which amended certain provisions including RR No. 13-2018, under page 15 of 20:

Overview of the TRAIN Law and its impact on the Philippine tax system

The Tax Reform for Acceleration and Inclusion (TRAIN) Law is a tax reform program implemented in the Philippines in 2018. It aims to increase government revenue by restructuring the country’s tax system, making it simpler, fairer, and more efficient.

TRAIN Law has brought about significant changes to the Philippine tax system. While it has helped address some long-standing issues, such as the need to simplify and make the system fairer, there is still a need to address the concerns raised by its implementation.

The TRAIN Law has several key provisions, including:

- Lowering personal income tax rates: The law reduced personal income tax rates, increasing the take-home pay of many Filipino workers.

- Imposing excise taxes on certain goods: The TRAIN Law imposed excise taxes on several goods, including sugar-sweetened beverages, petroleum products, and automobiles. The additional revenue generated from these taxes is intended to fund the government’s infrastructure and social programs.

- Expanding the value-added tax (VAT) base: The law also expanded the VAT base by removing some exemptions, such as those on certain types of services and goods.

According to TAXGURO (2021), the TRAIN Law has had a significant impact on the Philippine tax system. It has generated additional revenue for the government, allowing it to fund important programs and initiatives. However, some critics have argued that the excise taxes have increased the cost of living for many Filipinos, particularly those with lower incomes. On the other hand, it has provided relief to low- and middle-income earners by lowering income tax rates.

This has resulted in an increase in disposable income, which can be used to stimulate consumption and spur economic growth. However, the higher excise taxes on fuel, tobacco, and sugary drinks have led to inflation, particularly affecting the poor who are more sensitive to changes in prices of basic goods.

Nonetheless, the government has continued to implement the TRAIN Law, making some adjustments along the way, in order to improve the country’s tax system and promote economic growth.

Explanation of the Value-Added Tax (VAT) and how it applies to the provisions outlined in RR No. 13-2018

Value-Added Tax (VAT) is a type of consumption tax that is applied to the value added at each stage of the supply chain. In essence, it is a tax on the value added by businesses at each stage of the production and distribution process.

RR No. 13-2018 refers to the Implementing Rules and Regulations (IRR) of Republic Act No. 10963, also known as the Tax Reform for Acceleration and Inclusion (TRAIN) Law. RR No. 13-2018 outlines the provisions for the application of VAT in the Philippines, including the registration, invoicing, filing, and payment of VAT by taxpayers.

Details of the revenue regulation, including the scope of coverage, exemptions, and requirements for compliance.

The Bureau of Internal Revenue (BIR) has recently issued Revenue Regulations (RR) No. 21-2021 which amended certain provisions including RR No. 13-2018, under page 15 of 20:

Illustration 8: A manufacturer purchased capital goods on different occasions as follows:

| Month of Purchase | Amount (Php) 12% | Input Tax | Useful Life | No. of Monthly Amortization | Last Month of Amortization |

| January 2018 | Php 8,500,000 | Php 1,020,000 | 6 years | 60 | December 2022 |

| February 2018 | 8,500,000 | 1,020,000 | 4 years | 48 | January 2022 |

| December 2018 | 10,000,000 | 1,020,000 | 5 years | 60 | November 2022 |

| January 2018 | 10,000,000 | 1,020,000 | 5 years | – | *Outright claim on January 2022 |

- a) For purchases made in January 2018, the amortization shall be for the shorter period of 5 years only or up to December 2022 although the useful life is 6 years.

- b) For purchases made in February 2018, the amortization shall be for a period of 4 years only or up to January 2022 since the useful life of the asset is shorter than 5 years.

- c) For purchases made in December 2021, the amortization shall be for the period of 5 years or up to November 2026.

- d) For purchases made in January 2022, no amortization shall be made and the input VAT shall be claimed on the month of purchase or January 2022.

To further discuss what these mean:

- The Rule of amortizing the input vat on Capital Goods shall only be allowed until December 31, 2021.

- Taxpayers with unutilized input vat as of December 31, 2021, shall be allowed to apply the same as scheduled until fully utilized.

- Starting Jan 1, 2022, any purchase above 1M can be deducted from your VAT payable outright, and no amortization is required. This was different in the past where the input VAT needed to be amortized based on your purchase(s) useful life.

Here’s how Capital Goods works in JuanTax:

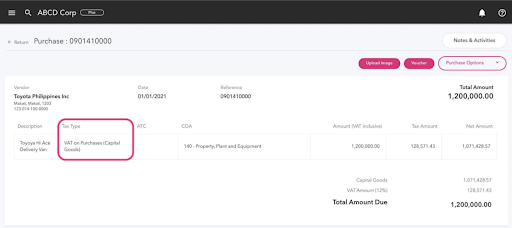

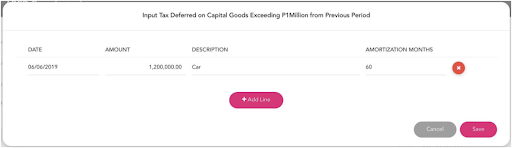

Enter the purchase and under the ‘Tax Type’ column and choose ‘Capital Goods’.

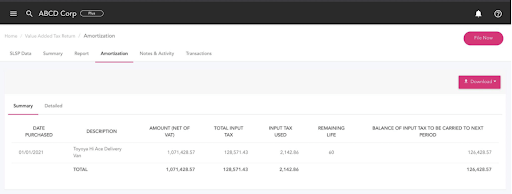

This will be automatically detected by the system upon generating your VAT tax form. Enter the required details together with the estimated life value in months then hit the ‘Save’ button.

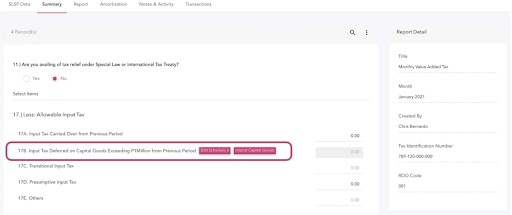

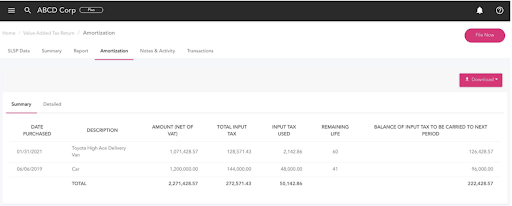

The Summary table will be filled with details and spread out automatically.

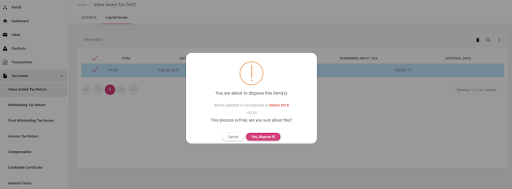

We also have a process for disposal wherein if the Capital Goods reaches exhaustion, you simply click the trash icon and this will successfully dispose of your item.

If you’re new to JuanTax:

If you’ve set up your ‘Start Date’ for the current year – 2022, you may have Capital Goods that you are still maintaining from the past year/s.

This will appear under your VAT’s ‘Amortization’ tab.

KEY TAKEAWAYS

Revenue Regulation (RR) No. 13-2018 is a regulation issued by the Bureau of Internal Revenue (BIR) in relation to the implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) Law, particularly with regards to the value-added tax (VAT) system. Here are some key takeaways from the regulation:

- The Tax Reform for Acceleration and Inclusion (TRAIN) Law is a tax reform program implemented in the Philippines in 2018. It aims to increase government revenue by restructuring the country’s tax system, making it simpler, fairer, and more efficient.

- There TRAIN law has several key provisions:

- Lowering personal income tax rates

- Imposing excise taxes on certain goods

- Expanding the value-added tax (VAT) base

- RR No. 13-2018 outlines the provisions for applying VAT in the Philippines, including the registration, invoicing, filing, and payment of VAT by taxpayers.

- Revenue regulations play a crucial role in implementing and enforcing tax laws. They provide guidance and clarity on tax-related issues, help ensure compliance with tax laws, and promote fairness and consistency in the tax system.

- VAT refunds and credits: Businesses with excess input VAT (VAT paid on purchases) can claim a refund or credit of such an amount. RR No. 13-2018 provides the procedures and requirements for claiming VAT refunds and credits.

JuanTax can help businesses comply with Revenue Regulations in several ways, including:

- Providing BIR-accredited software: JuanTax offers BIR-accredited invoicing and accounting software that is designed to comply with Revenue Regulations. The software helps businesses issue electronic receipts and invoices that contain all the necessary details required by the BIR.

- Automating tax compliance processes: JuanTax’s software automates the tax compliance processes, including the preparation and filing of tax returns. This eliminates errors and reduces the time and effort required for compliance.

- Generating accurate financial reports: JuanTax’s software generates accurate financial reports that can help businesses monitor their financial performance and ensure compliance with tax laws and regulations.

- Providing support and training: JuanTax provides support and training to businesses to help them understand and comply with Revenue Regulations. This includes assistance with the registration process, guidance on using the software, and answering any questions businesses may have.

- Staying up-to-date with tax changes: JuanTax stays up-to-date with changes in tax laws and regulations, including Revenue Regulations. This ensures that the software remains compliant, and businesses using the software are also compliant.

Overall, RR No. 13-2018 guides the implementation of the VAT system under the TRAIN Law. Businesses should be aware of the changes in the VAT threshold, VAT rate, and VAT-exempt transactions, as well as the procedures for claiming VAT refunds and credits.

CONCLUSION

Are you tired of the stress and hassle of filing your taxes? JuanTax can help! Our user-friendly, accurate, and reliable tax filing software makes it easy to file your VAT and other taxes with confidence. Don’t wait until the last minute – reach out now and discover how JuanTax can simplify your tax filing process. Visit our website at https://juan.tax/ to learn more!