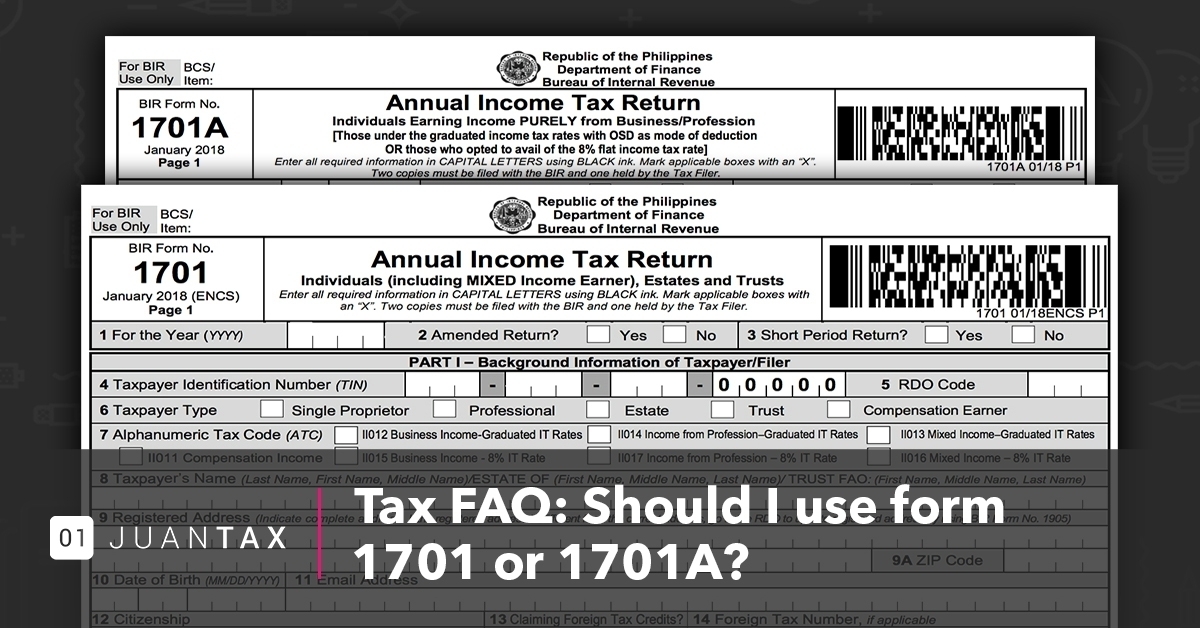

If you are a self-employed individual or a freelancer, you should know what Income Tax Return (ITR) form you should use. Apart from being vital to know the right form that will fit your needs, it also saves you time from filling out the wrong forms.

In our case, the Bureau of Internal Revenue (BIR) has provided two ITR forms for those self-employed: the form 1701 and the 1701A. Read on to find out which form you should use.

What Is the Difference Between 1701 and 1701A?

Using the 1701 or 1701A form varies depending on your income type.

If you are earning from being self-employed and being employed, like a school teacher doing part-time selling online, then you should use Form 1701 or the Annual Income Tax Return for Self-Employed Individuals, Estates, and Trusts. According to the BIR, Form 1701 shall be filed by the following individuals:

1. A resident citizen engaged in trade, business, or practice of profession within and without the Philippines.

2. A resident alien, non-resident citizen, or non-resident alien individual engaged in trade, business, or practice of a profession within the Philippines.

3. A trustee of a trust, guardian of a minor, executor/administrator of an estate, or any person acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business.

4. An individual engaged in trade or business or in the exercise of their profession and receiving compensation income as well.

On the other hand, if you are solely earning from being self-employed, like a full-time freelance writer, you should use Form 1701A, or the Annual Income Tax Return for Individuals Earning Income PURELY from Business/Profession. According to the BIR, form 1701A shall be filed by the following individuals:

1. A resident citizen (within and without the Philippines);

2. A resident alien, non-resident citizen, or non-resident alien (within the Philippines).

A Special Set of Criteria for 1701A

Form 1701A also has a special set of criteria for who can only use the form, which is the following:

1. Those subject to graduated income tax rates and availed of the optional standard deduction as a method of deduction, regardless of the amount of sales/receipts and other non-operating income; OR

2. Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3 million.

You cannot file both forms since if you are earning a regular salary outside of being self-employed, you are then required to file form 1701 and not 1701A. Both forms should be filed on 15 April preceding the taxable year.

How Do We Address This in JuanTax?

Typically, JuanTax requirement FOR FILING is three (3) hours before the due date. But for the special case of 15 April deadline, we suggest you file your taxes two (2) days before the due date, especially when you have to pay your tax dues over the counter.

As we understand that filing taxes can be a tough affair for self-employed individuals, we aim to help you by:

- Tracking your income flow by recording all photographs of receipts

- Extracting details from the receipt image using Optical Character Recognition (OCR) technology

- Automatically categorizing and populating your income into the necessary forms

- Providing easy filing and payment directly to BIR

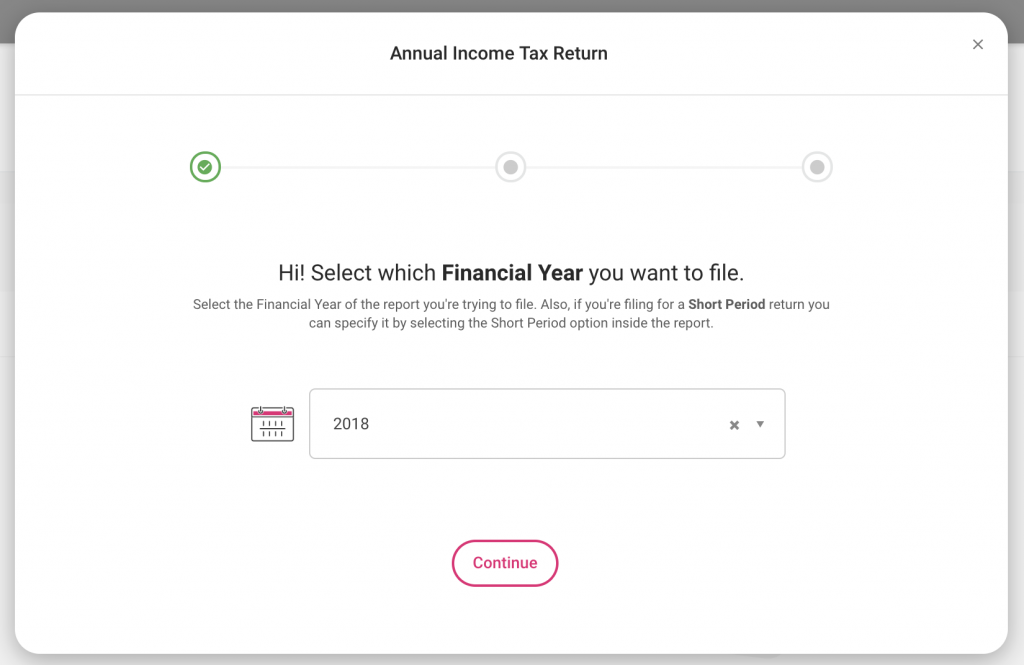

Here’s also a step-by-step guide on how you can easily Generate Income Tax Returns in JuanTax:

Step 1: Select which Financial Year you want to file. Then, click on Continue.

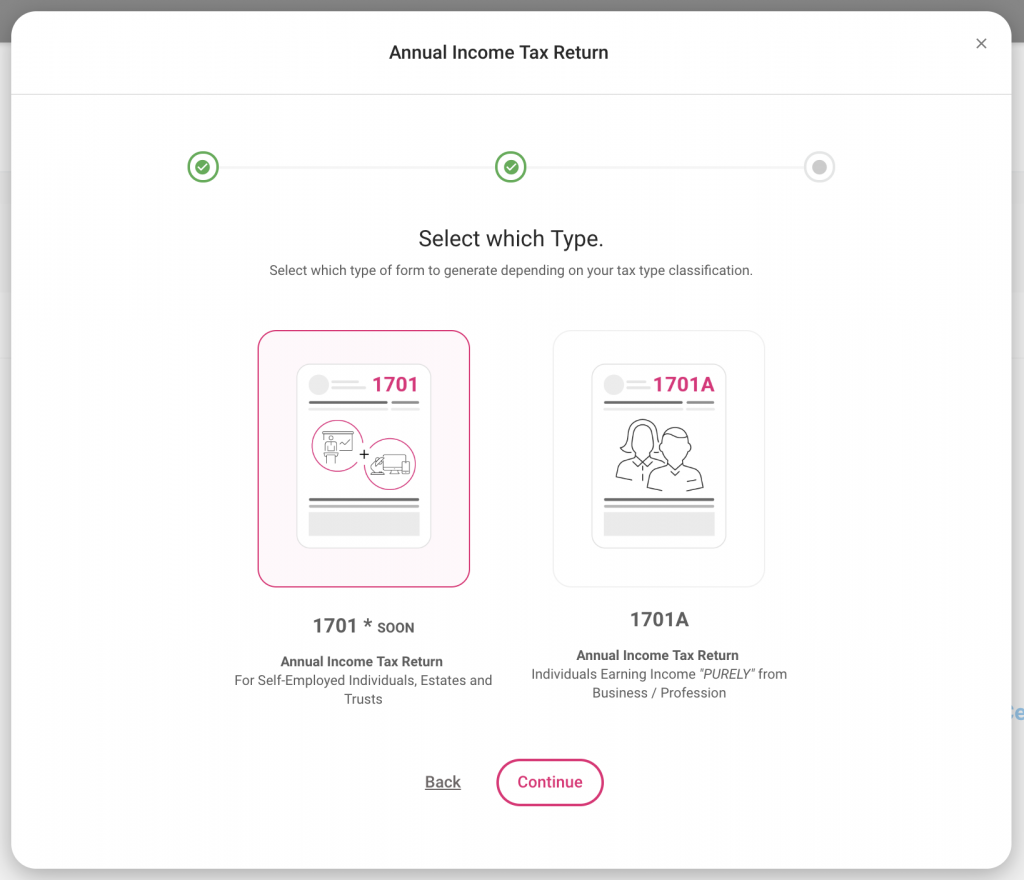

Step 2: Select which type of form you will generate depending on your tax classification. Note: Revised Form 1701 will be available in JuanTax before the April 15th deadline.

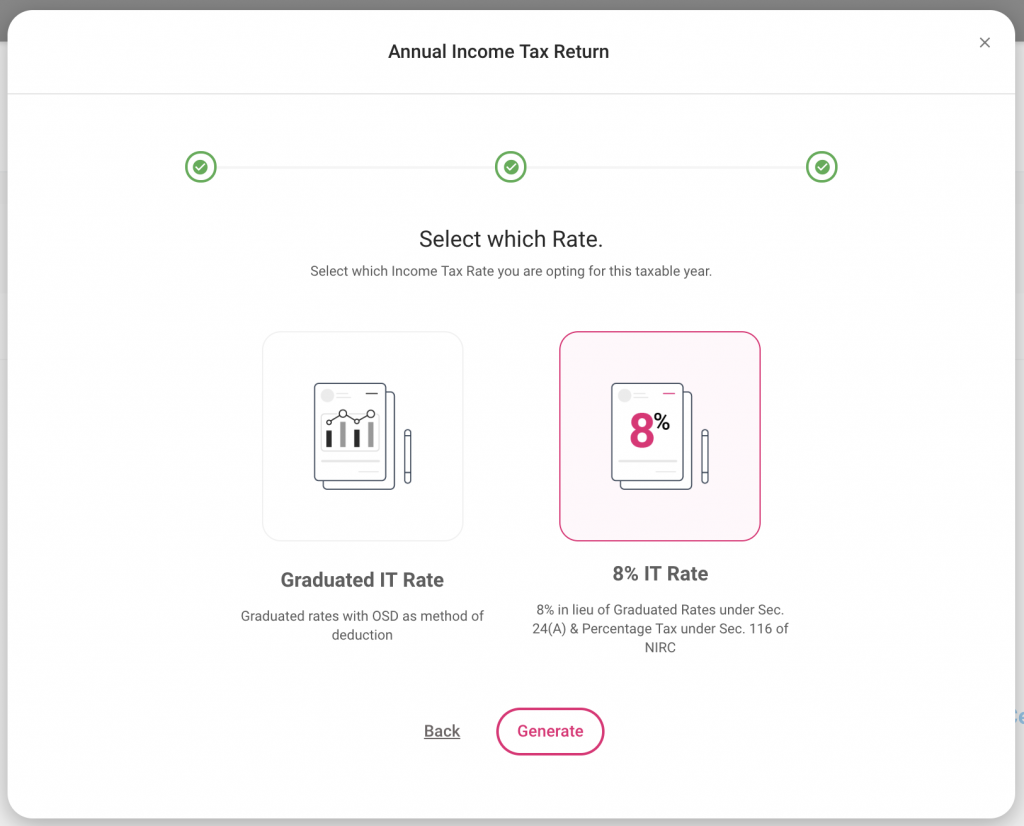

Step 3: Choose which Income Tax Rate you opted for for the year you are filing. Then, click on Generate.

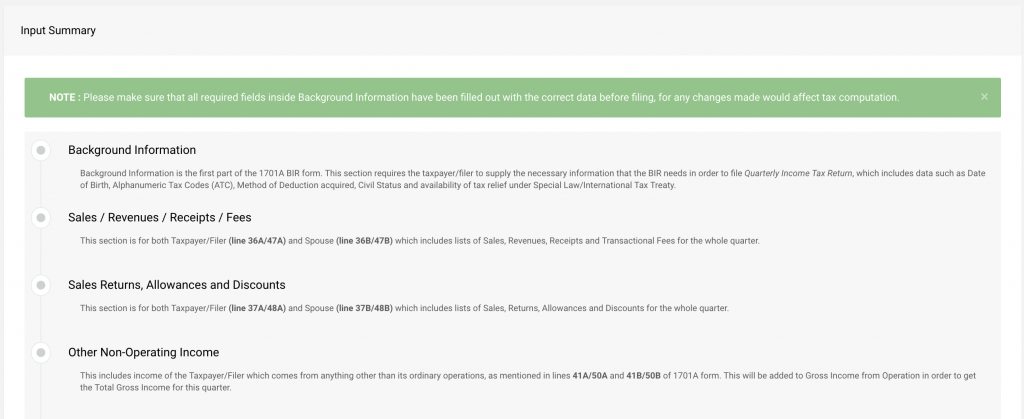

Step 4: In the Input Summary tab, enter the necessary information that will auto-populate the form that will be generated in JuanTax.

After which, you can now proceed with filing either manually or electronically.

For easy access, JuanTax has also been made available both for iOS and Android, which seamlessly synchronizes your records and activities while mobile and vice versa. The forms are also adjusted to the Tax Reform for Acceleration and Inclusion (TRAIN) Law with an automatic tax calculator.

We at JuanTax prioritize hassle-free and safe filing and paying of taxes. Contact us at help.juan.tax or chat with us on our website, https://juan.tax/ for your queries.

Are you planning to file your BIR Forms 1701 or 1701A soon?

Make tax compliance easier with Juan Accounting Software!

Juan integrates accounting, payments, financial reporting, and tax compliance with JuanTax into one complete solution, perfect for PH businesses. Experience all-in-Juan accounting and tax at https://www.juan.ac/.