Differences in Income Tax Forms: ITR 1702-RT vs 1702-MX

This article contains all you need to know about BIR Forms 1702-RT and 1702-MX as a Non-Individual Taxpayer. The BIR provided the necessary details to taxpayers in relation to these forms. Here’s what you need to know: BIR FORM 1702-RT What is this form? 1702-RT also known as, Annual Income Tax Return For Corporation, Partnership…

1702EX vs 1702MX vs 1702RT

This article is about the following forms: What makes you a Non-Individual Taxpayer? What are the forms for? What are the main differences between them? How do I know which one to file? How do I File and Pay? What makes you a Non-Individual Taxpayer? Corporations and partnerships, no matter how created or organized. Domestic…

Taxpayers Income Tax 101: All you need to know

This article contains all you need to know about Income Tax Returns as a Filipino Taxpayer. The Bureau provided What is Income Tax? Who are required to file for Income Tax? Who are not required to file for Income Tax? Who are exempt from Income Tax? What is JuanTax Fast File? How can you use…

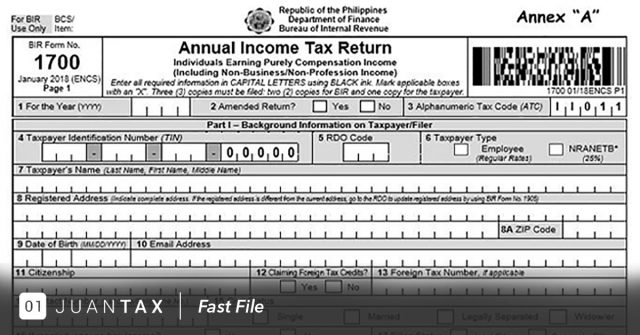

All you need to know about Form 1700

This article is about What is Form 1700? Who needs to file it? When does it need to be filed? What is JuanTax Fast File? How to file Form 1700 using Fast File? What is it? BIR Form No. 1700, also known as, Annual Income Tax Return For Individuals Earning Purely Compensation Income (Including Non-Business/Non-Profession…

BIR Income Tax Return Forms: 1700/1701/1701A: What to know!

Income tax forms can get very complicated. What more when it comes to comparing different forms? We’ve listed down the necessary details you need to know about these three different ITR forms for individual taxpayers. This article will answer these questions: What makes you an Individual Taxpayer? What are the forms for? What are the…

1701 vs 1701A: Which one should you pick?

What is the BIR Form 1701? BIR Form 1701, also known as the Annual Income Tax Return for Self-Employed Individuals, Mixed Income Earners, Estates, and Trusts, is a tax form that summarizes all the transactions made over the tax calendar year. According to the BIR, this form needs to be filed by individuals listed below:…

JuanTax Exclusive: A Closer Look on Percentage Tax (2551Q)

A list of important things you need to know about Percentage Tax Percentage Tax is a business tax regulated in our country Taxpayers who are Non-VAT with annual revenues less than PHP 3M Filing of 2551Q is on or before the 25th day after the last quarter Failure to pay BIR form 2551Q, individual will…

The Difference Between VAT and Non-VAT

Know the difference between VAT and Non-VAT and the forms that you might need to be tax compliant. The definition of Value-Added Tax and Percentage Tax. A list of things you need to know as a taxpayer if you are VAT or Non-VAT registered. A list of possible forms you need to submit. According to…