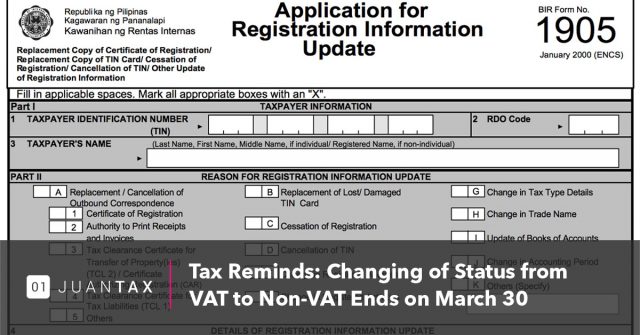

Alert! Change a Status from VAT to Non-VAT by March 30

March 20, 2018 — Wednesday — The deadline for changing of status from VAT to Non-VAT was moved from March 31 to March 30 (Friday). In Case You’ve Missed It As mentioned in a tax advisory sent out by the BIR (Bureau of internal Revenue), self-employed individuals and/or professionals with gross sales/receipts not exceeding the…