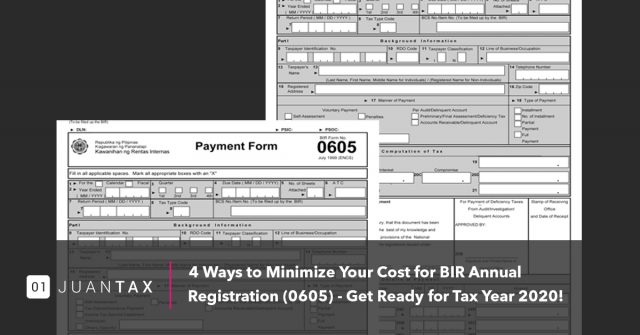

4 Ways to Minimize Your Cost for BIR Annual Registration

Minimize Cost in Accomplishing Your Payment Form 0605 for BIR Annual Registration As the year ends, accountants are wrapping up their tax compliance for 2019 while gearing up for 2020. And this means taking care of the annual BIR registration fee of 500 PHP using BIR’s Payment Form 0605. This is a yearly renewal requirement…